A patient sits gingerly on a chair as he prepares to get tested for COVID-19, and finds himself face to face not with a doctor or a nurse, but a robot.

Controlled remotely by a medical professional in a separate room, the robot moves its mechanical “arm”1 that is fitted with a disposable swab into position and inserts it into the patient’s nose to retrieve a sample.

The medical professional, who communicates with the patient via video, tells him to relax. In less than a minute, the swab is complete.

Such robots that will reduce the risk of transmission for hospital workers are quickly moving to the frontlines of South Korea’s fight against the pandemic. And South Korea is not alone in deploying such advanced technologies.

Governments across the world are realising the critical role advanced technologies and innovation can play in containing the coronavirus and saving lives.

As the global pandemic reshapes the future of healthcare, it is also sparking a renewed investment interest in the industry, particularly in Asia.

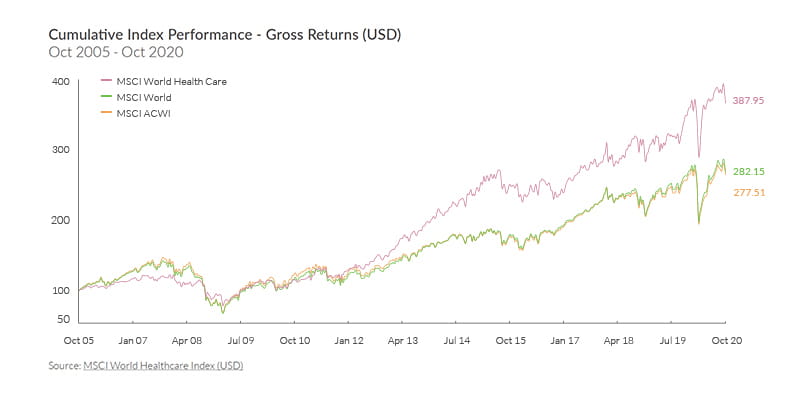

The MSCI World HealthCare Index had been outperformed by the MSCI World and MSCI ACWI for almost a decade (see MSCI World Performance table). While not immune to the broader volatility in the market, the healthcare sector has displayed relative resilience over others.

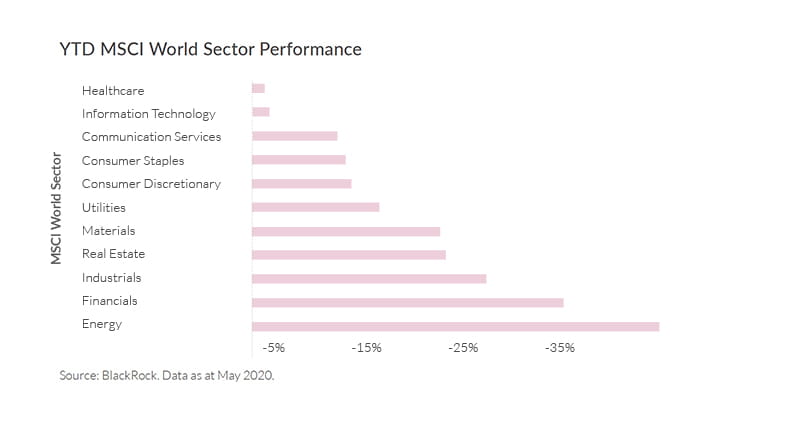

In fact, when all sectors headed south in the first four months of this year, healthcare was among those that performed remarkably well (see YTD MSCI World Sector Performance January-April chart).

As economies move into a post-pandemic world, segments like telehealth and robotics are poised for growth in a healthcare landscape that is embracing more innovation than before.

Telehealth: On-air wellness

COVID-19 has accelerated the shift of consumer behaviour into the online space, including in healthcare. This has drastically changed the way people view digital health tools.

The need for fewer face-to-face interactions and more home-based treatments has led to a huge surge in the adoption of telemedicine globally, from online symptom checkers to remote diagnosis and e-prescription services. This has allowed patients to access healthcare services from the comfort and safety of their homes.

For example, the number of new users on Ping An Good Doctor, a Chinese healthcare services platform, soared nearly 900 per cent2 from December 2019 to January 2020. At MyDoc, a telemedicine platform headquartered in Singapore, the number of daily active users rose 60 per cent in February and more than doubled in March.

Figures in Bain’s 2019 Asia-Pacific Front Line of Healthcare survey3 showed that nearly 50 per cent of patients expect to use digital health tools in the next five years. Another 91 per cent of consumers said they would use digital health services if the costs were covered by an employer or insurance provider.

This rising demand will pave the way for greater adoption of virtual health services, helped by government reforms to reduce reliance on hospital systems, according to BlackRock4.

In the US, the government has already lifted Medicare requirements for telemedicine visits to make it easier for patients and doctors to use the technology. This has also allowed more providers to accept Medicare payments for virtual visits.

A robot revolution

In the Circolo Hospital in Varese, a city in the epicentre of Italy’s COVID-19, “Tommy” the robot5 has become an indispensable presence.

He busies about the patients, taking their temperatures and measuring their blood pressure and oxygen saturation levels in place of healthcare workers – a move that would reduce the risk of infection and keep them safe.

Tommy the robot is symptomatic of the times, where demand for automation has skyrocketed as processes involving human contact is considered hazardous.

The demand is further fuelled by constraints to labour supply caused by movement restrictions, a shrinking workforce, and strict safe-distancing regulations.

In fact, robots of all sorts were involved in fighting the pandemic in at least 33 nations as of early July6, according to Robotics for Infectious Diseases, an organisation of researchers.

The investment landscape reflects this shift towards automation, where robotics companies received more than US$1.9 billion in funding7 in July 2020.

The potential is massive. Take Thailand, which plans to strengthen its position as a regional medical hub under the Thailand 4.0 vision. To promote medical robotics, the Thailand Board of Investment has offered a wide range of investment promotion incentives8.

Living lean and green

The major pharmaceutical and technology companies are not the only ones bringing about change to peoples’ health.

An increased awareness of livestock farming techniques and obesity-related diseases are making consumers more healthconscious. This is driving lifestyle trends like plant-based foods and sugarless drinks – opening alternative avenues in healthrelated investments.

A new report9 released by non-profit outfit The Good Food Institute revealed there were more investments in alternative proteins and plant-based food in the first quarter of 2020 than in all of 2019.

Another study by Nielson showed that plant-based meat purchases rocketed 279 per cent in March10 from the same time the year before. By contrast, fresh chicken sales grew only by 51 per cent over the same period.

This worldwide trend has spilled over to Malaysia, sparking up-and-coming start-ups like Phuture Foods11, which hopes to cater to the needs of a growing global population while tackling land and environmental concerns with its plant-based pork substitute.

At the same time, a growing consumer preference towards lowering or cutting out the intake of sugar is likely to boost the growth of the zero or lowcalorie beverage market in the coming years. The global market for reduced-sugar beverages, which includes instant coffee, grew from S$41.7 million in 2015 to S$65.5 million in 201912, according to Euromonitor.

For investors looking to get exposure to the healthcare sector, the Affin Hwang World Series – Global Healthscience Fund offers a well-regarded option.

A positive prognosis

While healthcare has been a major point of contention in the 2020 US Presidential Elections, giving rise to short-term volatility in related stocks and funds, the overall impact is likely to remain “muted”, said BlackRock.

This is due to the long-term, favourable tailwinds that remain firmly in place, such as an ageing global population, increased spending from emerging market economies, and strong innovation.

In the developed world, ageing populations will translate to higher demand and spending in healthcare. The same goes for emerging markets, where the modernisation of healthcare infrastructure and increased spending will lead to greater healthcare consumption.

Developed countries currently spend an average of about 10 to 17 per cent of their gross domestic product on healthcare, while India and China spend around 4 and 5 per cent respectively, based on 2017 data by the Organisation for Economic Cooperation and Development.

Beyond telehealth, medical robotics and changing lifestyle trends, other areas like genomics, immunology, and diagnostics are poised to see accelerated growth. In the race for a COVID-19 vaccine, for instance, genomics is helping drug makers and scientists decode the disease at an unprecedented pace.

With the healthcare sector trading one standard deviation below its long-run average, investors are also looking at an attractive point of entry.

COVID-19 might have turned the world on its head, but it has also opened up a path to a future where smart, innovative medical technology can create healthier, better lives.

Launched in 2019, it is a wholesale feeder growth fund that provides access to broad opportunities in healthcare by investing in a collective investment scheme, namely the BlackRock Global Funds World Healthscience Fund.

The Fund seeks to achieve capital appreciation over the long term through investments in companies that focus on healthcare, pharmaceuticals, medical technology and supplies, and the development of biotechnology.>

Speak to your RHB Relationship Manager to ride on the wave of growth in healthcare. Our wealth advisers will be happy to assist you on the investment plan that best suits your need.