Source: Company data, RHB

FIRST FOCUS: THE RAKYAT’S WELL-BEING

STRATEGY 1: RESTORING LIVES AND LIVELIHOODS

Initiative 1: Direct cash assistance and welfare

- Allocation of MYR8.2bn for Bantuan Keluarga Malaysia to channel assistance of MYR2,000 to households earning less than MYR2,500 per month with three or more children:

- Additional assistance of MYR500.00 to single parent households and MYR300.00 to senior citizen households;

- Increase the income eligibility requirement for welfare assistance managed by the Social Welfare Department in line with the 2019 Food Poverty Line Income at MYR1,169 vs the 2019 Food Poverty Line Income of MYR980.00;

- Provide MYR25m to Yayasan Keluarga Malaysia to ensure the welfare of children orphaned due to COVID-19.

Initiative 2: Access to public healthcare facilities

- Allocation of MYR32.4bn for the Ministry of Health:

- MYR4bn to continue the agenda on managing COVID-19, MYR750m for the supply of medicine, and MYR190m outsourcing of medical services to hospitals and private laboratories;

- MYR100m allocated for the sponsorship of medical specialist programmes for the benefit of 3,000 medical and dental contract officers;

- Expand the imposition of excise duties on sugary drink products in the form of premixed cocoa, malt, coffee, and tea;

- Impose excise duties on liquid or gel products containing nicotine used in electronic cigarettes and vaping;

- Allocate MYR70m to strengthen mental health support services.

Initiative 3: Quality education for all

- Allocation of MYR52.6bn and MYR14.5bn for the Ministries of Education and Higher Education;

- Allocation of MYR450m from the Government and MYR65m from telecommunication companies to implement the Peranti Siswa Keluarga Malaysia initiative to supply a tablet to every B40 student in institutions of higher learning;

- Extend the special individual income tax relief up to MYR2,500 for the purchase of mobile phones, computers, and tablets until 31 Dec 2022;

- Provide MYR6.6bn to strengthen the vocational education & training or TVET sector by implementing various initiatives under the relevant ministries and agencies;

- Discount on the repayment of National Higher Education Fund Corp or PTPTN loans from 1 Nov 2021 till 30 Apr 2022 – ranging from 10% to 15%.

Initiative 4: Generating and sustaining jobs

- Allocation of MYR4.8bn for the Jamin Kerja Keluarga Malaysia or JaminKerja initiative;

- Hiring incentive for employers via the JaminKerja initiative targeting 300,000 people with an incentive of 30% of monthly salaries for the first six months and 40% for the next six months for jobs with salaries of MYR1,500 and above;

- Continuation of the Malaysia Short-term Employment Programmes or MySTEP by offering 80,000 contract employment opportunities and 220,000 trainees to undergo upskilling and reskilling programmes;

- Increase the limit of individual income tax relief for upskilling course fees to MYR2,000 from MYR1,000:

- Tax relief of up to MYR7,000 for courses with any professional bodies.

Initiative 5: Social protection

- Stamp duty exemption for the Perlindungan Tenang product as well as insurance or takaful products with premiums not exceeding MYR150.00 and MYR250 for individuals and micro, small & medium enterprises or MSMEs;

- Allocation of MYR30m for the expansion of i-Saraan to include those aged between 55 and 60 years;

- Expand the protection coverage under the Social Security Organisation or SOCSO by contributing for self-employed and informal workers.

Initiative 1: Bumiputera development and Syiar Islam

- Continuing the Bumiputera empowerment agenda through an allocation of MYR11.4bn;

- MYR200m allocated to encourage the participation of Bumiputera youths in implementing small-scale government procurement projects.

Initiative 2: Community empowerment

- Provision of MYR200m and MYR145m for the socio-economic development of the Chinese and Indian communities;

- MYR274m allocated to implement programmes in improving the living standards of the Orang Asli community.

Initiative 3: Female empowerment

- Mandatory appointment of at least one woman on the board of directors for all public listed companies by 1 Sep 2022 for big-cap companies and 1 Jun 2023 for small- and mid-cap firms;

- Allocation of MYR30m provided for childcare in government buildings to improve existing support systems for working mothers.

Initiative 4: Community-focused empowerment

- Allocation of MYR635m for the purpose of welfare assistance, care institutions, and senior citizen activity centres;

- The Government is to bear the full cost of motor vehicle road tax on all private vehicles owned by the disabled in 2022.

Initiative 5: Youth and sports development

- Improving the monthly incentive to MYR900.00 from MYR800.00 previously for employers who employ apprentices for a period of up to six months in 2022;

- Allocation of MYR300m to credit MYR150.00 as one-off payments into the e-wallet accounts of youths aged 18-20 to foster a culture of cashless transactions.

STRATEGY 3: BUILDING A CONDUCIVE LIVING ENVIRONMENT

Initiative 1: Alleviating the cost of living

- Allocation of MYR31bn for subsidies, aid, and incentives intended to mitigate the rising cost of living via price controls;

- Reduction of the minimum employee contribution rate to the federal statutory providence fund to 9% from 11% will be extended up to Jun 2022, involving a potential value of MYR2bn;

- Extension of the 100% sales tax exemption on CKD passenger vehicles and 50% on CBU vehicles – including SUVs and MPVs – for six months until 30 Jun 2022.

Initiative 2: Home ownership

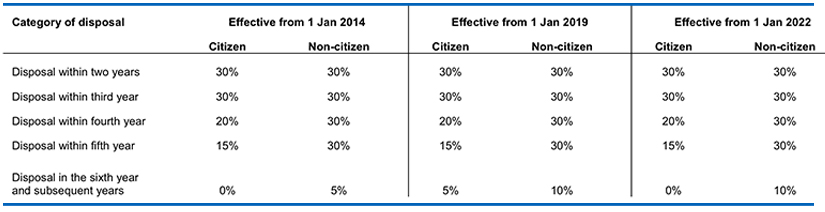

- Provision of MYR1.5bn to continue housing projects, specifically for low-income groups. The Government will also not impose Real Property Gains Tax or RPGT from the disposal of real property in the sixth year onwards.

Initiative 3: Access to public transportation

- Allocation of MYR209m as subsidy for air transportation in Sabah and Sarawak.

Initiative 4: Rural infrastructure

- Commitment of MYR2.5bn to improve rural roads and utility infrastructure.

Initiative 5: National defence and public safety

- Allocation of MYR16bn and MYR17bn for the Ministries of Defence and Home Affairs.

SECOND FOCUS: RESILIENT BUSINESSES

STRATEGY 1: REVIVE BUSINESS CAPABILITIES

Initiative 1: Microcredit scheme

- Microcredit financing worth about MYR1.8bn will be provided through various agencies such as TEKUN Nasional, Agrobank, Bank Simpanan Nasional, Bank Rakyat, and Bank Negara Malaysia or BNM on an interest-free basis;

- Allocation of MYR1.75bn to fund programmes aimed at providing food truck business sites in major urban areas.

Initiative 2: Business and alternative financing

- Provision of MYR2.1bn to support equity and quasi-equity investment schemes to assist companies facing gearing or leverage problems;

- The Government aims to assist public-listed companies that were affected by the COVID-19 pandemic via an injection of additional funds through equity or other related instruments. Khazanah Nasional will be given the mandate in providing the infrastructure to manage the fund size of at least MYR3bn.

Initiative 3: Business financing guarantee

- Syarikat Jaminan Pembiayaan Perniagaan or SJPP will enhance the scheme with an additional guarantee limit of MYR10bn – this is to provide guarantees for loans being rescheduled and restructured for companies in need, with MYR2bn being dedicated to Bumiputera businesses.

Initiative 4: Ease of doing business

- A special fund for strategic investments up to MYR2bn will be prepared to attract strategic foreign investments by multinational companies;

- Extension of tax deduction of up to MYR300,000 on the cost of renovating and refurbishing business premises until 31 Dec 2022 in order to comply with relevant SOP requirements;

- For companies registered under Safe@Work, a further tax deduction of up to MYR50,000 on rental expenses of employees' accommodation premises will be extended until 31 Dec 2022;

- Excise service:

- A deferment of income tax instalment payments for MSMEs for six months until 30 Jun 2022;

- All businesses are allowed to amend the estimated income tax payable on the 11th month before 31 Oct 2022;

- A special tax deduction to the owners of buildings or business premises that provide rental reductions to tenants of at least 30% from the original rate to be extended until Jun 2022;

- That accumulated unabsorbed business loss tax treatments that can be carried forward to be reviewed from seven consecutive years of assessment to a maximum of 10 consecutive years of assessment.

STRATEGY 2: DRIVING STRATEGIC INVESTMENTS

Initiative 1: Investments in key sectors

- A special fund for strategic investments up to MYR2bn will be prepared to attract strategic foreign investments by multinational companies;

- MYR25m is allocated under Budget 2022 to explore high-impact investments and new export markets through Trade & Investment Missions;

- A matching grant of MYR100m will be provided to Bumiputera SMEs to explore business opportunities in the aerospace segment;

- The Government will allocate MYR100m to provide Smart Automation matching grants to 200 companies in the manufacturing and services sectors to automate their business processes;

- Extension of the Additional Reinvestment Allowance or RA for two years for existing companies in Malaysia that have exhausted their RA and Special RA eligibilities.

Initiative 2: Science, technology, and innovation

- Allocation of MYR423m under the Ministries of Science, Technology & Innovation or MOSTI and Higher Education to intensify R&D activities;

- Allocation of MYR12m via matching grants through collaborative research in engineering, science, and technology in areas such as gallium nitride for application in light-emitting diodes or LEDs and EVs;

- MYR30m will be prepared to implement the Innovation Hub: Industrial Revolution 4.0 under Technology Park Malaysia;

- Cradle Fund will be allocated MYR20m to intensify recovery efforts and build the resilience of the start-up economy;

- Allocation of MYR45m as a technological transformation incentive for SMEs and midstage companies in the manufacturing and services sectors – in line with Industrial Revolution 4.0 or Industry4WRD.

Initiative 3: Perkukuh Pelaburan Rakyat or PERKUKUH initiative

- At least MYR30bn will be allocated for capital expenditure and investments next year. Government-linked companies or GLCs will continue to invest in areas including renewable energy, supply chain modernisation, and 5G infrastructure;

- Khazanah Nasional has prepared an Impact Fund amounting to MYR6bn as a catalyst towards the growth of new high-value industries.

STRATEGY 3: RECOVERY FOR TARGETED SECTORS

Initiative 1: Tourism industry

- Several key initiatives with a total value of MYR1.6bn will be implemented next year – this includes the implementation of the Wage Subsidy Programme or WSP targeted at tourism industry players;

- Various financing and funding for the tourism sector amounting to MYR875m;

- Special individual income tax relief for domestic tourism expenses up to MYR1,000 to be extended until Year of Assessment 2022;

- An allocation of MYR20m to the Malaysia Healthcare Travel Council;

- Exemption on entertainment duties for entertainment activities in all Federal Territories until 31 Dec 2022. State authorities are similarly advised.

Initiative 2: Creative industry

- A total of MYR188m is provided to continue creative industry initiatives.

Initiative 3: Retail industry

- Total of MYR285m is allocated to various campaigns and programmes aimed to stimulate the retail industry, eg Shop Malaysia Online and Malaysian Sales Programme;

- Perbadanan Nasional or PERNAS will provide MYR74m, among others, to provide training programmes and business guidance, as well as a simple zero-financing scheme for the first six months together with a moratorium.

Initiative 4: Agriculture industry, food security, and commodities

- The granting of subsidies and incentives for the agriculture and fisheries industries will be continued with an allocation of MYR1.7bn;

- A financing programme of up to MYR1.25bn will be provided by Agrobank and BNM through – among others – the AgroFood Facility amounting to MYR500m and AgroFood Financing Fund amounting to MYR200m;

- To support the oil palm industry, the Government has allocated MYR35m to implement the Smallholder Farmers’ Oil Palm Replanting Stimulus Scheme and MYR20m to address anti-palm oil campaigns at international levels;

- To increase the windfall levy threshold value for palm oil to MYR3,000 from MYR2,500 for West Malaysia and to MYR3,500 from MYR3,000 for East Malaysia. Meanwhile, the Sabah and Sarawak levy rates are adjusted to 3%, ie similar to the rates in West Malaysia.

THIRD FOCUS: A PROSPEROUS AND SUSTAINABLE ECONOMY

STRATEGY 1: SUSTAINABILITY AGENDA

Initiative 1: Low-carbon practice

- Launching of Voluntary Carbon Market or VCM for carbon credit trading by Bursa Malaysia;

- Matching grants – ease of transition to low carbon;

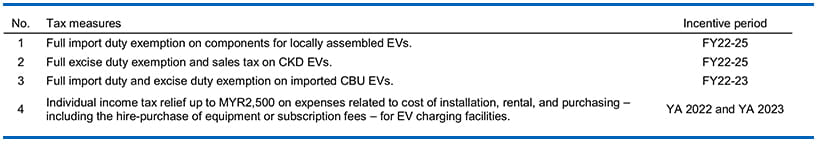

- Exemption from import duty, excise duties, and sales tax for EVs.

Initiative 2: Environment and biodiversity

- Allocation of MYR115m for nature conservation and preservation projects;

- 100m tree planting campaign.

Initiative 3: Community empowerment

- Income tax exemption on social enterprise income;

- A maximum of five days of unrecorded leave per year for civil servants engaging in non-governmental organisation or NGO activities.

Initiative 4: Sustainability sukuk

- Issuance of sustainability sukuk worth up to MYR10bn.

STRATEGY 2: BRIDGING THE ECONOMIC GAP

Initiative 1: Development projects for recovery

- Allocation of MYR3.5bn for national infrastructure development projects such as the construction of the Pan Borneo Highway and Central Spine Road;

- Infrastructure Facilitation Fund 3.0 to boost high-impact infrastructure development activities through public-private partnerships;

- Small- and medium-sized projects worth MYR2.9bn earmarked for contractors in Classes G1 and G4.

Initiative 2: Inter-regional development

- Allocation of MYR690m for the five regional economic development corridors;

- State-specific allocation of MYR20m per state to focus on projects related to food security, tourism, and environmental preservation and conservation;

- DE allocation for Sabah and Sarawak worth MYR5.2bn and MYR4.6bn;

- An additional 20 mobile banks in 250 rural areas.

Initiative 3: Digital connectivity projects

- Allocation of MYR700m for continuation of JENDELA

STRATEGY 3: FISCAL CONSOLIDATION AND REVENUE SUSTAINABILITY

Initiative 1: Fiscal Responsibility Act (FRA)

- Introduction of FRA to improve governance, accountability, and transparency in the country’s fiscal management.

Initiative 2: Revenue sustainability measures

- Revenue sustainability measures:

- Increase of stamp duty rates on contract notes from 0.1% to 0.15% and abolishment of MYR200.00 stamp duty limits;

- Exemption of brokerage services related to the trading of shares listed on Bursa Malaysia;

- Imposition of Cukai Makmur, a marginal income tax rate of 33% for companies with chargeable income of more than MYR100m for Year of Assessment 2022.

STRATEGY 4: SUPPORTING PUBLIC SERVICE DELIVERY

Initiative 1: Reforming service delivery

- MyDigital initiative:

- Implementation of the National Digital Identity project to enable secure digital transactions.

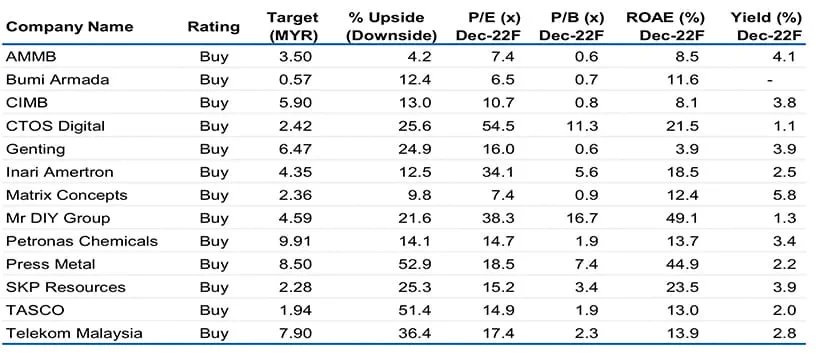

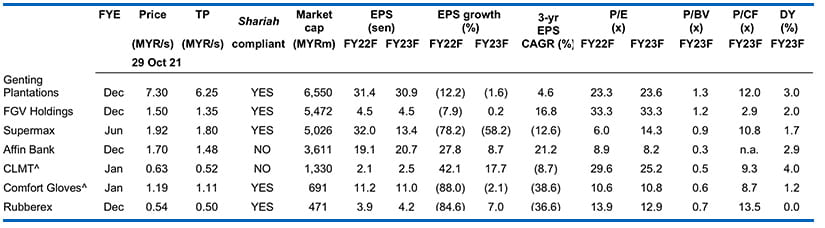

Figure 1: Earnings outlook and valuations FB