Esports, after so many years of being underestimated, has become an attractive market for strategic investors (investors looking for synergies and integration) and financial investors (investors looking for financial growth) alike. According to Deloitte and The Esports Observer in a joint report, the sector saw a huge leap in investments between 2017 and 20181. More significantly, traditional private equity firms joined in the fray, making more investments in 2018 than in the previous four years combined2.

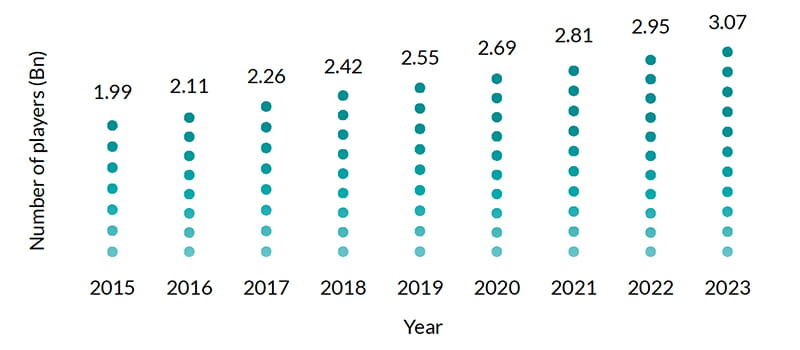

The esports market revenue was valued at USD947.1 million in 2020. The pandemic has increased the popularity of gaming in general, as people sought social interaction via the social aspects of online gaming during the lockdown. Newzoo, a leading provider of games and esports analytics, believes that the lockdown measures across the world have accelerated changes in the games market as the younger generation is leaving behind social media for the more interactive experiences that gaming offers. Newzoo forecasts the number of video game players to increase to 3.07 billion in 2023 from 2.7 billion in 2020.

“Malaysia’s highest-earning esports player has total prize earnings of USD1.89 million to date, eclipsing the prize earnings of some of our professional badminton players.”

What is esports exactly?

So, what is esports? Esports stands for electronic sports and essentially refers to organised competitive video games. Although video games and video game matches have been around since the 1970s, esports only began to gain traction in the 2010s. During this period game publishers transitioned to a “games as a service” (GaaS) model, which incentivised them to support a competitive scene as marketing extensions of their products.

Global Player Forecast

Source: Newzoo Global Games Market Report 2020

For example, Riot Games (owned by Tencent Holdings Ltd) and Valve run successful leagues for their most popular games, League of Legends and DOTA 2, respectively. When publishers of GaaS and free-to-play games turn their titles into esports games, the benefits include increased exposure for the title - both online and offline, and additional revenue streams from competition-themed in-game content.

Simultaneously, the emergence of dedicated online streaming services such as Twitch and Huya in the 2010s allowed esports to expand its audience and support regularly scheduled broadcasts. Online viewership grew and the prize pool for esports grew in tandem.

Now, esports tournaments are being played in stadiums and attract audiences from around the world. The major tournaments and leagues offer prize pools in the millions and are organised around the most popular games like League of Legends, DOTA, Fortnight, Counterstrike, Call of Duty, Overwatch, FIFA and Madden NFL.

In 2019, American teenager Kyle Giersdorf won the Fortnite World Cup at Arthur Ashe Stadium in New York City, together with prize money of USD3 million, eclipsing Tiger Woods’ PGA prize of USD2 million when he won the Masters Tournament the same year. Close to home, Yap “xNova” Jian Wei, Malaysia’s highest-earning esports player has total prize earnings of USD1.89 million to date3, eclipsing the prize earnings of some of our professional badminton players.

What makes esports such a compelling investment story?

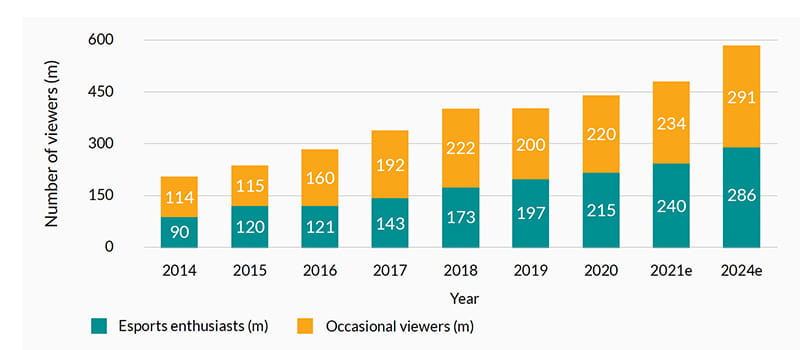

Esports viewership

Source: Newzoo Global Esports Market Report 2014-2020, Newzoo Global Esports and Live Stream Market Report 2021

Esports has seen rapid growth in viewership over the past few years from 204 million viewers in 2014 to 435 million viewers in 2020, representing a compounded annual growth rate (CAGR) of 13.5% per annum. To give context to the size of the esports audience, Twitch, the online platform where most esports are streamed has more viewers than HBO, Netflix and CNN. What makes this segment even more exciting is that this growth is just the tip of the iceberg. With a viewership of 435 million out of 2.7 billion people playing video games in 2020, there is a lot of room for esports viewership to grow. Newzoo is expecting the number of viewers to grow 32.6% to 577 million viewers by 2024.

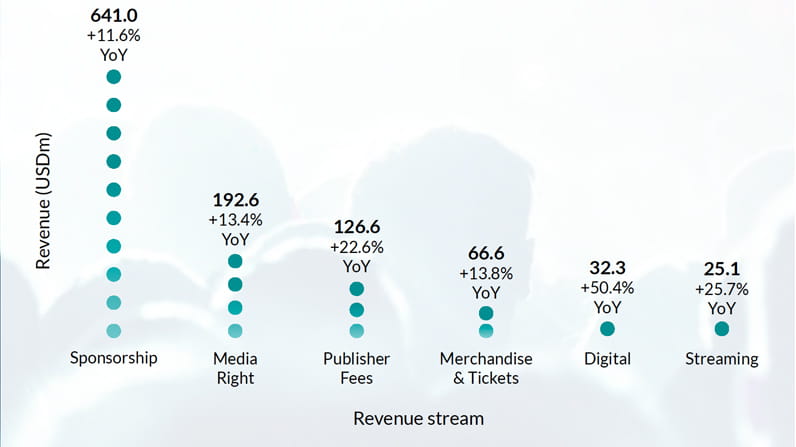

Esports Revenue Streams

Global 2021

Source: Newzoo Global Esports and Live Stream Market Report 2021

As viewership has grown, so has sponsorship and therefore revenue for this segment. The bulk of esports revenue comes from sponsorship which is expected to hit USD641 million in 2021. Sponsorship of esports is expected to continue to grow, particularly driven by the growth in non-endemic sponsorship by brands eager to connect to esports’ unique audience.

There are two types of sponsorships. Endemic sponsorships are made by brands that create the products used to produce and play esports, such as Razer, Logitech and Intel. Non-endemic sponsors are brands that produce products not vital to esports, including mainstream consumer brands like Coca-Cola, Vodafone and Toyota.

Endemic sponsorships have historically made up the bulk of esports sponsorship, but this changed in 2020 when non-endemic sponsors began to pull ahead4. These brands sought to connect to the esports fan base which comprises Millennials, the world’s largest cohort, who have largely turned away from traditional sports and media. This audience is very attractive to consumer brands because it is young, (37% are males aged 21 to 35, 16% are females aged 21 to 355) and have relatively high purchasing power (61% of US esports viewers earn more than USD50,000 per year6).

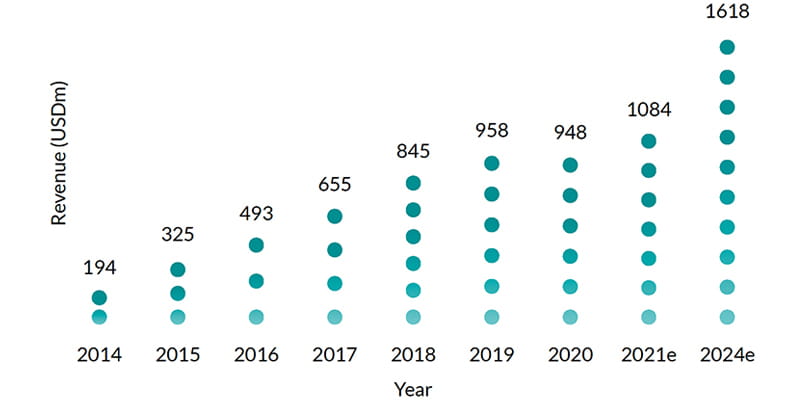

Esports Revenue

Source: Newzoo Global Esports Market Report 2014-2020, Newzoo Global Esports & Live Stream Market Report 2021

Esports has seen its revenues grow from USD194 million in 2014 to USD948 million in 2020 representing a CAGR of 30.2% per annum. Thanks to expected growth in viewership and sponsorship, Newzoo expects esports revenue to grow at a CAGR of 14.4% per annum to USD1.6 billion in 2024.

Investors are definitely taking notice of these growth rates. The big turning point for esports as an investment vehicle came in 2018 when investments in the industry jumped to USD4.5 billion in 2018 compared to USD490 million in 20177. 2018 is also significant as more traditional investors, such as private equity investors, began to invest in this sector, signalling its entry into the mainstream.

The future of esports

Many investors used to believe that esports was not a long-term trend. However, judging by the recent significant increase in investments in the industry, esports is probably here to stay. As it is esports is already being accepted by international sports bodies. It became a medal event in the 2019 SEA Games and will also be a medal event at the 2022 Asian Games in Hangzhou, China. In the Paris 2024 Olympics, esports will be used to enable fans to connect with the athletes by competing virtually with athletes in events like sailing, cycling and rowing. All these mean that there will be increased interest and sponsorships flowing to this industry.

Esports came of age in the digital era and as a digital native, it is poised to continue to ride the waves of technological change to greater heights. In fact, PWC analysts believe that esports is going to be more than a long-term trend and will evolve from a growing live sport with high entertainment characteristics into a leading factor in pop culture that has a significant impact on all games8. Here are three ways esports will continue to grow and evolve in tandem with future changes in technology.

Esports is especially popular in Asia, with China, Japan and South Korea being esports pioneers, together with the US. However, a 2015 Newzoo report showed that the Southeast Asian countries are also embracing esports. In fact, the 2019 SEA Games was the first time esports became a medal event at an Olympic recognised multi-sport competition.

In Malaysia, video games are seen as an activity for the young and are frowned upon by parents as a waste of time and a distraction from the all-important pursuit of good grades. However, former Minister of Youth and Sports, Syed Saddiq Syed Abdul Rahman, himself only in his mid-twenties, championed esports in Malaysia. Under his leadership, the Strategic Plan for Esports Development 2020-2025 was unveiled in 2019 to turn Malaysia into an esports hub in Southeast Asia. “I will try my best to bring whatever facilities, investments and development there is so that esports gamers and players will have a place,” he said9.

Thanks to these initiatives, Malaysia will see the opening of the largest esports facility in Southeast Asia in 2021. Located in Quill City Mall, the facility called the EBN sports City offers 65,000 square feet of space equipped with the latest technology and support system to host world-class esports tournaments, events and conventions.

Mobile Gaming

One future avenue of growth is mobile gaming, which is currently only in its infancy. Mobile gaming can only get bigger as out of the 2.7 billion gamers worldwide, 2.5 billion play games on their mobile phones compared to 1.3 billion players on a PC and 0.8 billion players on a console10. The mobile phone is the most affordable of the three types of gadgets used to play video games, and thus is expected to garner the biggest number of players and audience. The pandemic saw an increase in mobile gaming, and the challenge would be for the gaming industry to retain these new gamers. The introduction of 5G connectivity, widely expected to take place in the next few years, will increase connectivity and support more sophisticated games on the mobile phone.

2020 gives us a glimpse into the future of the mobile gaming esports scene. PUBG Mobile, a mobile game introduced in 2018 became the most-watched mobile esports title and is now the number four esports game via hours watched in 202011. Another mobile game Free Fire, saw impressive viewership numbers for the Continental Series, its 2020 global championship event. In Asia specifically, the Continental Series drew in over 2.5 million peak viewers during the grand finals12. This viewership number is encouraging, considering that the finals of the 2020 League of Legends World Championships, the most-watched esports event of 2020 chalked up 3.8 million peak viewers13.

When esports and real sports meet

Another expected area of growth is in the merging of real sports and esports. This is expected to happen as virtual reality technology becomes more ubiquitous. Although virtual reality is not expected to become mainstream for another 5-10 years, we can get a glimpse of this future in Zwift.

Zwift is an online gaming platform dedicated to indoor cycling. Thanks to the pandemic, cyclists have discovered Zwift as a way to make indoor cycling more fun. Subscribers to Zwift gain access to a virtual cycling world with multiple courses, group rides, and even races, and it has attracted both professional and amateur riders alike. Zwift as an esport is still in its infancy but shows promise. Since its inception in 2015, Zwift has seen the debut of a professional cycling esports league (KISS Super League) in 2019 and in December 2020, the first-ever UCI Cycling Esports World Championship was held on Zwift.

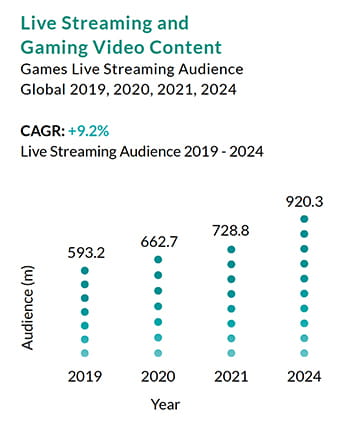

Live streaming and gaming video content

The third area of growth, that may not strictly be considered esports, is live streaming and gaming video content (GVC). While esports refers to professional tournaments, live streaming and GVC encompasses the content created around gaming, both professional and non-professional. There is a significant audience overlap between the live streaming and esports markets, although their content and monetization strategies differ. Many non-professional gamers, like Tyler Bevins who is known as Ninja, have built a following via online streaming.

Live streaming had an audience of 662.7 million in 2020 and this audience is expected to grow to 920.3 million in 2024. In light of the new developments in live streaming, Newzoo has expanded its annual Global Esports Market Report into the Global Esport and Live Streaming Market Report in 2021.

The future of esports looks bright. As more and more people turn to video games for entertainment and social connections, esports will continue to evolve and expand to become a key component of the entertainment industry of the future.

Source: Newzoo Global Esports and

Live Stream Market Report 2021.

How do we invest in esports?

As a sector that is still in its infancy, with great growth prospects for the medium to long term, now is a great time to invest in esports to fully participate in the growth potential of this sector. How do we as investors get a piece of the action? We can invest in the diverse range of businesses within the esports ecosystem namely teams, event management, developers, third party coordinators, media platforms and advertising, consumer products and gaming hardware producers.

Although many investments in esports are still done via private equity and venture capital funds, the segment is becoming more mainstream and there many stocks listed in international markets with exposure to the esports ecosystem. Major esports stocks are Tencent Holdings Ltd - the largest gaming company in the world, Activision Blizzard Inc, Razer Inc and Electronic Arts Inc. There are also esports-themed ETFs such as the Roundhill BITKRAFT Esports & Digital Entertainment ETF (NERD ETF) and the VanEck Vectors Video Gaming and eSports UCITS ETF (ESPO ETF) listed in the US.

However, if you would like to avoid the complications of purchasing different shares and ETFs in different markets around the world, RHB offers you exposure to esports investments via the Manulife Global Thematic Fund and Principal Global Millennial Equity Fund.

The Manulife Global Thematic Fund invests in global equity along multiple themes that are behind the structural shifts of our ever-changing world. The fund is actively managed and unconstrained by region, sector or market capitalisation. Digital life, which includes esports, has been identified as one of the fund’s key investment themes. Accordingly, the fund has investments in Electronic Arts Inc and Square Enix amongst others.

The Principal Global Millennial Equity Fund aims to gain exposure to the Millennial generation by investing in global equities which captures the spending and lifestyle choices of this demographic cohort, which is currently the world’s largest. As gaming and esports form part of the Millennial lifestyle, the fund has investments in these areas.

To find out more about the esports investments made by these funds, and how they can enhance your current portfolio, do not hesitate to contact your Relationship Manager.

Sources:

1The Rise of Esports Investment, Deloitte Corporate Finance LLC and The Esports Observer, April 2019.

2The Rise of Esports Investment, Deloitte Corporate Finance LLC and The Esports Observer, April 2019.

3Esportsearnings.com, Yap “xNova” Jianwei - Dota 2 Player, accessed 20 May 2021.

4Globaldata.com, Global esports sponsorship sector dominated by non-endemic brands worth $584m, 19 January 2021.

5TThe Rise of Esports Investment, Deloitte Corporate Finance LLC and The Esports Observer, April 2019.

6The Rise of Esports Investment, Deloitte Corporate Finance LLC and The Esports Observer, April 2019.

7The Rise of Esports Investment, Deloitte Corporate Finance LLC and The Esports Observer, April 2019.

8New Straits Times, Malaysia to be Esports hub in Asia: Syed Saddiq, 6 August 2018.

9PWC.de, Investors: High demand in esports attracts big brands from various industries, 2020.

10Newzoo.com, Three Billion Players by 2023: Engagement and Revenues Continue to Thrive Across the Global Games Market, 25 June 2020.

11Pocketgamer.biz, PUBG Mobile esports generated 200 million hours of viewing in 2020, 23 April 2021.

12Sportskeeda.com. Free Fire: FFCS Asia creates record with peak viewership of over 2.5 million, 26 December 2020.

13Dotesports.com, The most watched esports events of 2020, 24 December 2020.