Investing in a high inflation environment and preparing for the better times ahead

The storm of higher macroeconomic volatility is here as central banks juggle inflation and the consequences of higher interest rates on their economies. It feels like everything is up in the air at the moment, but wait, there’s a silver lining.

If the past quarter had a theme, it would be inflation. Central banks raced to raise interest rates to counter inflation and the equity markets bore the brunt of the pressure in Q3 2022. The US, Eurozone, UK, Japan, Asia (ex-Japan) and emerging markets all saw weaker returns, with emerging markets generally underperforming, in comparison to their developed counterparts. Commodities declined across the board.

In the US, the communications services sector, including telcos and media stocks, was among the weakest sectors, alongside real estate. On the opposite end, the consumer discretionary and energy sectors fought against the current tide, proving more resilient. In July, the world anticipated the Federal Reserve (Fed) to cut interest rates in 2023, but the central bank made an about-turn and continued to raise rates, and the rest of the world followed suit.

The energy crisis and rising inflation continued to weigh heavily on Eurozone shares. The European Central Bank raised interest rates in July and September, taking the deposit rate to 0.75% and refinancing rate to 1.25%. Annual inflation for the eurozone was estimated at 10.0% in September, up from 9.1% in August.

A key event in Q3 for the UK was the appointment of Liz Truss as Prime Minister. The new government’s new fiscal package was poorly received, sending the normally robust sterling tumbling to an all-time low against the US dollar. The impact of rising energy bills weighed on consumer-dependent industries like retail, travel and leisure, and home construction as British folk found themselves with less disposable income.

After an initial rise in July and August, the Japanese stock market followed the trend of global markets, ending the quarter on a low 0.8%. The shocking assassination of former Prime Minister Shinzo Abe, two days before the nationwide Upper House elections, overshadowed the markets in July. Abe was the longest-serving Prime Minister. Somewhat against the norm, the Bank of Japan left its policy rate unchanged, thus, weakening the yen against the dollar.

Ongoing tensions between China and Taiwan, and the war in Ukraine weighed heavily on Asia (ex-Japan) equities. China’s all-or-nothing approach to Covid restrictions prompted fears of lockdowns as the number of cases rose. India ended the quarter on a positive note, although interest rate concerns weakened sentiment towards the end. Growth-sensitive north Asian markets, such as South Korea and Taiwan, suffered as the outlook for global trade deteriorated.

In the fixed income market, government bond yields were generally higher and credit spread wider across the global market, weighing heavily on market returns.

Let’s look at how the money moved in Q3 to better understand our next steps.

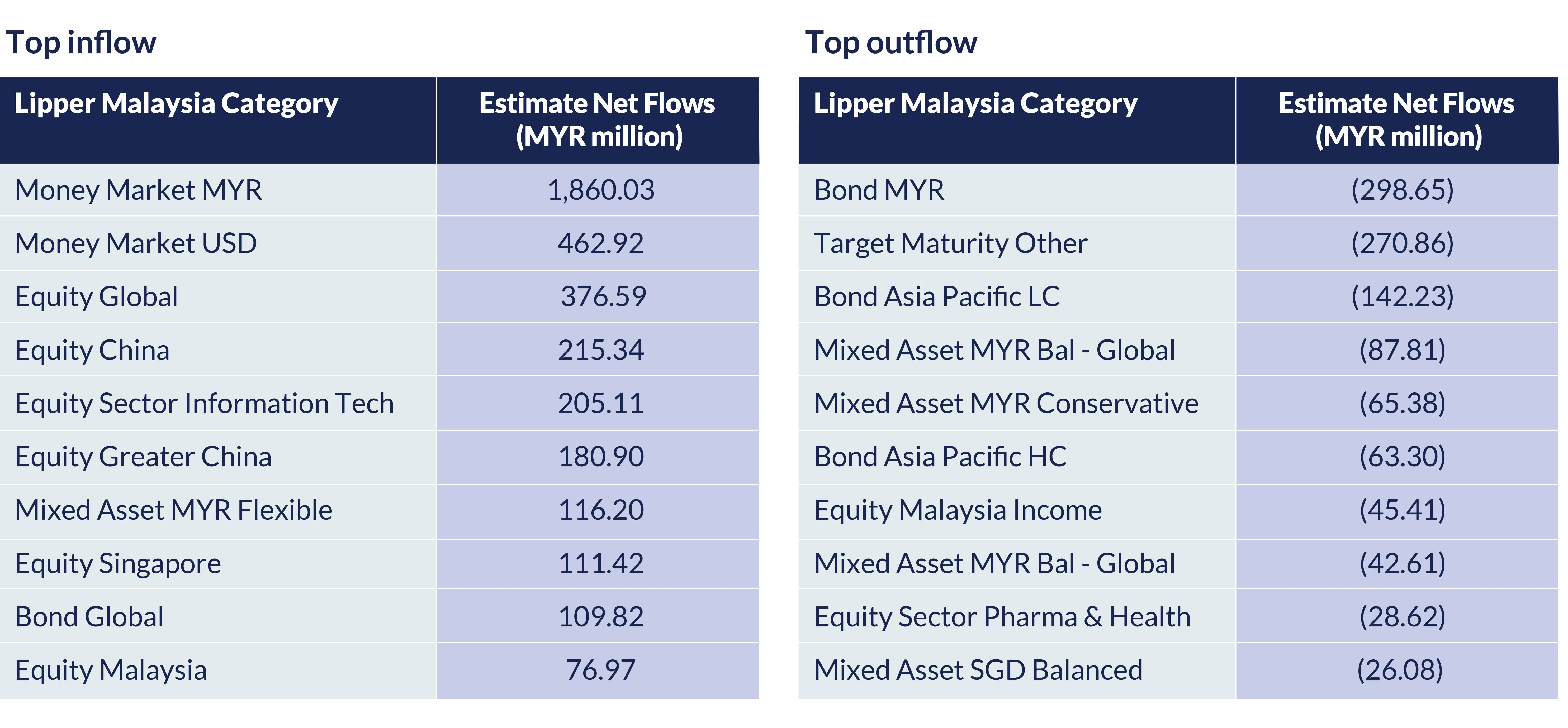

Top Outflow in Q3 2022

Source: Lipper Investment Management as of September 2022

Interestingly, Q3 was the first time we saw the MYR money market topping the inflow list. This is possibly due to the continuous pressure from the Fed to hike interest rates, making equities less attractive. Investors largely took a wait-and-see approach, parking their money in lower-risk funds, including global bonds until the sentiment improved. The higher interest rates in the US and stronger dollar pulled investors into the USD money market. Global equities, tech funds and China funds remained a favourite for investors who saw a silver lining in these areas.

In terms of outflow, investors raised cash in minimal loss areas like the Malaysia and Asia Pacific bond funds and mixed asset funds.

Find a good shelter for your money

There’s a storm, so what do we do now? The good news is that the fear surrounding rising interest rates will likely simmer down towards the end of the year. The bad news is that we might actually need a recession to pull down the demand that is driving inflation.

Hunker down, folks, and get ready. Here are some of the funds to park your money in to minimise the impact to your diversified portfolio and help you weather the storm.

RHB US Value Fund

We’ve suggested this in Q3, and RHB US Value Fund makes the list again in Q4. Why? Because US Value stocks are supported by elevated inflation, the interest rate hike cycle, tighter monetary policies, and undemanding relative valuation. This fund thrives in bad equity weather, making it a good option to balance your portfolio.

The fund focuses on US large caps that have share buy-back capabilities due to a high level of retained earnings. These companies have enough in their coffers to keep their share prices afloat. RHB US Value Fund leverages on the stock selection expertise of JP Morgan Asset Management. With banks among its investments, the fund will benefit from the increase in net interest income in the coming months. If you’re keen on getting some cyclical non-tech exposure, you can consider this fund.

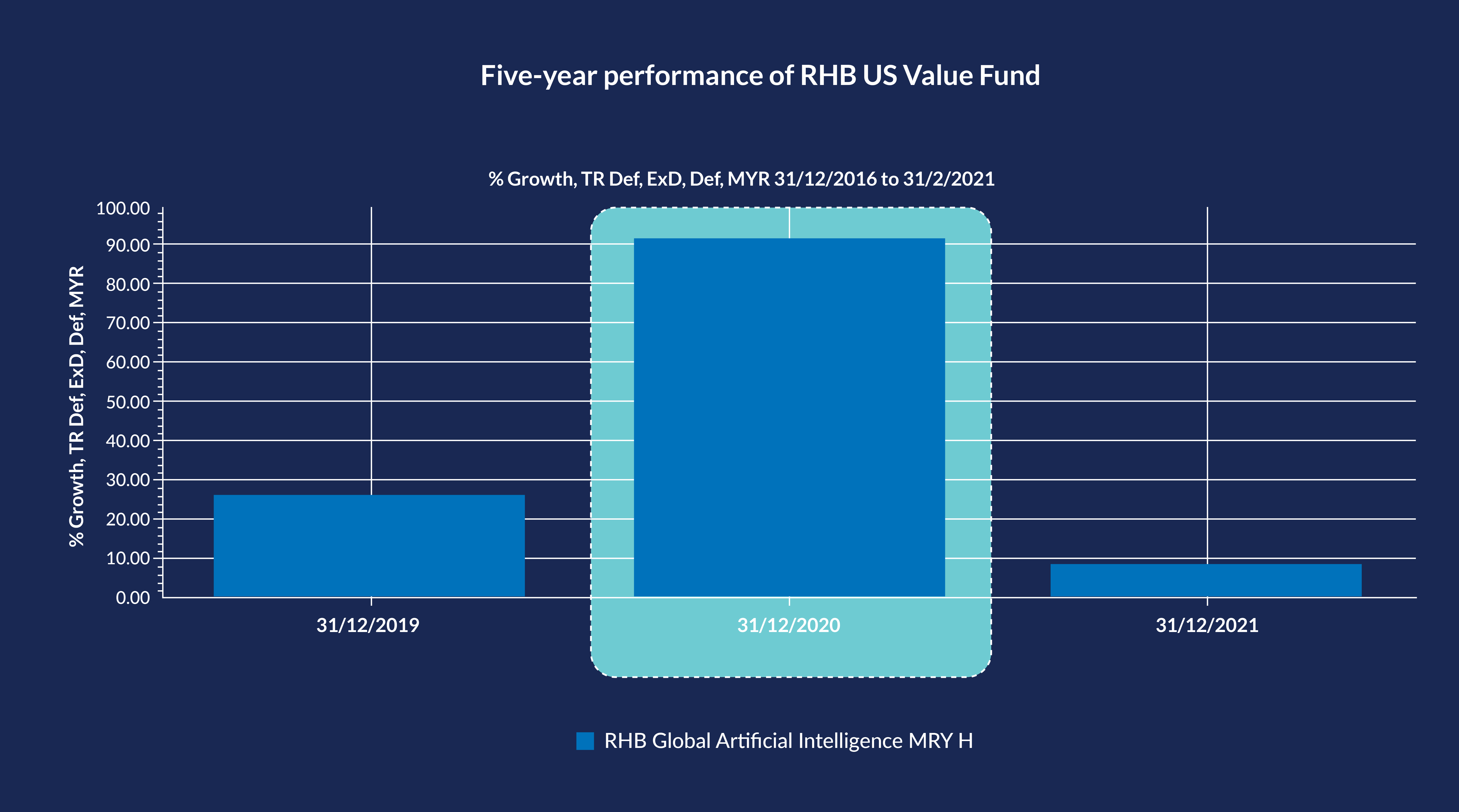

Five-year performance of RHB US Value Fund

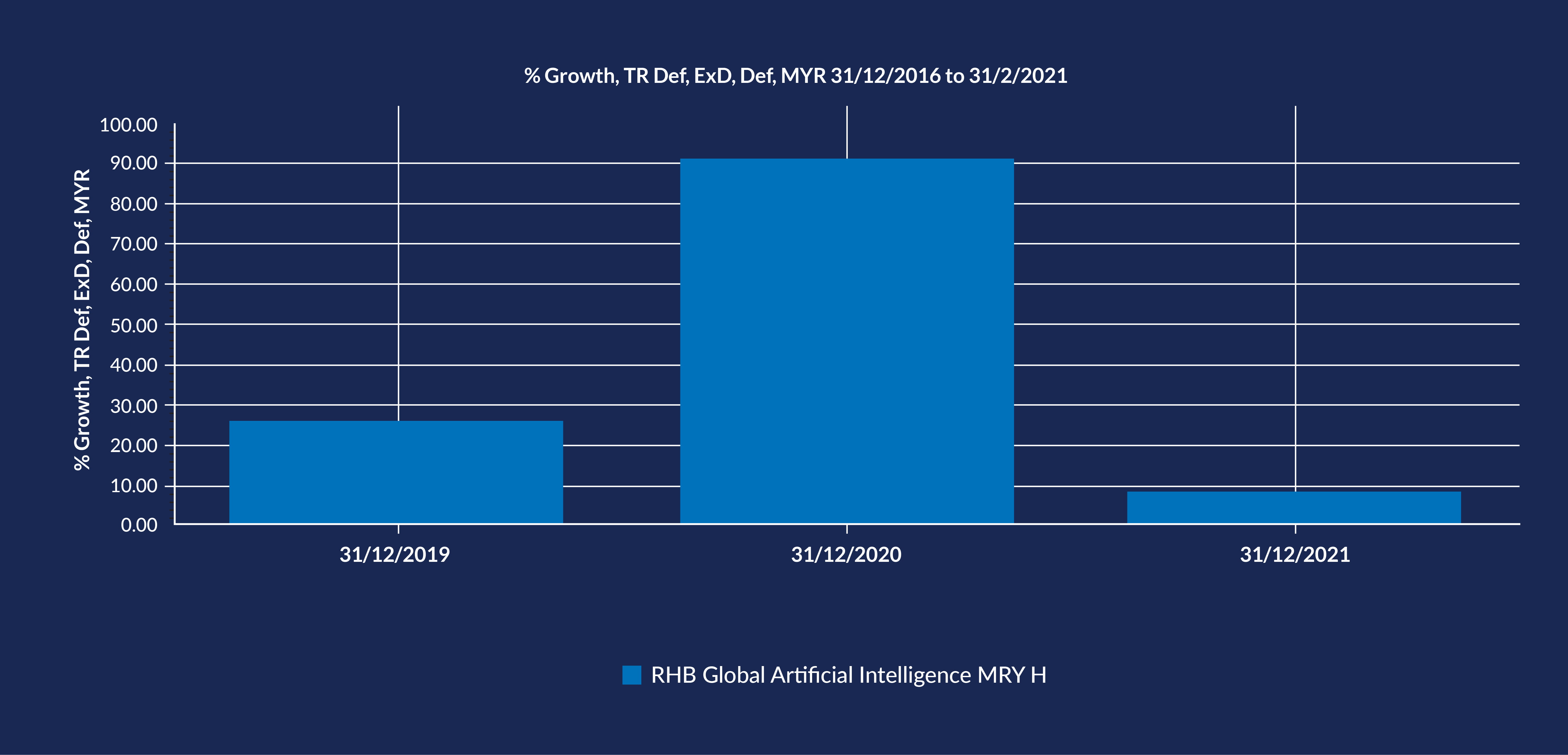

AI is the future, and the future is now. RHB Global Artificial Intelligence Fund provides long term capital growth by investing in global companies that benefit from or are related to the evolution of AI.

By now, most of the interest rate fear has been priced in. If there is any reversal in rates, a high beta (high risk) fund like this is likely to benefit from the recovery.

Prior to 2022, the fund had three consecutive years of positive returns, with 2020 seeing returns of 90%. However, as of the end of September 2022, the fund is down nearly 40%, so it’s a good time to make a fashionably late entry.

If you have a long-term strategy and want to take the tactical approach of investing in a sectoral fund, try this one. Do take note, though, that a single sector fund comes with more volatility.

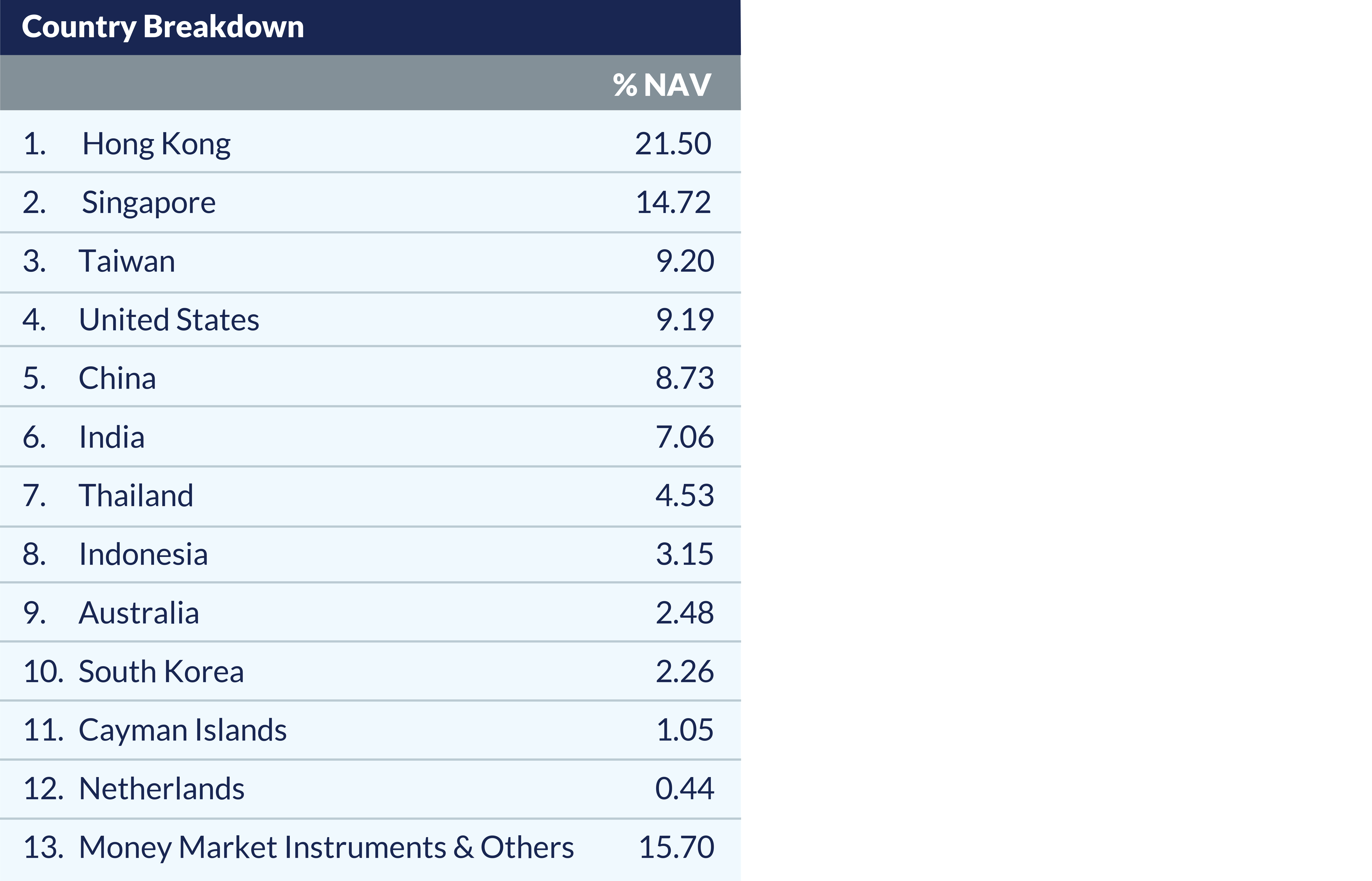

On the opposite end of the spectrum is the very diversified TA Asia Absolute Alpha Fund, which could provide some refuge from volatility. Let’s look at the fund’s breakdown by country.

The Chinese tech sector valuations and share prices are looking very attractive, after being pushed down by regulatory crackdowns, external headwinds, and China’s zero tolerance approach to the pandemic. Overall, the fund fell almost 23% (as of 30 September 2022), opening opportunities for new and existing investors to add more exposure at a cheaper NAV price.

MSCI Asia (ex-Japan) is among the cheapest broad base index on both Price-To-Earnings and Price-To-Book ratios.

The reopening of Asian borders and economy are potential growth catalysts, particularly for China and Hong Kong. The floodgates will release pent-up demand and revenge spending in the coming quarters.

The fund's external investment manager is Fullerton Investment Management (Singapore), which aims to achieve a positive return in any business cycle (on a 3-year rolling period) with an absolute return benchmark of 8% per annum. To achieve this, cash and index hedges are employed to preserve capital and capture opportunities during downturns.

The fund actively reallocates its position on a bottom-up basis, seeking opportunities to buy low. As of end August, the fund’s main exposure is in Hong Kong, Singapore, and Taiwan. The fund was holding 15.7% cash to be redeployed into the equity market.

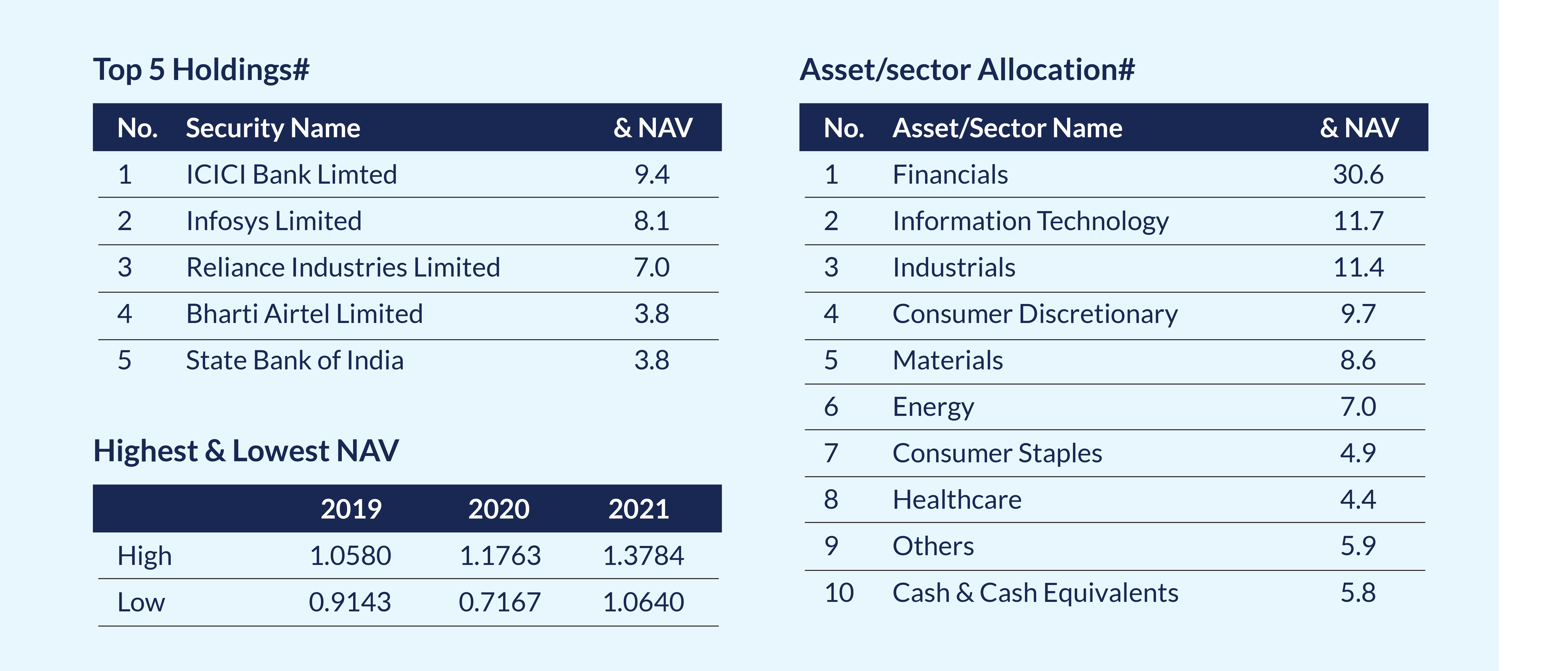

Within the emerging markets space, India has good potential for investors looking to diversify in the country. There’s a good reason for that. The manufacturers for large foreign companies have been moving out of China to India, with Apple being a notable example. To support this movement, India registered the highest factory activity among the larger economies, showcasing economic resilience. The country’s inflation rate, at 7.41% (September 2022, CPI), is also among the lowest.

According to the International Monetary fund, India is set to be the fastest growing major economy, at 6.8% in 2022 and 6.1% in 2023. Its policy tightening cycle will benefit the banking sector, and the fund’s 30% exposure is a good opportunity to capture this growth.

For moderate-risk investors, or those who are relatively conservative, we’ve got a freshly launched fund for you.

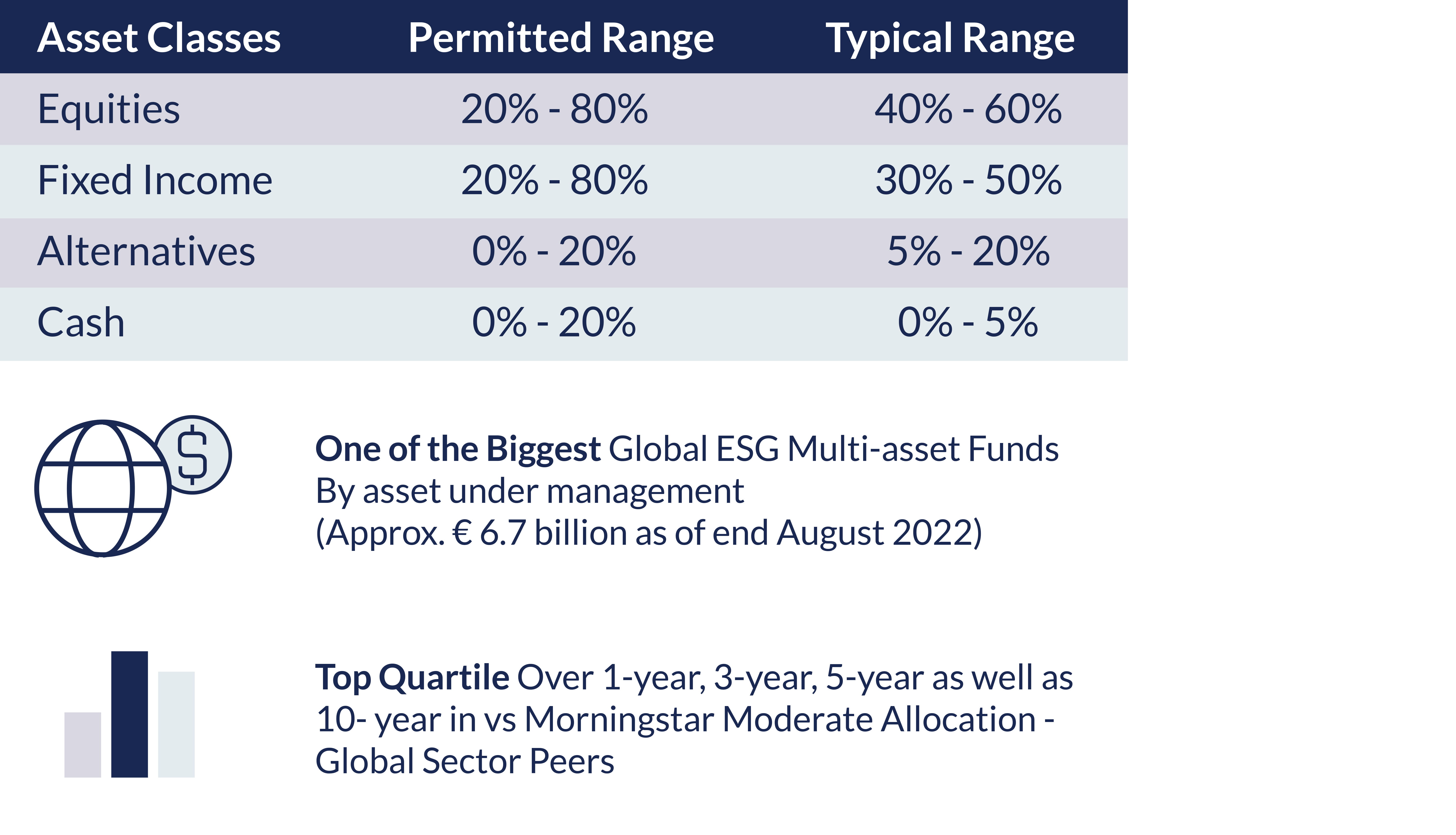

RHB ESG Multi-Asset Fund positions itself in various asset classes, such as fixed income, derivatives, futures, exchange-traded assets, and cash, with the aim of reducing portfolio volatility and generating a consistent price movement. The fund feeds into BlackRock Global – ESG Multi-Asset Fund. According to Thinking Ahead Institute, BlackRock is the world’s largest asset manager in terms of Assets Under Management (AUM), with USD10 trillion in AUM as of January 2022.

The target fund is one of the biggest global ESG Multi Asset funds in the market, with a 3-year annualised return of 6.42% (as at end-August 2022).

The target fund’s manager aims to invest in resilient, profitable companies with persistent pricing power based in developed markets.

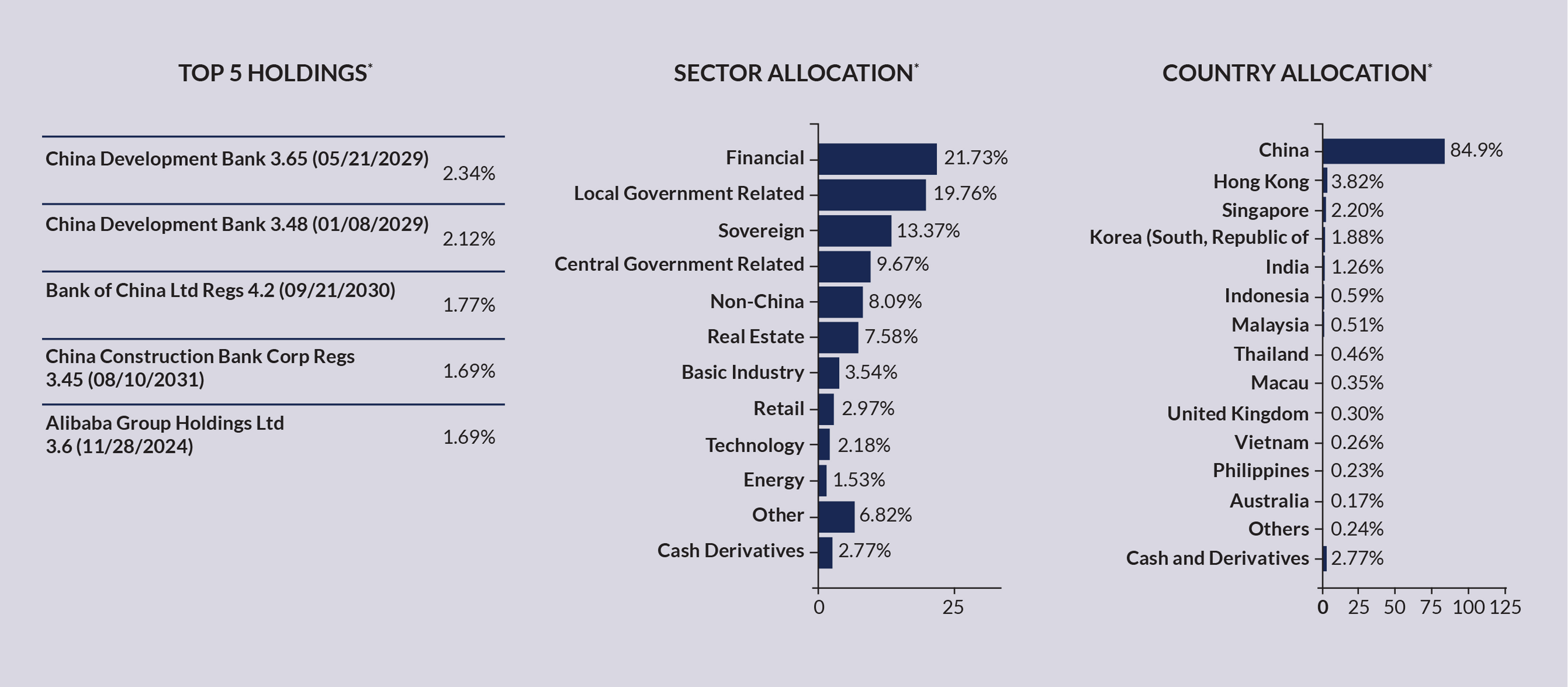

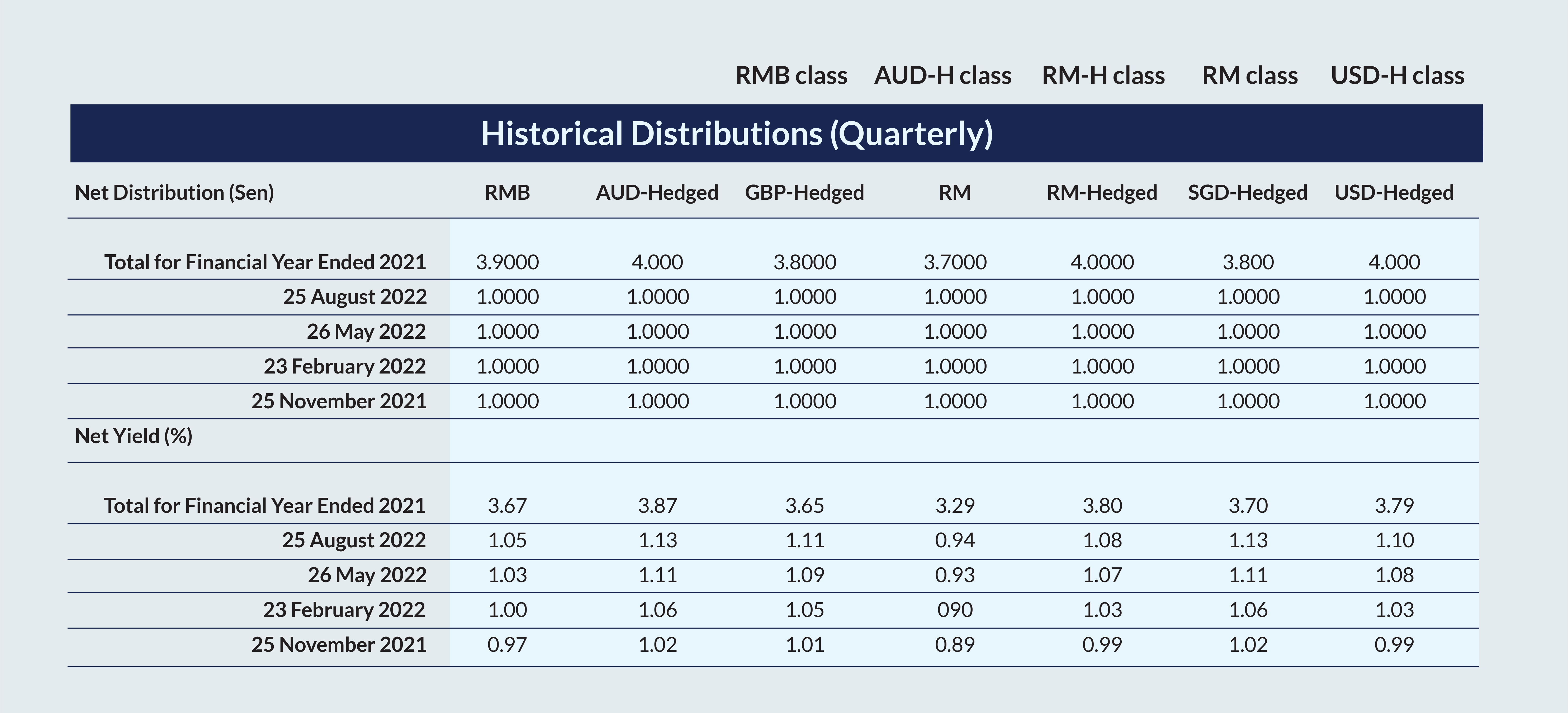

For those who wish to invest in an income fund with a touch of foreign market exposure, RHB China Bond Fund is well-diversified across multiple bond papers in various sectors, reducing the potential loss in the event of a default. As at end-August 2021, the fund has been repositioned into mainly financial sector bonds, with the rest going to government-related bonds.

Why does China still look good from a fixed-income perspective? The country is widely expected to loosen its monetary policy to accommodate its return to expansion mode. The eventual cessation of its hard-line approach to Covid will shine a positive light on its financial market. The yields on China’s investment-grade bonds are also relatively better than those of large, developed economies.

Let’s look at how the fund is structured.

Source: Lipper Investment Management as of 30 October 2022

Past performance is not indicative of future performance. Investment involves risk, and investors should conduct their own assessment before investing and seek professional advice, when necessary.

*As a percentage of NAV. Source: BlackRock, 31 August 2022. Exposure in BlackRock Global Funds - China Bond Fund - 95.98%

The fund’s track record is quite positive as well.

So, it’s not all gloom and doom. There’s always that bright spark of opportunity. Get in touch with your Relationship Manager today to make the most of your portfolio.

RHB Bank’s Relationship Managers and Investment Specialists are ready to help you formulate an effective investment strategy that suits your risk profile and will help you achieve your long-term investment goals. Contact your nearest RHB Branch today.

Disclaimer:

This article is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party, without obtaining prior permission of RHB Bank Sdn Bhd (“RHB”).

This podcast has been prepared by RHB and is solely for your information only. It may not be copied, published, circulated, reproduced or distributed in whole or part to any person without the prior written consent of RHB. In preparing this presentation, RHB has relied upon and assumed the accuracy and completeness of all information available from public sources or which was otherwise reviewed by RHB. Accordingly, whilst we have taken all reasonable care to ensure that the information contained in this presentation is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness and make no representation or warranty (whether expressed or implied) and accept no responsibility or liability for its accuracy or completeness. You should not act on the information contained in this podcast without first independently verifying its contents.

Any opinion, management forecast or estimate contained in this article is based on information available as the date of this podcast and are subject to change without notice. It does not constitute an offer or solicitation to deal in units of any RHB fund and does not have regard to the specific investment objectives, financial situation or the particular needs of any specific person who may receive this. Investors may wish to seek advice from a financial adviser/unit trust consultant before purchasing units of any funds. In the event that the investor chooses not to seek advice from a financial adviser/unit trust consultant, he should consider whether the fund in question is suitable for him. Past performance of the fund or the manager, and any economic and market trends or forecast, are not necessarily indicative of the future or likely performance of the fund or the manager. The value of units in the fund, and the income accruing to the units, if any, from the fund, may fall as well as rise.

A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the RHB US Value Fund dated 24 August 2021, RHB Global Artificial Intelligence Fund dated 18 November 2018, TA Asia Absolute Alpha Fund dated 9 June 2022 , Manulife India Equity Fund dated 25 January 2022, RHB ESG Multi-Asset Fund dated 3 October 2022 and RHB China Bond Fund dated 23 October 2019. (“Fund”) is available and investors have the right to request for a PHS.

Investors are advised to obtain, read and understand the PHS and the contents of the Information Memorandum and its supplementary (ies) (if) (“the Information Memorandum”) before investing. The Information Memorandum has been registered with the Securities Commission Malaysia (“SC”) who takes no responsibility for its contents. The SC’s approval and authorization of the registration of the Information Memorandum should not be taken to indicate that the SC has recommended or endorsed the Fund. Amongst others, investors should consider the fees and charges involved. Investors should also note that the price of units and distributions payable, if any, may go down as well as up. Where a distribution is declared, investors are advised that following the issue of additional units/distribution, the NAV per unit will be reduced from cum distribution NAV to ex-distribution NAV. Any issue of units to which the Information Memorandum relates will only be made on receipt of a form of application referred to in the Information Memorandum. The printed copy of prospectus and Product Highlight Sheet is available at RHB branches/Premier Centre and investors have the right to request for a Product Highlight Sheet. Investors are advised that investments are subject to investment risk and that there can be no guarantee that any investment objectives will be achieved. Investors should conduct their own assessment before investing and seek professional advice, where necessary and should not make an investment decision based solely on this update.

The Manager wishes to highlight the specific risks of the RHB US Value Fund are Management Risk, Liquidity Risk, Currency Risk, Country Risk, Interest Rate Risk, Fund Structure Risks, Regulatory Risks, Political Risks, Legal Risks, Management Risk, Concentration Risk, Derivatives Risk, Distribution of Capital Risk, Hedging Risk, Security Exclusion Risk, Securities Lending Risk, Style Bias Risk, Equities Risk, Real Estate Investment Trusts Risk, Smaller Companies Risk, Liquidity Risk, Market Risk and Sustainability Risk. The specific risks of the RHB Global Artificial Intelligence Fund are Management Risk, Liquidity Risk, Country Risk, Currency Risk, General Market risk, Emerging Markets Risk, Company-specific Risk, Concentration Risk, Volatility Risk, Derivatives Risk. The specific risks of the TA Asia Absolute Alpha Fund are External Investment Manager’s Risk, Equity and Equity-related Securities Risk, Financial Derivative Instruments Risk, Currency Risk, Country Risk, Liquidity Risk, Concentration Risk and Counterparty Risk. The specific risks of the Manulife India Equity Fund are Manager’s Risk, Market Risk, Liquidity Risk, Country Risk, Currency Risk, Small-Cap Risk, Natural Resources Sector Risk, Taxation Risks, Financial Derivative Instruments other than for Investment Purpose Risk, Foreign Exchange Risks, Liquidity and Volatility Risks, Emerging Markets Risks, Political and Regulatory Risks, Custodial, Clearance and Settlement Risk, Credit Downgrade Risk, Macroeconomic Risk Factors, Global Commodity Prices Risk, Oil Price Risks, Government Policy Risks, Risk of Price Controls, Risk of Stock Market Controls, Geopolitical Risks, Labour Market Risks, Environmental Regulation Risks, Swing Pricing Risk. The specific risks of the RHB ESG Multi-Asset Fund are Management Risk, Liquidity Risk, Currency Risk, Country Risk, Interest Rate Risk, General Risks, Financial Markets, Counterparties and Service Providers Risk, Tax Considerations Risk, Share Class Contagion Risk, Currency Risk Base Currency, Global Financial Market Crisis and Governmental Intervention Risk, Impact of Natural or Man Made Disasters and Disease Epidemics Risk, Recent Market Events Risk, Derivatives Risk, Securities Lending Risk, Risks Relating to Repurchase Agreements, Risks Relating to Reverse Repurchase Agreements, Counterparty Risk, Counterparty Risk to the Depositary, Fund Liability Risk, Market Leverage Risk, Repurchase and Reverse Repurchase Agreements Risk, MiFID II Risk, Cybersecurity Risk, Tax Risk, Sustainability Risk, Other Risks, Liquidity Risk, Options Strategies Risk, Fixed Income Transferable Securities Risk, Investment in High Yield Debt Securities Risk, Asset backed Securities Risk, Mortgage backed Securities Risk, Contingent Convertible Bonds Risk, Equity Risks, Money Market Instruments Risk, Emerging Markets Risk, Sovereign Debt Risk, Bond Downgrade Risk Bank Corporate Bonds “Bail in” Risk, Investments in the PRC Risk, Investments in Russia Risk, Potential implications of Brexit Risk, Euro and Euro Zone Risk, Exposure to Commodities within Exchange Traded Funds Risk, ESG Investment Policy Risk, MSCI ESG Screening Criteria Risk, Specific Risks Applicable to Investing via the Stock Connects, Specific Risks Associated with China Interbank Bond Market. The specific risks of the RHB China Bond Fund are Management Risk, Liquidity Risk, Country Risk, Currency Risk, Fixed Income Transferable Securities Risk, Emerging Market Risk, Portfolio Concentration Risk, Bond Downgrade Risk, Sovereign Debt Risk, Distressed Securities Risk, Contingent Convertible Bond Risk, Credit Risk of Issuers, Liquidity Risk, Restriction on Foreign Investment Risks, Currency Risk, Derivatives Risk and Securities Lending Risk and other general risks are elaborated in the Information Memorandum.

This article has not been reviewed by the Securities Commission Malaysia (SC).