For many people, personal banking is perceived as a bureaucratic process that requires documents, time and effort for the sake of security and clarity. Considering the technological advancements over the past decade, these processes should not have to come at the expense of convenience.

As the banking industry evolves from one generation to the next over time, so have the expectations of banking customers — from shorter waiting times at physical bank branches to better parking facilities, for example. Consumers are increasingly more time and cost-conscious, and are demanding greater convenience to help ease their busy lifestyles.

The Covid-19 pandemic has added layers of complexity to the bureaucratic process, however, increasing wait time and decreasing convenience, all of which are the antithesis to consumers’ demands. Customers are now required to adhere to Covid-19 standard operating procedures (SOPs), wear face masks, practise social distancing and register for contact tracing purposes.

Coupled with the implementation of the Conditional Movement Control Order (CMCO), consumers are now more cautious of contracting or spreading the virus. Thus, they are moving away from visiting bank branches physically in favour of contactless banking, not just to reduce the risk of infection but also to enjoy the convenience that contactless banking provides.

The banking industry has to accept the fact that the market is heading towards e-solutions, which is evident in the growth figures of food delivery and grocery shopping services and fintech platforms. Many banks, including RHB Bank, have taken steps to adapt to this new market environment.

The pandemic has condensed what would have been years of digital adoption down to a few months. Much of this shift can be attributed to the rapid digitalisation efforts of the banking industry, as well as the growing awareness of the benefits of contactless banking among customers.

Amid these rapid changes in the industry, consumers’ financial positions have been adversely affected by the pandemic as well. With employment uncertainty, depleting cash flow and loss of income, many Malaysians are slowly realising the importance of accumulating enough funds for rainy days.

There has also been a paradigm shift in their spending habits, from “spend first, save later” to “save first, spend later”. A survey conducted by the Department of Statistics Malaysia (DOSM) during the MCO shows that more than two-thirds (71.4%) of self-employed citizens do not have enough savings to last even a month while 82.7% of employees in the private sector have sufficient savings to survive up to two months.

Given the current circumstances, RHB Bank aims to resolve two key issues brought on by the pandemic — to prioritise banking convenience and safety through physical distancing; and to provide consumers with an avenue to save and grow their wealth.

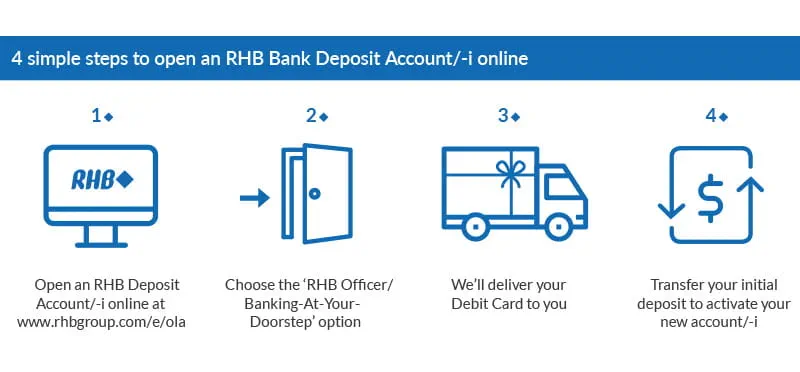

After months of careful planning and development, RHB Bank has arrived at an online account opening solution that is hassle-free, relieving customers of the need to visit a bank branch physically.

Introducing Malaysia’s first online account opening channel with a rider service. Existing RHB Bank customers can now set up a new deposit account/-i easily through a simple three step process that will take no longer than 10 minutes. After clicking on the designated link found on the RHB Bank homepage, they would need to fill in a form with their personal information, agree to the terms and conditions and transfer a minimum initial deposit of RM1,000 to activate the account/-i.

New RHB Bank customers would have an additional step of providing documents, such as their identification card and valid working permit (for non-Malaysian residents), to any RHB Bank branch within 30 days to activate the account/-i. This would be a better solution than the conventional process of physically visiting a bank branch, which would involve an intensive know-your-customer (KYC) process.

Introducing this service during a time of pandemic is also a crucial move to assist Malaysians who have yet to prepare a savings fund for rainy days. RHB Bank introduced this new online account opening service to help lower the barrier to entry for those who wish to start their savings journey or for those looking for more attractive deposit rates and benefits.

RHB Bank’s recent initiatives are geared towards cultivating a conducive environment in which customers are incentivised to save money for a rainy day. To assist in that process, the bank has introduced a salary crediting account programme — Joy@Work.

With Joy@Work, account holders are able to benefit from no-fee credit cards for life, preferential rates on personal, mortgage and auto financing, and competitive rates for Amanah Saham Bumiputera (ASB) financing.

There are also higher interest rates for the salary account/-i, lower initial deposit for the Multi Currency Account/-i with a debit card, waivers on Multi Currency Debit Card/-i fees and preferential rates for term deposits. For customers with a long-term horizon, Joy@Work provides special offers for the Private Retirement Schemes (PRS) as well as special packages for will writing services and Islamic estate planning.

The Joy@Work programme is made available to employees who receive their salaries from companies that perform payroll transactions through RHB Bank, as well as those credited through other banks. You can enjoy the Joy@Work benefit by nominating the RHB account/-i as your salary account.

Through the programme, customers are able to enjoy returns of up to 2.85% a year with the RHB Smart Account/-i, which is ideal for the man in the street, who may be struggling to cope with the current low interest rate environment.

Considering the health risks, opening a bank account/-i at a physical branch has become increasingly difficult during the pandemic, while online banking solutions are quickly becoming a necessity rather than an additional option for Malaysians.

This trend is further supported by the rise of digital banks in foreign countries. A 2018 McKinsey’s Asia Personal Financial Services (PFS) survey reveals that digital banking penetration has grown 1½ to 3 times in emerging Asia since 2014.

A 2020 report by Pricewaterhouse - Coopers (PwC) shows that 74% of Malaysians are interested in becoming a customer of a virtual bank. The silver-haired population aged 55 and above is also twice as likely to be interested in virtual banks, owing to their bad experience with their current bank.

From our observation, there is a strong demand for more digitally accessible banking services, and the market is eager to adopt new technological solutions that help in their banking journey. We believe that introducing both the ability to open a bank account online and the Joy@Work programme will have a compounding effect on one another, allowing greater accessibility to quality financial services without the hassle of visiting a bank branch physically.

To learn more about Joy@Work or our online account opening process, please contact the RHB Customer Service Hotline at 03-9206 8118.