are yours to enjoy when you apply and spend

with your RHB Credit Card/-i.

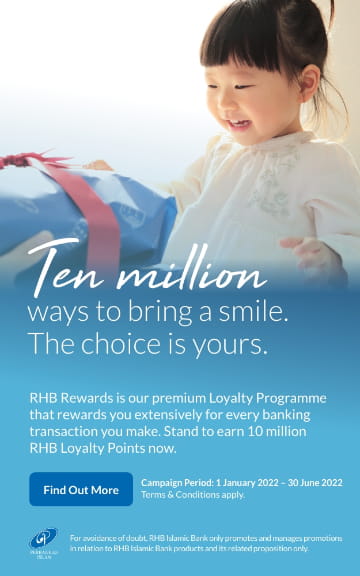

Apply and spend with your RHB Credit Card/-i, and enjoy cashback and Loyalty

Points that come your way along with card privileges and other benefits – much

deserved rewards that’ll have everyone smiling with so much happiness.

Campaign Period:

1 January 2022 – 30 June 2022