The fourth quarter of the year is traditionally a volatile time for the equity markets, with concerns surrounding monetary policy, inflation turning to stagflation, and the prospect of interest rates rising. However, any worries tend to fall by the wayside as strong fundamentals continue to prop up the markets and investors wrap up profit-taking.

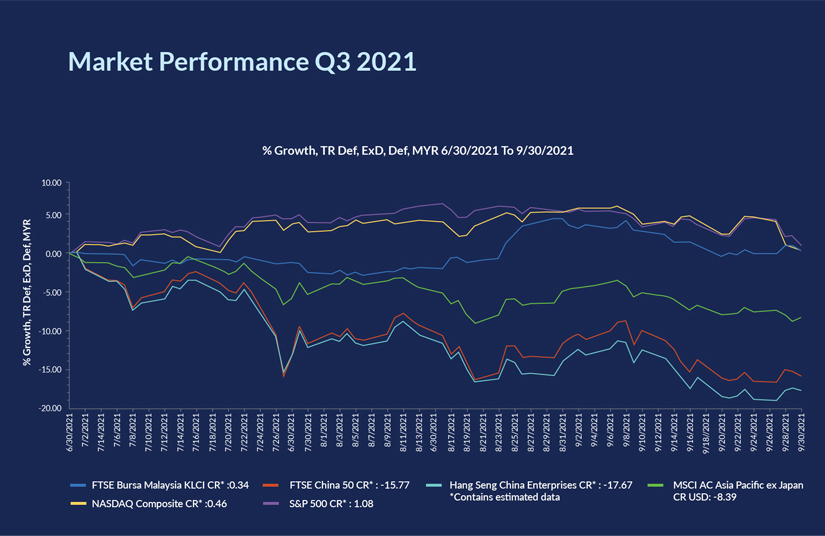

Positive momentum has been building up. The MSCI world equity index, which tracks shares in 50 countries, has gained 38.5% since Q3 as investors were encouraged by relatively strong earnings, and companies took advantage of the low interest rates to beef up their capital expenditure1. The favourable liquidity environment is set to continue for the rest of the year, with any potential tightening likely to be gradual. These factors, and the success of vaccination rollouts and reopening of economies all added to the overall supportive macroeconomic backdrop.

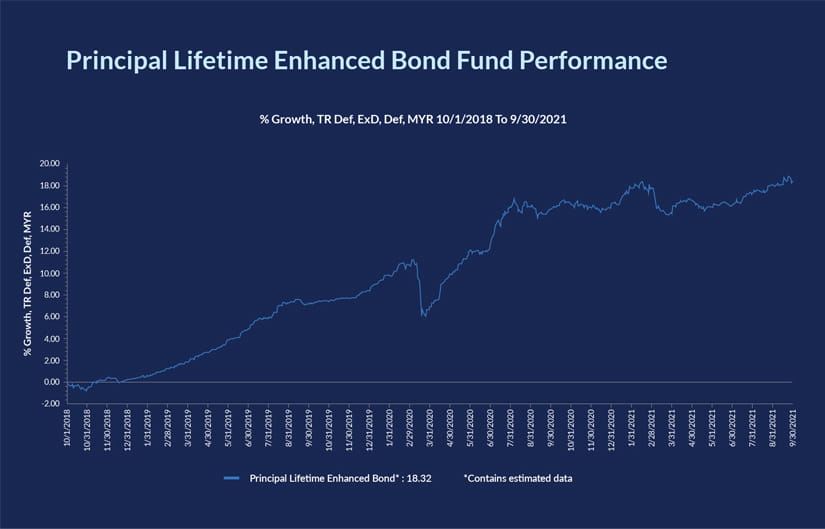

At home, the easing of movement restrictions and increased private consumption are expected to underpin Malaysian growth momentum for some time. Bank Negara’s accommodative policies will benefit corporate bonds. Overall, there are options on both the fixed income and equities sides.

RHB Equities maintains an overweight outlook on equites vs fixed income for Q4 2021.

Following the money trail

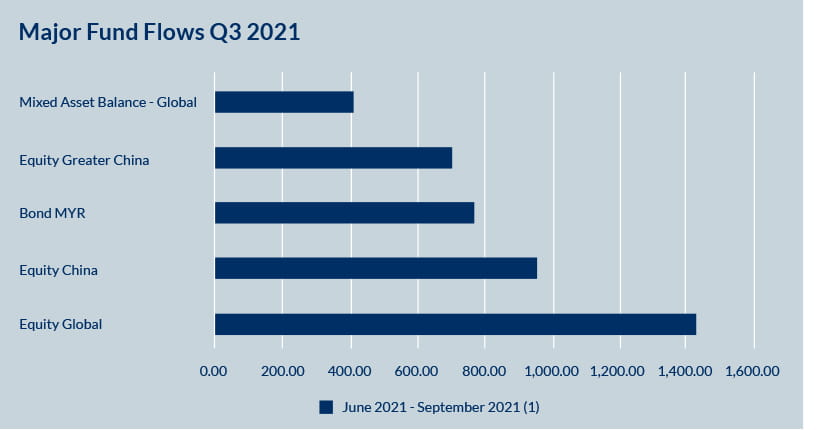

To unearth investment ideas for investing in equity funds in this period, let’s follow the money trail to see where it leads. Based on the data in the chart below, most fund flows in Q3 led to global equity funds, which currently stand at RM1.43 billion. But looking at China alone, combining both the inflows into Equity China and Equity Greater China funds, a total of RM1.67 billion was invested in Q3.

Fund flows into China-related equities was likely driven by investors seeking to buy in the dip to cost average their entry into the market, as both the China on-shore (FTSE China A50 Index) and off shore (Hang Seng China Enterprise Index) markets were down by 15.77% and 17.67%, respectively, in Q3 2021.

Fund outflows moved largely towards the fixed income space. Fund outflows within the equities space occurred in the technology sector as investors took the opportunity to realise profits before pouring some of that money back into areas where they had seen losses.

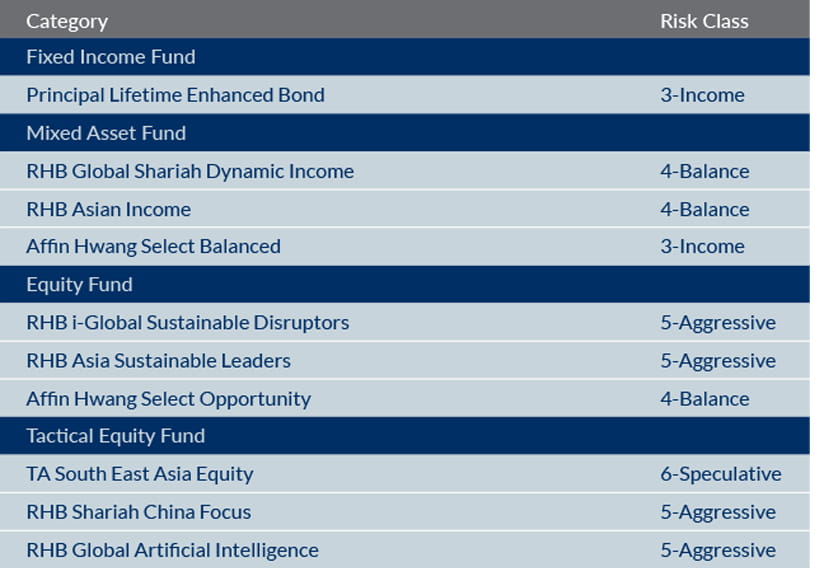

These funds are suited to investors willing to take on moderate risk assets by investing into global mixed asset funds.

As a side note, as at end September 2021 the total exposure to Chinese equity funds is only 4.2% and exposure in Asian Equity is only 6.7% by total Asset Under Management (AUM), as seen in the chart below.

Mixed assets

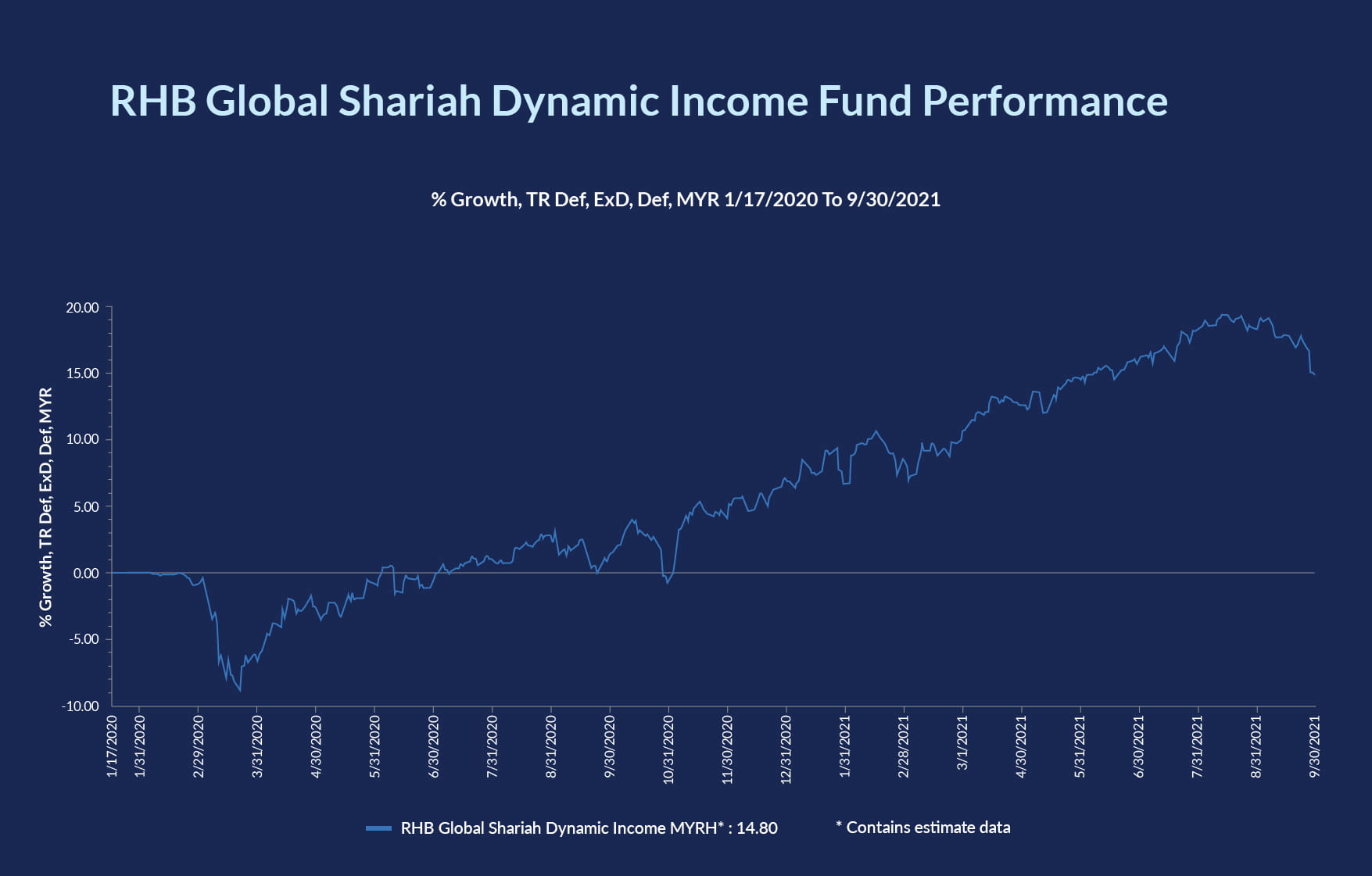

For investors who want to have their feet in both equites and fixed income and prefer to let their fund manager determine the allocation may find a mixed asset fund to their liking. RHB Global Shariah Dynamic Income fund invests into global equities and fixed income instruments, and adheres to Shariah investing principles. The fund is managed by RHB Islamic International Asset Management and advise by Schroder Investment Management (Singapore) Limited. Since inception (17 January 2020), the fund has generated 14.80% in returns to investors.

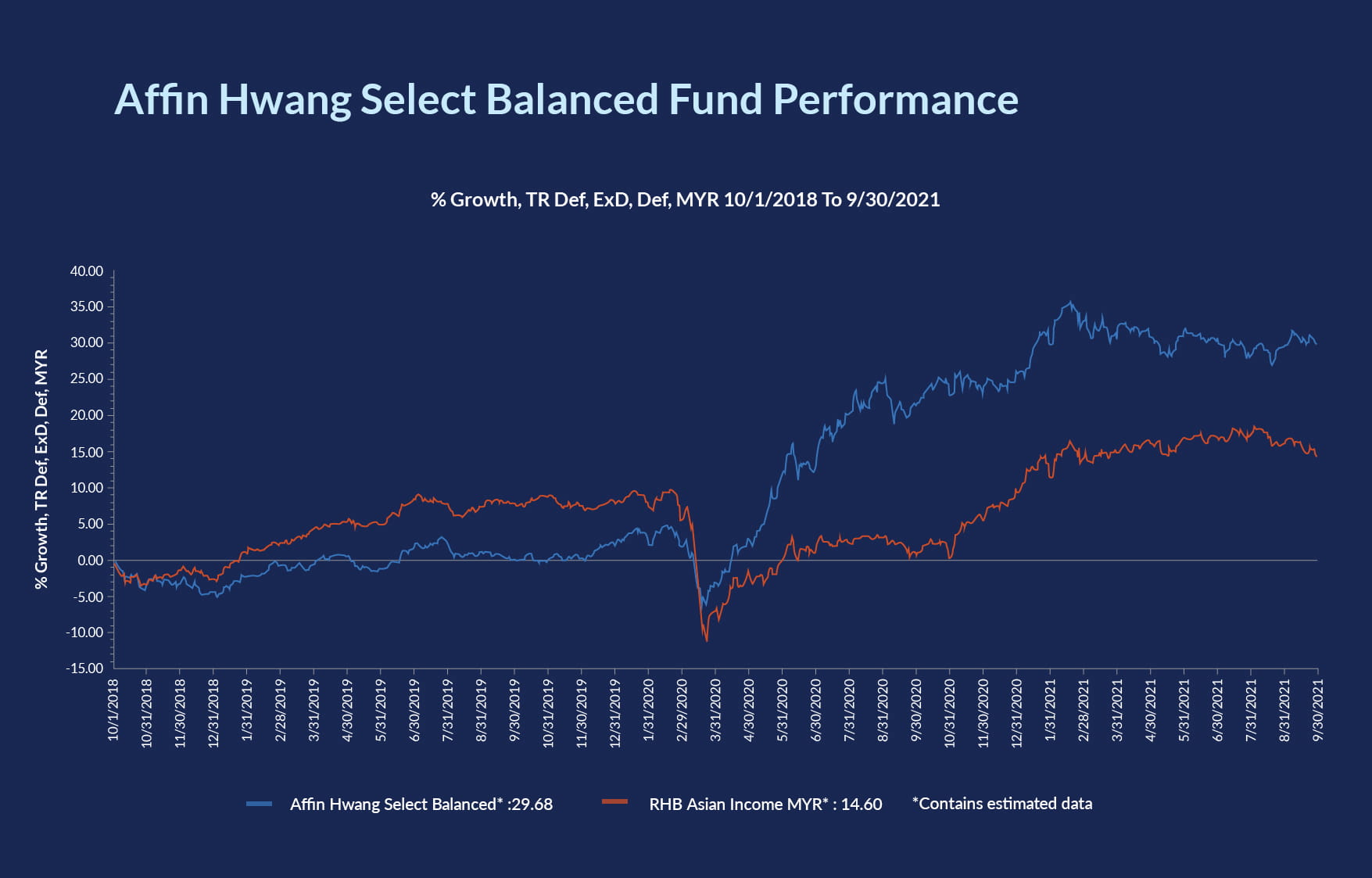

Investors with more experience or who are willing to take on a little more risk can consider investing in the Malaysian market through funds like Affin Hwang Select Balanced or Asian mixed asset funds like RHB Asian Income. Over a three-year period, the funds brought returns of 29.68% and 14.6%, respectively.

Equities

The complex and unpredictable effects of the Covid-19 pandemic served as a harsh wakeup call for decision-maker. Now, more than ever before, the issue of societal wellbeing and sustainable development has taken centre stage in all social, political and business affairs. Governments and businesses are realising that environmental and social responsibility goes hand in hand with corporate profitability, and since the pandemic, Environmental, Social, and Governance (“ESG”) values have become a central component to all investment decision-making processes.

In line with the growing interest in ESG values, over the past three years, the MSCI ex Japan ESG Leaders Index has outperformed the MSCI Asia ex Japan Index.

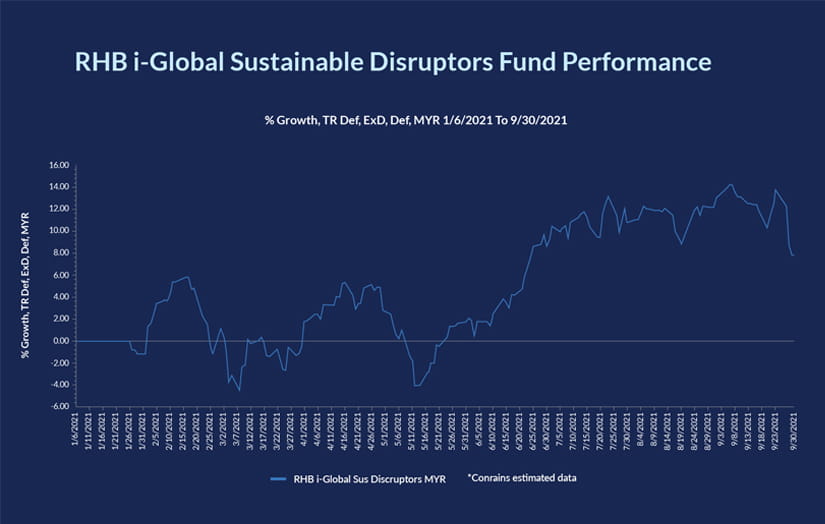

Investors who prefer a diversified portfolio of global equity funds with ESG integration may consider RHB i-Global Sustainable Disruptors. Since inception (6 January 2021) the fund is up by 8%. This fund is also managed by RHB Islamic International Asset Management with JPMorgan Asset Management (Singapore) acting as the investment adviser.

For ESG options a little closer to home, RHB Asia Sustainable Leaders Fund is a good option. The fund, freshly launched on 20 September 2021, invests in companies whose products and services bring positive environmental and social impact. The external investment manager for the fund is RHB Asset Management Pte Ltd, Singapore.

The Malaysian market is a laggard in comparison to its ASEAN peers, but with the high vaccination rate and economy reopening, there is potential for further recovery in Malaysia’s equity market. The KLCI has been relatively flat in the past few years, however, there was a bright spark in the past year where Affin Hwang Select Opportunity scaled up by 20%.

Tactical equities

From a regional standpoint, RHB Asset Management recently upgraded its view in ASEAN market. ASEAN economies are starting to open up with vaccination rates on an upward trend and cases going downward. This will lead to upswing in economy growth, with strong commodity prices benefiting developing economies like Indonesia and Malaysia.

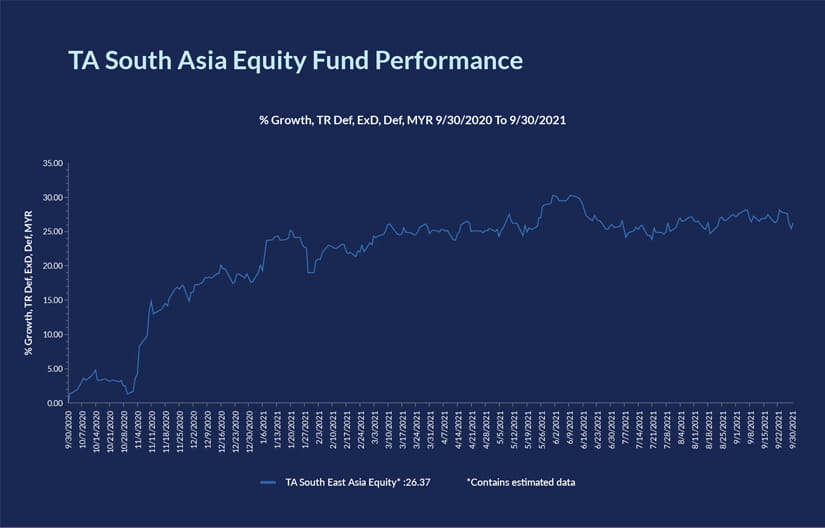

Investors who wish to participate in this area may consider TA South East Asia Equity Fund. The fund’s external fund manager is Lion Global Investors Limited (Singapore). After staying relatively flat for three years, performance ramped up by 26.37% in the past year alone.

RHB Asset Management has a neutral view in Chinese equity, but there are still options. For those who want to participate in the long-term growth of China, RHB Shariah China Focus Fund is a suitable option. Since inception in 13 November 2018, the fund has increased by 103.38%. The fund focuses its investments into the China A shares market. The investment adviser for the fund, China AMC, has highlighted a potential upside in the Chinese technology and consumer sectors.

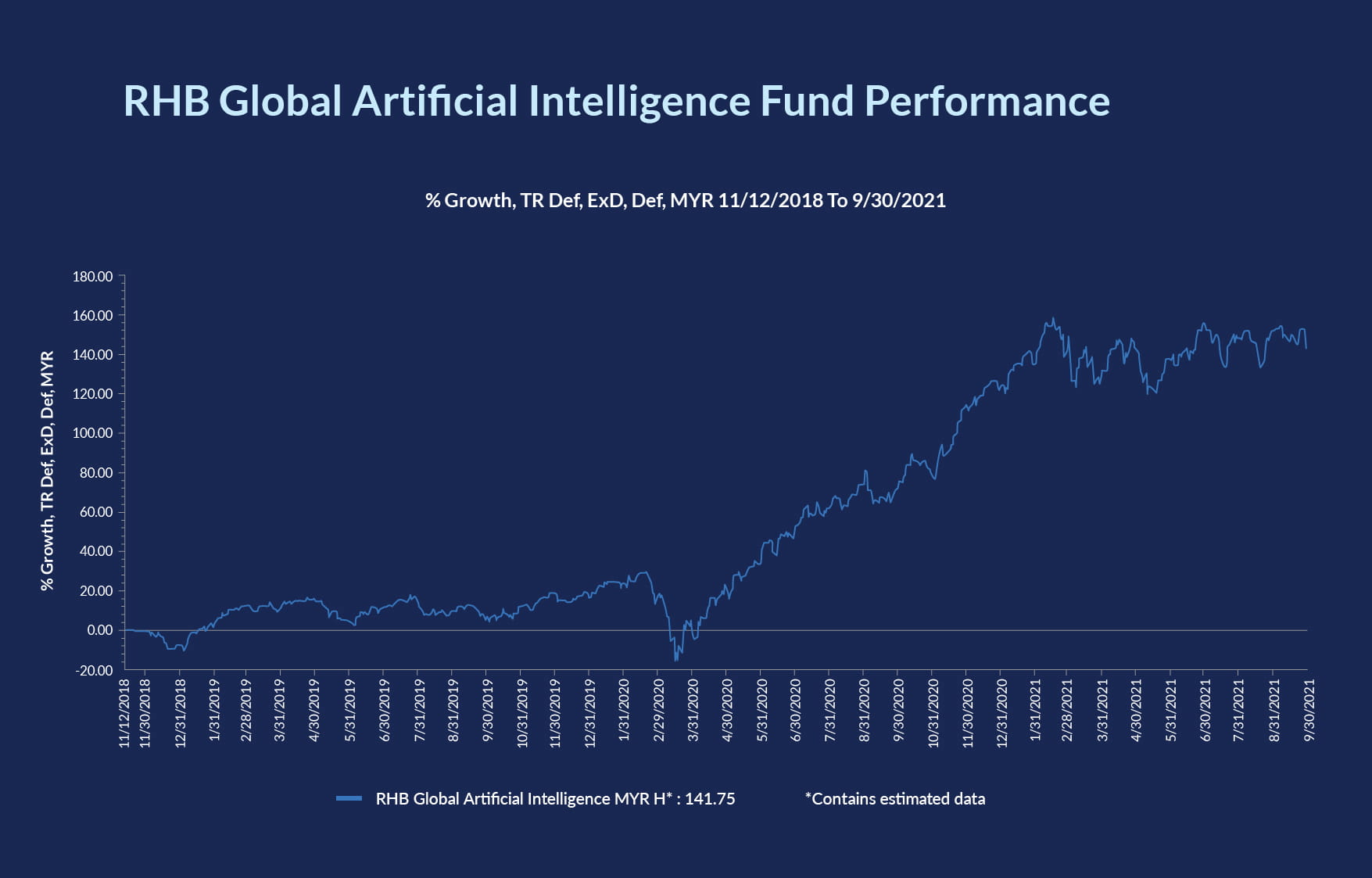

Investors who want to take on a tactical approach in global technology related funds may consider RHB Global Artificial Intelligence. The fund feeds into the Allianz Global Artificial Intelligence fund, which is managed by Allianz Global Investors. Since inception (12 November 2018), the fund is up by 141.75%.

RHB Bank’s Relationship Managers and Investment Specialists are ready to help you formulate an effective investment strategy that suits your risk profile and will help you achieve your long-term investment goals. Contact your nearest RHB Branch today.

1Reuters, Global equities edge up on upbeat earnings, Chibuike Oguh, 27 October 2021

Disclaimer:

IThis article is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party, without obtaining prior permission of RHB Bank Sdn Bhd (“RHB”).

This article has been prepared by RHB and is solely for your information only. It may not be copied, published, circulated, reproduced or distributed in whole or part to any person without the prior written consent of RHB. In preparing this article, RHB has relied upon and assumed the accuracy and completeness of all information available from public sources or which was otherwise reviewed by RHB. Accordingly, whilst we have taken all reasonable care to ensure that the information contained in this presentation is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness and make no representation or warranty (whether expressed or implied) and accept no responsibility or liability for its accuracy or completeness. You should not act on the information contained in this podcast without first independently verifying its contents.

Any opinion, management forecast or estimate contained in this article is based on information available as the date of this podcast and are subject to change without notice. It does not constitute an offer or solicitation to deal in units of any RHB fund and does not have regard to the specific investment objectives, financial situation or the particular needs of any specific person who may receive this. Investors may wish to seek advice from a financial adviser/unit trust consultant before purchasing units of any funds. In the event that the investor chooses not to seek advice from a financial adviser/unit trust consultant, he should consider whether the fund in question is suitable for him. Past performance of the fund or the manager, and any economic and market trends or forecast, are not necessarily indicative of the future or likely performance of the fund or the manager. The value of units in the fund, and the income accruing to the units, if any, from the fund, may fall as well as rise.

A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the Principal Lifetime Enhanced Bond Fund dated 25 June 2021, Global Shariah Dynamic Income dated 17 January 2020, Affin Hwang Select Balanced dated 20 December 2019 and Asian Income Fund dated 30 September 2019, RHB i Global Sustainable Disruptor Fund dated 6 January 2021, RHB Asia Sustainable Leaders Fund, Affin Hwang Select Opportunity Fund dated 20 December 2019, TA South East Asia Fund dated 1 June 2021, RHB Shariah China Focus Fund dated 8 March 2021, RHB Global Artificial Intelligence dated 12 November 2018 Fund (“Fund”) is available and investors have the right to request for a PHS. Investors are advised to obtain, read and understand the PHS and the contents of the Information Memorandum and its supplementary (ies) (if) (“the Information Memorandum”) before investing. The Information Memorandum has been registered with the Securities Commission Malaysia (“SC”) who takes no responsibility for its contents. The SC’s approval and authorization of the registration of the Information Memorandum should not be taken to indicate that the SC has recommended or endorsed the Fund. Amongst others, investors should consider the fees and charges involved. Investors should also note that the price of units and distributions payable, if any, may go down as well as up. Where a distribution is declared, investors are advised that following the issue of additional units/distribution, the NAV per unit will be reduced from cum distribution NAV to ex-distribution NAV. Any issue of units to which the Information Memorandum relates will only be made on receipt of a form of application referred to in the Information Memorandum. The printed copy of prospectus and Product Highlight Sheet is available at RHB branches/Premier Centre and investors have the right to request for a Product Highlight Sheet. Investors are advised that investments are subject to investment risk and that there can be no guarantee that any investment objectives will be achieved. Investors should conduct their own assessment before investing and seek professional advice, where necessary and should not make an investment decision based solely on this update.

The Manager wishes to highlight the specific risks of the Principal Lifetime Enhanced Bond Fund are Returns not guaranteed, Market risk, Inflation risk, Manager risk, Financing risk, Credit and default risk, country risk, currency risk, interest rate risk, Company specific risk, risk associate with investment in warrants and/or options, Risk associated with investment in structured products, Risk associated with investment derivative, Risk of investing in emerging markets. The specific risks of Global Shariah Dynamic Income are Management Risk, Redemption Risk, Loan/financing risk, Risk of non-compliance, Returns are not guaranteed, Risk of Termination of the Fund, Inflation Risk, Investment Derivatives Risk, Shariah-compliant Equity Related Securities Risk, Market risk, Credit/Default risk, Currency Risk, Profit rate risk, Country risk, Reclassification of Shariah status risk, Unrated Shariah-complaint Securities Risk, Liquidity Risk, Shariah-compliant Equity Risk, Regulatory Risk, Risk of Use of Rating Agencies and Other Third Parties, Market Risk in Emerging and Less Developed Markets. The specific risks of Affin Hwang Select Balanced Fund are Market risk, Fund Management Risk, Performance risk, Inflation risk, Liquidity Risk, Operational Risk, Loan financing risk, Stock specific risk, Credit and default risk, Interest rate risk, Warrants investment risk, Country risk, Currency risk, Regulatory Risk. The specific risks of Asian Income Fund are Market risk in Asia, Credit Risk, Investment grade, below investment grade and unrated debt securities risk, Risks relating to distributions, Emerging markets and frontier, Derivatives risk. The specific risks of RHB i Global Sustainable Disruptor Fund are Management Risk, Redemption Risk, Loan/Financing Risk, Risk of Non-compliance, Returns are not guaranteed, Risk of Termination of the Fund, Inflation Risk, Islamic Derivatives Risk, Shariah Compliant Equity Related Securities Risk, Market Risk, Counterparty and issuer Risk, Currency Risk, Profit Rate Risk, Country Risk, Reclassification of Shariah Status Risk, Liquidity Risk, Shariah-Compliant Equity Risk, Regulatory Risk, Market Risk in Emerging and Less Developed Markets. The specific risks of RHB Asia Sustainable Leaders Fund are Management risk, Redemption risk, Loan/Financing Risk, Risk of Non Compliance, Returns are not guaranteed, Risk of Termination of the Fund, Inflation risk, Market risk, Liquidity risk,Financial Derivatives risk, Counterpart and Issuer risk, Interest Rate risk, Equity risk, Equity-related Securities risk, Currency risk, Country risk, Collective Investment Schemes risk, The specific risks of Affin Hwang Select Opportunity Fund are Market Risk, Fund management risk, Performance risk, Inflation risk, Liquidity risk, Operational risk, Loan financing risk, Stock specific risk, Credit and default risk, Interest rate risk, Warrants investment risk, Country risk, Currency Risk and Regulatory Risk. The specific risks of TA South East Asia Fund are Market Risk, Economic Risk, Currency Risk, Emerging Market Risk, External Fund Manager’s Risk. The specific risks of RHB Shariah China Focus Fund are Country Risk, Currency Risk, Market Risk, Particular Security Risk, Reclassification of Shariah Status Risk. The specific risks of RHB Global Artificial Intelligence are General market risk, Currency risk, Company specific risk, Volatility risk, Emerging market risk, Liquidity risk, Concentration Risk, Derivatives risk and other general risks are elaborated in the Information Memorandum.

This article has not been reviewed by the SC.