Around this time last year, one could point their finger at a fund, put some money in, and watch it grow. That time has come and gone and perhaps you’d like to consider a different approach.

Throughout Q2 2022, inflation levels continued to rise in many major economies and both bonds and equities were under pressure as investors moved to price in further interest rates and the increased risk of recession.

In the US, equities across sectors fell. Investors focused on inflation and waited for the Federal Reserve’s next move, and this was echoed in all major global markets, even at home in Malaysia. Bank Negara Malaysia (BNM) raised the interest rate by 25bps to 2.5% in September as part of its tightening monetary policy.

Asia (ex-Japan) equities saw negative returns as investors retreated amidst concerns of rising global inflation, which exacerbated legacy supply chain problems from the pandemic. Only China’s equity markets ended the second quarter with positive return (April to June) 2022, boosted by increased factory activity.

The yen weakened sharply against the US dollar by 14% between March and June, breaching the 130-yen mark for the first time in 20 years, leading to the Japanese stock market ending the quarter on a lower note.

The stronger US dollar also affected emerging markets, along with rising concern over a global recession, domestic policy uncertainty, and industrial metals prices.

In Europe, Q2 saw further steep declines across the equity markets as the war in Ukraine continued and potential gas shortages placed additional pressure. Higher inflation also negatively impacted consumer confidence.

With inflation becoming an increasing concern and global economies teetering on the edge of recession, it takes a different type of fund to perform well in leaner times. Luckily for you, we’ve highlighted some gems.

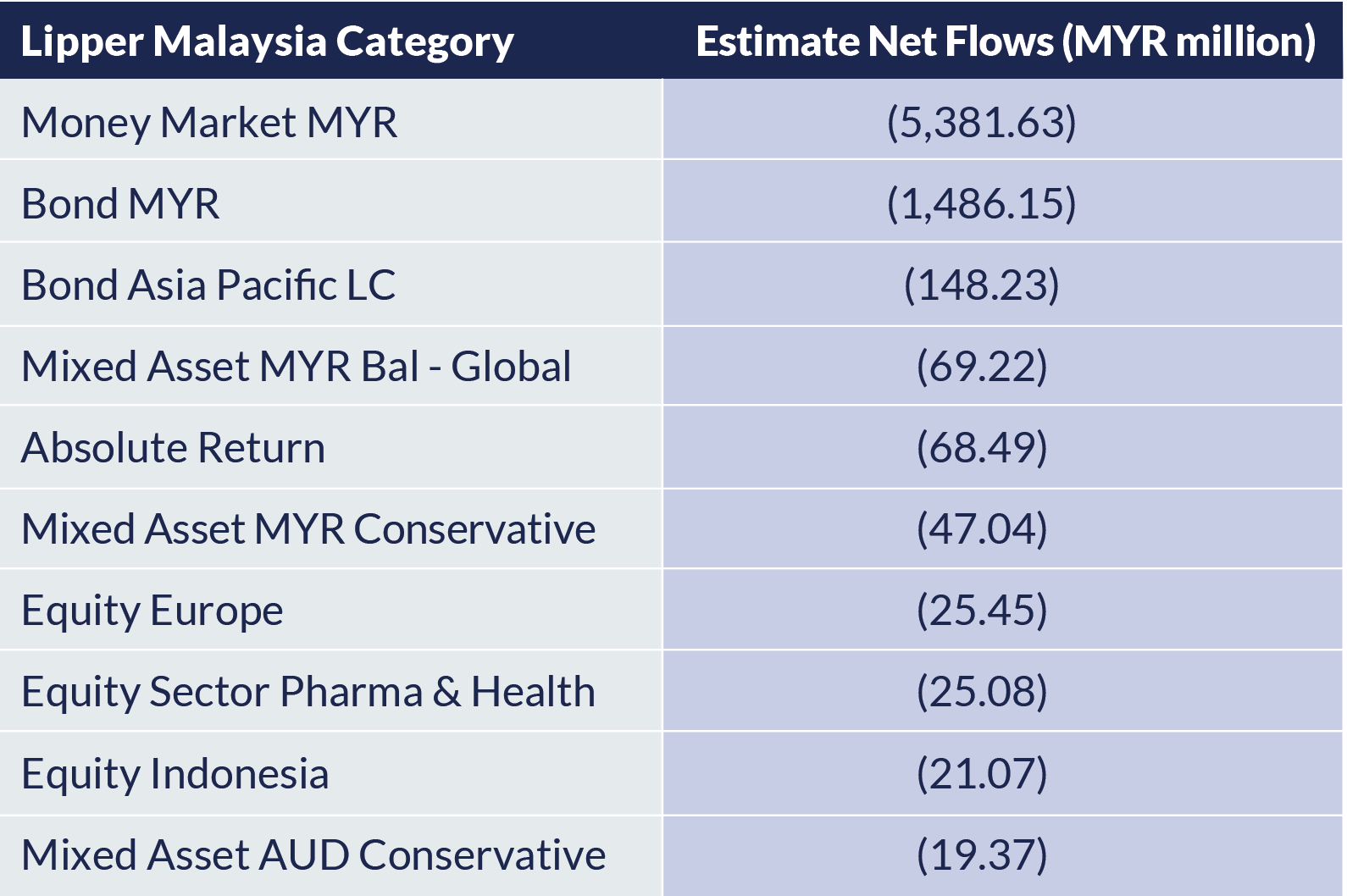

Let’s take a quick look at how the money moved in Q2 2022 before we plot our next steps.

Source: Lipper Investment Management as at June 2022

The bulk of the outflow for Q2 was from the Money Market Fund, with some outflow from single region and single sector funds. However, overall outflow from the latter two funds was minimal.

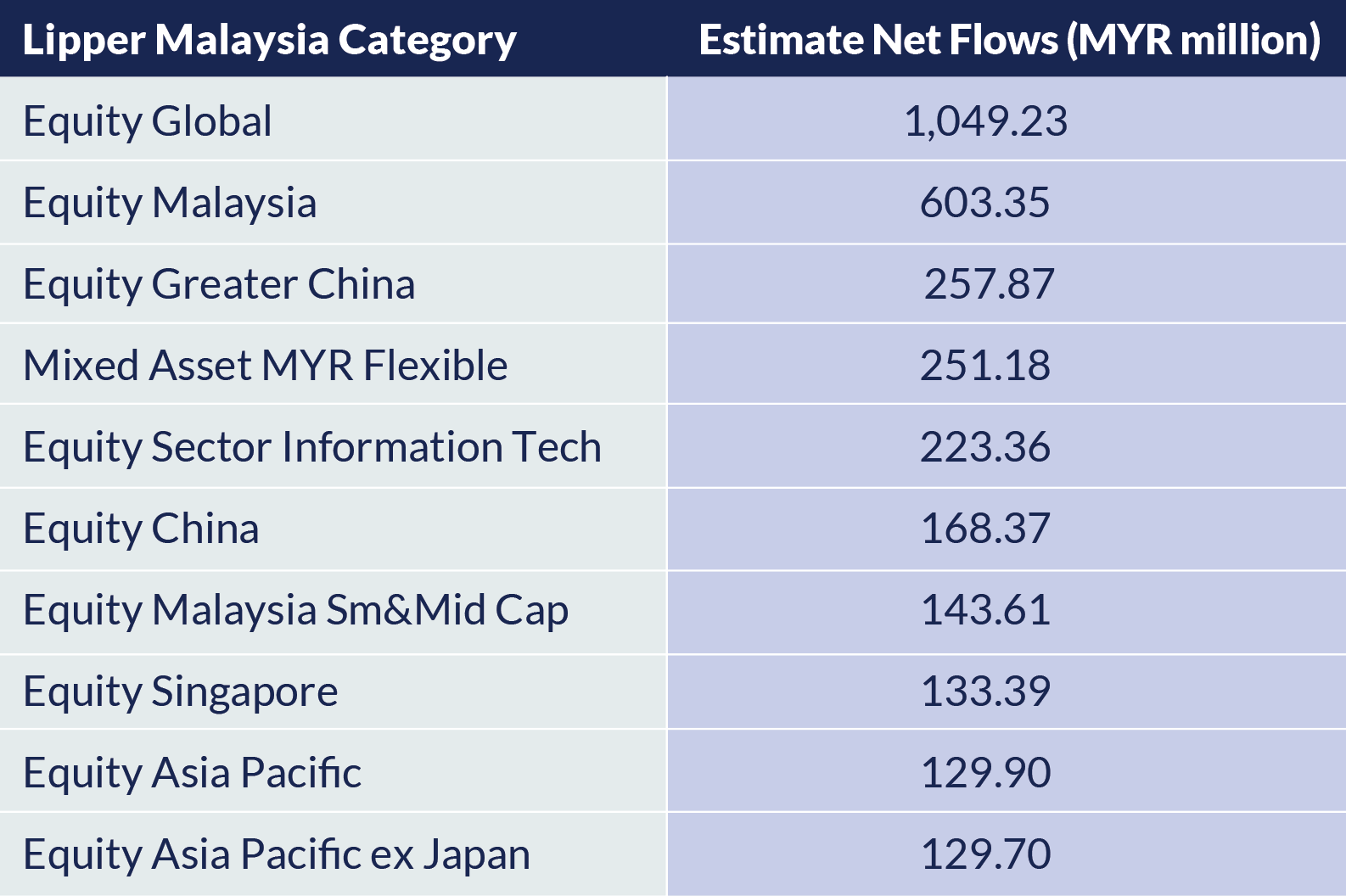

Source: Lipper Investment Management as of June 2022.

In terms of inflow, global equity funds retained the top position from Q1. As local equities were undervalued, investors took the opportunity to buy in at a low entry point, pushing Malaysian equities to the second spot. Then, of course, we have the all-time favourites in China and Asia Pacific equities, both of which saw healthy inflow. We also observed some inflow into Singapore equities, potentially motivated by investors who also wish to gain exposure in both Singapore equities and currency.

In the investing world, inflation is not necessarily a bad thing and can be seen as a normal part of an economic cycle. Play your cards right, and it can work in your favour. Here are a few funds that typically perform well in this climate.

RHB US Value Fund

Most investors who are exposed to global equities via funds will likely already be exposed to growth sectors through the US market, which itself has a high exposure to the tech sector.

Volatility and slowing economic growth in the US warrant a more defensive and value-based approach. As such, RHB US Value Fund offers investors the chance to diversify their portfolio and balance it out by adding exposure into the underlying value stocks. The stocks in this fund are supported by elevated inflation, interest rate hike cycles, tighter monetary control and undemanding relative valuation.

Historically, US Value has a positive correlation to inflation. As of May 2022, US Value stocks were trading at 40% discount compared with its US Growth counterpart. The fund’s largest sectorial exposure is in financials (26%), healthcare (19%), and consumer discretionary (9%), as of April 2022.

The fund feeds into a target fund managed by JP Morgan Asset Management, and aims to provide long-term (5-7 years) capital growth.

RHB Shariah China Focus Fund

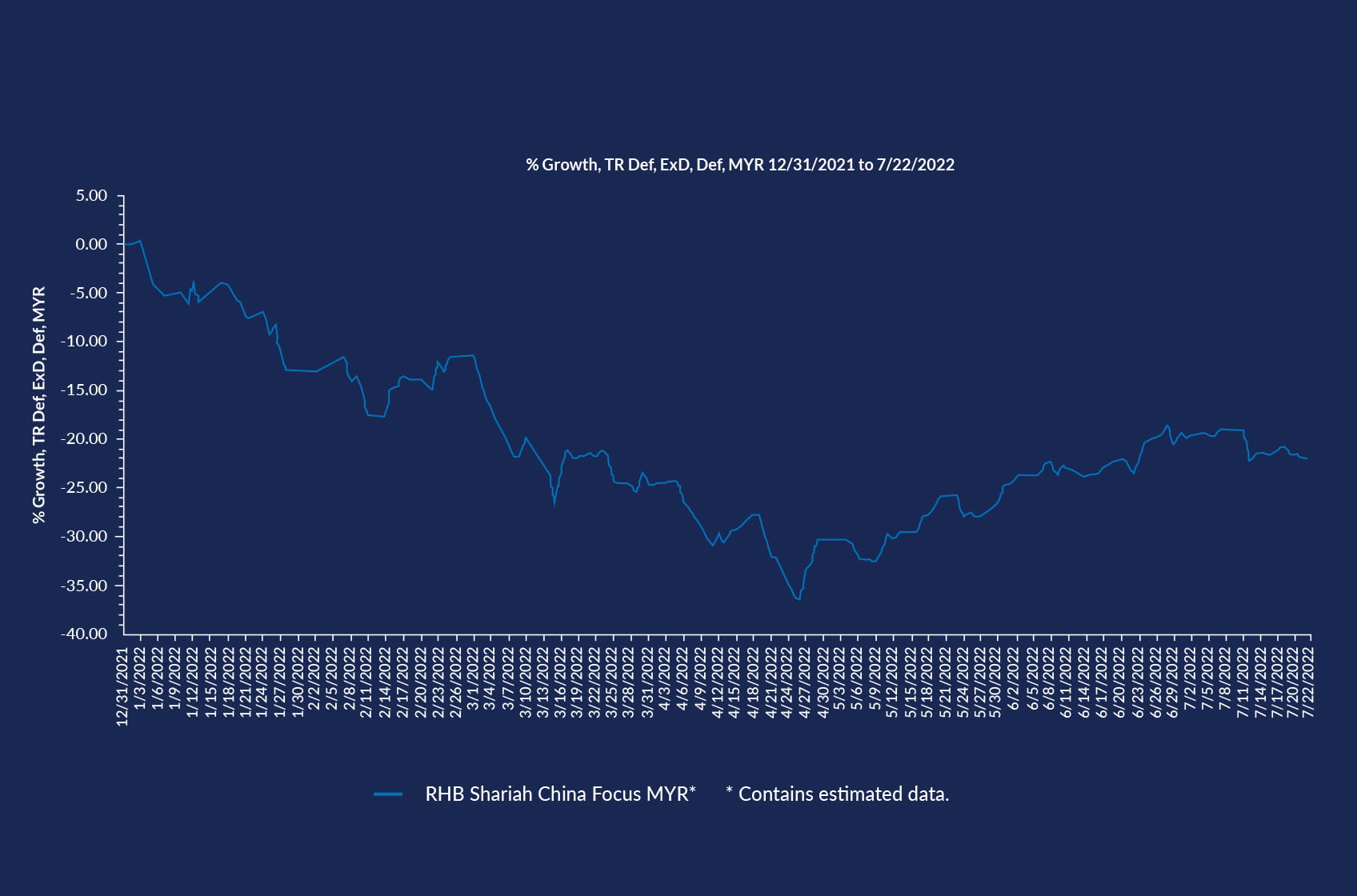

The Chinese equity market has seen a downward trajectory since February 2021, but given the current market conditions, now is an attractive entry point.

RHB Shariah China Focus offers investors the chance to get their foot in the door of the Chinese onshore market, particularly the industrial sector (25%). As mentioned earlier, China’s positive performance in Q2 (April to June) was largely driven by the uptick in manufacturing activity. This is also reflected in the fund’s value, which has bottomed up as of end-April 2022.

Source: Lipper Investment Management as at 22 July 2022.

As a Shariah-compliant fund, its principles are similar to ESG, where the focus is on socially responsible investing. China Asset Management Company (China AMC), with its depth of experience in the Chinese onshore market, brings value as the fund’s adviser. This fund aims to create long-term capital appreciation.

TA Asia Absolute Alpha Fund

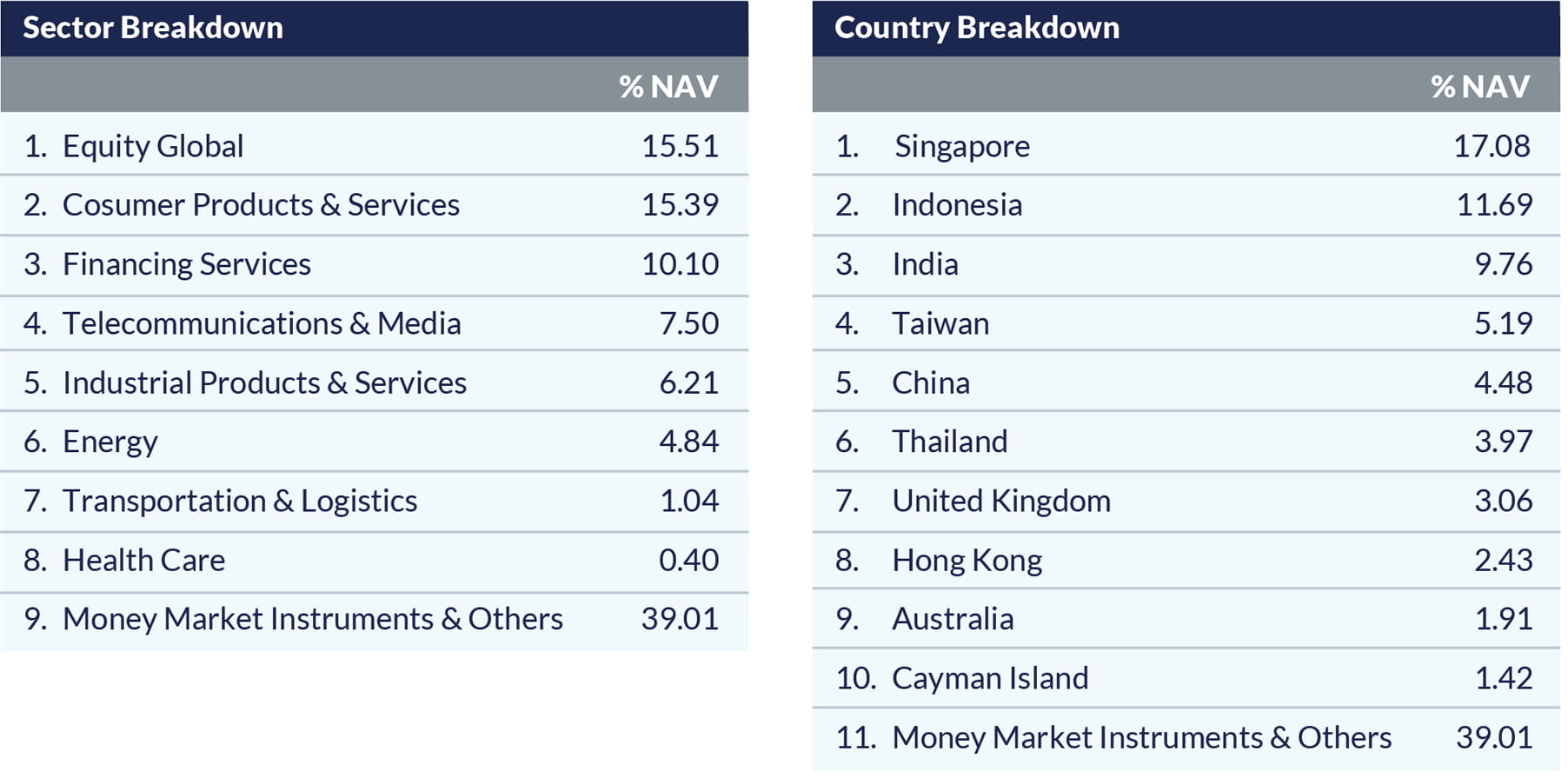

Investors who prefer a more versatile and diversified approach towards emerging markets may consider TA Asia Absolute Alpha Fund, which primarily invests in equities and equity-related securities in Asia using a bottom-up approach. As the fund allocation is not benchmark-hugging, the fund manager may allocate in any country or sector which will offer a positive return to the client.

This fund aims to achieve a positive return in any business cycle based on a three-year rolling period, with an absolute return benchmark of 8% per annum. Cash and index hedges are utilised opportunistically to preserve capital and capture opportunities during downturns, and the fund can even hold a high cash exposure in a bearish market.

The fund is advised by Fullerton Investment Management based in Singapore, a subsidiary of Temasek Holdings.

Source: Fund fact sheet as of June 2022.

RHB Asian Income Fund

If you are more focused on income over the medium to long term (3 – 10 years), RHB Asian Income is a mixed asset fund that invests in both equities and fixed income, with a focus on company shares with a high dividend-yielding profile and investment grade direct bonds. The fund aims to achieve long term capital gains and quarterly distributions.

The fund manager actively allocates assets depending on the market cycle. During a strong equity market, the fund manager will allocate a larger portion of assets to equities. Similarly, during a bearish market the focus will be switched to fixed income and more defensive sectors.

The fund leverages on Schroders Investment Management’s expertise in Asian fixed income and Asian high dividend-yielding stocks and feeds into Schroders Asian Income Fund, which was established in October 2011.

Schroders Asset Management currently manages GBP773.4 billion in assets under management (AUM) as at 30 June 2022 and ranks in the top thirty-six largest asset management firms by AUM.

RHB China Bond Fund

For investors who prefer the relative safety of bonds, the RHB China Bond feeds into BlackRock GF - China Bond Fund that invests in a wide range of onshore and offshore Chinese corporate debt papers with the aim of achieving long-term capital gains. The Chinese bond market is poised to benefit from a reduction in the prime loan rate and reserve requirement ratio, so it is a good time to invest in this segment.

BlackRock is the largest asset management firm by AUM, with a staggering USD8.5 trillion AUM as of June 2022.

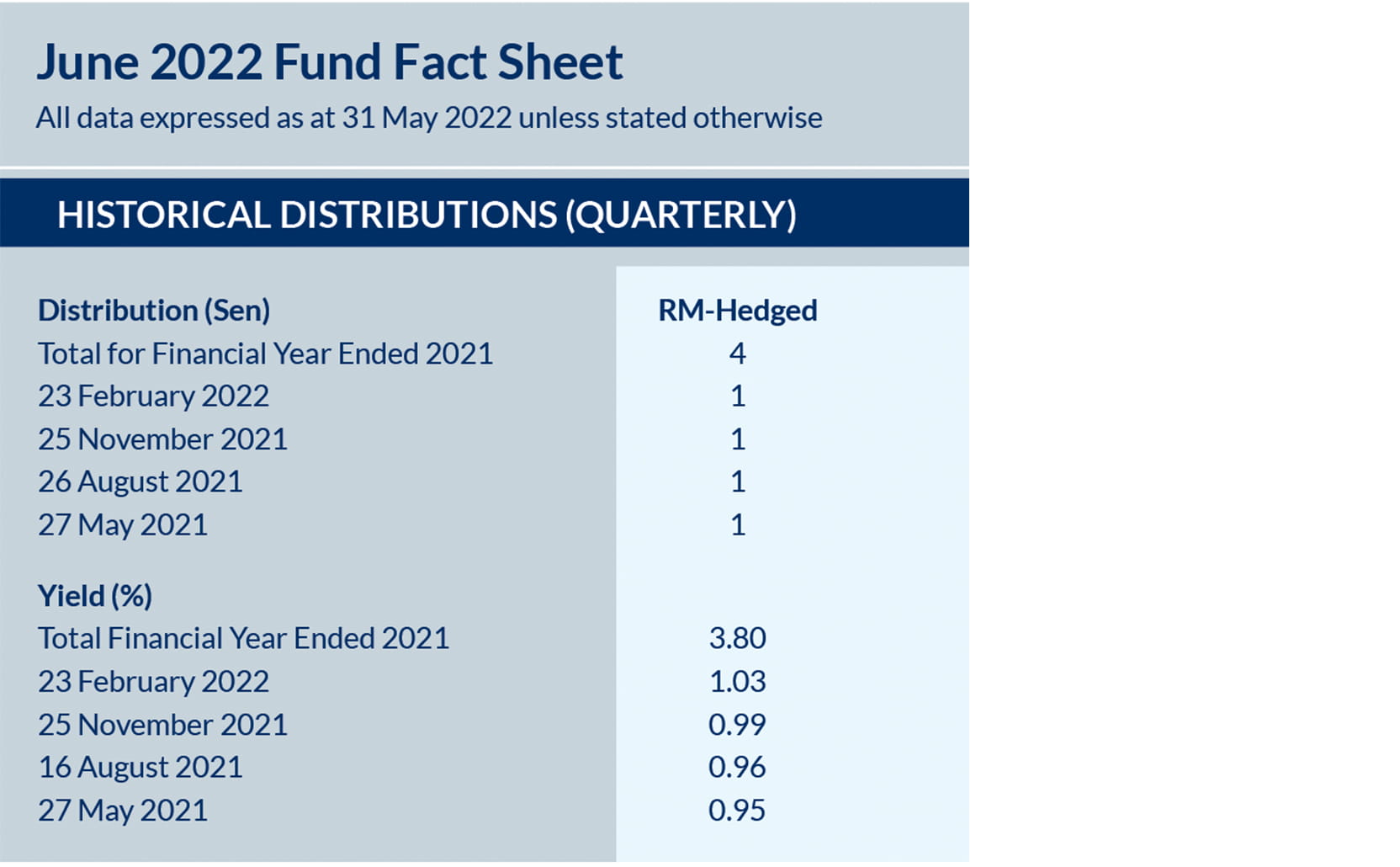

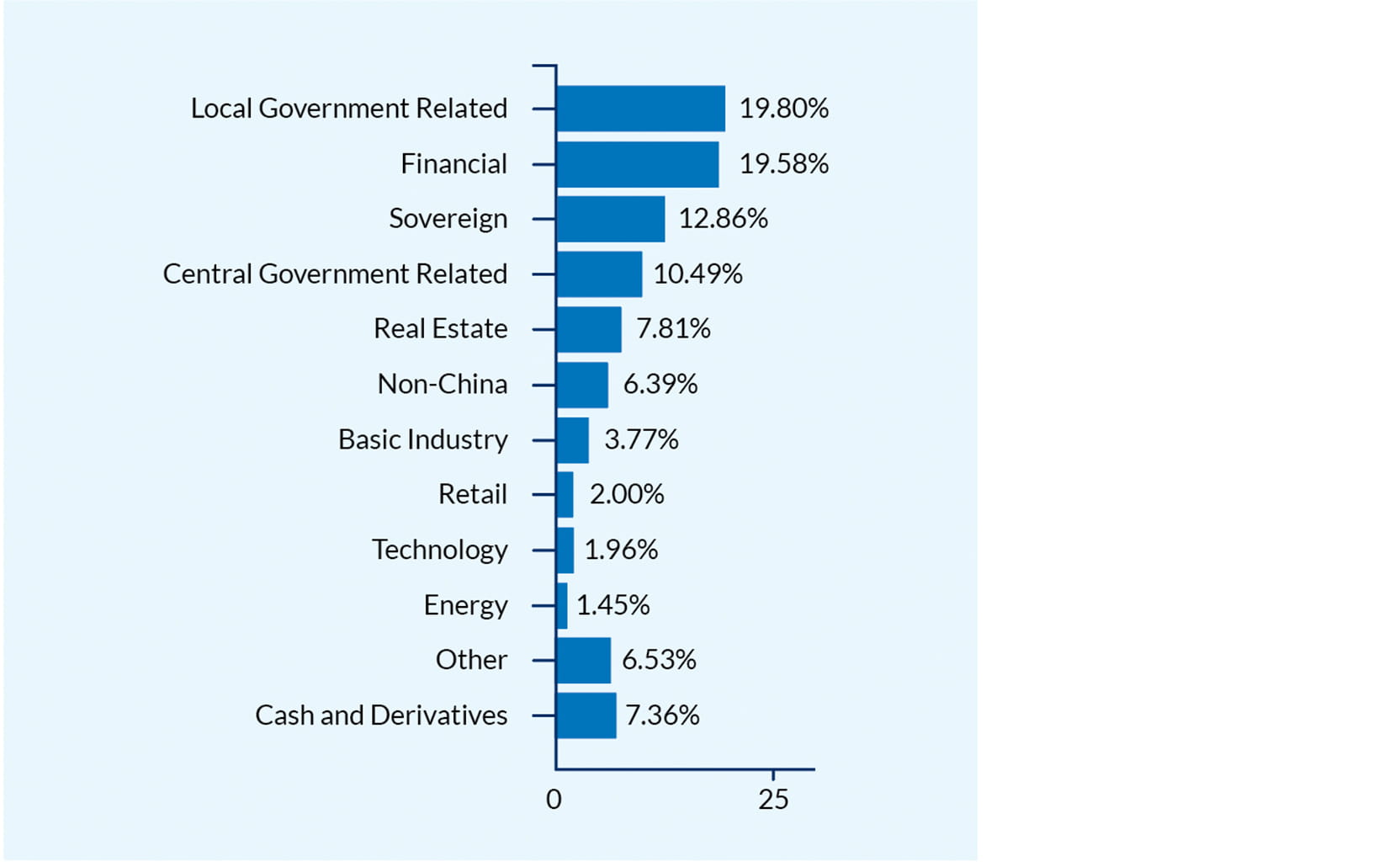

Source: Fund Fact Sheet as at 31 May 2022.

As of end-May 2022, most of the fund’s allocation was in local government bonds, financial sector bonds and sovereign bonds.

Source: Fund Fact Sheet as at 31 May 2022.