Is there such a thing as a “safe” investment?

As investors, we want the comfort of safety. We’re human after all, and safety ranks second in Maslow’s hierarchy of needs, just after our basic physiological needs. The irony is that this inherent need for safety is the very thing that gets us into trouble. It’s this need that draws us to investments that promise returns with “no risk”.

In the world of finance, risk and return are the yin and yang. They exist on opposite realms but balance each other out. Every investment has its risks; it’s just a matter of how high or low the level of risk is. The term “safe investment” is an oxymoron, like “living dead” or “exact estimate”. A zero-risk investment can’t be an actual thing because it is impossible. If you see it written on a brochure, scratch it out and write “relatively safe investment”. There, fixed it.

Our idea of “safe” has been challenged. Swiss banking is known for its stability (and tight privacy laws), but even the biggest institutions in the most financially stable countries aren’t immune to risk. Credit Suisse, founded in 1856 to help fund the Swiss railways, recently found itself on the brink of collapse, and the Swiss government had to intervene and orchestrate a bailout by UBS to the tune of US$3.25 billion. Credit Suisse had to writedown US$17 billion worth of its AT1 bonds, a slap in the face to the reputation of bonds as the safest investment.

On the other side of the world, the abrupt collapse of the US$212 billion Silicon Valley Bank (SVB) sent shockwaves throughout the finance world. SVB was the darling of the tech industry, lending money to start ups who were turned away by conventional banks. Intoxicated by the highly lucrative tech industry, the bank turned the earnings from these loans into bonds (again, bonds!) which it then stretched out into longer terms. In its shortsightedness, SVB failed to address the risk of rising interest rates, which pushed down the market price of these longer-term bonds.

We were all caught by surprise… or were we, really? Let’s be honest with ourselves. These collapses were largely the result of poor risk management and bad decision-making. Investors place a huge amount of trust in the hands of key decision makers, which we may end up paying for in the end. It’s our responsibility to carry out our own research and due diligence before investing. We can’t be blinded by the prospects of the next “in” thing.

Nothing is sacred

So, if that’s not safe, what is? Nothing! But that doesn’t mean we should all withdraw all our money and run for the hills with bags of cash. Instead, our idea of “safe” needs to change. We really need to stop looking for that one safe investment, that holy grail to throw all our money at. Instead, we should change our approach to investing to reduce the overall risk through diversification , also known as putting your eggs in multiple baskets. This isn’t a new concept, but it is one that investors should be encouraged to take.

Spreading your risk

Diversification reduces risk by investing in various vehicles across different financial instruments, industries, and other categories. Although market risk is unavoidable, diversifying your investments drastically reduces unsystematic risk. In other words, you manage the risks that are within your control by adjusting the level of exposure within and across asset classes through proper asset allocation.

Diversifying across asset classes

A well-diversified portfolio is made up of different types of investments. The three main asset classes are stocks, bonds and cash alternatives. Some investors also add other investments, such as real estate and commodities like gold and coal to their portfolios. Each asset class tends to respond differently to similar market conditions. The gains made from one asset class would be able to partially offset the losses from another at the very least.

A non-financial example is Skittles. Ever wonder why you can’t find mass-produced single flavour packs? You like the red and green Skittles, while someone else only likes the purple ones. Yellow is the least popular flavour, according to the company website, but some people (like the writer) still like them. The company diversifies their Skittles to optimise their inventory and manufacturing and to reach as wide a market as possible. Similarly, in your portfolio, you pick a little bit of everything.

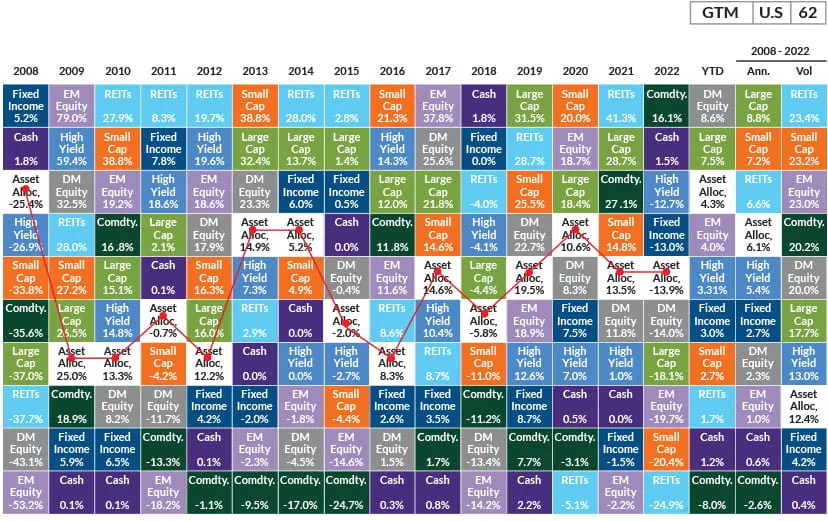

This chart below shows how having a well-diversified portfolio protects you from crazy fluctuations. Each coloured box represents an asset class, while the white box is a diversified position. Imagine if you had dumped all your money into equities. You would be a very, very stressed investor.

In the last two columns on the right, you can see the annualised returns and volume. Your diversified portfolio still ranked among the top performers, without having to shift that much volatility.

Asset class returns

Large cap: S&P 500, Small cap: Russell 2000, EM Equity: MSCI EME, DM Equity: MSCI EAFE, Comdty: Bloomberg Commodity Index, High Yield: Bloomberg Global HY Index, Fixed Income: Bloomberg US Aggregate, REITs: NAREIT Equity REIT Index, Cash: Bloomberg 1-3m Treasury. The “Asset Allocation” portfolio assumes the following weights: 25% in the S&P 500, 10% in the Russell 2000, 15% in the MSCI EAFE, 5% in the MSCI EME, 25% in the Bloomberg US Aggregate, 5% in the Bloomberg 1-3 Treasury, 5% in the Bloomberg Global Yield Index, 5% in the Bloomberg Commodity Index and 5% in the NAREIT Equity REIT Index. Balanced portfolio assumes annual rebalancing. Annualized (Ann.) return and volatility (Vol.) represents period from 12/31/2007 to 12/31/2022. All data represents total return for stated period. The “Asset Allocation” portfolio is for illustrative purposes only. Past performance is no indicative of future returns.

Guide to the Markets - U.S. Data are as of March 31, 2023.

Diversifying within an asset class

Now that you’ve picked your range of assets classes, you can diversify within the asset class. You can diversify by the size of the companies, by geography (domestic or international), and by industry and sector. Mutual funds or exchange-traded funds are a great way to diversify within an asset class without having to comb through the financials of each company you are investing in.

It’s just more fun

Diversification is also way more fun because you get to research new investments as the market improves in sophistication and accessibility, if that sort of stuff floats your boat. For example, the range of Environment, Governance and Social (ESG) focused funds has increased over the past decade, giving the investor more options. New opportunities will present themselves in your research, which your Relationship Manager will be happy to help decipher. Your Relationship Manager will also help you build a well-diversified portfolio based on your long-term goals, risk appetite and needs.