Introducing RHB Vehicle Financing-i (Variable Rate) with the flexibility to reduce principal balance and profit charges.

Fascinated by your dream car?

Whether you are seeking an upgrade, purchasing a used car for your growing family or

simply being enticed by the latest models, you will enjoy extra savings with

RHB Vehicle Financing-i (Variable Rate) when you pay more.

Not just that, steer towards a cleaner, greener future by getting

an eco-friendly car with our Green Financing Package or take advantage of our

competitive rate for Volvo cars!

Good news! The campaign has now been extended.

Don't miss the chance to enjoy the attractive offer!

Campaign period:

1 April 2022 - 31 July 2024

Green Financing Rate

As low as

BR+0.19% p.a.

or 2.10%* p.a. (Flat Rate equivalent)

• For Hybrid Plug-in/Electric Vehicle

• Financing Amount: Up to RM500,000.00

Volvo Car Finance Package

As low as

BR+0.01% p.a.

or 2.00%* p.a. (Flat Rate equivalent)

• Up to 90% Financing • 9 years tenure

* RHB Base Rate(BR) is based on current prevailing BR of 3.75% as at 8 May 2023.

Offered rates vary depending on your commercial credit assessment

Drop us your contact below to find out more.

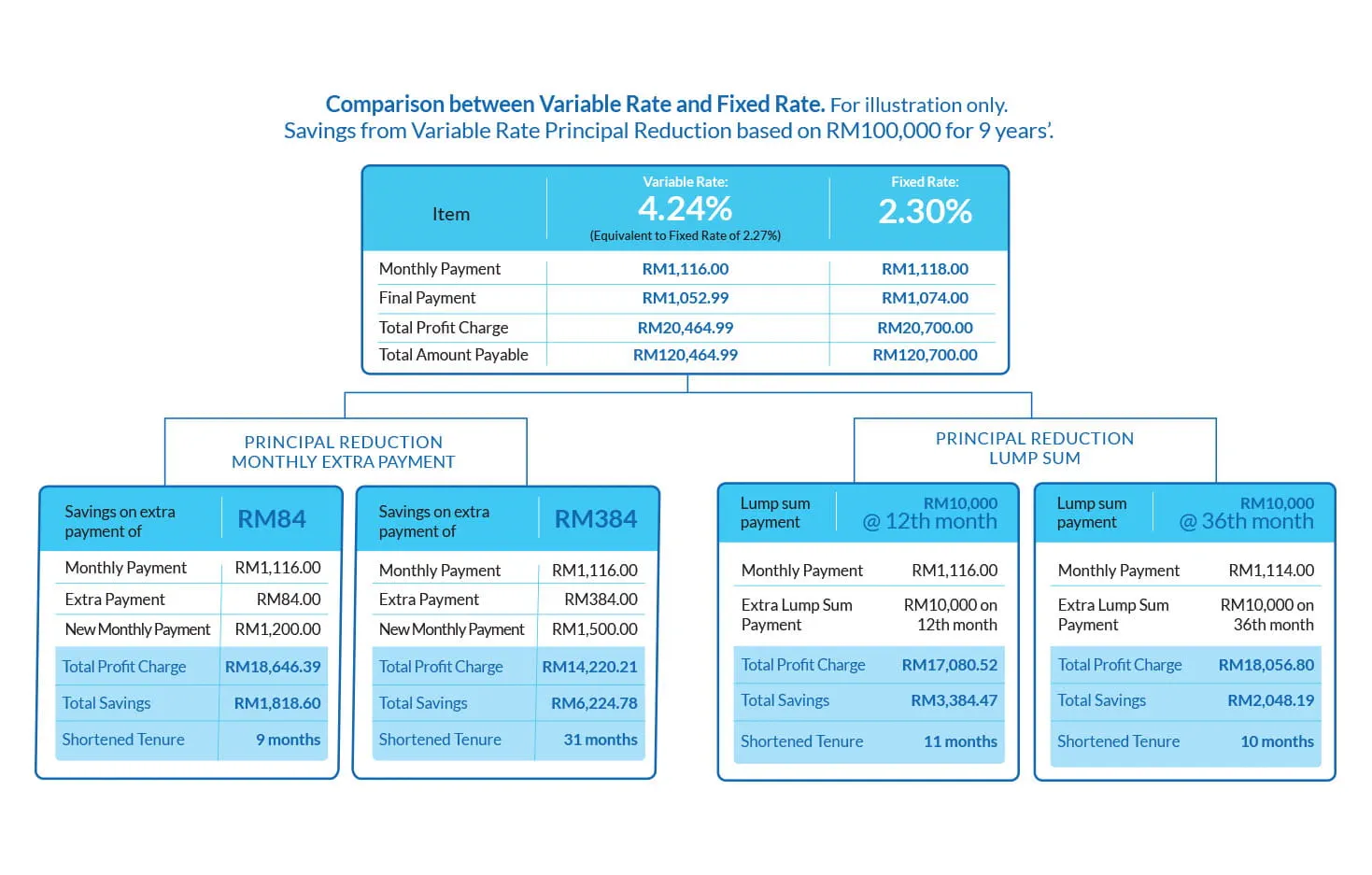

Principal Reduction

Get your financing

amount reduced

when you pay extra.

Daily Rest Balance

Reduction

Save on profit charges

with more savings.

Competitive Rates

Enjoy lower monthly financing plan for your new, used or reconditioned vehicle.

No Penalty

No exit fees on early

settlement.

Flexible Tenure

Up to 9 years tenure.

Individuals 18 years old and above, sole proprietorships,

partnerships, private limited and public limited companies.

Guarantor required for those below 21 years old or

above 60 years old and

non-Malaysians.