Why you should invest in commodities

The spotlight is on the commodities sector right now. With most countries struggling with the worsening pandemic as new Covid-19 strains make their way around the world, a commodity boom is on the horizon. The reason for this rally is the pent-up demand for raw materials as countries look to rebuild their economies and the disruptions in supply from manufacturers and suppliers getting back on their feet after a lengthy lockdown. Although newer strains are pushing countries back into lockdown, recovery is expected as vaccine rollouts continue and businesses return to operation.

With material supply at a bottleneck, inflation is expected to rise in the coming months as manufacturers lower on the supply chain ramp up prices. Government stimulus packages to pump cash into the economy, like those carried out by the US and Malaysia, will push consumer demand, adding pressure on manufacturers.

The International Monetary Fund (IMF) has warned that the increase in inflation could be more than just transitory1. In the US, the CPI stood at 5.4% in June 2021, the fastest pace in almost 13 years. China’s PPI rose 9% year-on-year in July 2021, affected by price hikes for crude oil.

While all this is happening, the push for greener energy sources and green technology continues. The shift to green energy will push demand for raw materials such as copper, lithium and steel. The buildout of green infrastructure will also require lumber, steel, and other industrial materials, which could keep demand and prices for materials higher for years.

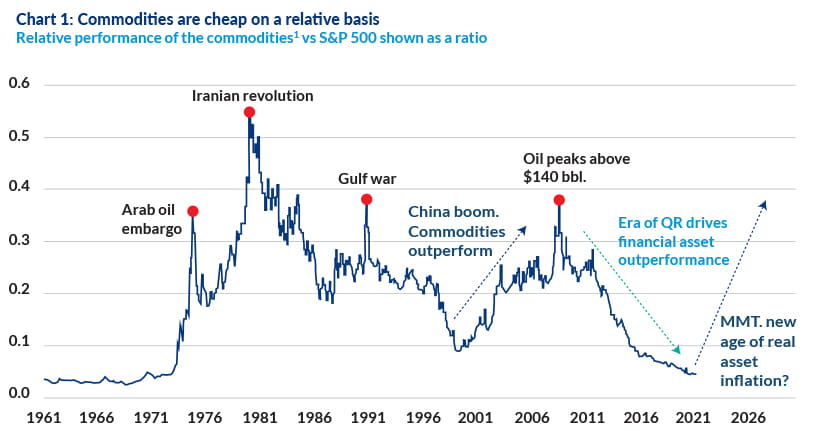

Commodities tend to outperform equities, by a large margin, when certain conditions come into place, as seen in the chart below which compares the S&P 500 to commodities.

Past performance is not an accurate predictor for future performance.

Source: Schroders, Bloomberg - 29 January 2021, 1Represented by BCOM TR index. 600500.

The pandemic and lockdown badly affected oil prices. Demand dropped as businesses shuttered and people stayed home. Earlier this year, demand for oil picked up as countries emerged from lockdown and travel restrictions were eased. In the second half of 2022, OPEC (Organization of the Petroleum Exporting Countries) was expected to limit or delay production increases for the rest of the year. Over the past 12 months, oil prices have almost doubled, touching USD70 per barrel at the end of August 2021.

Source: Refinitiv Eikon as of 1 September 2021

Despite a relatively flat movement so far this year, gold, another heavily traded commodity, has seen a huge appreciation in value over the past 12 months as investors looked for a safe haven following the pandemic.

Source: Refinitiv Eikon as of 6 September 2021

Copper, after a correction in May this year, is building momentum. If we observe prices over a 12-month period, we can see that copper prices have nearly doubled. Copper is an essential raw material in electronics manufacturing.

Source: Refinitiv Eikon as of 1 September 2021

Commodities can help diversify your portfolio risk

Due to changes in supply and demand, commodity prices will fluctuate. For example, if mining companies are forced to cease operations, the price of metals will increase. If there’s a bumper crop of soy, prices will decrease. Some commodities, like gold, remain relatively stable, which is why it is used as a reserve asset by central banks. Overall, commodities are more volatile than stocks.

However, investors will choose commodities for the purpose of diversification because they have low correlation (prices do not move in tandem) to equities. Unlike traditional asset classes like stocks and bonds which tend to have a positive correlation, commodity prices are bet on unexpected inflation and so have little relation to the movement of equities.

Commodities are also a popular hedge against inflation. High inflation causes commodity prices to soar, while stocks and bonds tend to perform better in a low inflation environment. Because commodity prices typically rise when inflation is accelerating, they offer protection from the effects of inflation. Few assets benefit from rising inflation, particularly unexpected inflation, but commodities usually do. As the demand for goods and services increases, the price of goods and services rises as does the price of the commodities used to produce those goods and services.

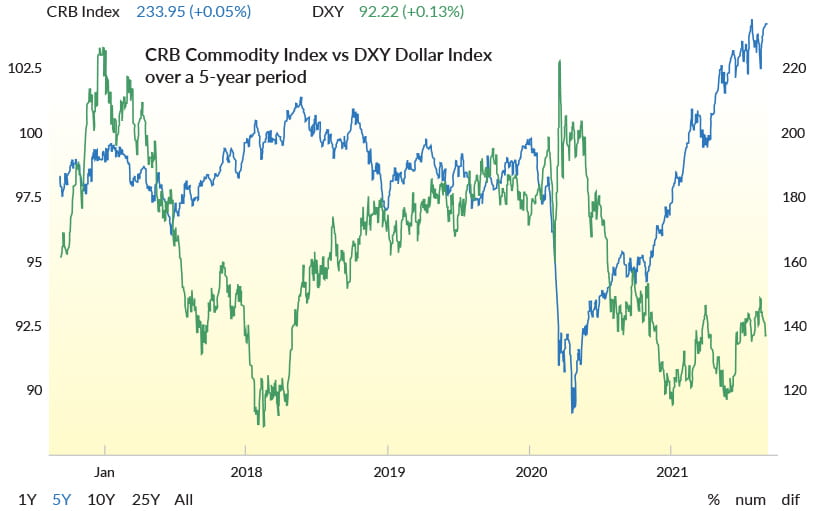

There’s normally an inverse relationship between the value of the dollar and commodities prices. The prices of commodities tend to drop when the dollar strengthens and vice versa. The Commodity Research Bureau Index tracks the performance of a group of commodities against the value of the dollar.

By adding commodities to your portfolio, you effectively decrease your overall portfolio risk.

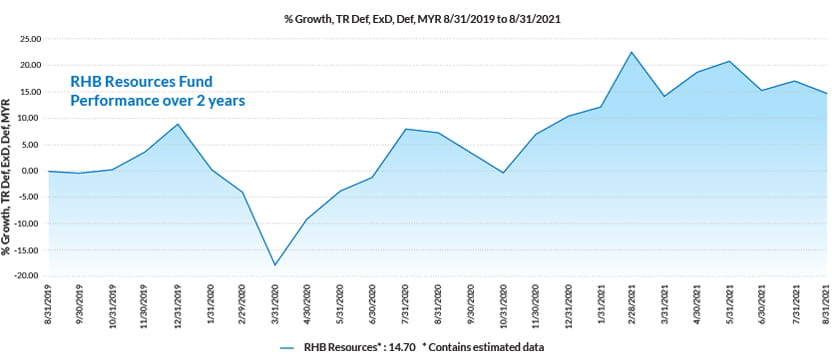

Source: Lipper Investment Manager as of 31 August 2021

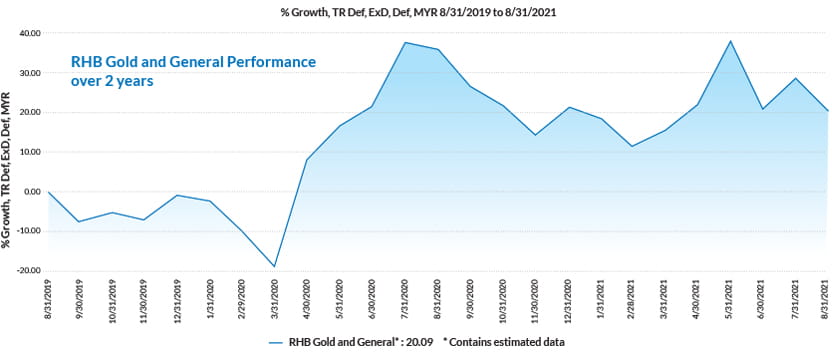

For those keen on investing in companies involved in precious metals, energy, or base metals, you could opt for RHB Gold and General Fund. This fund is suited to the investor who is willing to accept a higher risk for potentially higher returns.

This fund aims to achieve returns on investment mainly in securities of corporations (whether or not listed on any stock exchange, and in any part of the world) whose business (in any part of the world) is or is substantially in the mining or extraction of gold, silver or precious metals (e.g. platinum, palladium, rhodium etc.), bulk commodities (e.g. coal, iron ore, steel etc.), base metals of all kinds (e.g. copper, aluminium, nickel, zinc, lead tin etc.), and other commodities (e.g. industrial minerals, titanium dioxide, borates etc.) and it includes the mining or extraction of oil, gas, coal and alternative energy or other commodities or other minerals.

At least 95% of the fund’s NAV is invested in units of the United gold and General Fund, and the remainder is invested in liquid assets.

Source: Lipper Investment Manager as of 31 August 2021

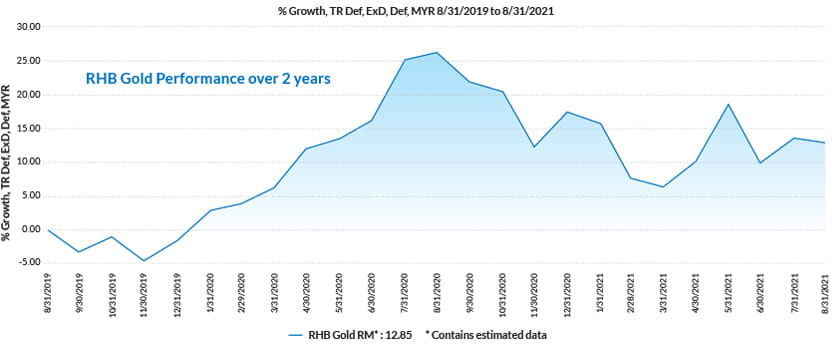

RHB Gold Fund offers investors the opportunity to gain direct exposure to gold spot prices as the fund feeds directly into Blackrock’s iShares Gold ETF, which tracks the returns of gold spot prices. This fund is suitable for investors who want a targeted exposure to a single commodity’s price.

Source: Lipper Investment Manager as of 31 August 2021

Overall, commodities should be part of a well-diversified portfolio. Discuss your options with your Relationship Manager to see which of the safer options best suits your needs and risk profile.

1CNBC, IMF warns that inflation could prove to be persistent and central banks may need to act, Silvia Amaro, 27 July, 2021.

Disclaimer:

This article is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party, without obtaining prior permission of RHB Bank.

This article has been prepared by RHB Bank and is solely for information only. It may not be copied, published, circulated, reproduced or distributed in whole or part to any person without the prior written consent of RHB Bank. In preparing this article, RHB Bank has relied upon and assumed the accuracy and completeness of all information available from public sources or which was otherwise reviewed by RHB Bank. Accordingly, whilst RHB Bank have taken all reasonable care to ensure that the information contained in this article is not untrue or misleading at the time of publication, RHB Bank cannot guarantee its accuracy or completeness and make no representation or warranty (whether expressed or implied) and accept no responsibility or liability for its accuracy or completeness. You should not act on the information contained in this presentation without first independently verifying its contents.

Any opinion, management forecast or estimate contained in this article is based on information available as the date of this article and reflects prevailing conditions and underlying fund manager’s views as of the date of this presentation, all of which are subject to change at any time without notice. Such opinions, forecasts and estimates as well as the information contained herein relating to the historical performance of various indices is for information only and is not indicative of the future or likely performance of the Fund and should not be construed as such.

A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the RHB Resources Fund, RHB Gold and General Fund and RHB Gold Fund (“Fund”) are available and investors have the right to request for a PHS. Investors are advised to obtain, read and understand the PHS and the contents of the Information Memorandum dated 31 May 2021 for RHB Resources Fund, 27 August 2021 for RHB Gold and General Fund and 11 April 2018 for RHB Gold Fund and its supplementary (ies) (if) (“the Information Memorandum”) before investing. The Information Memorandum has been registered with the Securities Commission Malaysia (“SC”) who takes no responsibility for its contents. The SC’s approval and authorization of the registration of the Information Memorandum should not be taken to indicate that the SC has recommended or endorsed the Fund. Amongst others, investors should consider the fees and charges involved. Investors should also note that the price of units and distributions payable, if any, may go down as well as up. Where a distribution is declared, investors are advised that following the issue of additional units/distribution, the NAV per unit will be reduced from cum distribution NAV to ex-distribution NAV. Any issue of units to which the Information Memorandum relates will only be made on receipt of a form of application referred to in the Information Memorandum. The printed copy of prospectus and Product Highlight Sheet is available at RHB branches/Premier Centre and investors have the right to request for a Product Highlight Sheet. Investors are advised that investments are subject to investment risk and that there can be no guarantee that any investment objectives will be achieved. Investors should conduct their own assessment before investing and seek professional advice, where necessary and should not make an investment decision based solely on this update.

The Manager wishes to highlight the specific risks of the RHB Resources Fund Fund are Currency Risk and Country Risk. The specific risks of the RHB Gold and General Fund are Market Risk In Global Markets, Foreign Exchange/Currency Risk, Political Risk, Derivatives Risk, Liquidity Risk in UGGF’s Investments, Small Capitalisation Companies Risk, Single Sector Risk and Commodities Risk. The specific risks of RHB Gold Fund are Management Risk, Secondary Trading Risk, Country Risk, Currency Risk, Investment Risk, Derivative Risks, Concentration Risk, Risk Related To Precious Metals Generally and Shortage of Physical Metals risk and other general risks are elaborated in the Information Memorandum.

This article has not been reviewed by the SC