“Stagflation” has been the buzzword lately. The global economy once again faces uncertainty, as geopolitical and supply risks are thrown into the pot with pandemic problems. As the Russia-Ukraine conflict shows no signs of ending any time soon, the negative spillover effects are expected to lead to lower global economic growth combined with high inflation. Risk of stagflation however could be limited in 2022 due to inflation nearing its peak.

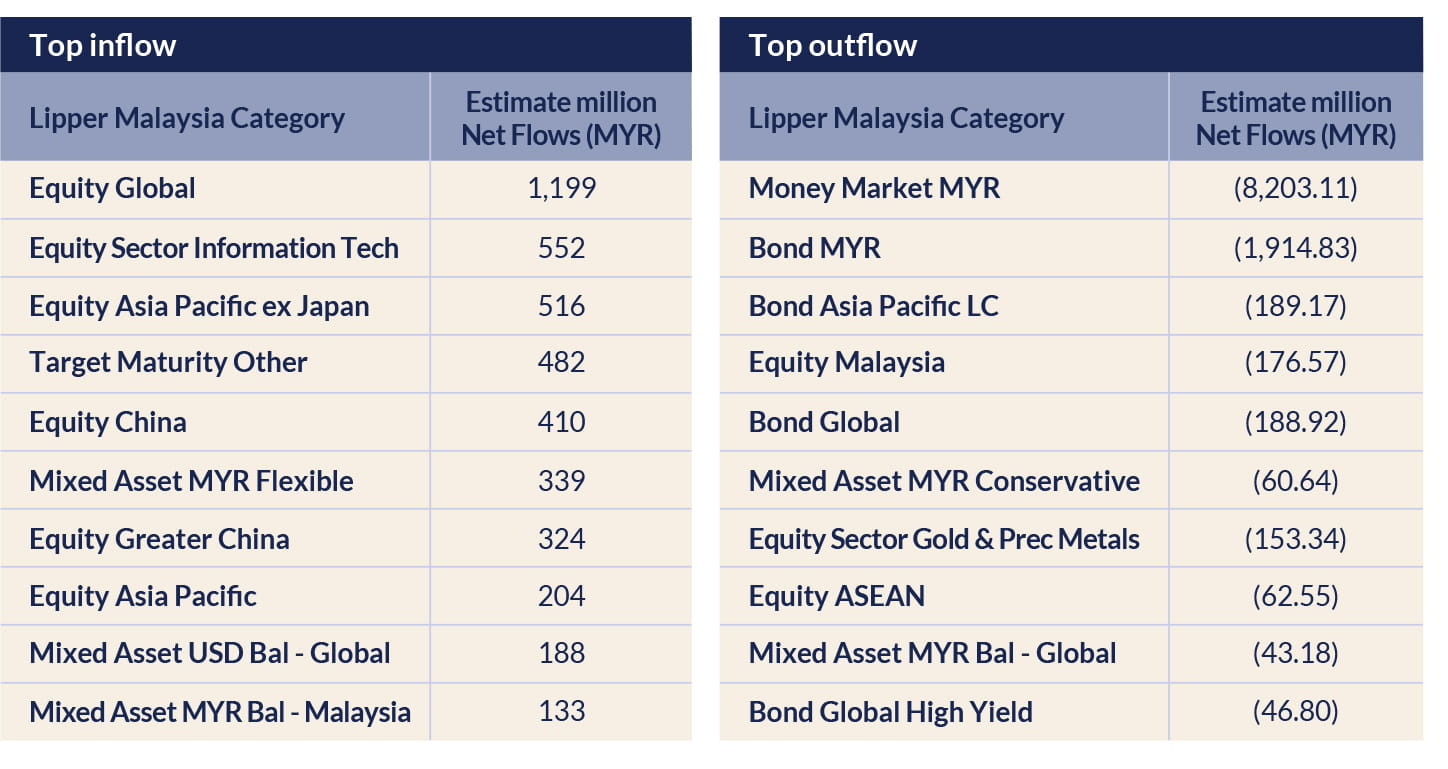

To recap, in the first quarter of 2022, global equity funds in Malaysia continued to be the main target for inflows, almost doubling the second-ranked fund type, which is information technology equities. However, overall, inflows into equities were lower than the amount seen in the previous quarter.

Investors also took on a defensive approach, putting their money into target maturity funds, which are usually capital protected and offer clients a certain degree of protection on the downside in the equities market.

In terms of geography, the Asia Pacific and China equity funds saw the largest inflows. On the other end, the ASEAN region and Malaysia saw the largest outflows.

Overall, the outflows were mainly money market and bond-related funds, as investors exited bonds and potentially reinvested into equities as part of dollar averaging. Investors also took advantage of gold’s best quarter since 2020, as the precious metal rose 8% year to date, locking in their profits from the rally.

Source: Lipper Investment Manager as of 31 March 2022

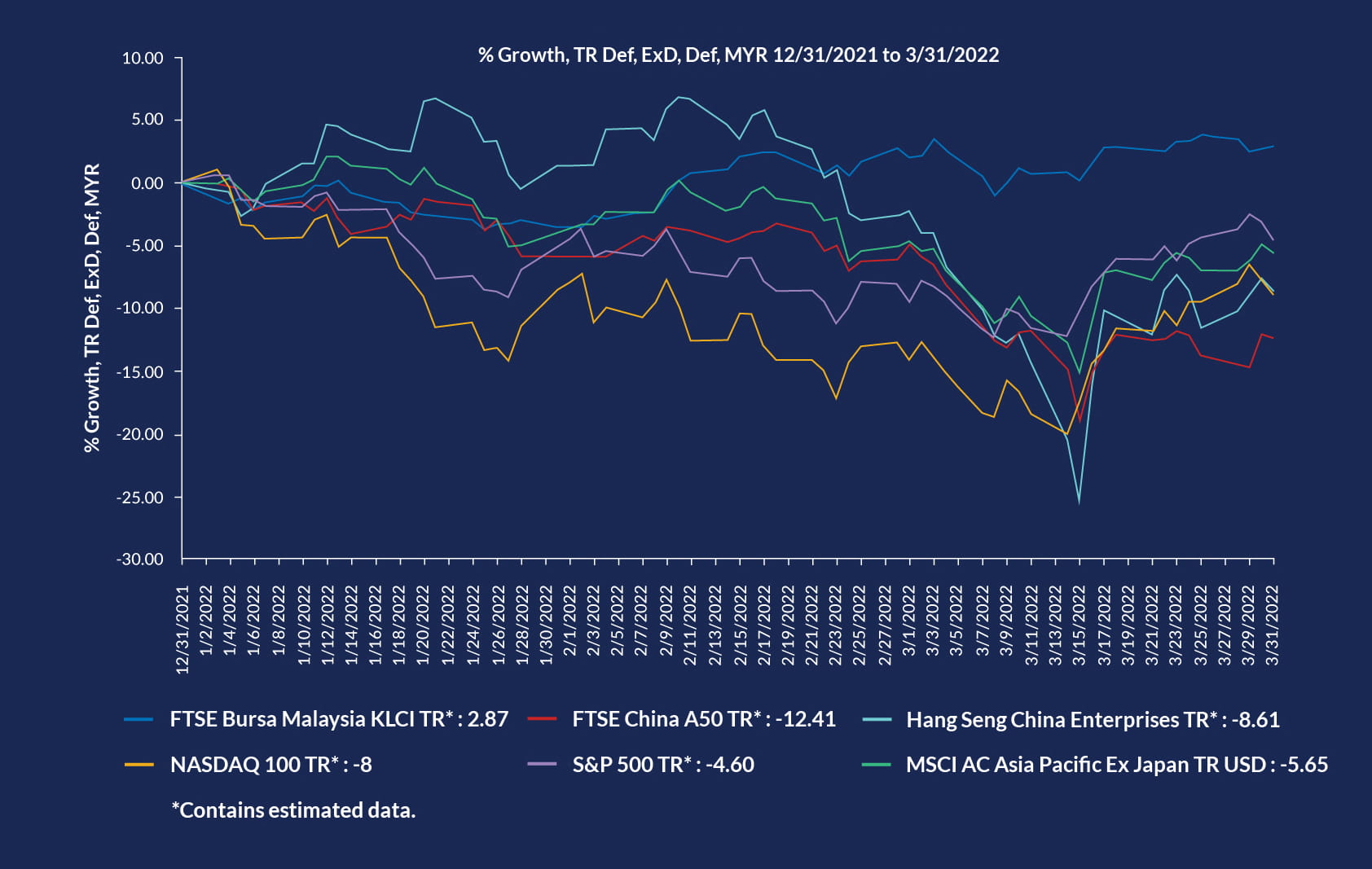

Q1 was a challenging quarter for the equity market. Almost all major markets showed negative returns, bottoming out in mid-March. There was a rebound after the first US Federal Reserve (Fed) rate hike, but this did little to prevent the markets from ending the quarter in negative territory. Still, the FTSE Bursa Malaysia KLCI index ended the quarter on a positive note of 2.87%.

Source: Lipper as at 31 March 2022

RHB maintains our overweight view on equities and alternative assets, while our new position is neutral in fixed income and underweight in cash. A few key risks investors need to keep an eye on include stubbornly high interest rates, US Fed rate hikes, and the ongoing Russia-Ukraine conflict.

Most of the market negativity might have priced in, hence Q2 presents the opportunity to buy in on the dip. Yes, this is a good time to go in. Bear in mind that the global economy is recovering from an unprecedented pandemic, and rising interest rates are to be expected after all-time lows as the path to getting back to normal. As governments beef up their economies with healthy fiscal and monetary policies, the risk of the dreaded stagflation actually occurring in 2022 remains low.

Nevertheless, it’s always a good idea to review your investment portfolio to ensure it is well-diversified with exposure in both equities and fixed income. In this table, we’ve highlighted some salient points to help you make an informed decision.

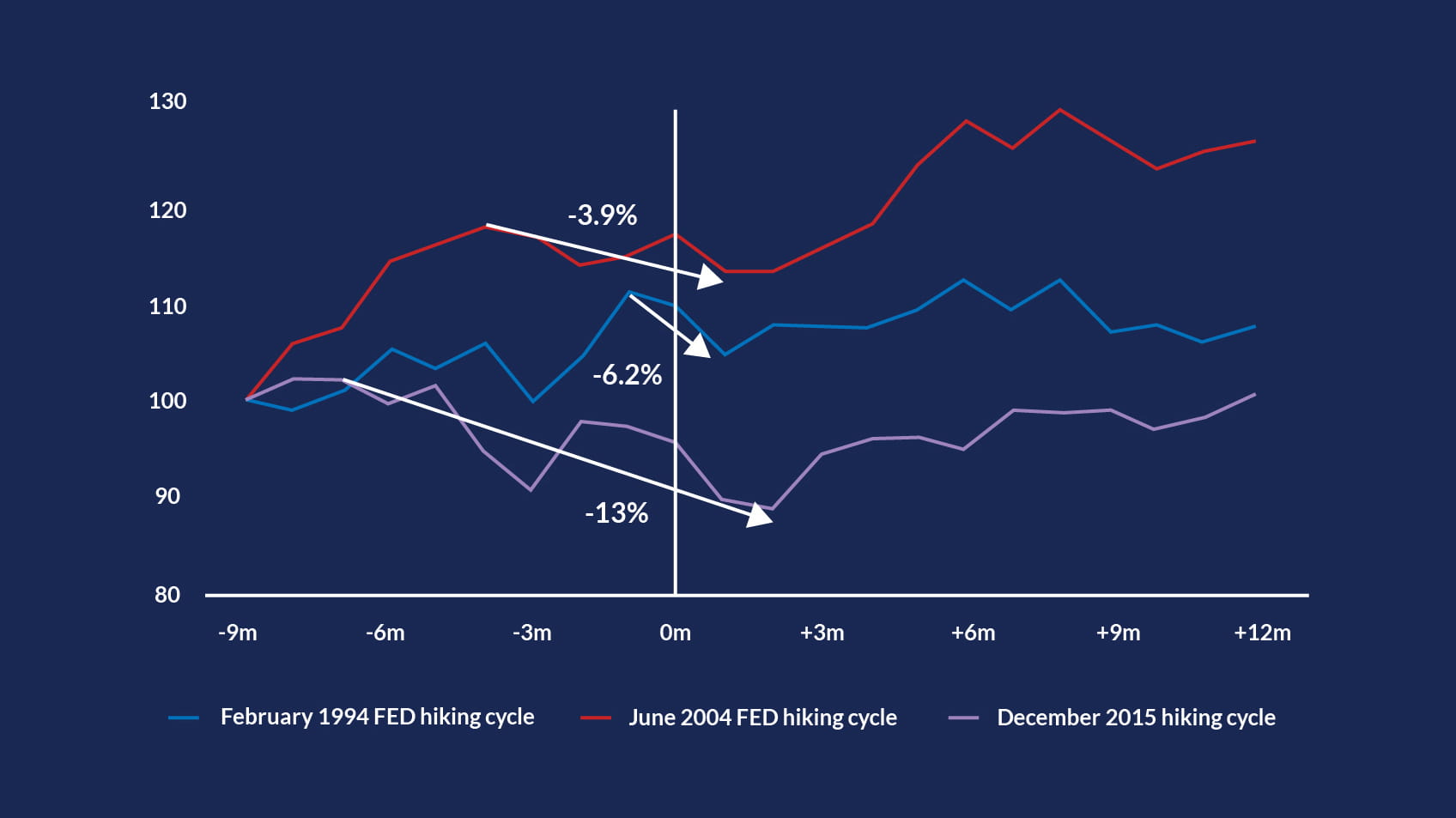

Analysts are expecting the S&P500 to register profit growths of 9% this year, as most of the market negativity has already been priced in. Lower NAV pricing following the January sell off and March bottoming opens up opportunities to buy in on the dip. In previous Fed hike cycles, we observed that the MSCI World Equity Index had an upward trend after the first hike. Job and wage growth also substantiate the Fed’s tightening measures. In addition, global liquidity remains ample and supportive of equity markets.

Source: Bloomberg, RHB Economics & Market Strategy

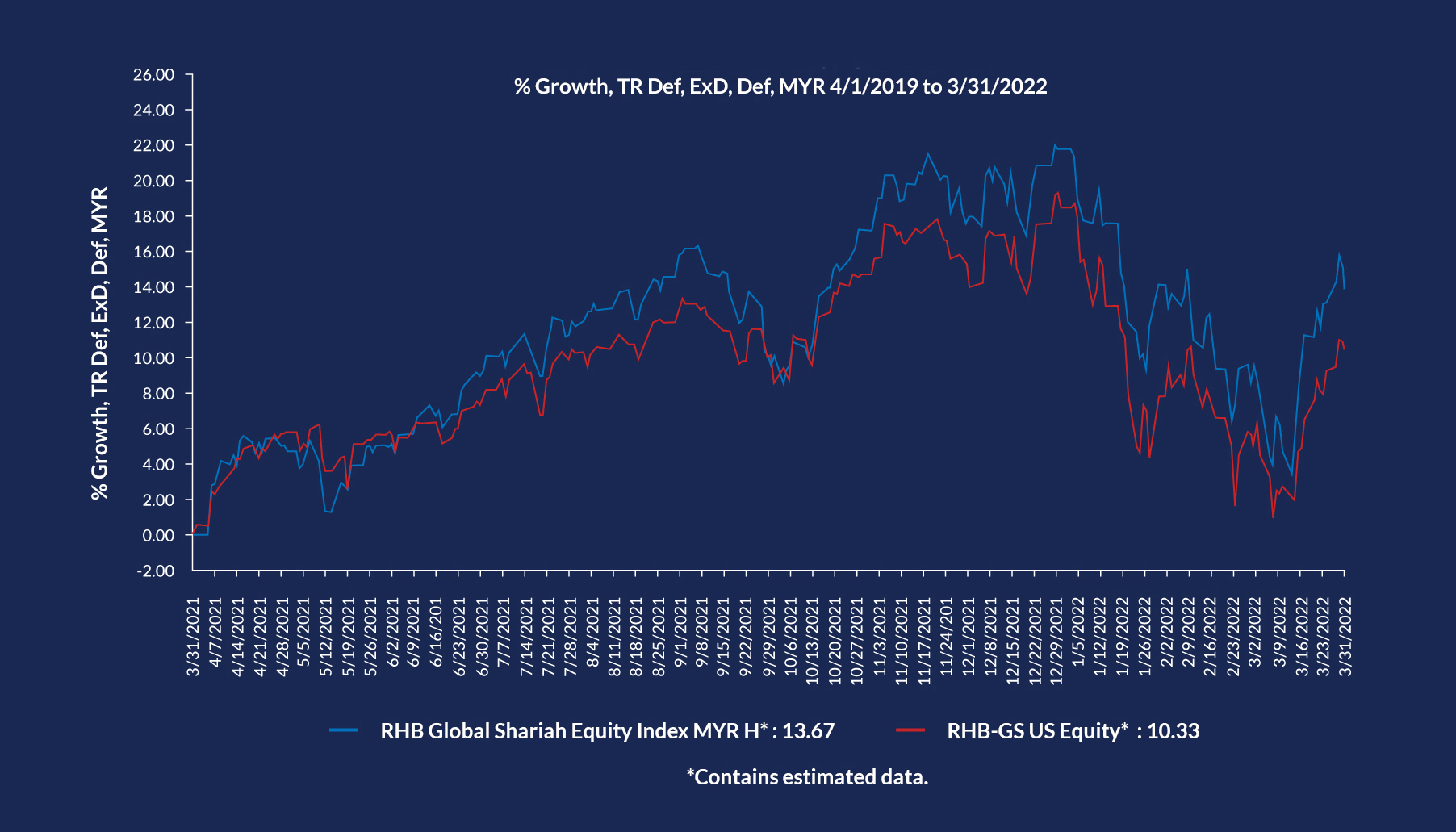

Investors keen on taking up this buying opportunity can opt for the RHB-GS US Equity Fund. Alternatively, you can invest in the RHB Global Shariah Equity Index Fund for a shariah-compliant approach.

Source: Lipper as at 31 March 2022

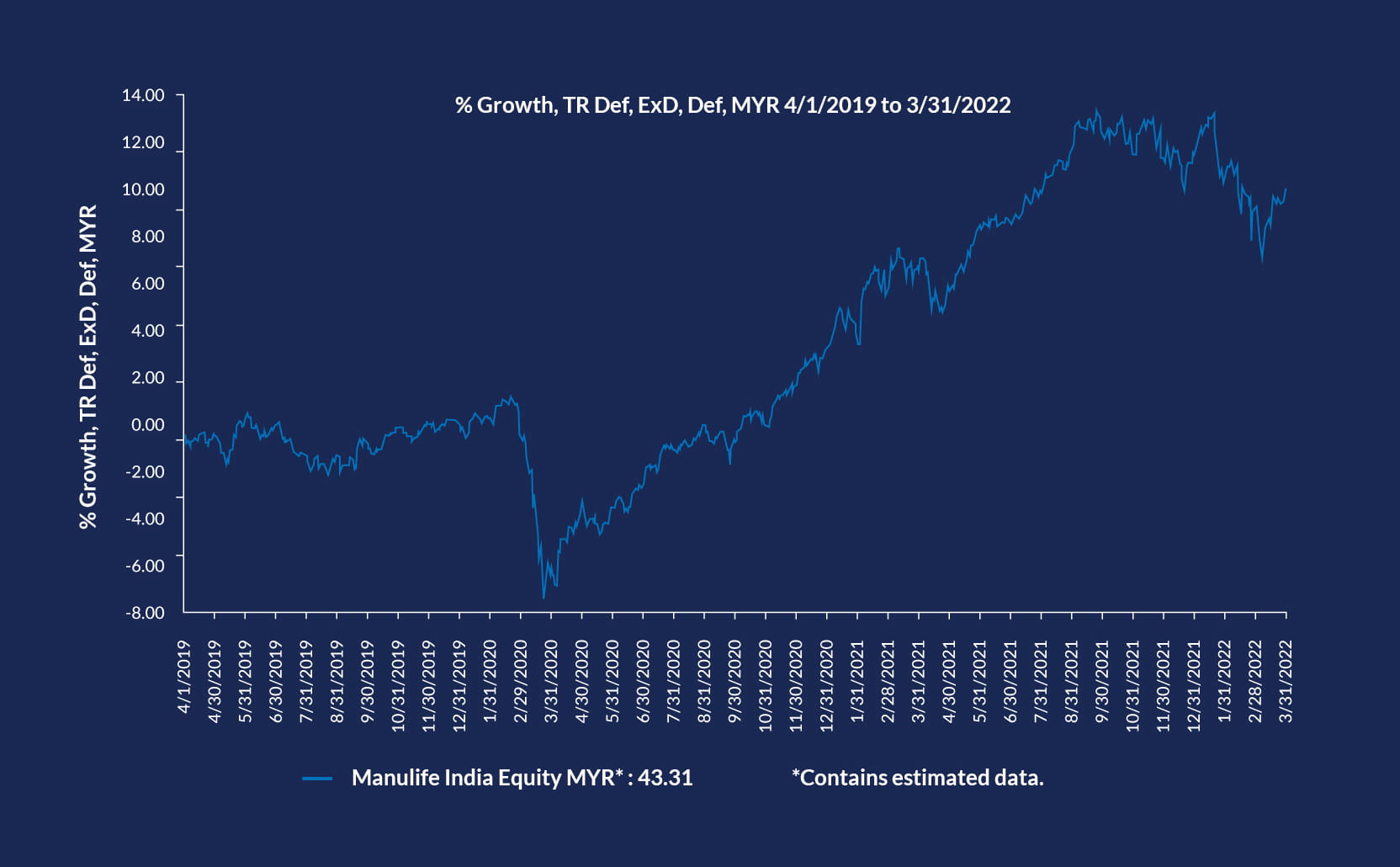

While the focus is on China and the US, India should not be overlooked. The sell down earlier this year presents a great opportunity to invest in India from a cheaper entry point. India has helped ease inflationary pressure in rising commodity prices from spilling over into the global market by buying up cheap Russian oil. For those keen on diversifying their portfolio into an emerging market, Manulife India Equity Fund is perfect. The fund carries a high weightage in the financial sector, which makes it a suitable fund for capturing opportunities in a rising interest rate environment. The fund also has significant exposure in the information technology sector, which is poised for continued growth.

Source: Lipper as at 31 March 2022

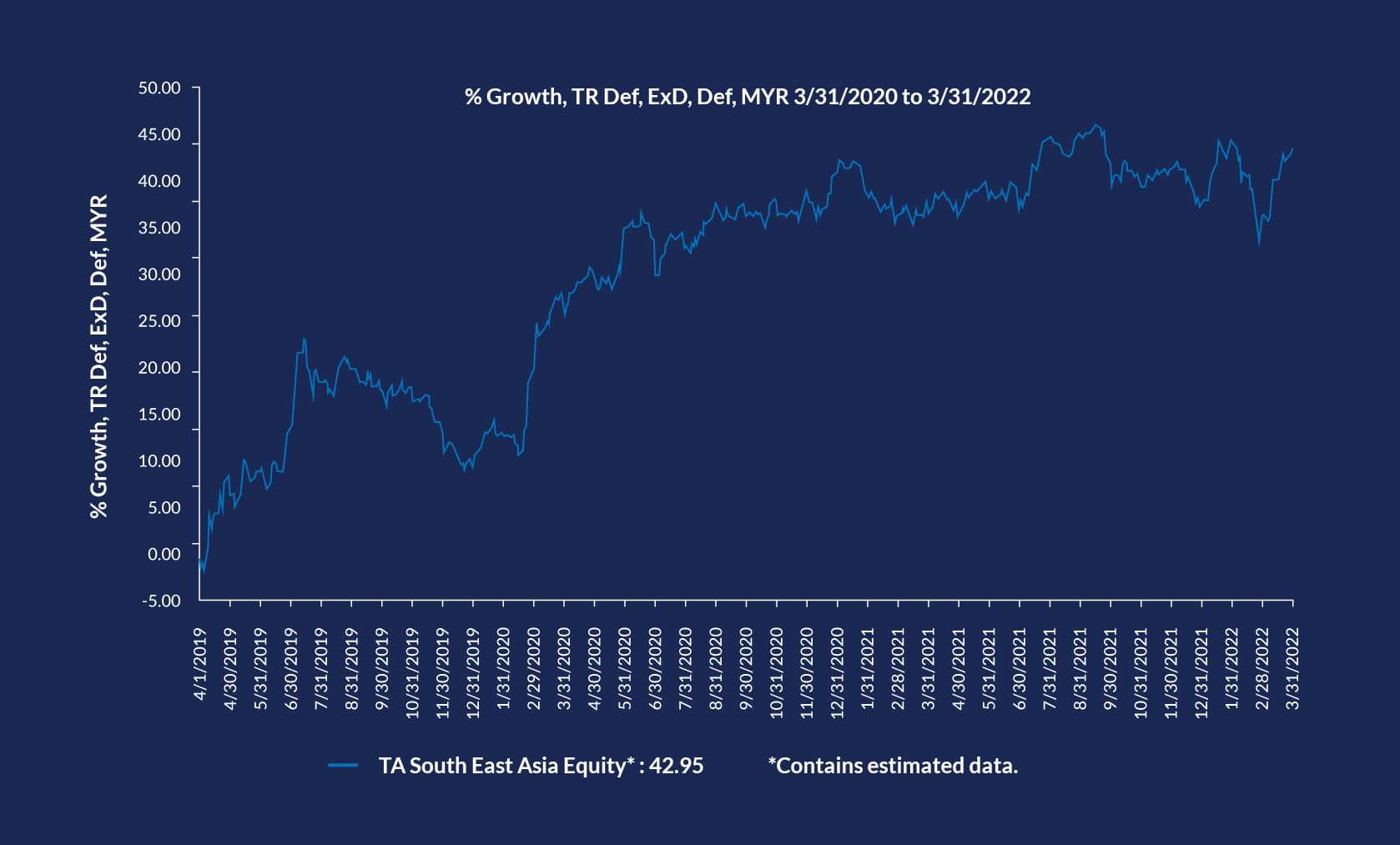

ASEAN equities are still flying under the radar. Investors who diversify into this region will capitalise on the sustainable growth and strength of commodities, i.e., palm oil, fossil fuels and metals like nickel, as countries in the region as traditional producers of raw materials and natural resources. Trade surpluses for Malaysia and Indonesia are expected to be maintained, underpinning higher government revenues and encouraging consumer spending.

Malaysia is transitioning into the endemic phase, with restrictions lifted. Borders have opened up for both Malaysia and Singapore, and other countries like Thailand, a major tourist destination, are following suit, paving the way for more growth.

A great way to diversify your portfolio across the ASEAN region is through the TA South East Asia Fund, which is managed by Lion Global Investors (Singapore). Despite the fund going up 43% over a two-year span, it’s just close to its pre-Covid NAV levels.

Source: Lipper as at 31 March 2022

Speaking of natural resources, here’s a little cherry to top it all – water. There is opportunity to invest sustainably and responsibly in water, which is a necessity for all. In line with RHB’s Sustainability Framework (2019), RHB has added the Manulife Global Aqua Fund as another sustainable offering for our clients.

Floods, pollution, and increasing demand for water from various industries will only place additional pressure on the world’s water supply. Through investment, the fund aims to mitigate the increasing gap between the demand and supply of water and rising concerns over global water quality.

The fund aims to provide capital appreciation by investing at least 95% of the fund’s net asset value (NAV) in the BNP Paribas Funds Aqua (the target fund), which is managed by BNP Paribas Asset Management Luxembourg. The target fund invests in stocks across three broad sectors in the growing global water value chain: Water Infrastructure, Water Treatment and Water Utilities.

Below are some compelling reasons why Manulife Global Aqua Fund would make a great addition to your portfolio.

For advice on which of these opportunities best suit your investment goals and risk profile, speak to your Relationship Manager, or drop by your nearest RHB branch.

Disclaimer:

This article is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party, without obtaining prior permission of RHB Bank Sdn Bhd (“RHB”).

This article has been prepared by RHB and is solely for your information only. It may not be copied, published, circulated, reproduced or distributed in whole or part to any person without the prior written consent of RHB. In preparing this article, RHB has relied upon and assumed the accuracy and completeness of all information available from public sources or which was otherwise reviewed by RHB. Accordingly, whilst we have taken all reasonable care to ensure that the information contained in this presentation is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness and make no representation or warranty (whether expressed or implied) and accept no responsibility or liability for its accuracy or completeness. You should not act on the information contained in this podcast without first independently verifying its contents.

Any opinion, management forecast or estimate contained in this article is based on information available as the date of this podcast and are subject to change without notice. It does not constitute an offer or solicitation to deal in units of any RHB fund and does not have regard to the specific investment objectives, financial situation or the particular needs of any specific person who may receive this. Investors may wish to seek advice from a financial adviser/unit trust consultant before purchasing units of any funds. In the event that the investor chooses not to seek advice from a financial adviser/unit trust consultant, he should consider whether the fund in question is suitable for him. Past performance of the fund or the manager, and any economic and market trends or forecast, are not necessarily indicative of the future or likely performance of the fund or the manager. The value of units in the fund, and the income accruing to the units, if any, from the fund, may fall as well as rise.

A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the Manulife India Equity Fund dated 13 September 2021, TA South East Asia Equity Fund dated 23 November 2021, Manulife Global Aqua Fund dated 26 October 2021, RHB-GS US Equity Fund dated 27 August 2021, RHB Global Shariah Equity Index Fund dated 16 November 2020 (“Fund”) is available and investors have the right to request for a PHS. Investors are advised to obtain, read and understand the PHS and the contents of the Information Memorandum and its supplementary (ies) (if) (“the Information Memorandum”) before investing. The Information Memorandum has been registered with the Securities Commission Malaysia (“SC”) who takes no responsibility for its contents. The SC’s approval and authorization of the registration of the Information Memorandum should not be taken to indicate that the SC has recommended or endorsed the Fund. Amongst others, investors should consider the fees and charges involved. Investors should also note that the price of units and distributions payable, if any, may go down as well as up. Where a distribution is declared, investors are advised that following the issue of additional units/distribution, the NAV per unit will be reduced from cum distribution NAV to ex-distribution NAV. Any issue of units to which the Information Memorandum relates will only be made on receipt of a form of application referred to in the Information Memorandum. The printed copy of prospectus and Product Highlight Sheet is available at RHB branches/Premier Centre and investors have the right to request for a Product Highlight Sheet. Investors are advised that investments are subject to investment risk and that there can be no guarantee that any investment objectives will be achieved. Investors should conduct their own assessment before investing and seek professional advice, where necessary and should not make an investment decision based solely on this update.

The Manager wishes to highlight the specific risks of the RHB Global Shariah Equity Index Fund are Management Risk, Liquidity Risk, Currency Risk, Country Risk, Market Risk, Emerging Markets Risk, Foreign Exchange Risk, Shariah Restrictions Risk, Stock Risk, Liquidity Risk ,Risks Associated with Government or Central Banks' Intervention, Prohibited Securities Risk, Taxation Risk, Withdrawal of the UK from the EU Risk, Risks relating to the Index, Counterparty Risk, Derivatives Risk, Index Tracking Risk and Operational Risk. The specific risks of RHB-GS US Equity Fund are Investment Manager Risk, Market Risk, Currency Risk, Liquidity Risk, Regulatory Risk, Risk of Substantial Redemptions, Suspension of NAV Calculation/Limitation of Redemption Payments, Concentration Risk, Corporate action and voting rights, Derivatives and structured products risk, uncertain tax positions, Certain ERISA (i.e. Employee Retirement Income Security Act 1974, United States federal pension regulations) Considerations, Securities risk, Inclusion of shares in an index, Investments in American Depositary Receipts, European Depositary Receipts and Global Depositary Receipts, Cross-contamination between portfolios and share classes, Materiality policy for correcting valuation errors, “Fair value” prices, Debt securities, interest rate risk, Real estate companies, Illiquid assets, Risk of changes in borrowing rates and Legal, tax and regulatory risk. The specific risks of Manulife Global Aqua Fund are Market Risk, Manager Risk, Loan Financing Risk, Target Fund Manager Risk, Country Risk, Currency Risk, Liquidity Risk, Withholding Tax Risk, Concentration Risk, Emerging Market Risk, Risks Related to Investments in some countries, Environmental, Social and Governance (ESG) Investment Risk, Small Cap, Specialised or Restricted Risk, Equity Risk, Changes in PRC Taxation Risk, Risks related to Stock Connect and Swing Pricing Risk. The specific risks of Manulife India Equity Fund are Manager Risk, Market Risk, Liquidity Risk, Country Risk, Currency Risk, Risk Consideration for Investing in Derivatives, Investment Manager Risk, Small-Cap Risks, Natural Resources Sector Risk, Taxation Risks, Financial Derivatives Instruments other than for Investment Purpose, Foreign Exchange Risks, Liquidity and Volatility Risks, Emerging Markets Risks, Political and Regulatory Risks, Custodial, Clearance and Settlement Risks, Credit Downgrade Risk, Macroeconomic Risk Factors, Global Commodity Prices, Oil Prices Risks, Government Policy Risks, Risk of Price Controls, Risk of Stock market Controls, Geopolitical Risks, Labour Market Risks, Environmental Regulation Risks and Swing Pricing Risk. The specific risks of TA South East Asia Equity Fund are Economic Risk, Currency Risk, Emerging Market Risk and External Fund Manager Risk. Management Risk, Liquidity Risk, Currency Risk, Country Risk, Interest Rate Risk, General Risks, Certain Legal and Regulatory Risks, Cybersecurity Risk, Market Risk, Borrowing Risk, Loans of Portfolio Securities Risk, Taxation Risk, FATCA and Certain Withholding Risk, Investment Strategy Risk, Country Risks – Emerging Market, Focused Portfolio Risks, Allocation Risk, Turnover Risk, Derivatives Risk, OTC Derivatives Counterpart Risk, Equity Securities Risk, REITs Risk and other general risks are elaborated in the Information Memorandum.

This article has not been reviewed by the Securities Commission Malaysia (SC).

RHB Bank Berhad 196501000373 (6171-M) | RHB Islamic Bank Berhad 200501003283 (680329-V)