Green and clean are in. Sustainable development initiatives have been around for decades since the drafting of the Brundtland Report in 1987, but Covid-19’s devastating impact on economies was the straw that finally broke the camel’s back, highlighting our race against time.

As businesses closed, folks lost their jobs, and central banks took unprecedented measures to sustain their economies, we began to ask ourselves what we could have done to prevent this. We can’t undo what just happened, but we can take measures to ensure we won’t be as badly affected again.

If anything, the pandemic has only further revealed the weaknesses of the “traditional” business model, which tends to focus on the bottom line. Sustainability has to be at the heart of any business model if the business intends to ride out any unforeseen circumstances. The goal is no longer short-term profits, but long-term sustainability.

We’re taking huge strides in the right direction, with governments stepping up their efforts in sustainability. Environmental responsibility and transparency are among the issues that sustainability addresses.

Newly-elected US President Joe Biden’s Build Back Better1 plan aims to develop a sustainable infrastructure and clean energy economy. China, long derided as a major contributor to global pollution, has already stepped up its efforts in clean energy. The nation surprised the world when it released its 2020 total wind and solar capacity additions2 of a whopping 120 gigawatts, the largest in the world. China has pledged to be carbon-neutral by 2060.

China President Xi Jinping has stressed the need to fight corruption if the country is to achieve its political and economic goals. The country launched its “Sky Net 2021” campaign to track down corrupt fugitives from state-owned enterprises and recover their illegal gains. Sky Net was originally launched in 2015. China’s efforts to reduce corruption over the last few years has gained traction, with the country climbing up the rankings of Transparency International’s 2020 Corruption Index to 78th place out of 180 countries.

While these are decisions at the highest administration levels, as investors we have the power and responsibility to make the right investment choices, and these choices will, in turn, change the landscape. When stakeholders are increasingly pricing in sustainability preferences, it makes perfect sense for businesses to take a more conscious approach. There’s no better time than now to get on the green train.

Sustainable investing is an investment discipline that considers environmental, social and corporate governance (ESG) criteria to generate long-term competitive financial returns and positive societal impact. Taking the cue from shariah and similar investments, sustainable investing also avoids tobacco, weapons and alcohol companies.

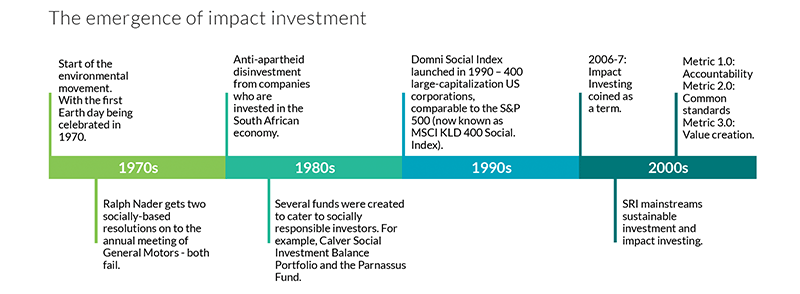

ESG has its roots in socially responsible investing (SRI) which relies on strategies that emphasise sustainable, responsible and impact investing. SRI sprung from a niche investment strategy that emerged in the 1960s and '70s, but some might say it goes further back, to the Quaker, Islamic and Jewish exclusion of “sinful” companies. The apartheid in South Africa became a tipping point, when investors began divesting from companies that did business there on moral and ethical grounds, refusing to invest in a government that implemented a system of institutionalised racial segregation.

Source: https://dnbam.com/se/finance-blog/esg-we-have-come-a-long-way-since-the-first-exclusions-of-sin-stocks.

ESG factors benefit both investors and businesses. By adopting ESG factors, businesses not only create an ethical approach; the holistic view also allows them to tap into a wider pool of information - along with traditional financial analysis - to better understand both the risks and create new opportunities.

It definitely pays to go green. Companies that can better manage ESG issues are likely to be more resilient throughout the current crisis. If they invest time and effort in addressing supply chain risks, they will be in a better position to manage disruptions in their businesses due to lockdowns. An example we’ve seen recently is how well some businesses have been able to adapt the restrictions of the new normal. Companies offering their employees more work flexibility and are more focused on their wellbeing are better adjusted to the work-from-home culture. Those that were already conducting business online didn’t have much to change during the lockdown.

Resources are vital to business continuity (raw materials, water, etc) are crucial to business continuity, and their continued depletion has led corporations to become more environmentally aware than ever.

Automotive companies are known to be among the biggest polluters and the Ford Motor Company is determined to change that. The company uses sustainable fabrics in its vehicles, and 80% of parts in the Focus and Escape models are recyclable.

Tech giants have spent millions on solar and wind power to cut energy expenses and greenhouse gas emissions at the same time, among them Google, Facebook and Amazon. Each company is committed to getting 100% of their power for their data centers from renewable resources.

Today, in the age of social media and big data, you can’t hide the impact of businesses and investments. For companies, reputational risk is very real and can inflict serious long-term damage. Prevention is always better than the cure. Rubber glove makers Top Glove Berhad found out the hard way when the US Department of Labour (DOL) moved to ban imports of the company’s products on allegations of forced labour. Top Glove remedied this by blacklisting unethical recruitment agents and paying out a total of RM136 million in remediation payments to workers. Top Glove’s share price, which had seen a meteoric rise due to the pandemic, dropped 47% following news reports on the labour issues. Corporate governance and transparency are also no longer second-tier requirements, as any slip-up can lead to a company’s swift demise. Remember Enron in the early 2000s? The company’s leadership fooled regulators with fake holdings and off-the-books accounting practices. It hid massive debts behind multiple special purpose vehicles (SPV) and as a result the company and its auditors were subject to a criminal investigation. Within a few short years since its tricks were unveiled, the company ended up filing for bankruptcy and liquidated its assets, paying creditors more than US$21.7 billion.

From an investor’s standpoint, we want to invest in businesses that consider all angles for opportunities and risk mitigation, which ESG covers. In addition to that, many investors are not only interested in the financial outcomes of investments; we are also interested in the impact of our investments and the role these assets can have in promoting global issues such as climate action.

Here’s why ESG investing makes sense. Figures from Fidelity’s Putting Sustainability to the Test report showed stocks at the top of the fund house’s ESG rating scale regularly outperformed those with weaker ratings in 2020. This su3ggests that stocks with higher ESG ratings are less prone to volatility in the markets. Fidelity analysed 2,660 firms for the report.

Due to its appeal, momentum is fast building up behind ESG investing. Global sustainable funds saw inflows of US$45.7 billion (Q1 2020), while the broader fund universe had an outflow of US$384.7 billion. Morningstar reported a bumper year for ESG funds in 2020. During the year, sustainable open-end and exchange-traded funds (ETFs) attracted net inflows of US$278.7 billion. This was almost double the figure for 2019. In the fourth quarter alone, sustainable funds pulled close to US$119.6 billion in net new money, taking 45% of overall European funds flows.

.png)

Source: Morningstar.

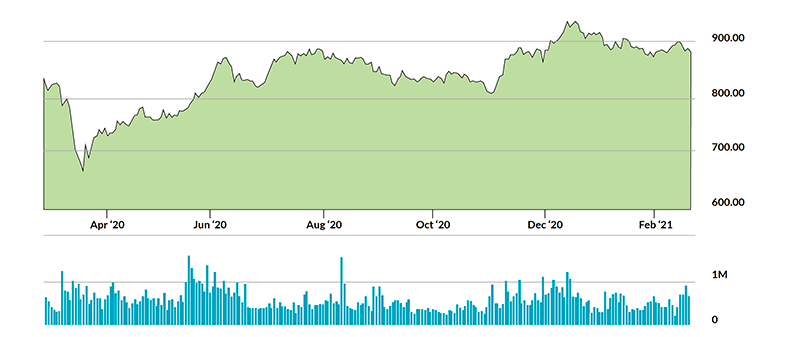

At home, Bursa Malaysia’s FTSE4Good Index has been on the rise since Movement Control Order (MCO) 1.0 in March 2020. Since its inception, the number of F4GBM Index constituents has since grown three-fold4, increasing from 24 to 73 as of the latest review in June 2020.

Source: Bursa Malaysia.

Finding the best ESG companies with strong stocks and growth needn't be a trade-off with environmental, social and governance values. Zooming in on individual companies with a greener stance, Tesla has seen a remarkable growth in value over the last year, quadrupling since January 2020. This rise reflects a shift in investor sentiment towards investing in clean energy solutions. Examples of ESG-rated companies that have performed strongly over the last five years include Nvidia, Pool and Adobe.

Sustainability is at the heart of recovery plans for most governments, including Malaysia. With plans to invest in large scale renewables, clean transport, sustainable food, and shortening and diversifying global supply chains, this will likely support ongoing investment in sustainable industries. The government has set a target of 20% renewable energy mix, from the current 2%, by 2025 and banks are increasing their financing in this segment. And, under the National Agrofood Policy 2.0, the government will invest in modernising agriculture and advancing towards sustainable practices along the entire supply chain. As investors, these are areas we can look into for opportunities.

RHB Wealth Management offers investors the opportunity to invest in businesses that have an ethical edge via the RHB i-Global Sustainable Disruptors Fund.

The fund is Shariah-compliant and it is suitable for investors with a higher risk appetite who wish to seek capital appreciation over the medium to long-term periods through investments in sustainable equities.

The investment philosophy centres on the belief of long-term earnings growth and the likelihood of the earnings growth being delivered by investing in good quality and sustainable companies that can potentially offer attractive and sustainable long-term growth.

The fund invests up to 95% of its net asset value (NAV) in Shariah-compliant global equities. The balance of the Fund’s NAV shall be invested in Islamic liquid assets including Islamic money market instruments, Placements of Cash and Islamic collective investment schemes investing in Islamic money market instruments and Placements of Cash.

You don’t have to be a Greenpeace donor to invest in ESG. Think of it as taking a long-term strategy that also benefits the community and environment. Your investment choices today will play a role in determining the quality of life for generations to come.

Interested in ESG investment?

Contact your Relationship Manager to discuss your ESG investment options.

Or fill up the form below.