Our lives have changed drastically over the past few years. The pandemic has altered the way we work and play, and the rise of digital platforms and currencies has made us really reconsider the value of money. Some of us are just getting back on our feet and slowly starting to save up again.

To add to that, we are heading towards inflation after a period of low interest/profit rates. What can we do to ensure our money keeps working for us? How can we outrun inflation? The time is right to strategise our wealth-growing approach and better manage our finances.

Most of us keep our money in our savings accounts and don’t think much about what’s happening to it. We’ve always avoided deciding what to do with it.

Plus, look out for the 26th of every month – that’s RHB Day – and earn extra points on top of festive promotions and redeem gifts with lower Loyalty points!

As an example, a new signup for RHB Smart Account-/i will earn you 3,000 RHB Loyalty Points. If you open deposit account together with RHB Joy@Work salary account , you get up to 5,000 RHB Loyalty Points.

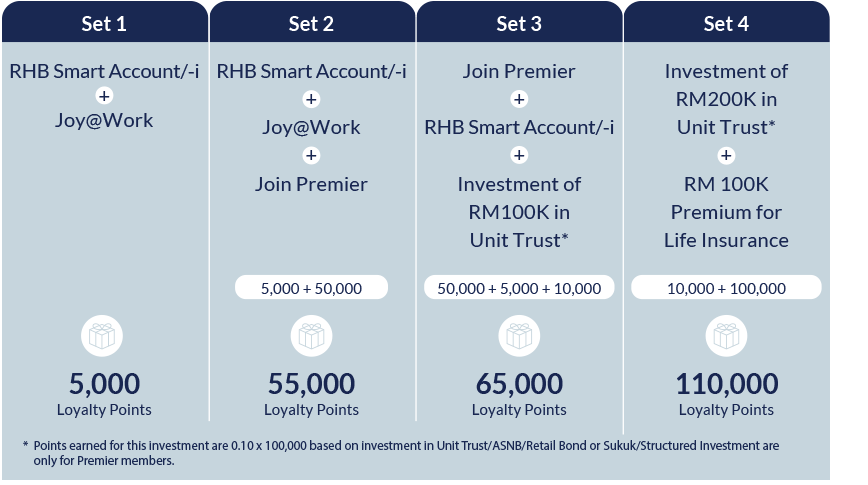

Smart Tip: Take up more products to accumulate more Loyalty Points! You may combine several products to meet your wealth-building goals and earn even more Loyalty Points.

It’s a perpetual Loyalty Program that you can accumulate Loyalty Points for all transactions you made with the bank moving forward. Here’s how to maximise your points earned!

Sign up for these combos to maximise your points earned!

From now until 30 June 2022, you can earn additional entries - on top of the perpetual Loyalty Points and stand a chance to win up to 10 million RHB Loyalty Points!

Drop by your nearest RHB branch today to find out more, or fill in your details below and our Financial Experts will get in touch. Make your money work “smarter” and “harder” for you!