Equities to benefit from positive vaccine developments

The Indian variant of the virus that drove the India Covid-19 outbreak — now referred to as the Delta variant — may cause a new wave of confirmed cases in the developed world. It was responsible for a rise in the number of new cases in the UK recently. The US also reported about 20% of its new cases were of the Delta variant.

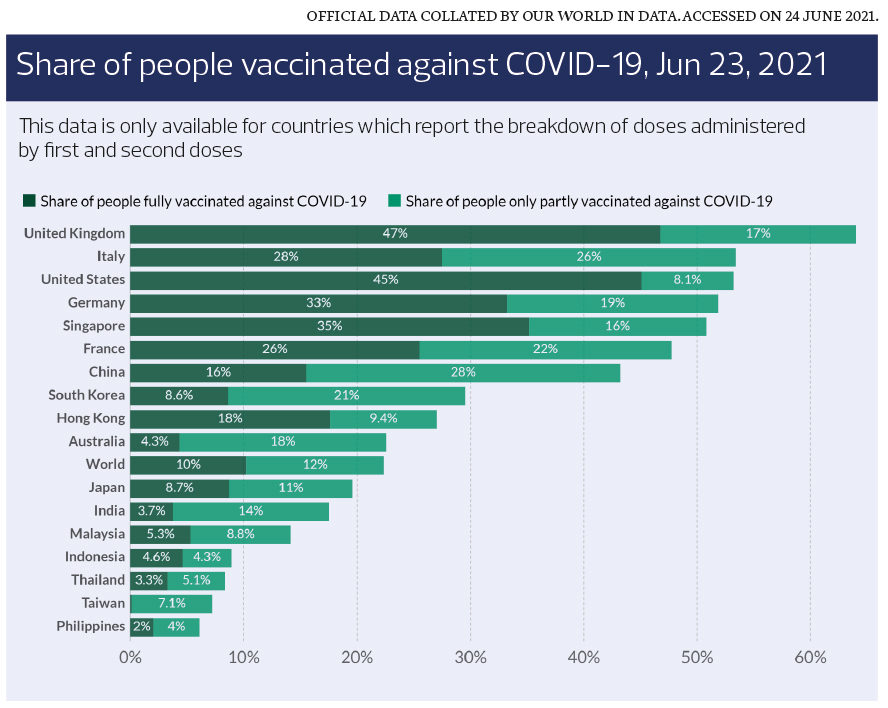

The surge in new cases in Asia has eased, but the elevated number of Covid-19 cases in parts of Asia will continue to undermine investor confidence in the short term. The good news is that the vaccine rollout in the region has gained momentum.

Equities are expected to perform well, as corporate earnings will be upgraded, in line with the global economic recovery. The low interest rate environment and ample liquidity will favour equities in the second half of the year (2H2021).

Given such a backdrop, RHB favours cyclical names expected to benefit from the economic recovery, with positive vaccine developments. The move towards a green environment, advancement in technology and developments in the healthcare sectors will also benefit from government policies across the globe, such as US President Joe Biden’s infrastructure plan and China President Xi Jinping’s 14th Five-Year Plan.

In Malaysia, RHB expects market sentiment to be dampened in the short term by the extension of the Full Movement Control Order and, now, the imposition in Selangor and Kuala Lumpur of the Enhanced MCO from July 3 to 16. Market players will closely monitor the latest lockdown and its potential impact on the economy and corporate earnings.

Given RHB’s cautiously optimistic view of the global macroeconomic outlook, we expect interest rates to gradually normalise.

The US Federal Reserve has sounded slightly more hawkish in its latest Federal Open Market Committee meeting in June. It brought forward its rate hike forecasts to reflect two potential rate hikes in 2023. Fed chairman Jerome Powell also indicated that the FOMC had talked about tapering.

RHB does not expect interest rates to rise significantly, however, because there is still a high degree of uncertainty over this outlook, especially regarding possible renewed virus waves and the mutation of new variants. The central theme for 2021 will continue to be effective vaccination programmes that will sustain economic recovery from the impact of of the 2020 pandemic.

As such, monetary policies are likely to remain accommodative across both developed and emerging economies in the near to medium term, in support of the sporadic and, hopefully, sustained economic recovery.

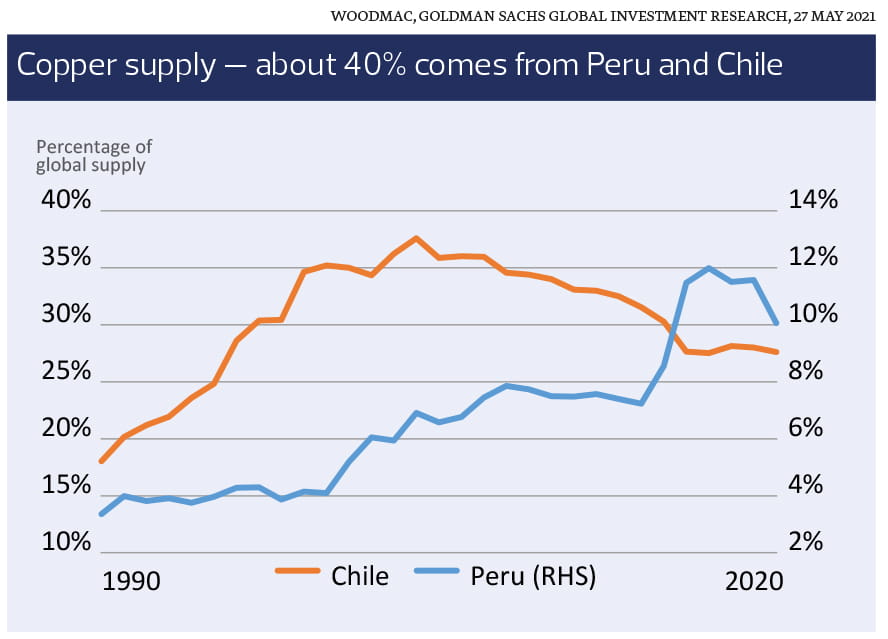

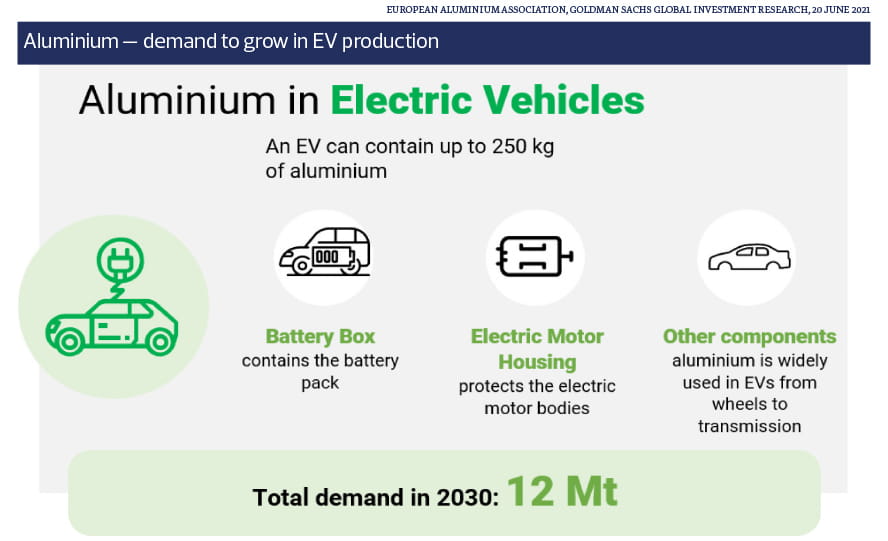

Green commodities on the rise

A significant structural driver for numerous industrial commodities is the renewed global commitment towards decarbonisation.

Invest with RHB Premier to unlock wealth opportunities.

Join RHB Premier today.