Despite the economic challenges present during the pandemic, there are still trading and investment opportunities to be made amid the turbulent market landscape. Stocks, cryptocurrencies and exchange-traded funds were hot picks in recent months, but one prospective asset has fallen under the radar — foreign currencies.

Economies around the world are recovering from the effects of the pandemic at different rates. Coupled with shifting interest rates and the influx of money into the economy from stimulus packages, these variables have both direct and indirect impact on the foreign exchange (FX) markets.

This represents plenty of trading opportunities to accumulate undervalued currencies. For example, a June 2020 report by PricewaterhouseCoopers UK highlighted that the pandemic has made it difficult to properly evaluate currencies, with the GBP falling 15% against the USD since the beginning of 2020.

Internally, RHB Bank is bullish on the USD, believing that the greenback is the best currency to hold long term, moving into a post-pandemic recovery. The USD is expected to gain momentum in 2Q2021 before stabilising in 2H2021, and continue to strengthen again in 1Q2022.

“The technical picture for the USD index indicates that the Upper Bollinger band level of 92.86 will be breached and, consequently, we believe the rapid pace of USD strength is in place for 2Q2021,” says Dr Suresh Rama, RHB’s head of rates and FX strategy.

“The currency’s pivotal level is at 95.00. Once that level is tested, we believe the USD index will stabilise for some time. Directionally, the USD is headed higher for the next one or two quarters from the current levels.”

In addition, Suresh believes that recent FX liberalisation policies announced by Bank Negara Malaysia are positive for the domestic currency market in the long term.

Announced on March 31, these policies provide market participants with more flexibility to manage FX risks, allow them to hedge commodity positions with better pricing, as well as provide exporters with the avenue to manage their export proceeds prudently. These policies are seen as favourable for the USD/RM exchange rates.

charts by Bloomberg , RHBAM

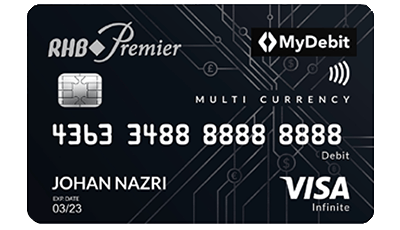

Manage multiple currencies in one account

The card is compatible with major currencies around the world, such as the US dollar, euro, Australian dollar, Japanese yen, as well as currencies closer to home such as the Thai baht and Singapore dollar.

Users can enjoy attractive and competitive currency conversion rates exclusive only to the cardholders, while avoiding additional currency conversion fees when making overseas retail purchases. The currency conversion is instant, fast and seamless, and the exchange rates are locked in to protect the user’s money from foreign currency fluctuations.

The debit card is great for just about anyone — including expatriates, e-commerce shoppers, traders and entrepreneurs, or even parents with children studying abroad.

Depending on the service provider, it is common for customers to pay foreign exchange fees as high as 3% per transaction. With the debit card, customers can save on the foreign exchange fee while having the option to buy into currencies at their lowest. Because of its consumer-friendly features, the card was named debit card of the year at the 2019 Global Retail Banking Innovation Awards.

The debit card has impressive features, but the RHB Multi Currency Account* is not to be sneezed at either. The interest-bearing account can hold up to 24 different foreign currencies as well as precious metals investment, such as paper gold and paper silver, in a single account.

Having a multicurrency account opens up a multitude of options for customers. For example, customers can buy any of the 24 currencies at their lowest and keep it for online e-commerce purchases, place it in a term deposit for higher interest rate returns, or hedge it against inflation.

This is in stark contrast to holding only Malaysian ringgit, which is usable only in Malaysia. The RHB Multi Currency Account* helps support customers in their online activities, such as conducting business transactions and cross-border trading — providing the much-needed flexibility and convenience to store different currencies in a single account.

In addition to the features above, customers can apply for the RHB Premier Multi Currency Debit Card and enjoy annual fee waivers on their multi currency account*. Customers can also rest assured that the account is protected under PIDM for up to RM250,000, and there is no initial deposit required to set up the account.

For more information about RHB Multi Currency Account* and RHB Premier Multi Currency Visa Debit Card, visit www.rhbgroup.com/mc/index.

*RHB Multi Currency Account is protected by PIDM up to RM250,000 for each depositor. MCA Gold Investment and MCA Silver Investment are not protected by PIDM.

For more information or to apply for RHB Premier Visa Multi Currency Debit Card.

Join RHB Premier today.