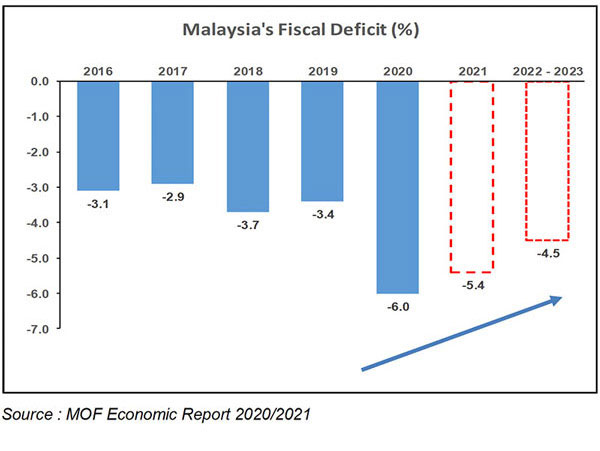

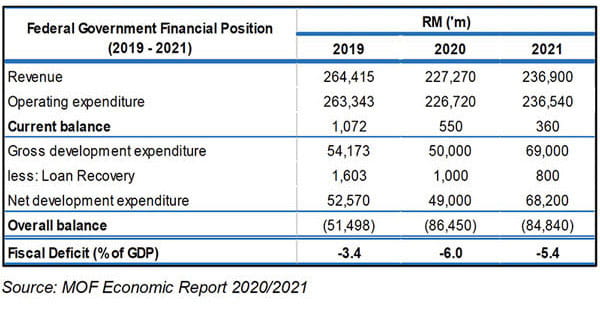

In the coming 2021, the Federal Government’s revenue is expected to improve to MYR236.9bn (est. improvement of +4.2% versus 2020) Total expenditure will comprise of operating expenditure of MYR236.5bn and development expenditure of MYR69.0bn. We opine Budget 2021 is expansionary in nature with a robust MYR19.0bn allocated to development expenditure to support strategic infrastructure projects with high multiplier effects to boost growth during the current pandemic environment.

According to the MOF Economic Report 2020/2021, the Government will increase development expenditure further by c.MYR19.0bn (compared to 2020) to spur and revitalize public investments via capital formation, as measures to strengthen the long-term potential of the Malaysian economy. Planned development expenditure on impactful public infrastructure projects, primarily for transport and connectivity such as MRT 2, Pan Borneo Highway as well as the National Fiberisation and Connectivity Plan (NFCP) projects will help rejuvenate growth prospects and provide further multiplier impacts across economic activities.

In 2021, MOF’s expects domestic growth to contract by -4.5% before improving towards a projected level of +6.5% - +7.5% in 2021. Fiscal spending and positive spill-over effects from stimulus efforts to provide added catalysts in boosting recovery prospects. Domestic growth is poise to improve in 2021 but the speed of recovery will depend on the successful containment of the pandemic and sustained recovery in terms of external demand. Meanwhile the outlook on inflation is expected to remain subdued and stay in negative territory around -1.0% in 2020 before normalizing back to +2.5% in 2021 according to the MOF Economic Outlook Report.

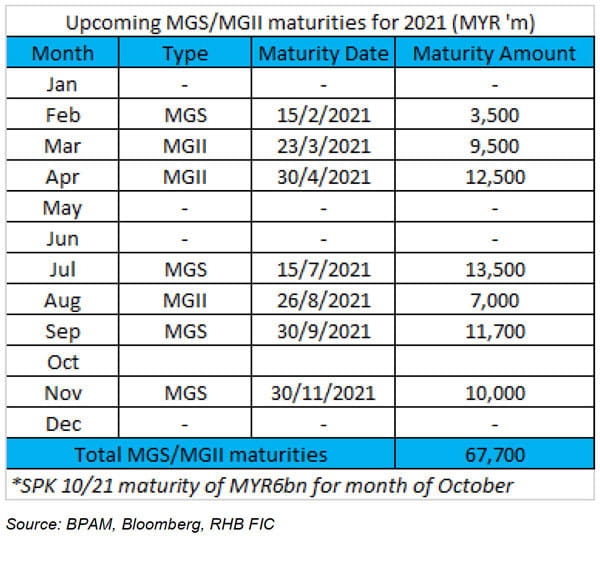

In the coming 2021, we are projecting gross supply of MGS/MGII to range between MYR152bn-MYR154bn on the back of scheduled MGS/MGII maturities worth MYR67.7bn maturing next year. Please refer to Figure 2 for upcoming MGS/MGII maturities in 2021. There will be MYR6bn worth of SPK 10/21 maturing in 2021 which will instead be replaced with LPPSA issuances. Despite the higher gross supply, we opine private placements to be featured again in the upcoming Auction Calendar for 2021 which will remain supportive for MYR bonds.

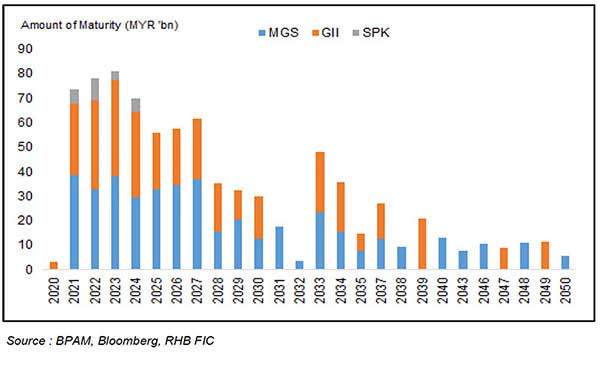

A closer analysis on the maturity profile of outstanding MGS/MGII/SPK issuances suggest that issuance supply for the coming year will likely be skewed towards the longer end.. This is in line with efforts in terms of smoothening out the maturity profiles of existing government bonds whilst locking in on the lower borrowing cost given the low interest environment which augurs well for funding initiatives. In terms of composition of MGS: MGII, we continue to see further convergence towards a more balanced mixed, potentially moving into a balanced 50:50 ratio. Current outstanding MGS is around 54% of total govvies bond outstanding, with the balance of 46% represented by MGII. A balanced mixed will help deepen the MYR sovereign sukuk space given the larger outstanding MGII segment.

We view that the current demand and supply dynamics of the MYR bond market remains healthy as mirrored by sturdy YTD average bid to cover ratio (BTC) at 2.25 times. Renewed foreign inflows on the back of higher real yields from investing in MYR bonds are seen as added plus points. Amid the current ultra-low interest rates environment in advanced economies, investors hunting for real yields will continue to persist in the emerging Asia space. Foreign holdings of MYR government bonds continue to register positive inflows from May to October bringing current cumulative inflows of c. MYR30.0bn.

The following are some of the key takeaways from Budget 2021 which will provide further catalysts for the issuance landscape:

1. Prospects of increase bond issuances in the ESG-themed- SRI Sukuk space

2. Support for corporate financing through Danajamin and Syarikat Jaminan Pembiayaan Perniagaan (SJJP)

RHB GTGM Disclaimer

This report is prepared for information purposes only by RHB Group Treasury & Global Markets (“RHB GTGM”), a strategic business group of RHB Bank Berhad (“RHB Bank”).

All research is based on material compiled from data considered to be reliable at the time of writing, but RHB GTGM does not make any representation or warranty, express or implied, as to its accuracy, completeness or correctness.

Neither this report, nor any opinion expressed herein, should be construed as an offer to sell or a solicitation of an offer to acquire any securities or financial instruments mentioned herein. RHB GTGM accepts no liability whatsoever for any direct or consequential loss arising from the use of this report or its contents. This report may not be reproduced, distributed or published by any recipient for any purpose without prior consent of RHB GTGM and RHB GTGM accepts no liability whatsoever for the actions of third parties in this respect.

Readers are reminded that the financial circumstances surrounding any company or any market covered in the reports may change since the time of their publication. The contents of the reports themselves are subject to change without any notification. Readers should obtain separate legal or financial advice to independently evaluate the particular investments and strategies.

RHB Bank, its affiliates and related companies, their respective directors, associates, connected parties and/or employees may own or have positions in securities or financial instruments of the company(ies) covered in this research report or any securities or financial instruments related thereto, and may from time to time add to, or dispose off, or may be materially interested in any such securities or financial instruments. Further, RHB Bank, its affiliates and related companies do and seek to do business with the company(ies) covered in this research report and may from time to time act as market maker or have assumed an underwriting commitment in securities or financial instruments of such company(ies), may sell them or buy them from customers on a principal basis and may also perform or seek to perform significant banking, advisory or underwriting services for or relating to such company(ies), as well as solicit such banking, advisory or other services from any entity mentioned in this research report.

RHB Bank and its employees and/or agents do not accept any liability, be it directly, indirectly or consequential losses, loss of profits or damages that may arise from any reliance based on this report or further communication given in relation to this report, including where such losses, loss of profits or damages are alleged to have arisen due to the contents of such report or communication being perceived as defamatory in nature.