For well over a century, International Women’s Day has helped highlight the challenges women face in everyday life and marks a call to action for accelerating women’s equality. The theme for International Women’s Day this year is “Breaking the Bias”.

There is still a lot to do in our bid for equality. The women in our lives play so many important roles, and despite progress in some areas, they still have to overcome so many obstacles placed in their way by a system rooted in patriarchy. It takes an entire community – both men and women – to push for equality and ensure equal access for all.

Every woman has a remarkable story to tell. Despite the overwhelming odds against them, they’ve succeeded in their own right.

Sarah, 37, is an aeronautical engineer and single mum of two. As a young girl growing up in a small kampung in Perak, she dreamed of coming to Kuala Lumpur to make a better life for her family. A survivor of an abusive marriage, she overcame so much to achieve her goals and is truly a superheroine.

“I didn’t have a support system and was always told that I wouldn’t succeed. From my childhood to my career and marriage - I went through so much. I’m glad that I persevered. I want the best for my children and I tell them that they can achieve anything. I don’t want them to go through what I did and I hope that things will change for the better,” she says.

Julie, 45, is a successful businesswoman who runs a construction materials company. She has had to work extra hard to prove herself in a male-dominated field. She nearly became bankrupt 12 years ago due to mounting debts, but her business is now thriving.

These stories highlight an uneven playing ground. A change in the system and in attitudes towards women are required to level it. Part of the push towards equality is improving the financial literacy rate among women.

Increasing the quality of a longer life

The life expectancy of women is higher than men, and women juggle multiple roles in life. Both women and men need to be sufficiently financially literate to effectively participate in economic activities and to take appropriate financial decisions. That’s why it is crucial for women to have access to financial education and the right tools to help in financial planning. Financial literacy involves being able to identify and understand the opportunities for income generation, access to funding, and learning how to make the most of the range of financial products available.

Low financial literacy rates dramatically impact the lives of women, demanding they work harder, take more time to pay debts and, sometimes settle for earning less. Although wages have increased over the last few decades, financial literacy rates have not increased much.

With the socio-economic environment in Asia changing rapidly, there is greater uncertainty and volatility. The financial system has also become more complex, with new risks emerging. This increased sophistication makes it increasingly difficult for those who are less financially literate to make sound decisions.

At RHB, we believe in equality. We provide the right products and the expertise to help women close the gap on financial literacy and income disparity. From wealth management, succession planning and protection, to financial tools for enterprising women, we’ve got you covered.

Financial planning for tomorrow

A longer lifespan for women means more spending after retirement.

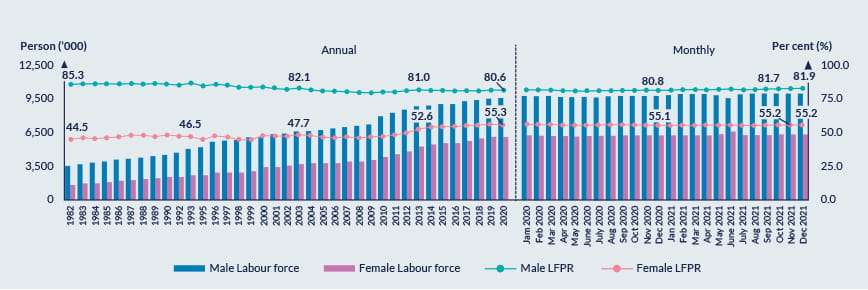

As at 31 December 2021, 55.2% of the female population (6.33 million) in Malaysia are employed, while 81.9% (10 million) of the male population are participants of the labour force. Although more women have joined the working world, income disparity means that not many women have sufficient savings for retirement. Lower pay means smaller contributions towards the Employee Provident Fund (EPF), so there is less to live on post-retirement. The cost of living steadily increases every year as well.

Labour force and participation rate by gender, 1982 - 2021

Source: DOSM