How to apply football strategies to your investment portfolio

The 2022 World Cup has come and gone. But, there’s no denying that the strategies and tactics displayed have made the tournament all the more exciting. Life and football are a lot alike, which is why applying the right strategies and tactics for your investments can produce long term positive results.

In terms of strategy, investing isn’t that much different from football. There are defensive, holding, and attacking approaches which you can apply to your investments, depending on your risk profile and your investment horizon. And just like managing a team in a league, you can change your strategy as you go along, adjusting it according to the market conditions.

Think of the different classes of investments as your players and select them to build a portfolio with a long-term strategy. It’s crucial to remember that investing isn’t a one-off match; it’s a league.

Build your team and formulate your game plan

Deciding on where to put your excess cash is the start of your investment journey. The next phase is to consider all options on the table and make an informed decision based on your risk appetite, time horizon and personal preferences. Your Relationship Manager will advise you on the best approach based on the abovementioned factors.

Once that is established, you can begin to allocate your personal savings to building your dream team - an investment portfolio with a diverse selection of asset classes based on geographical locations and sector preferences.

An investment portfolio typically consists of a basket of financial assets that includes forex, money market, equities, fixed income, and deposits. The weightage of each asset represents individual financial goal and risk tolerance.

Fixed income tools are your defenders that help you protect your investment goal. Your forwards are equity investments in higher risk and growth sectors, with occasional bursts of speed to boost your income. Funds with a bit of both in more stable sectors will hold the midfield and create opportunities to deploy your forwards.

Striking a perfect balance of fixed income and equity stock, balanced funds are your midfielders. Just like the playmakers who set the tempo for the game, balanced funds provide the setting for investors who are looking for safety, income and modest capital appreciation over the medium to long-term period. By spreading the money across a diversified portfolio of stocks and bonds, it affords investors the opportunity to cultivate more dynamic strategies for more aggressive or defensive approaches in getting the best out of annualised returns for your investments.

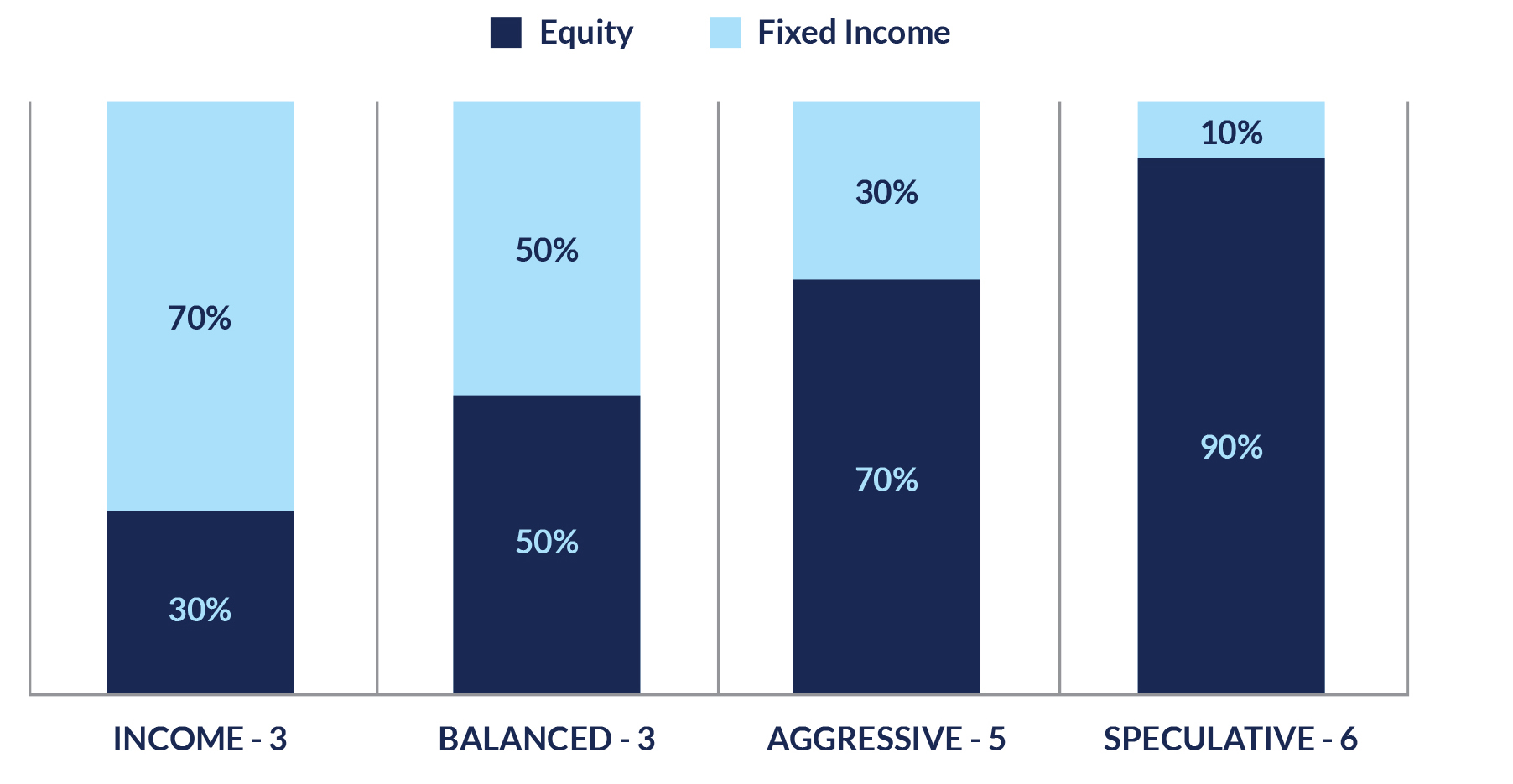

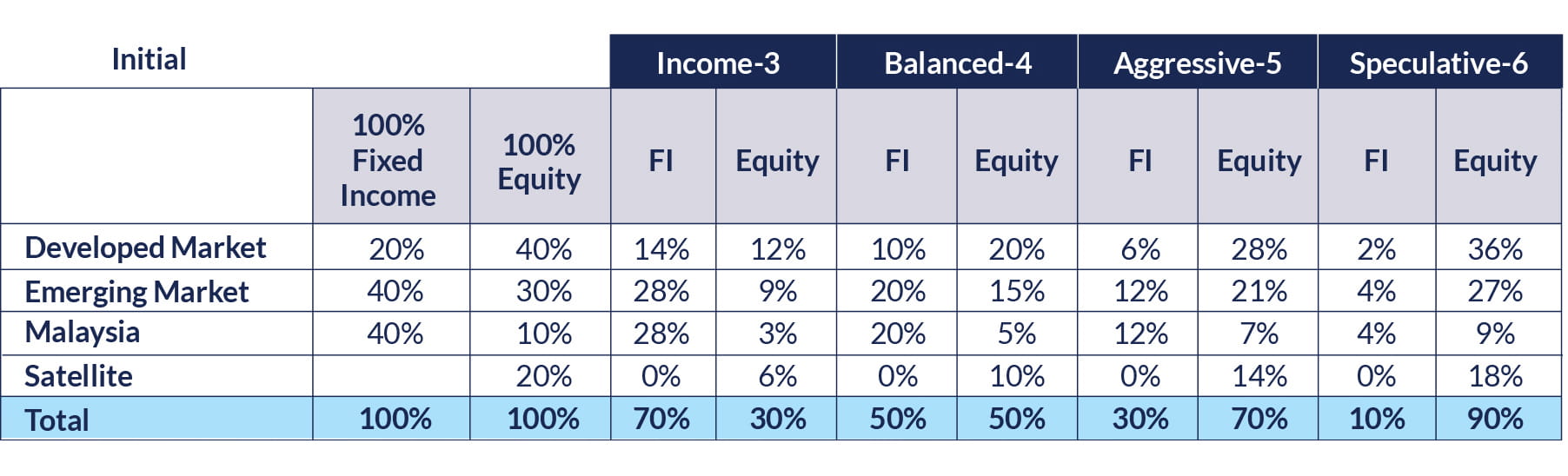

Like placing your players in a formation such as 4-4-2 or 5-4-1, there are several ways to allocate your assets, based on the weightage of equities or fixed income. The higher the equity portion, the higher the risk, or the more attacking the style of play. It depends on your risk appetite. These allocations, like formations, can change over time based on market performance, change in personal circumstances, and evolving financial needs.

Asset Allocation