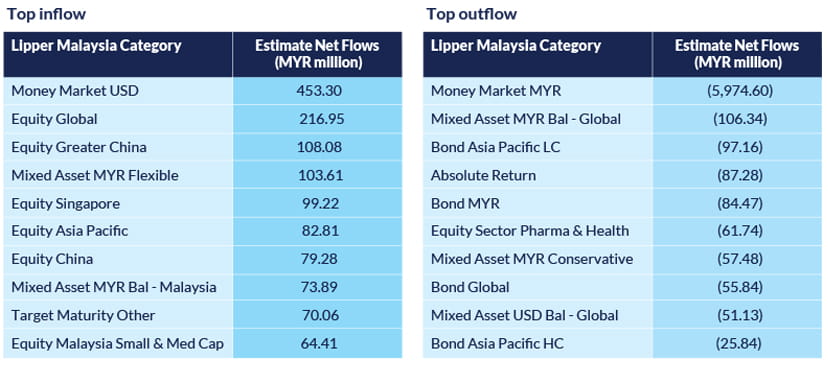

Source: Lipper Investment Manager

In the final quarter of 2022, the USD Money Market Fund continued to see inflows attracted by the potential USD appreciations and high-yields in USD-based fixed income assets. Justifying this movement was the fund’s 4% growth in ringgit terms for 2022.

The top two ranked funds in terms of inflow were Equity Global and Equity Greater China, albeit at a slower rate compared to the previous quarter. Investors who entered the equity market via these funds before or during Q4 2022 were likely to have made positive returns, since the Chinese equity market was up by close to 35% in the closing months of the year.

The jitters leading up to Malaysia’s general elections were eased, and inflows to Malaysia-based assets increased. We see this trend likely to continue based on investors’ belief that small/mid-cap companies will be up and running post GE 15. From October 2022 to January 2023, small/mid-cap equity funds were up by an average of close to 10%, with the best performing fund way ahead of the pack at 20%.

While funds were pouring into the USD Money Market, Malaysian Money Market funds saw a massive outflow, with net redemptions of close to RM6 billion. The movement was largely caused by institutional investors, though. If we were to remove their movements from our tracking, we would see net inflows of nearly RM300 mil.

Moving forward, we expect to see investors continuing to redeem their investments in conservative funds and reinvesting their returns in other assets with higher potential returns.

Next, we will look at some fund ideas for Q1 2023. These are potential diversification ideas for equities, mixed, and fixed income funds that you can further discuss with your Relationship Manager, who will help you decide which of these would best suit your goals and risk profile. As with any investment, these funds carry some degree of risk, so we advise you to conduct some research on your own and discuss your options with a professional.

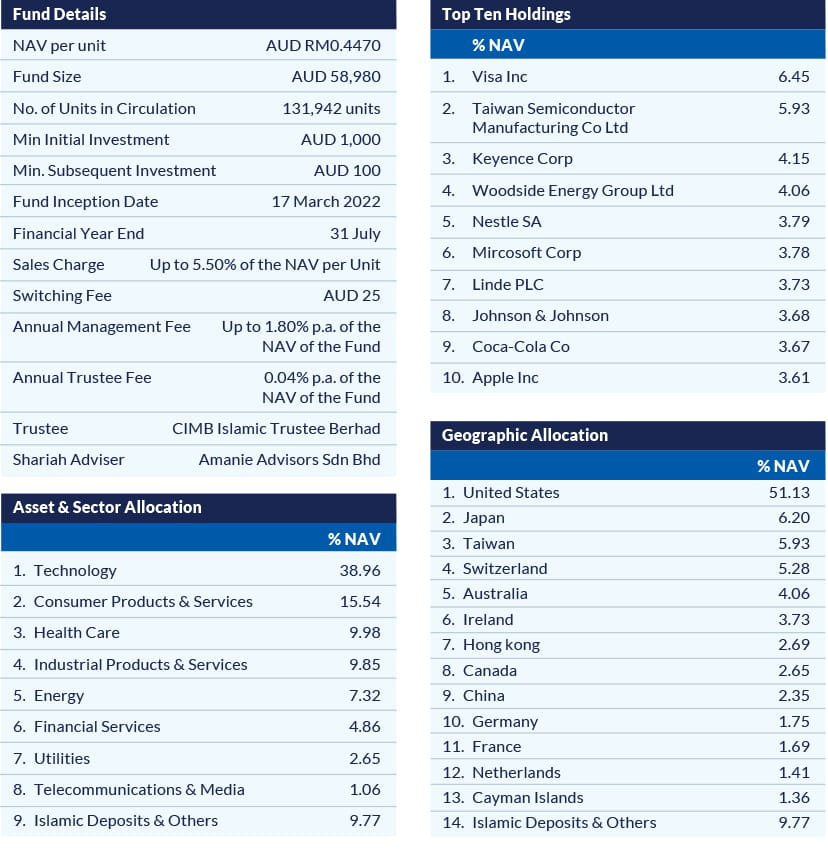

TA Global Absolute Alpha-i

This is a Shariah-compliant equity fund that invests in global equities with the aim of generating long-term positive returns in both capital appreciation and income. The fund is supervised by Ken Goh, a renown fund manager from Fullerton Investment Management.

Why we like this fund

Its investment mandate allows it to invest up to 35% of its assets under management (AUM) into the Chinese equity market, giving investors the chance to capitalise on the potential recovery in both developed and emerging markets. There are also potential upsides in the US, where markets have already priced in the negativity of past quarters. Any growth in gross domestic product (GDP) will benefit the equity market. The Federal Reserve’s aggressive rate hikes may pause in Q2 2023, further benefiting equities. There is also hope that the US may dodge recession, although growth may be slowed. The fund also has a benchmark absolute medium to long-term target return of 8%, which means its strategy won’t be weighed down by any equity benchmark.

Source: TA Global Absolute Alpha-i Fund fact sheet as at 31 January 2023

RHB ESG Multi-Asset Fund

This feeder fund invests principally in the EUR-denominated share class of BlackRock Global – ESG Multi-Asset Fund. BlackRock is the world’s largest investment firm by AUM. It aims to provide investors with medium to long-term capital growth. The fund is a qualified SRI fund, investing in the target fund which adopts the principles of ESG (Environment, Social, Governance) focused investing to ensure investments are in line with sustainable principles.

Why we like this fund

The target fund positions itself in various asset classes, such as equity, fixed income, derivatives, exchange-traded funds, and cash, which aims to reduce portfolio volatility and to generate a consistent and stable price movement. Its diverse spread makes it a good choice for those who wish to start investing in the global equity market with a portfolio that can buffer any potential downside or volatility.

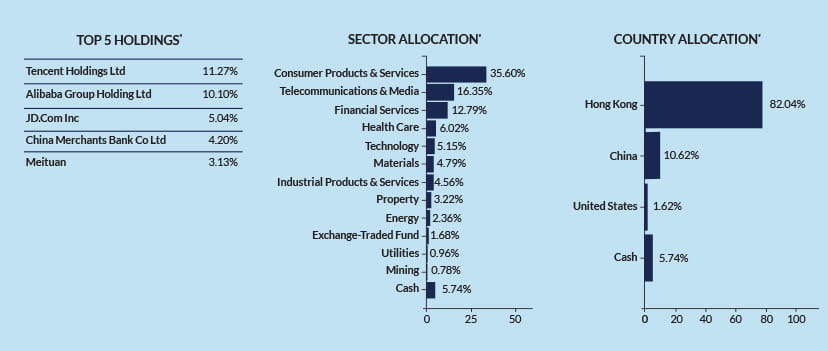

RHB Big Cap China Enterprise Fund

This fund suits those looking to participate in the fast-growing Chinese economy and are willing to take on a little more risk for long-term capital growth. It primarily invests in equities and equity-linked securities issued by companies whose businesses are in China and are listed there and/or other markets. As of end of January 2023, the fund’s highest exposure is in Hong Kong, at 82%.

Why we like this fund

This fund is well-positioned to capitalise on the reopening of China, riding on the potential rebound in consumer spending via its top three holdings in Tencent, Alibaba and JD.com. Its exposure in the Hong Kong market will likely benefit investors, as the Hang Seng China Enterprise Index and Hang Seng Index both grew about 35% in the closing months of 2022. We find the low base effect attractive as well, as there is likely to be improvement in economic performance which is yet to be reflected in corporate earnings and statistics.

Source: Lipper Investment Management as of 31 January 2023

Figures shown are a percentage of NAV

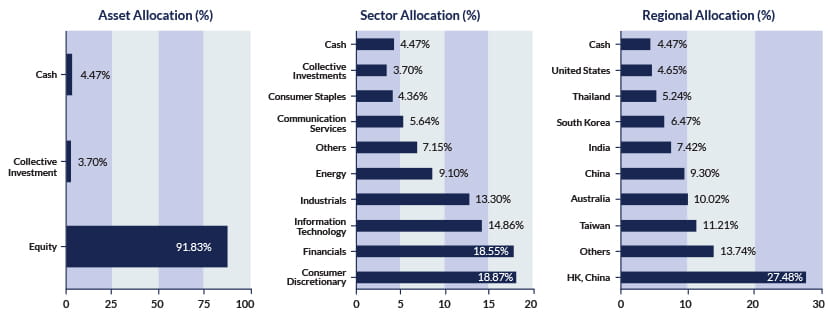

Principal Asia Pacific Dynamic Income Fund

The fund aims to provide regular income by investing primarily in the Asia Pacific ex-Japan region, while achieving capital appreciation over the medium to long term. Under general market conditions, the fund's investment will focus on high dividend yielding equities of companies, sustainable dividend payments and/or will exhibit above-average growth potential when compared to its industry or the overall market at the point of purchase.

Why we like this fund

Like the previous fund, this fund offers investors the chance to benefit from the recovery in China, but with a more diversified approach. As of January 2023, the fund’s highest exposure is in China and Hong Kong with a main focus in the consumer discretionary sector.

Note: ‘Up years’ include the 5 years 2014, 2016-2017 and 2019-2020 when MXAPJ rose. ‘Down years’ include 2015, 2018 and 2021 when MXAJP fell.

Source: JP Morgan Asset Management, 2023

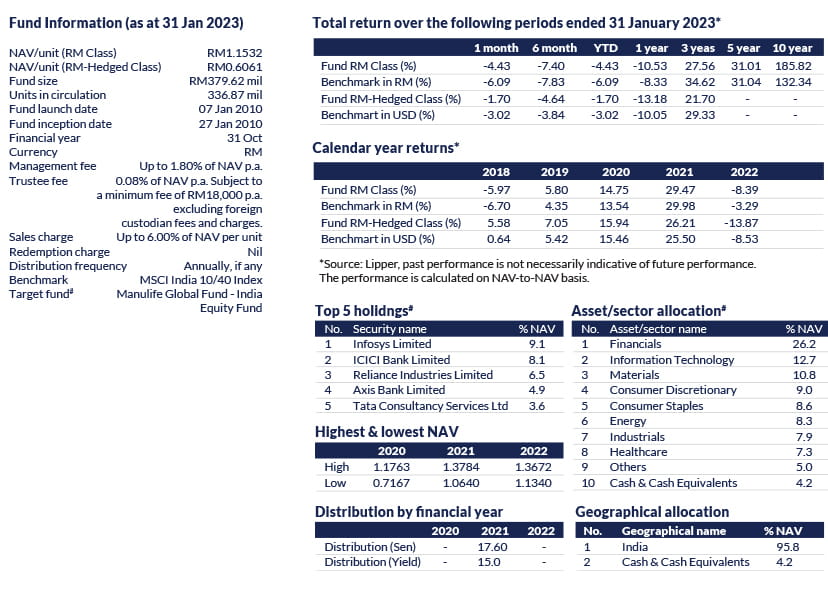

Manulife India Equity Fund

This fund aims to achieve long-term capital growth through equities and equity-related investments of companies covering different sectors of the Indian economy. Its strategy suits investors willing to take on more risk to achieve long-term capital growth.

Why we like this fund

While all the focus is on China post-Covid, let’s not forget India – the other regional economic powerhouse. This fund suits investors looking for other countries with similar growth prospects and wish to diversify their exposure in the region.

There’s good reason, too. The International Monetary Fund (IMF) has projected India’s growth at 6.1% for 2023. This growth is backed by a composite PMI of 60, one of the highest in the world. Any figure above 50 shows expansion and increased activity.

The fund’s top holdings in the country’s financial sector are a plus point. India’s efforts to curb inflation by hiking interest rates benefit the banking sector’s net margins, which will be reflected in subsequent quarters.

Source: Manulife India Equity Fund fact sheet as of 31 January 2023

We hope your investment year gets off to a good start with these diversification tips. Our Relationship Managers are happy to help you consider these options, or any other.

Disclaimer:

This article is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party, without obtaining prior permission of RHB Bank Sdn Bhd (“RHB”).

This article has been prepared by RHB and is solely for your information only. It may not be copied, published, circulated, reproduced or distributed in whole or part to any person without the prior written consent of RHB. In preparing this presentation, RHB has relied upon and assumed the accuracy and completeness of all information available from public sources or which was otherwise reviewed by RHB. Accordingly, whilst we have taken all reasonable care to ensure that the information contained in this presentation is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness and make no representation or warranty (whether expressed or implied) and accept no responsibility or liability for its accuracy or completeness. You should not act on the information contained in this podcast without first independently verifying its contents.

Any opinion, management forecast or estimate contained in this article is based on information available as the date of this podcast and are subject to change without notice. It does not constitute an offer or solicitation to deal in units of any RHB fund and does not have regard to the specific investment objectives, financial situation or the particular needs of any specific person who may receive this. Investors may wish to seek advice from a financial adviser/unit trust consultant before purchasing units of any funds. In the event that the investor chooses not to seek advice from a financial adviser/unit trust consultant, he should consider whether the fund in question is suitable for him. Past performance of the fund or the manager, and any economic and market trends or forecast, are not necessarily indicative of the future or likely performance of the fund or the manager. The value of units in the fund, and the income accruing to the units, if any, from the fund, may fall as well as rise.

A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the TA Global Absolute Alpha-i fund dated 17 March 2022, RHB ESG Multi-Asset Fund dated 3 October 2022, RHB Big Cap China Enterprise Fund dated 28 February 2022, Principal Asia Pacific Dynamic Income Fund dated 29 November 2022, RHB Asia Pacific Equity Dividend Fund dated 3 January 2023 and RHB Manulife India Equity Fund dated 25 January 2022. (“Fund”) is available and investors have the right to request for a PHS.

Investors are advised to obtain, read and understand the PHS and the contents of the Information Memorandum and its supplementary (ies) (if) (“the Information Memorandum”) before investing. The Information Memorandum has been registered with the Securities Commission Malaysia (“SC”) who takes no responsibility for its contents. The SC’s approval and authorization of the registration of the Information Memorandum should not be taken to indicate that the SC has recommended or endorsed the Fund. Amongst others, investors should consider the fees and charges involved. Investors should also note that the price of units and distributions payable, if any, may go down as well as up. Where a distribution is declared, investors are advised that following the issue of additional units/distribution, the NAV per unit will be reduced from cum distribution NAV to ex-distribution NAV. Any issue of units to which the Information Memorandum relates will only be made on receipt of a form of application referred to in the Information Memorandum. The printed copy of prospectus and Product Highlight Sheet is available at RHB branches/Premier Centre and investors have the right to request for a Product Highlight Sheet. Investors are advised that investments are subject to investment risk and that there can be no guarantee that any investment objectives will be achieved. Investors should conduct their own assessment before investing and seek professional advice, where necessary and should not make an investment decision based solely on this update.

The Manager wishes to highlight the specific risks of the TA Global Absolute Alpha-i Fund are External Investment Manager’s Risk, Shariah non-compliance Risk, Shariah Status Reclassification Risk, Profit Rate Risk, Islamic Collective Investment Scheme Risk, Shariah-compliant Equity Risk, Islamic Financial Derivative Instruments (Islamic FDI) Risk, Currency Risk, Currency Risk, Country Risk, Liquidity Risk, Concentration Risk, Counterparty Risk and Distribution Out of Capital Risk. The specific risks of the RHB ESG Multi-Asset Fund are Management Risk, Liquidity Risk, Currency Risk, Country Risk, Interest Rate Risk, General Risks, Financial Markets, Counterparties and Service Providers Risk, Tax Considerations Risk, Share Class Contagion Risk, Currency Risk Base Currency, Global Financial Market Crisis and Governmental Intervention Risk, Impact of Natural or Man Made Disasters and Disease Epidemics Risk, Recent Market Events Risk, Derivatives Risk, Securities Lending Risk, Risks Relating to Repurchase Agreements, Risks Relating to Reverse Repurchase Agreements, Counterparty Risk, Counterparty Risk to the Depositary, Fund Liability Risk, Market Leverage Risk, Repurchase and Reverse Repurchase Agreements Risk, MiFID II Risk, Cybersecurity Risk, Tax Risk, Sustainability Risk, Other Risks, Liquidity Risk, Options Strategies Risk, Fixed Income Transferable Securities Risk, Investment in High Yield Debt Securities Risk, Asset backed Securities Risk, Mortgage backed Securities Risk, Contingent Convertible Bonds Risk, Equity Risks, Money Market Instruments Risk, Emerging Markets Risk, Sovereign Debt Risk, Bond Downgrade Risk Bank Corporate Bonds “Bail in” Risk, Investments in the PRC Risk, Investments in Russia Risk, Potential implications of Brexit Risk, Euro and Euro Zone Risk, Exposure to Commodities within Exchange Traded Funds Risk, ESG Investment Policy Risk, MSCI ESG Screening Criteria Risk, Specific Risks Applicable to Investing via the Stock Connects, Specific Risks Associated with China Interbank Bond Market. The specific risks of the RHB Big Cap China Enterprise Fund are Currency Risk, Country Risk, Market Risk and Particular Security Risk. The specific risks of the Principal Asia Pacific Dynamic Income Fund are Returns not guaranteed Risk, Market Risk, Inflation Risk, Manager Risk, Financing Risk, Stock Specific Risk, Country Risk, Liquidity Risk, Currency Risk, Credit and Default Risk, Interest Rate Risk, Risk associated with investing in CIS and Risk of investing in emerging markets. The specific risks of the RHB Asia Pacific Equity Dividend Fund are Management Risk, Liquidity Risk, Currency Risk, Country Risk, Interest Rate Risk, Investment Risk, Equity Risk, Political, Economic and Social Risks, Market Risk, Dividend-paying Equity Risk, Emerging Markets Risk, Concentration Risk, Smaller Companies Risk, Risk associated with high volatility of the equity market in the Asian region, Hedging Risk, Derivatives Risk, Leverage Risk, RMB Currency Risk, Real Estate Investment Trusts (REITs) Risk, Special Purpose Acquisition Company (SPAC) Risk, Payment of Distributions Out of Capital Risk, Low Level of Monitoring Risk, Legal, Tax and Regulatory Risk, Valuation Risk, Volatility Risk, Custodial Risk, Counterparty Risk, People’s Republic of China (PRC) Tax Risk Consideration, Early Termination Risk, Technology Related Companies Risk, Cross-class Liability Risk, China Market Risk, Risk associated with foreign shareholding restrictions on China A-Shares, Risk associated with short swing profit rule, Risks associated with China Connect, Risks associated with the investments in stocks listed on the Beijing Stock Exchange and/or the ChiNext Board of the SZSE and or the Science and Technology Innovation Board (“STAR Board”) of the SSE, Risks associated with equity-linked notes and participation notes, Risks associated with collateral management and re-investment of cash collateral, London Interbank Offer Rate (“LIBOR”) discontinuance or unavailability risk. The specific risks of the RHB Manulife India Equity Fund are Manager’s Risk, Market Risk, Liquidity Risk, Country Risk, Currency Risk, Small-Cap Risk, Natural Resources Sector Risk, Taxation Risks, Financial Derivative Instruments other than for Investment Purpose Risk, Foreign Exchange Risks, Liquidity and Volatility Risks, Emerging Markets Risks, Political and Regulatory Risks, Custodial, Clearance and Settlement Risk, Credit Downgrade Risk, Macroeconomic Risk Factors, Global Commodity Prices Risk, Oil Price Risks, Government Policy Risks, Risk of Price Controls, Risk of Stock Market Controls, Geopolitical Risks, Labour Market Risks, Environmental Regulation Risks, Swing Pricing Risk and other general risks are elaborated in the Information Memorandum.

This article has not been reviewed by the Securities Commission Malaysia (SC).