Equity investors are familiar with the age-old strategy of “buy low, sell high” but what can investors do in a range-bound market? In uncertain market conditions, many investors normally stay on the side lines and hesitate to invest. With the launch of Auto-callable Equity-Linked Investment by the Banks, investors can now diversify and invest to enhance their portfolio performance. Structured products are a financial instrument where its return is linked to the performance of the underlying assets. The underlying assets may include market indices, an equity, basket of equities, fund(s), a commodity, a foreign currency, interest rates etc. Structured products can provide tailored solutions with different payout mechanisms for different market conditions. It can offer an interesting risk adjusted return that is different from conventional bonds or equities investment.

Auto-callable Equity-Linked Investments are structured products that you may choose to invest in to generate potential investment returns that are linked to the performance of the underlying equity, even if the equity market is range-bound. This product has a short tenure of 12 to 18 months with regular coupon payments ranging from 5% p.a. to above 10% p.a.

The ‘Auto-callable’ feature allows the product to automatically mature before the scheduled maturity date. The product is automatically matured (“auto-called”) if the underlying asset is at or above a pre-set level (“knock-out”) on a predetermined observation date. If called, the investor will receive the initial principal investment plus the prevailing outstanding coupon. The auto-call is carried out on a set schedule of predetermined observation dates, typically monthly or quarterly. The product can only mature on one of these “auto-call” dates.

This product also offers a downside protection feature that fully protects the investor’s initial principal investment as long as the underlying asset has not traded at or below the pre-set downside barrier (“knock-in”). The downside barrier risk will be observed based on a set schedule of predetermined observation dates. If the underlying asset traded at or below the pre-set downside barrier at any of the observation dates, investor’s initial principal investment will no longer be fully protected.

At the scheduled maturity date, if the underlying asset is below the initial strike price and the product has not been auto-called on any observation dates, the investor’s initial principal investment will be converted into physical shares/equity at the initial strike price and to be delivered into investor’s share trading account. In a low interest environment, Auto-callable Equity-linked investment provides yield-enhancing investment solution, with the potential for attractive coupons balanced against the risk that the underlying asset will fluctuate out of a predefined range.

Given the flexibility and high customizability of structured products, RHB has recently expanded the variants of Auto-callable Equity-Linked Investments, where our investors can now invest in Auto-callable Equity-Linked Investments with underlying foreign equity using Ringgit (MYR) instead of the foreign currencies. This allows investors to diversify into underlying global equities and receive coupon payments in Ringgit (MYR) without the need for currency conversion.

Investors who are holding on to MYR can now diversify and invest into other names and sectors which are offered in other markets.

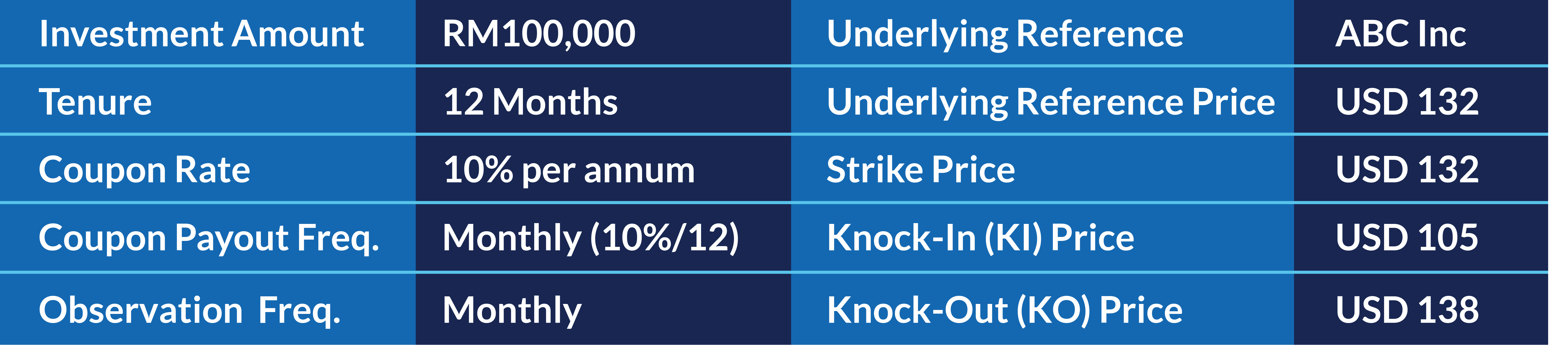

The following scenarios are meant for illustration purposes and do not reflect the current or future market trends.

Scenario 1: Assuming that the Knock-Out (“KO”) event had occurred on the 4th month

If the share price of the underlying reference, ABC Inc e.g. USD143 closed at or above the Knock-Out Price of USD138 on 4th month of the observation date, this product will be automatically matured or auto-called. The investor will receive the initial Investment Amount of RM100,000 and the prevailing 4th month coupon payment. Prior to being auto-called, the investor would have received a monthly coupon payment of RM833.33 (RM100,000 x 10% / 12) on the 1st, 2nd and 3rd month.

Scenario 2: Assuming that No Knock-Out (“KO”) event and Knock-In (“KI”) event had occurred during the entire tenure of investment

If the share price of the underlying reference, ABC Inc closed within the KO and KI range on any of the observation dates, the investor will receive monthly coupon payment of RM 833.33 (RM100,000 x 10% /12) over the tenure of 12 months and the initial Investment Amount of RM100,000 on the scheduled maturity date.

Scenario 3: Assuming that the Knock-In (“KI”) event occurred on the 4th month, no Knock-Out (“KO”) event occurred after the 4th month and the underlying reference closed below Strike Price at Scheduled Maturity Date

If the share price of the underlying reference, ABC Inc closed below the Knock-In price on the 4th month of observation date (e.g. USD100) and the share price closed below the strike price at scheduled maturity date, the investor will receive the coupon payment on a monthly basis over the tenure of 12 months, however the settlement on the scheduled maturity date will be via physical delivery of ABC Inc shares at the strike price (USD132).

Scenario 4: Assuming that the Knock-In (“KI”) event occurred on the 4th month and the underlying reference closed above the Strike Price at the Scheduled Maturity Date

If the share price of the underlying reference, ABC Inc closed below the Knock-In price on the 4th month of the observation date (e.g USD100) but the share price rebounded to above strike price at the scheduled maturity date, the investor will receive the coupon payment on a monthly basis over the tenure of 12 months and the initial Investment Amount of RM100,000 at the scheduled maturity date.

Auto-callable Equity-linked Investments may be suitable for investors who are looking for enhanced yield opportunities in a shorter tenure (e.g 12 months) as well as investors who are seeking to diversify their investment portfolio. At the same time, investors should be willing to risk some of their principal investment and be comfortable with holding the underlying securities (if any).

Interested in Auto-callable Equity-Linked Investments? Please contact your Relationship Manager for more details or to request for a product term sheet.