How (and where) to invest during high interest times

We explain how interest rates and inflation affect your investments and how you can optimise your portfolio.

Investing during high interest times is a great way to make sure you're getting the best bang for your buck. That means right now. Less than three years on from the pandemic-induced all-time low of 1.75% in 2020, Malaysia’s overnight policy rate (OPR) has climbed back up to 2.75%.

While you could just let your money sit in your fixed deposit account to accrue interest, that’s not exactly optimal, because inflation will eat away at your savings before you get the chance to dip into it. Malaysia’s headline consumer price inflation rate is expected to hover between 2.5% to 3% in 2023, according to the World Bank. At best, your savings won’t lose any value this year, but you won’t be making anything, either. Over the long term, you won’t outrun inflation with a fixed deposit account.

Although Malaysia’s inflation rate has eased since December 2022, it’s still outpacing interest. And we’re still not feeling the impact of deflation on our wallets and savings – just ask anyone if they think things have suddenly become cheaper since Christmas. If you want to upset them even more, ask them if they’ve had to withdraw some of their public retirement fund during the pandemic years. On a serious note, dwindling retirement savings1 is a real issue, one that we must address by making informed investment decisions.

Regionally, the inflation2 story isn’t much better. Indonesia’s inflation stands at 5.47%, while our neighbour Singapore is seeing 6.6%. Laos is the inflation king of the region (not a good thing) at 40.3%.

There are several factors that affect investments, including inflation and the economy. When there's an increase in inflation, it means that prices are rising at a faster rate than before, which can have a direct impact on how much money you make from investing.

The same thing goes for investments. If there's more inflation than expected during high-interest times, then your investment will lose value over time.

So, you see what we’re getting at? Finding the right investment option is mostly about how hot or cold interest and inflation rates are and getting the temperature just right.

This is why it's important for investors to hedge against inflation by choosing investment options that are protected from these fluctuations in price AND might even thrive in high interest environments. Where does one find such a magical, mystical thing – this unicorn in the mist?

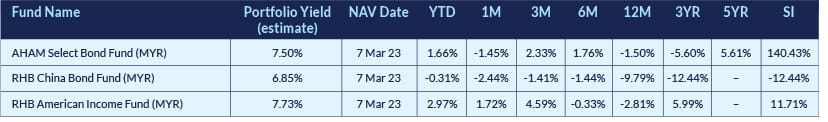

Now before you shout “BONDS!!”, we’re going to (partially) debunk a popular investment myth. Despite their reputation as a haven in times of inflation, not all investment-grade bonds are created equal. They only serve this purpose if they offer high yields or offer both a coupon and potential capital gains. That somewhat narrows your bond choices, but we’ve made it easier by highlighting some funds that invest in this type of bond for you to consider.

Source: Novagni 7 March 2023

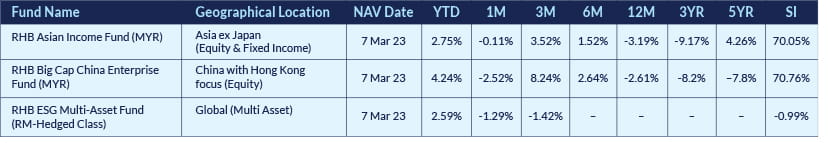

Inflation is a bad thing for our wallets, but it can be good for equities. Equities can hedge against inflation through dividends and capital gain. As a company’s net profit increases, so does your dividend. That’s more money for you to improve your purchasing power, even as inflation rates rise. Then, as the stock grows in value over time, you gain from capital appreciation. Congrats, you’ve outrun inflation.

But what if you don’t want to wait that long? Zoom in to the equity market and look for growth stocks. Growth stocks are shares in companies whose revenue is growing faster than the market average, which means the stock price is more likely to rise quickly. The idea is to get a quicker capital gain. This contrasts to an income stock - which offers consistent dividends instead - that investors hold on to for longer. Both serve to outrun inflation. While one is a sprinter, the latter is a marathoner. These are some choices of funds to consider:

Source: Novagni 7 March 2023

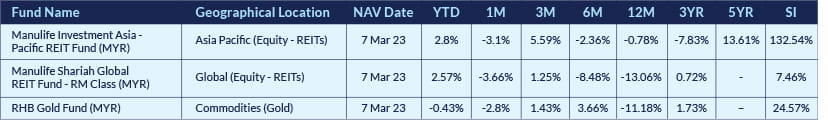

A more direct way to benefit from inflation is to invest in something that appreciates with inflation. Doesn’t that make perfect sense? Property is a classic example. Inflation pushes prices of things up, including property. And because your mortgage stays the same throughout, you enjoy the increase in value of your property over time. You can also get a more immediate income through rental. There’s a downside, though. Owning property comes with its own additional costs and responsibilities, like taxes, maintenance costs, crazy tenants, etc. Also, you don’t usually sell the house you happen to live in. If you don’t want the headache or risk of being a property owner but want the income benefits, invest in a fund that invests in properties.

REITs, or real estate investment trusts, do exactly that. REITs own income-generating properties across a wide range of property types, including offices, shopping malls, and hotels. REITs collect rent and distribute it to their shareholders in the form of dividends. When a REITs sells a property, the capital gain is also shared out.

Throughout the ups and downs of the global economy, one form of investment has (literally) kept shining – gold. This precious metal has been a coveted material throughout history because of its multiple uses in jewellery-making, electronics, and so on. Minor dips in value aside, gold has been a steady performer, cementing its reputation as a solid “set-it-and-forget-it” investment over the long term. Its value has risen 600% over the past 30 years. Imagine buying some now and surprising yourself on the first morning of your retirement years with how much value you’ve gained. That’s the best retirement present to yourself. Owning gold has become much more convenient and safer, too. It’s as easy as buying shares in a fund that invests in this asset. No need to hide your stash of doubloons like a pirate.

Remember what we said earlier about equities? Choosing equities armed with pricing power will help you fight the inflation beast. Pricing power is, ahem, the performance enhancer in times of inflation. Companies with pricing power have the distinct advantage of being able to increase the price of their products and services without provoking an outcry among consumers, either because a) they don’t mind or aren’t affected, or b) it’s a necessity. Some examples are healthcare, utilities, luxury goods, and companies with products that have a competitive edge and/or a loyal consumer base. When was the last time you heard someone complain that Birkins aren’t as cheap as they used to be?

Source: Novagni 7 March 2023

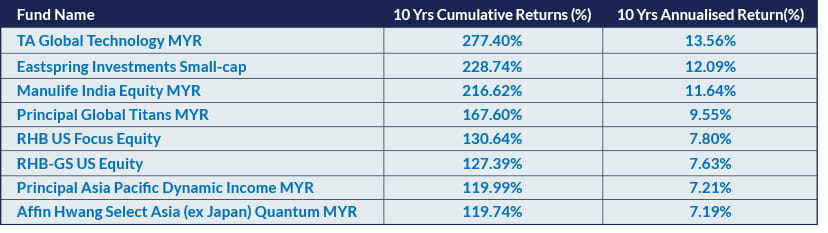

We’ve picked out some funds that invest in these assets to save you the trouble of sifting through thousands of funds, and the risk of putting all your money into one asset class.

The cherry on top, the finishing touch, is always diversification. Spreading your investments across a wide range of asset classes and sectors - thereby spreading your risk - can help reduce volatility, while keeping you on track to your long-term investment goal. That’s why the Avengers combine forces across a diverse range of individual skills, as opposed to just one lone superhero trying to save the world.

These are samples of funds…

Source: Lipper Investment Management 8 March 2023

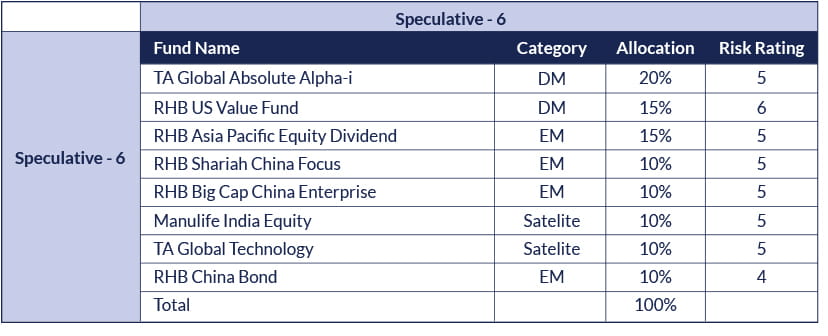

... and here’s an example of how investments can be allocated among these funds in a well-diversified portfolio based on the investor’s risk profile:

Source: RHB Bank February 2023

Like leprechauns, there is no such thing as a fail-proof strategy - all investments come with some degree of risk. However, by adopting the right strategy in making informed investment decisions, you can mitigate or reduce the impact of inflation on your portfolio and even find opportunities to make a profit.

With RHB Premier Banking, you’ll get access to a dedicated Relationship Manager who will help you in your investment journey to achieving your financial goals.

1The Star, MOF: Dwindling EPF savings a concern, Martin Carvalho & Tarrence Tan, 17 Nov 2023.

2Trading Economics, Inflation Rate Asia, 2 March 2023.

Disclaimer:

This article is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party, without obtaining prior permission of RHB Bank Sdn Bhd (“RHB”).

This article has been prepared by RHB and is solely for your information only. It may not be copied, published, circulated, reproduced or distributed in whole or part to any person without the prior written consent of RHB. In preparing this presentation, RHB has relied upon and assumed the accuracy and completeness of all information available from public sources or which was otherwise reviewed by RHB. Accordingly, whilst we have taken all reasonable care to ensure that the information contained in this presentation is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness and make no representation or warranty (whether expressed or implied) and accept no responsibility or liability for its accuracy or completeness. You should not act on the information contained in this podcast without first independently verifying its contents.

Any opinion, management forecast or estimate contained in this article is based on information available as the date of this podcast and are subject to change without notice. It does not constitute an offer or solicitation to deal in units of any RHB fund and does not have regard to the specific investment objectives, financial situation or the particular needs of any specific person who may receive this. Investors may wish to seek advice from a financial adviser/unit trust consultant before purchasing units of any funds. In the event that the investor chooses not to seek advice from a financial adviser/unit trust consultant, he should consider whether the fund in question is suitable for him. Past performance of the fund or the manager, and any economic and market trends or forecast, are not necessarily indicative of the future or likely performance of the fund or the manager. The value of units in the fund, and the income accruing to the units, if any, from the fund, may fall as well as rise.

A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the TA Global Absolute Alpha-i fund dated 17 March 2022, RHB ESG Multi-Asset Fund dated 3 October 2022, RHB Big Cap China Enterprise Fund dated 28 February 2022, Principal Asia Pacific Dynamic Income Fund dated 29 November 2022, RHB Asia Pacific Equity Dividend Fund dated 3 January 2023 and RHB Manulife India Equity Fund dated 25 January 2022. (“Fund”) is available and investors have the right to request for a PHS.

Investors are advised to obtain, read and understand the PHS and the contents of the Information Memorandum and its supplementary (ies) (if) (“the Information Memorandum”) before investing. The Information Memorandum has been registered with the Securities Commission Malaysia (“SC”) who takes no responsibility for its contents. The SC’s approval and authorization of the registration of the Information Memorandum should not be taken to indicate that the SC has recommended or endorsed the Fund. Amongst others, investors should consider the fees and charges involved. Investors should also note that the price of units and distributions payable, if any, may go down as well as up. Where a distribution is declared, investors are advised that following the issue of additional units/distribution, the NAV per unit will be reduced from cum distribution NAV to ex-distribution NAV. Any issue of units to which the Information Memorandum relates will only be made on receipt of a form of application referred to in the Information Memorandum. The printed copy of prospectus and Product Highlight Sheet is available at RHB branches/Premier Centre and investors have the right to request for a Product Highlight Sheet. Investors are advised that investments are subject to investment risk and that there can be no guarantee that any investment objectives will be achieved. Investors should conduct their own assessment before investing and seek professional advice, where necessary and should not make an investment decision based solely on this update.

The Manager wishes to highlight the specific risks of the TA Global Absolute Alpha-i Fund are External Investment Manager’s Risk, Shariah non-compliance Risk, Shariah Status Reclassification Risk, Profit Rate Risk, Islamic Collective Investment Scheme Risk, Shariah-compliant Equity Risk, Islamic Financial Derivative Instruments (Islamic FDI) Risk, Currency Risk, Currency Risk, Country Risk, Liquidity Risk, Concentration Risk, Counterparty Risk and Distribution Out of Capital Risk. The specific risks of the RHB ESG Multi-Asset Fund are Management Risk, Liquidity Risk, Currency Risk, Country Risk, Interest Rate Risk, General Risks, Financial Markets, Counterparties and Service Providers Risk, Tax Considerations Risk, Share Class Contagion Risk, Currency Risk Base Currency, Global Financial Market Crisis and Governmental Intervention Risk, Impact of Natural or Man Made Disasters and Disease Epidemics Risk, Recent Market Events Risk, Derivatives Risk, Securities Lending Risk, Risks Relating to Repurchase Agreements, Risks Relating to Reverse Repurchase Agreements, Counterparty Risk, Counterparty Risk to the Depositary, Fund Liability Risk, Market Leverage Risk, Repurchase and Reverse Repurchase Agreements Risk, MiFID II Risk, Cybersecurity Risk, Tax Risk, Sustainability Risk, Other Risks, Liquidity Risk, Options Strategies Risk, Fixed Income Transferable Securities Risk, Investment in High Yield Debt Securities Risk, Asset backed Securities Risk, Mortgage backed Securities Risk, Contingent Convertible Bonds Risk, Equity Risks, Money Market Instruments Risk, Emerging Markets Risk, Sovereign Debt Risk, Bond Downgrade Risk Bank Corporate Bonds “Bail in” Risk, Investments in the PRC Risk, Investments in Russia Risk, Potential implications of Brexit Risk, Euro and Euro Zone Risk, Exposure to Commodities within Exchange Traded Funds Risk, ESG Investment Policy Risk, MSCI ESG Screening Criteria Risk, Specific Risks Applicable to Investing via the Stock Connects, Specific Risks Associated with China Interbank Bond Market. The specific risks of the RHB Big Cap China Enterprise Fund are Currency Risk, Country Risk, Market Risk and Particular Security Risk. The specific risks of the Principal Asia Pacific Dynamic Income Fund are Returns not guaranteed Risk, Market Risk, Inflation Risk, Manager Risk, Financing Risk, Stock Specific Risk, Country Risk, Liquidity Risk, Currency Risk, Credit and Default Risk, Interest Rate Risk, Risk associated with investing in CIS and Risk of investing in emerging markets. The specific risks of the RHB Asia Pacific Equity Dividend Fund are Management Risk, Liquidity Risk, Currency Risk, Country Risk, Interest Rate Risk, Investment Risk, Equity Risk, Political, Economic and Social Risks, Market Risk, Dividend-paying Equity Risk, Emerging Markets Risk, Concentration Risk, Smaller Companies Risk, Risk associated with high volatility of the equity market in the Asian region, Hedging Risk, Derivatives Risk, Leverage Risk, RMB Currency Risk, Real Estate Investment Trusts (REITs) Risk, Special Purpose Acquisition Company (SPAC) Risk, Payment of Distributions Out of Capital Risk, Low Level of Monitoring Risk, Legal, Tax and Regulatory Risk, Valuation Risk, Volatility Risk, Custodial Risk, Counterparty Risk, People’s Republic of China (PRC) Tax Risk Consideration, Early Termination Risk, Technology Related Companies Risk, Cross-class Liability Risk, China Market Risk, Risk associated with foreign shareholding restrictions on China A-Shares, Risk associated with short swing profit rule, Risks associated with China Connect, Risks associated with the investments in stocks listed on the Beijing Stock Exchange and/or the ChiNext Board of the SZSE and or the Science and Technology Innovation Board (“STAR Board”) of the SSE, Risks associated with equity-linked notes and participation notes, Risks associated with collateral management and re-investment of cash collateral, London Interbank Offer Rate (“LIBOR”) discontinuance or unavailability risk. The specific risks of the RHB Manulife India Equity Fund are Manager’s Risk, Market Risk, Liquidity Risk, Country Risk, Currency Risk, Small-Cap Risk, Natural Resources Sector Risk, Taxation Risks, Financial Derivative Instruments other than for Investment Purpose Risk, Foreign Exchange Risks, Liquidity and Volatility Risks, Emerging Markets Risks, Political and Regulatory Risks, Custodial, Clearance and Settlement Risk, Credit Downgrade Risk, Macroeconomic Risk Factors, Global Commodity Prices Risk, Oil Price Risks, Government Policy Risks, Risk of Price Controls, Risk of Stock Market Controls, Geopolitical Risks, Labour Market Risks, Environmental Regulation Risks, Swing Pricing Risk and other general risks are elaborated in the Information Memorandum.

This article has not been reviewed by the Securities Commission Malaysia (SC).