Main Implications of the Budget: Near-Term Neutral for Markets, Medium-Term Not Very Encouraging

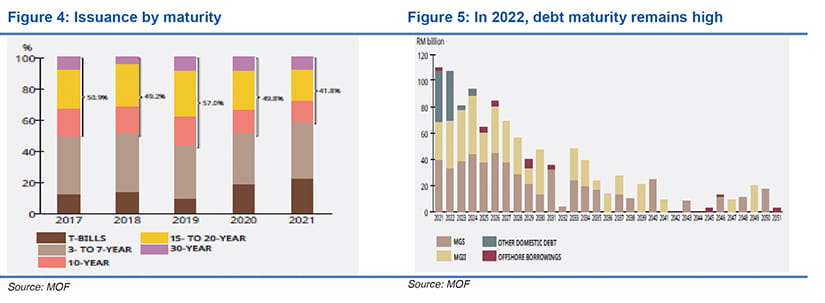

In 2022, we foresee the possibility of a bear flattening of the local currency bond curve as the government’s options to issue bonds to finance the 2022 fiscal deficit of 6% of GDP is towards the front end of the curve (which so far has been modest in the last few years as shown in Figure 4 and maturing debt remains high in 2022 as seen in Figure 5). Note also that long duration government bonds face external pressures from rising UST10YR yields, which we believe will hit around 2% by mid-2022.

In Foreign Exchange, we expect USDMYR to trade a range of 4.15-4.20 in 4Q21, followed by 4.20-4.30 in 1Q22, and then drop to around 4.15 in 4Q22. Inspite of the aforementioned fiscal risks, the positive factor is that we expect Malaysia to achieve a current account surplus of 3% of GDP in 2022 versus 3.5% in 2021. Hence MYR has quite a bit of cushion to avert significant depreciation pressures against the USD. However, we notice that once currency markets start pricing in fiscal and or political risks, Malaysia 5YR CDS starts to rise and pushes USDMYR up. Hence, while other Asian currencies could appreciate against the USD from 2Q22 onwards at a healthy pace, MYR could under-perform regional peers as the opposing forces of a robust current account surplus in Malaysia and rising 5YR CDS play themselves out.

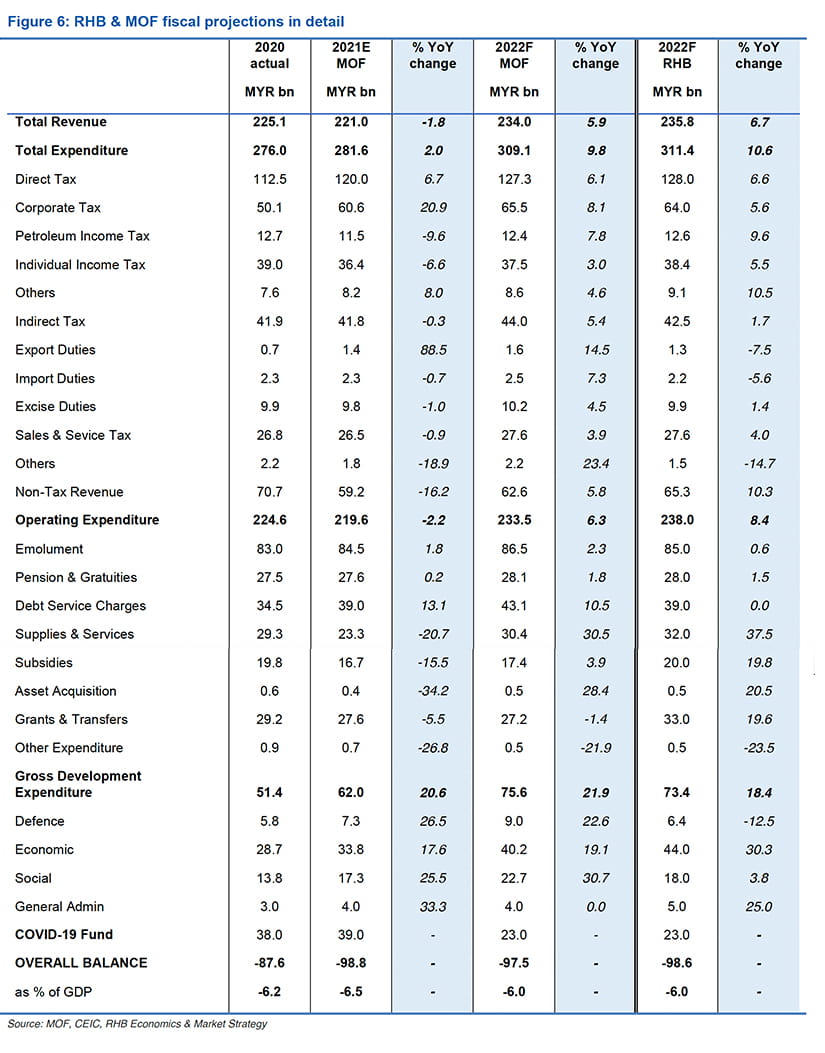

In our view, markets will remain concerned about the government’s fiscal consolidation path in 2022. Budget 2022 didn’t provide enough details on how the Federal Government Debt to GDP ratio (which is around 63.3% of GDP as of June 2021) could be brought down below 60% of GDP and well below the statutory debt limit of 65%. Nor was the issue of rising debt service charges addressed in any length or the rising liabilities of statutory bodies and non-financial corporations consolidation path laid out in any detail.

At a very high level, we find that Malaysia’s Federal government debt sustainability is at a razor’s edge. This is excluding the depth of issues related to rising public sector debt (which is defined as the sum of Federal Government, Statutory bodies, and non-financial public corporation debt) which stands at 89.5% of GDP (as of June 2021).

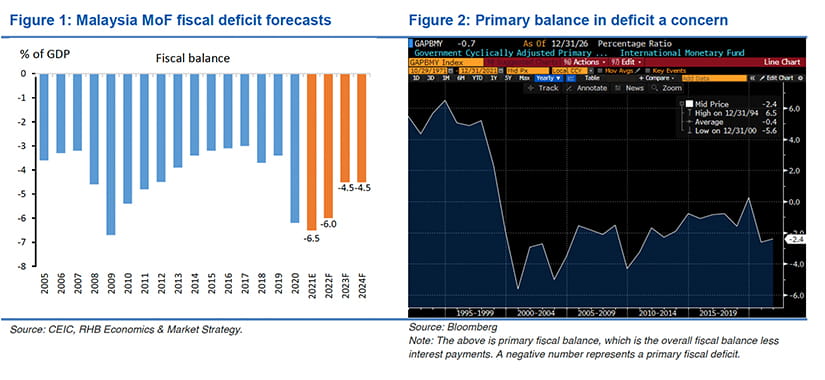

Countries which run primary balance deficits like Malaysia (which was at -3.8 of GDP in 2020 and is estimated by the Ministry of Finance (MoF) at -3.9% in 2021 and -3.3% in 2022), experience swings in exchanges rates, rising long-term government bond yields, and trend growth which doesn’t fully compensate for these weaknesses usually have financial markets which under-perform regional peers. In the post-Asian financial crisis era, in the early 2000s, Indonesia and the Philippines come to mind. Is Malaysia headed in this direction in 2022? It’s too early to tell, but the balance of risks is skewed in this direction.

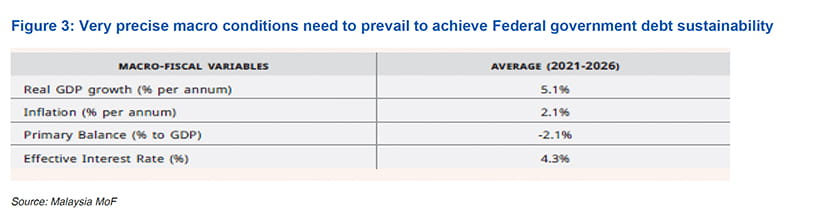

By the MoF’s own calculations, to have a stable debt to GDP ratio of around 65% all the way till 2026, the economic assumptions indicated in Figure 3 need to hold. In addition, the gross financing needs are assumed to fall to 7.1% of GDP from 13.8% in 2021. On trend GDP growth of around 5%, it’s achievable, but this is taking into consideration that no idiosyncratic global or domestic shocks arise in the next 5 years. The primary balance needs to average -2.1% of GDP in the next five years versus the last four years average of -2.6%, and an effective interest rate of 4.3% (which implicitly assumes, in our view, no more than 1-2% annual average depreciation of MYR against the USD), and the trajectory of market interest rates remains benign.

So, examining these very basic parameters of computing debt sustainability, the government has quite limited room to push the envelope in terms of further expansionary fiscal policy. It could do so, but this would come at the expense of much higher long-term government bond yields and a weaker exchange rate.

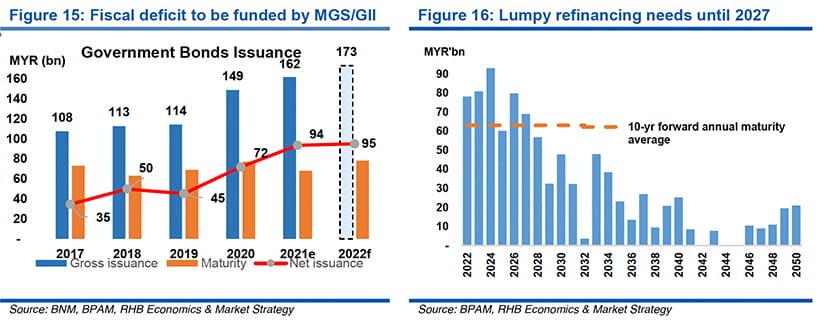

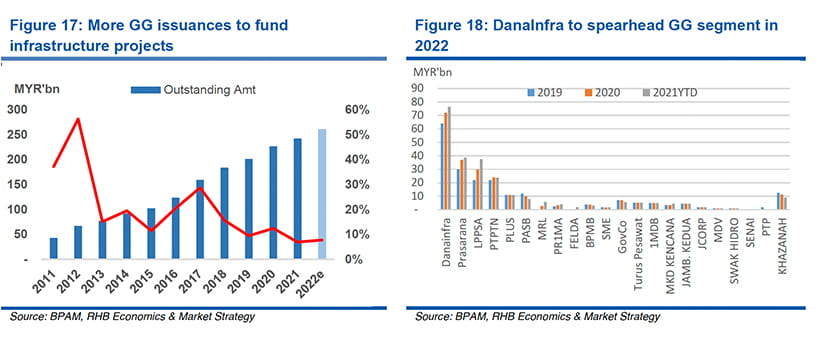

Fixed Income Strategy: Supply Pressures Still Intact-Long Duration Risks Prevalent

We view the target fiscal deficits of MYR97bn or 6% as announced in the Budget 2022 to be funded mostly by MGS/GII issuance. As such, our baseline forecast of total gross MGS/GII supply is to grow to MYR173bn next year compared to this year’s estimates of MYR163bn (Figure 15). Most of the infrastructure programme will be financed via the Government-Guaranteed (GG) issuances, in the like of DanaInfra (for LRT, MRT and Pan Borneo), Malaysia Rail Link (for ECRL), PASB (water-related) and PR1MA (people’s housing initiatives).

Our baseline forecast is for the net supply to be around MYR95bnin 2022, largely to fund the Government’s fiscal deficits, while the remaining MYR78bn is to be directed for MGS/GII scheduled maturities in 2022. Higher gross supply is expected to be channelled to fund the development expenditure target of MYR75.6bn, with net supply likely to remain within this year’s level of MYR94bn (Figure 15).

Government may need to smoothen the maturity profile until 2027, given the above-average amount of over MYR60bn of scheduled maturity (Figure 16). Based on the maturity profile, we anticipate more supply of MGS/GII for the next year to be skewed towards the longer end, i.e. 7YR and above, while there is huge gap for the 10YR bucket (of 2032 maturity) to be filled up, apart from the longer tenor of 15YR and above.

Government may need to smoothen the maturity profile until 2027, given the above-average amount of over MYR60bn of scheduled maturity (Figure 16). Based on the maturity profile, we anticipate more supply of MGS/GII for the next year to be skewed towards the longer end, i.e. 7YR and above, while there is huge gap for the 10YR bucket (of 2032 maturity) to be filled up, apart from the longer tenor of 15YR and above.

Most of the infrastructure programme is to be financed by the Government-Guaranteed (GG) issuances, which we pencilled a baseline total gross issuance of MYR35bn or 8% net increase to the total outstanding in 2022 (Figure 17). DanaInfra set to raise more sukuk for the LRT3, MRT and Pan Borneo Highway projects (Figure 18), while other issuers such as Malaysia Rail Link (for ECRL), PASB (water-related) and PR1MA (people’s housing initiatives) are all expected to ride on the existing programmes. We could also expect the maiden issuance of telecommunication-related GG via Digital Nasional Berhad (DNB) for the nationwide deployment of fifth-generation (5G) network to fulfil the digital economy objectives under the 12MP. To recap, DNB has appointed Ericsson (Malaysia) Sdn Bhd to design and build its 5G network at a total cost of MYR11bn, under the 10-year partnership agreement in July 2021.

Foreign Exchange Strategy: USDMYR Will Eventually Head Higher

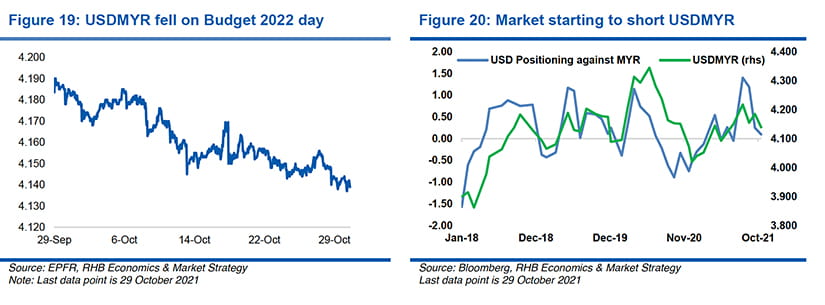

We believe in coming weeks positioning of USD longs against the MYR to be gradually reduced, giving the MYR to test key support level of 4.1200 before rebounding. We note market positioning of USD against MYR as reflected by Refinitiv data for the week ending October 21st shows USD longs against MYR is being reduced to +0.1 from +0.3 in the previous fortnight.

Over the next few weeks, USDMYR will remain in the 4.15-4.20 range in 4Q21, before rising to 4.20-4.30 in 1Q22. We believe the market is still positioned for Taper Framework by the US Fed and this should provide the USD broad based strength against G10 and Asian FX, thus our trajectory for USDMYR weakness to peak in 1Q22 at 4.30 remains.

The immediate reaction to budget 2022 was USDMYR trading lower towards 4.1370 and continued to be on a bid tone at the Asia close on October 29 (Figure 19). The FX market had priced in a deficit of 6.8-7.0% of GDP in 2021, and the fiscal deficit this year coming in at 6.5% has provided positive impulse for the currency. We expect USDMYR to trade within 4.120-4.150 in the next 1-2 weeks as the currency market soaks up the positive impulse of a larger budget for 2022 and a smaller fiscal trajectory in 2022 of 6.0%. A firmer MYR in the near term should attract flows from importers and increase in hedges by exporters.

Disclaimer Economics and Market Strategy

This report is prepared for information purposes only by the Economics and Market Strategy division within RHB Bank Berhad and/or its subsidiaries, related companies and affiliates, as applicable (“RHB”).

All research is based on material compiled from data considered to be reliable at the time of writing, but RHB does not make any representation or warranty, express or implied, as to its accuracy, completeness or correctness.

Neither this report, nor any opinion expressed herein, should be construed as an offer to sell or a solicitation of an offer to acquire any securities or financial instruments mentioned herein. RHB (including its officers, directors, associates, connected parties, and/or employees) accepts no liability whatsoever for any direct or consequential loss arising from the use of this report or its contents. This report may not be reproduced, distributed or published by any recipient for any purpose without prior consent of RHB and RHB (including its officers, directors, associates, connected parties, and/or employees) accepts no liability whatsoever for the actions of third parties in this respect.

Recipients are reminded that the financial circumstances surrounding any company or any market covered in the reports may change since the time of their publication. The contents of this report are also subject to change without any notification.

This report does not purport to be comprehensive or to contain all the information that a prospective investor may need in order to make an investment decision. The recipient of this report is making its own independent assessment and decisions regarding any securities or financial instruments referenced herein. Any investment discussed or recommended in this report may be unsuitable for an investor depending on the investor’s specific investment objectives and financial position. The material in this report is general information intended for recipients who understand the risks of investing in financial instruments. This report does not take into account whether an investment or course of action and any associated risks are suitable for the recipient. Any recommendations contained in this report must therefore not be relied upon as investment advice based on the recipient's personal circumstances. Investors should make their own independent evaluation of the information contained herein, consider their own investment objective, financial situation and particular needs and seek their own financial, business, legal, tax and other advice regarding the appropriateness of investing in any securities or the investment strategies discussed or recommended in this report.

RHB (including its respective directors, associates, connected parties and/or employees) may own or have positions in securities or financial instruments of the company(ies) covered in this research report or any securities or financial instruments related thereto, and may from time to time add to, or dispose off, or may be materially interested in any such securities or financial instruments. Further, RHB does and seeks to do business with the company(ies) covered in this research report and may from time to time act as market maker or have assumed an underwriting commitment in securities or financial instruments of such company(ies), may sell them or buy them from customers on a principal basis and may also perform or seek to perform significant banking, advisory or underwriting services for or relating to such company(ies), as well as solicit such banking, advisory or other services from any entity mentioned in this research report.

RHB (including its respective directors, associates, connected parties and/or employees) do not accept any liability, be it directly, indirectly or consequential losses, loss of profits or damages that may arise from any reliance based on this report or further communication given in relation to this report, including where such losses, loss of profits or damages are alleged to have arisen due to the contents of such report or communication being perceived as defamatory in nature.