The US Federal Reserve’s monetary policy tightening cycle is likely to be short and sharp, with two 50-basis-point hikes taking place in June and July. This will take the federal funds rate (FFR) towards 1.75% by end-July, with further hikes remaining on balance as the US Fed takes a pause-and-wait approach.

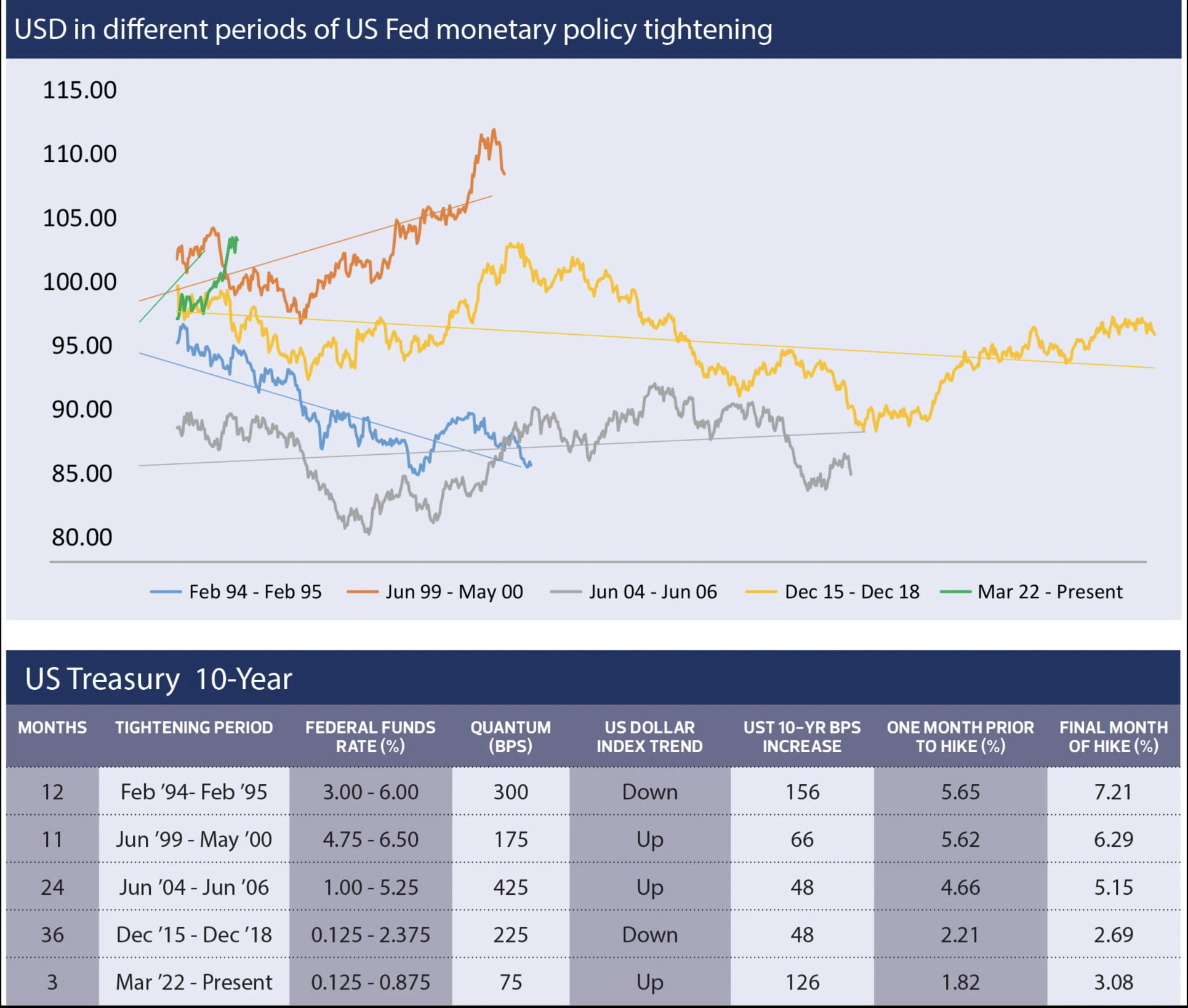

This approach by the Fed would be similar to the June 1999-May 2000 period of a tightening cycle, suggesting that the FFR could eventually settle around 1.75% to 2% and fall short of the terminal rate that the market is currently pricing in excess of 2.5%.

We believe that if the Fed intends to avoid a hard landing or a possible recession, a pause-and-re-evaluation scenario by the Fed will play out after the Federal Open Market Committee meeting in July.

A pattern of monetary policy tightening similar to June 1999-May 2000 would indicate that the US 10-year Treasury yield may need to unwind the excessive tightening that it is currently being priced in.

For the US dollar (USD), a pattern of monetary policy tightening that is short and sharp, as in June 1999-May 2000, would suggest the USD is near its peak. The risk is the strength of the USD will come off beyond the July period. Thus, the current market pricing would need to be calibrated eventually to unwind the excessive tightening that is being priced via the USD. This will eventually give regional Asian currencies, particularly the USD/MYR (Malaysian ringgit), leeway for a change in directional trend from its current upward trajectory.

Based on the current correlation, we note the US Dollar Index (DYX) and the US 10-year Treasury yield have continued to edge higher, moving in lockstep as financial conditions via the foreign exchange (FX) and the rates market tighten. The risk is a possible pullback in either market instruments — the US 10-year Treasury Yield or DYX — once the market has fully priced in rate hikes of 50bps in June and July by the Fed.

For the MYR, the recent decision by Bank Negara Malaysia (BNM) to raise rates would put a ceiling on the currency from coming off significantly. The topside of 4.40 to 4.45 is deemed an overshoot, and we believe the decision by BNM will be seen as positive for the local currency. The retrace in USD/MYR could take the pair gradually on an intraday basis towards 4.350, 4.300 and eventually towards our end-2022 target of 4.100 over the medium term.

For the major currencies, the Japanese yen (JPY) has been susceptible to weakness on the back of divergence in monetary policy between the Fed and the Bank of Japan (BoJ). However, we believe over the medium term, the BoJ will eventually need to normalise interest rates, thus putting a ceiling on the JPY that will prevent it from further weakness. Similar action is likely to play out for the euro, whereby we believe the European Central Bank would need to adjust interest rates higher, putting a floor on it from weakening further.

In the risk-sensitive currencies, we note the Australian dollar (AUD) has stabilised, following the recent hike by the Reserve Bank of Australia (RBA) that provides a floor for the AUD from breaching below the significant 0.700 level on the downside. Further rate hikes are in store. For the market, the decision by the RBA to raise interest rates has, to a large extent, signalled the intention that it is normalising monetary policy.

For the pound sterling, we note that a raising of rates by the Bank of England (BoE) puts a floor on the currency from breaching the significant support line of 1.200. We believe with further rate hikes in store by the BoE, the upside for the British pound remains in the near term.

On balance, we believe though the Fed is aggressive on its rate tightening stance, the recent decision by the BoE and RBA to raise rates will eventually provide investors with an opportunity to engage in relative value trades.

Investors who want to capture the FX opportunities or hedge against currency fluctuations can set up an RHB Multi Currency Account* that allows them to store up to 24 foreign currencies on top of the Malaysian ringgit. Users can enjoy attractive conversion rates for the currency of their choice to take advantage of price fluctuation. The currency conversion is fast and seamless, where the user can convert one currency to another instantly via RHB Internet Banking and the RHB Mobile Banking App.

For investors who are keen to invest in FX-related products, our relationship managers and investment specialists stand ready to work with you to design an effective investment strategy to meet your long-term investment goals.

*Deposit products are protected by PIDM up to RM250,000 for each depositor. MCA Gold Investment and MCA Silver Investment are not protected by PIDM. RHB is a member of PIDM.