Modern problems require modern solutions. In a bid to curb environmental pollution, more countries are decreasing their dependency on fossil fuels, shifting to all-electric options in hopes of creating a cleaner and more environmentally sustainable world.

An innovative solution taking the world by storm is new energy vehicles (NEV) — cars that rely on electric or traction motors powered by batteries, solar panels, fuel cells or generators designed to convert fuel into electricity.

A decade ago, the notion that NEVs would be able to exist as a viable alternative to conventional vehicles was unthinkable, let alone replacing them in the future. Thanks to technological advancements and supportive government policies, however, high-performance electric vehicles (EVs) are sharing the same roads with conventional vehicles.

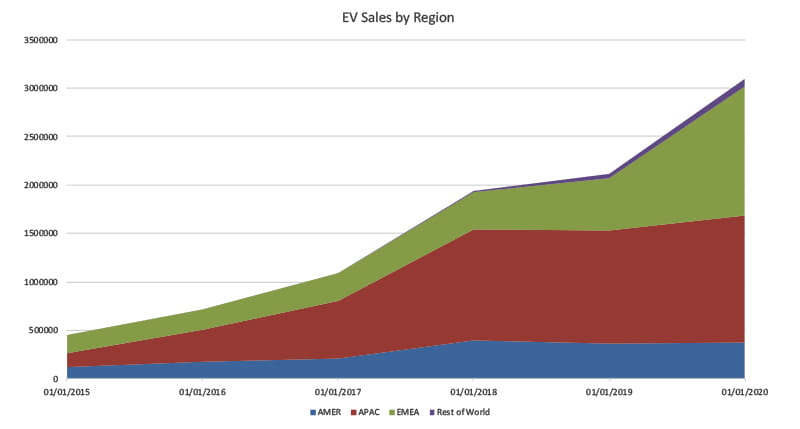

The adoption of EVs across the globe is rapidly gaining steam, increasing sixfold since 2015. In 2020, EV sales improved to 3.24 million units, up from 2.26 million in the previous year.

Furthermore, demand for EV is expected to remain resilient even amid a pandemic recovery. The Bloomberg New Energy Finance (BNEF) suggests that better-quality batteries, cost price parity with internal combustion engine (ICE) vehicles, increasing availability of charging infrastructure and new markets as growth drivers will continue to sustain demand.

Source: Bloomberg, 6 May 2021

Europe has seen remarkable growth, with overall sales increasing by double- digit percentages year-on-year in most countries. The main driver behind the growth in EV demand and production over recent years is due to the surge in demand from Chinese consumers.

China has been the world’s largest market since 2015 and has been strengthening its lead since. As at end-December last year, there were almost five million EVs on the roads, accounting for more than half of the world’s total, according to the Chinese Ministry of Public Security. The country is the world’s largest buyer and manufacturer of EVs and accounts for more than 90% of the world’s electric buses and trucks.

Of the 3.24 million EVs sold globally in 2020, 1.33 million were sold in China — marking a 62% increase since 2017 — and 1.21 million were produced there.

Although Covid-19 has affected market sentiment, demand for EVs reached 226,000 units in March 2021, rising more than 239% year on year.

While the US lags behind China and the European Union in its transition to EVs, the world’s largest economy is adopting measures that would benefit the adoption in the near future. Most notably, automobile powerhouse General Motors Co announced that it would stop the sale of gas and diesel lightweight vehicles by 2035. Plans to build a nationwide network of charging stations and improving EV batteries are already being implemented.

The Biden administration has pledged to install 50,000 individual chargers — five times the current number — in 28,000 new charging stations by 2030, which would successfully meet half the US’ charging demands.

With a more environmentally conscious administration now in office, it is likely that the US would focus further on sustainable development matters over the coming years, which bodes well for EV adoption.

The key to successful adoption of an electronic alternative lies in effective government policies that can improve the technical levels and performance of EVs. Subsidies will also stimulate consumer demand.

The best example of this is China, whose dominance in the EV space is largely due to the “carrot and stick” policy implementation to push cleaner and greener EVs. This would create jobs and enhance upstream industries, as well as alleviate the country’s heavy dependence on oil imports and tackle severe pollution in key cities.

On the “carrot” side, the Chinese government has been trying to incentivise domestic consumers to make the switch to EVs through various subsidies, especially during the early stages when the price point of EVs was comparatively more expensive. As at end- 2017, central and local authorities had already invested more than RMB393 billion in the sector.

As the government seeks to reduce reliance on subsidies within the sector, however, the level of incentives will be reduced by 10% a year for the period between 2020 and 2022.

On the “stick” side, the Chinese government has introduced an “NEV credits” regime to push for more supply. In general, Chinese car manufacturers will need to achieve a certain number of NEV credits obtained through meeting production quotas, which will increase each year. Failure to meet the targets will result in production suspension for existing high-fuel-consuming models.

In Europe, governments largely rely on carbon dioxide (CO2) emission legislation to push the automobile industry to deliver a sizeable near-term cut in the release of CO2. A 37.5% reduction is needed by 2030, from 2021 levels. The overarching objective of the legislation is to achieve net-zero greenhouse gas emissions by 2050, a goal that will be enshrined in a “Climate Law” presented by the European Commission in March 2020.

By year-end, the average CO2 emmissions of new cars sold in Europe must meet the 95g/km maximum limit and there are bespoke targets for each orginal equipment manufacturer based on its fleet mass. Failure will result in a €95 (RM476) fine for every gram of CO2 over the bespoke limit per vehicle.

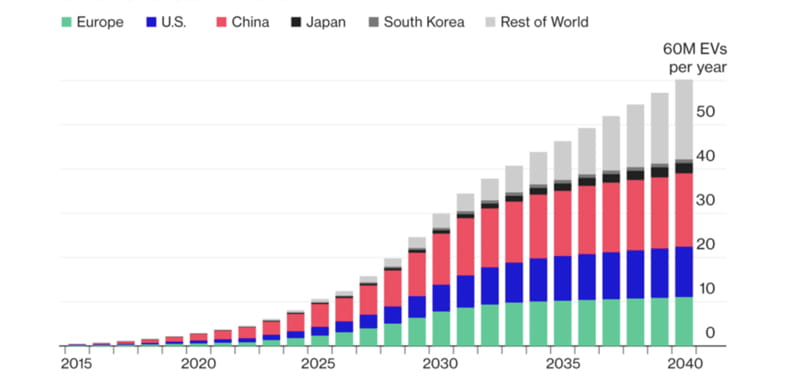

Source: Bloomberg New Energy Finance

As more countries continue to pledge to achieve net-zero greenhouse gas emissions, and as technology continues to develop and mature, it is all but assured that the EV revolution is here to stay. Studies estimate that EVs will hit 10% of global passenger vehicle sales by 2025. The number will increase to 28% in 2030 and 58% in 2040.

Global EV volume is forecast to enjoy a compound annual growth rate of 52% from 2021 to 2025, based on IHS Markit estimates. China is expected to hold 49% of the global EV market while Europe is likely to account for 27%. The US will hold 14% by 2030.

With market forces gaining momentum and consumer consciousness on the rise, EVs are fast becoming the future of the automotive industry. This rapid transformation would also present valuable investment opportunities for investors.

For example, with the forecast increase in EV sales, there will be significant increases in EV battery capacity, which translates into higher overall battery equipment demand globally. Nearly one-third of demand is coming from China. Currently, the top five battery makers are based in Asia, with the largest based in China.

Battery technology advances will play a huge role in reducing battery costs and increasing energy density gains. Manufacturing scale and price competition within the battery materials supply chain, along with raw material price fluctuations, can play an even larger role in EV economics. With the battery industry and upstream supply chain improving faster than expected, there has been consolidation among battery makers. The manufacturing scale gains by the top five are far greater than the rest of the industry.

“The EV landscape is getting more and more exciting,” said Tan Jee Toon, chief investment officer at Asia Pacific Equities, RHB Asset Management. “With the rapid developments made, investors would do well to align themselves with a trusted fund manager and take advantage of the current boom.”

At RHB, our Relationship Managers and Investor Specialists stand ready to advise you on the investment strategy to achieve your financial goals. Scan the QR code below to leave your contact details with us so we may address your concerns.

Invest with RHB Premier to unlock wealth opportunities.

Join RHB Premier today.

Visit any RHB Premier Centre.