Events over the past few years have pushed the urgency for businesses and investors to focus on sustainability. It is no longer enough to just make a profit, without considering the impact on our environment’s dwindling resources. Businesses are held accountable for every aspect of their operations. They know that success is not just reflected in their profit/loss statements, and that financial success goes hand-in-hand with environmental health and social wellbeing.

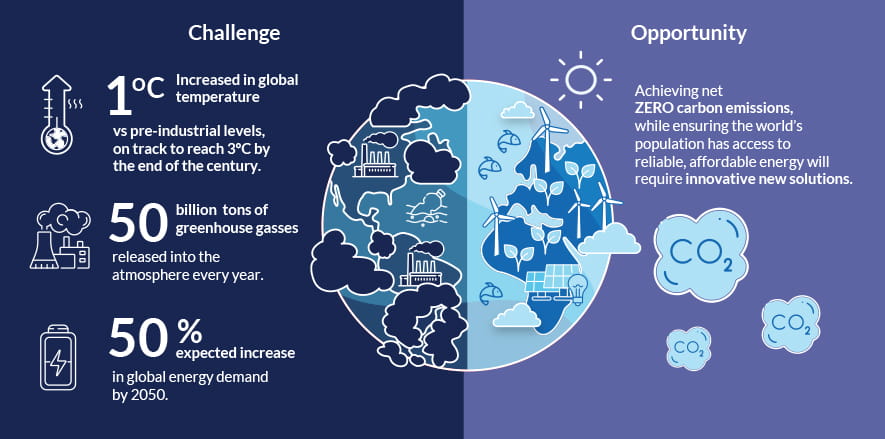

Climate change is one of the biggest challenges we face as a society. This challenge is spurring innovation across a wide range of sectors. As investors, it is important to recognise that our investment choices play a big part in ensuring the sustainability of the planet.

Climate change refers to long-term shifts in temperature and weather patterns, which is seen in the effects of global warming. These changes might be seen as natural, but humans have made it far worse through the effects of industrialisation and commercial agriculture. Burning fossil fuels for energy releases greenhouse gasses, mostly carbon dioxide and methane, into the environment. These gases are trapped near the Earth’s surface, causing an increase in temperature.

As the Earth’s population increases, the demand for energy will increase, too. By 2050, we will need 50% more energy than we do now1.

While centuries of destructive habits cannot be undone instantly, we can always do more to make things better for the next generation. We can start by reducing carbon emissions and increasing the use - and accessibility - of clean energy solutions. Since the Earth reacts to small changes in the amount of greenhouse gasses in the atmosphere, the logical step would be to reduce these emissions until the climate system is in balance. That’s when we will achieve net zero emissions.

There is support for this change towards clean energy from the global community. Most of the world’s largest economies have committed to the Paris Agreement, an international treaty on climate change. Many governments have supportive policies encouraging investment and innovation in renewables.

This innovation has led to the birth of new technologies that has brought down the cost of renewable energy, while making them more reliable.

Consumer habits have changed as there is increasing awareness on climate change. Consumers are making better choices, shifting towards more sustainable alternatives for everyday products. To cater to this shift - and encourage it - companies are re-evaluating their supply chains and investing in sustainable frameworks.

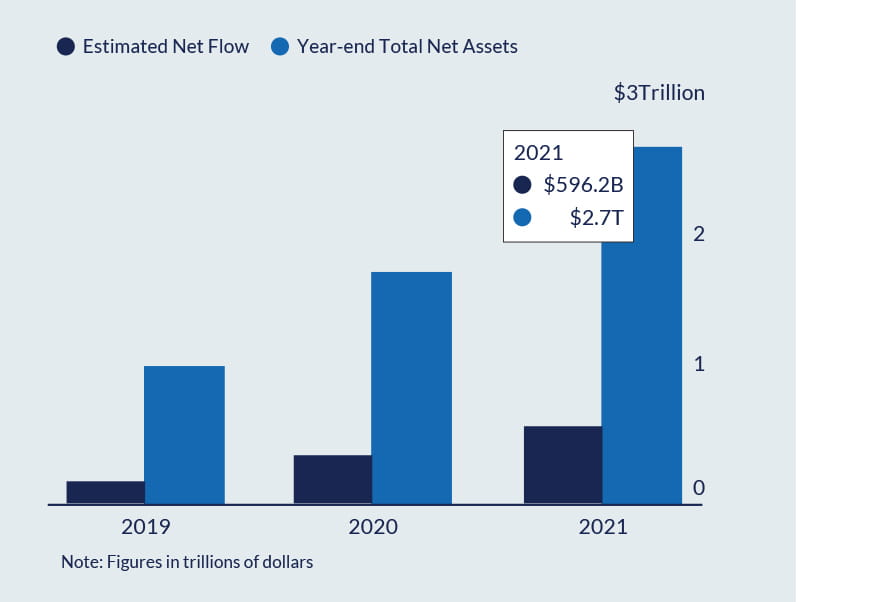

Investing habits are shifting as well. Money held in sustainable mutual funds and ESG-focused exchange-traded funds rose globally by 53% last year to USD2.7 trillion, with a net USD596 billion flowing into the strategy, according to Morningstar Inc2. The increase takes into account a revision in Europe, where regulators are imposing stricter rules to define what can be labeled a sustainable fund.

As investors, you can indeed benefit from a sustainable future. Think of it as investing in the future of our planet.

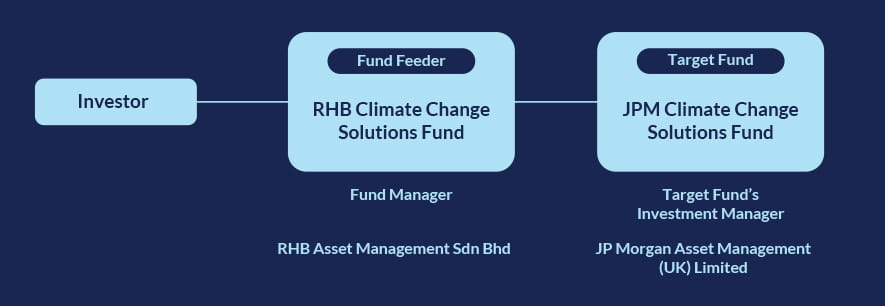

RHB Climate Change Solutions Fund investment strategy combines artificial intelligence and human insight to invest in the companies across sectors developing innovative solutions to address the global challenge of climate change. Offering investors easy access to global long-term sustainability-themed that is designed with diversified exposure and aim to provide long-term capital growth by investing in US dollar denominated shares.

The fund feeds into JPM Climate Change Solutions Fund, which aims to achieve returns through investing at least 80% of its assets in equity securities of companies with exposure to the theme of climate change solutions. The target fund’s portfolio includes smaller more pure-play companies along with large established companies.

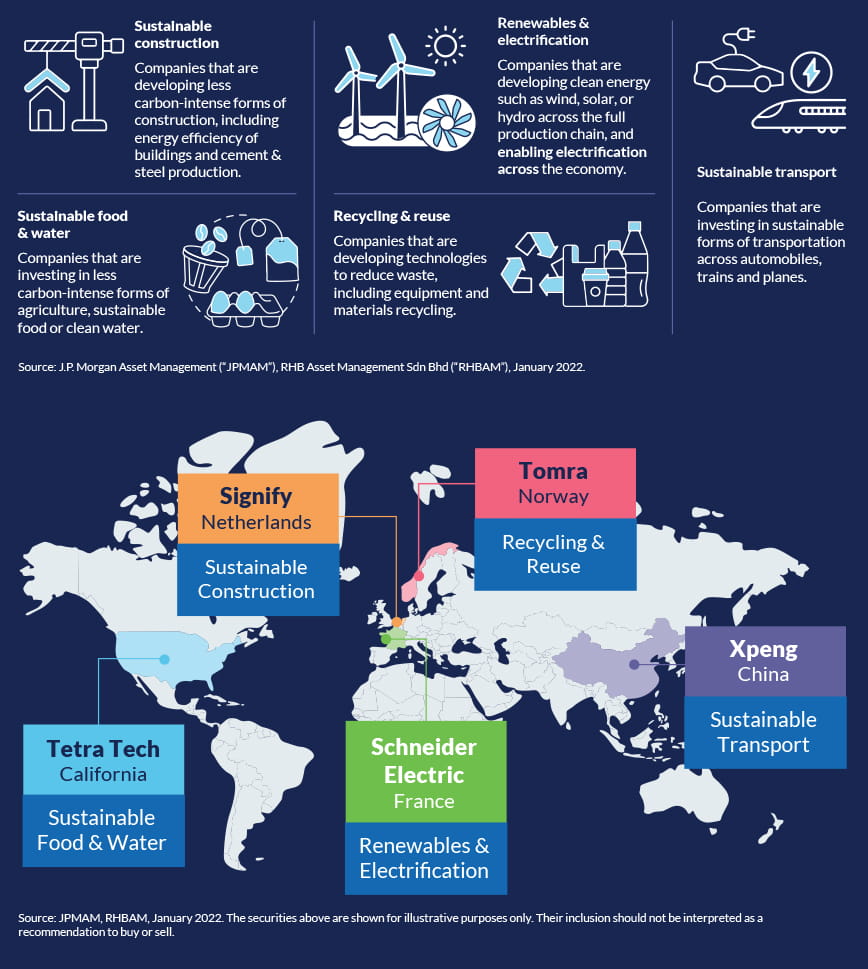

Through your investment, you can tap into the wave of innovation spreading across across a wide range of sectors and across the market cap spectrum, while supporting a sustainable future. The target fund uses a thematic approach to build a differentiated portfolio of opportunities across the globe.

Here are the key climate change solutions and some examples of companies the fund invests in:

For now, the majority of exposure is in Renewables & Electrification, followed by Sustainable Construction, Sustainable Food & Water, Recycling and Reuse, and Sustainable Transport.

RHB Climate Change Solutions Fund acts as a feeder fund for JPMorgan Climate Change Solutions Fund, investing 95% of its NAV the US denominated share classes of the target fund. The target fund combines artificial intelligence with human research talent to pick the cream of the crop and uses natural language processing-based ThemeBot to identify companies exposed to the theme. It relies on climate change insights and stewardship from JPMAM’s dedicated Sustainable Investing Team.

After initial selection using AI, fundamental active managers select their high-conviction ideas, focusing on company fundamentals, and invest in long-term, quality/growth companies, supported by solid corporate governance and sustainability practices.

You can decide to take this opportunity to invest in a better future for yourself, while ensuring that your investments contribute positively to the health of our planet and the next generation. So, kickstart your wealth journey and grow your wealth with RHB. Enjoy a low sales charge of just 1.5% if you are a new customer, and if you are a premier customer, you can enjoy an even lower charge of just 1% for all Unit Trust investments. Reach out to your Relationship Manager for more information, and start investing with us virtually through Adobe Sign.

With Adobe Sign, you get a seamless investing experience, anytime, anywhere. Your Relationship Manager will help you review your portfolio and options virtually, then you can start performing investment transactions on a secure electronic platform. It’s that easy!

Enjoy a seamless investing experience, anytime, anywhere, with Adobe Sign. All it takes is two simple steps.

Step 1

Reach out to your Relationship Manager to review your portfolio virtually.

Step 2

Perform investment transactions via Adobe Sign. Complete the transaction with e-Fill and e-Sign.