The recently announced Budget 2020 will be a boon for Malaysia, with multiple initiatives that would make the economy and business landscape attractive for local and foreign investors. The government has placed more emphasis on increasing spending to support economic growth, according to the RHB Wealth Research Team.

On the whole, the team finds the proposals laid out in Budget 2020 to be relatively market-friendly and broadly in line with expectations. The people-centric budget contains multiple proposals to address issues impacting the B40 segment as well as measures to pump-prime the economy via the construction sector. Investors take note, while the construction and consumer sectors remain the biggest winners, Budget 2020 is also mildly positive for the plantation, property and telecommunication sectors.

The budget treads the line between fiscal consolidation and expansionary initiatives in such a way so as to prioritise value for money, spent on the right outcomes. RHB Wealth Research believes this could help instil confidence among investors, despite an increase in the fiscal deficit from 3.2% of GDP from the medium-term target of 3%.

All told, the fiscal deficit of 3.2% in 2020 is down from last year’s 3.4% deficit. Budget 2020 placed more emphasis on spending to support economic growth. To this end, the government projects GDP growth of 4.8% in 2020, slightly up from 2019. However, RHB Wealth Research advises caution, as official growth forecasts might be optimistic. The team projects a real GDP forecast of 4.3% next year, down from the estimated 4.5% this year.

Despite slight deviations from the government’s medium-term fiscal consolidation agenda, the team believes this is unavoidable given the challenging global economic environment. Nevertheless, RHB Wealth Research does not see international ratings agencies cutting Malaysia’s sovereign credit rating.

Taking into account ongoing geopolitical risks, the team says the local market has lagged on growth concerns and unattractive valuations. A likely US-China trade truce looks far from being comprehensive right now, and leaves in place existing punitive tariffs that will weigh on global growth next year.

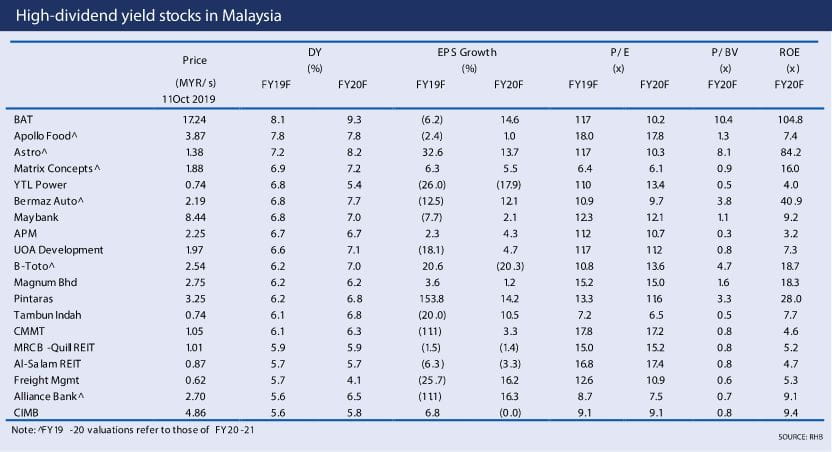

Under the circumstances, bottom-up stock-picking will be key, with a focus on quality laggards, resilient yield plays and defensive stocks as tactical options. Alternatively, small and mid-cap stocks may offer more robust growth, on the condition, however, that they are available at sensible valuations.

At present, RHB Wealth Research is overweight on construction, gaming, rubber gloves, non-banking financial institutions (NBFIs) and real estate investment trusts (REITs). The team maintains an end-2019 FBM KLCI target of 1,620 points.

The team’s overweight call on construction is supported by construction-friendly budget proposals that include comprehensive measures for rural development, infrastructure maintenance, new hospitals as well as confirmation that the Rapid Transit System (RTS) between Johor Baru and Singapore will proceed after all.

Crucially, the government has earmarked a bigger construction expenditure for 2020 compared to this year. Going forward, industry and investors can look forward to a total of RM56 billion worth of construction projects in 2020. This is up 4.3% from RM53.7 billion for 2019.

Budget 2020 is notable in that the development expenditure earmarked for Sabah (RM5.2 billion) and Sarawak (RM4.4 billion) represents the largest portion of the budget’s overall development expenditure. Clean water initiatives for Sabah and Sarawak will come up to RM587 million and RM470 million respectively. In addition, RM326 million and RM224 million have been earmarked respectively for the development of rural roads.

Meanwhile, the Pan Borneo Highway project remains relevant to spur economic growth in East Malaysia. All this indicates the likelihood of more contracts being awarded over the next 12 months for the remaining packages of the Pan Borneo Sabah Project (to date, only 12 out of 35 projects for this initiative have been awarded). RHB Wealth Research believes the higher allocation for East Malaysia will benefit local contractors and basic materials players there, namely Hock Seng Lee Bhd and Cahya Mata Sarawak Bhd.

Previously stalled construction projects — most notably, the Bandar Malaysia development — has been revived. Sunway Construction Sdn Bhd and Econpile (M) Sdn Bhd are potential beneficiaries of the project’s civil works. On this point, while not explicitly mentioned in Budget 2020, the team believes the revival of Bandar Malaysia raises the likelihood that the high-speed rail project will eventually follow suit.

More broadly, the government has allocated significan’t sums for the construction of various primary infrastructure developments throughout the country. Some RM1.1 billion has been earmarked for this purpose.

RM50 million has been committed to the construction of the Chuping Valley Industrial Area in Perlis, via the Northern Corridor Implementation Authority. RM69.5 million has been set aside for projects related to the Kuantan Port development, under the auspices of the East Coast Economic Region Development Council. Meanwhile, some RM55 million has been set aside for infrastructure development in Samalaju Industrial Park in Sarawak, via the Regional Corridor Development Authority.

In addition, the Cabinet in early October approved the Finance Ministry’s proposed acquisition of four Klang Valley highways. The four highways in question are the Shah Alam Expressway (Kesas), Damansara-Puchong Expressway (LDP), Sprint Expressway (Sprint) and the Stormwater Management And Road Tunnel (SMART Tunnel).

RHB Wealth Research remains neutral on the property sector, with a slight near-term positive impact. The lower minimum price for foreign ownership of high-rise properties (down to RM600,000 from RM1 million previously) should encourage foreign nationals to purchase from a wider pool of properties.

That said, the overall effectiveness of this policy will depend on how individual states take to the guideline. Currently, Penang and Selangor have different floor prices for foreign property buyers. Assuming all states follow the new standards, the team believes this will help ease the glut in the high-end property segment.

Looking to the Real Property Gains Tax (RPGT), there is no material change, beyond the revision in base year to Jan 1, 2013. Previously, the base year for the calculation of RPGT was set at Jan 1, 2000. This revision will result in property owners incurring less punishing RPGT bills when selling their properties. Historically, property prices had peaked in 2013, so by bringing forward the assessable market value for properties, the resultant RPGT bill should be lower.

With rent-to-own (RTO) schemes gaining ground, some RM10 billion in financing is set to be provided by foreign investors (FIs), with additional support from the government via a 30% (RM3 billion) guarantee. The scheme is meant to help prospective homeowners purchase their first home, valued at up to RM500,000. There will also be stamp duty exemptions on the instruments of transfer between the developer and FIs, as well as between the FIs and buyers who utilise the RTO scheme.

RHB Wealth Research is presently overweight on NBFIs, given the heavy focus that Budget 2020 places on protecting citizens in the B40 segment. The mySalam national health insurance scheme, rolled out by the government last year, has been expanded.

Under this scheme, some 3.8 million B40 individuals between the ages of 18 and 55, as well as their spouses, will receive free Takaful health protection. The scheme contains a one-off cash support of RM8,000 for recipients who are diagnosed with one of 36 critical illnesses, in addition to income replacement of RM50 a day, for up to a maximum of 15 days. Budget 2020 now sees this scheme expanded to individuals aged between 56 and 65, and covering up to 45 critical illnesses.

Meanwhile, RHB Wealth Research is neutral on the wider banking sector. In addition to its B40-friendly measures, Budget 2020 has been notable for the amount of assistance and initiatives earmarked for small and medium-sized enterprises (SMEs).

There are several proposals for SMEs in priority segments — those that are export-oriented, produce halal products or invest in automation and digitisation. The proposals include higher government guarantees and allocations, an annual interest rate subsidy of 2% to reduce SME borrowing costs, as well as significan’t amounts of support for the burgeoning equity crowdfunding and peer-to-peer (P2P) financing segments.

Currently, several banks are participating in Credit Guarantee Corporation Malaysia’s (CGC) guarantee schemes for lending to SMEs. According to RHB Wealth Research, Budget 2020’s proposals for even higher allocation and guarantee limits would support banks’ continued efforts to grow their respective SME loan portfolios.

Budget 2020 also reiterated Bank Negara Malaysia’s commitment to finalising the licensing framework for digital banks by end-2019 for public consultation. The final framework will be issued by the first half of 2020. As at June this year, Bank Negara revealed that more than 10 parties have expressed interest in setting up digital banks in Malaysia, including Singaporean unicorn Grab, and at least four banks.

Overall, there are positive momentum that the investors to look forward to.

To understand how to navigate this, speak to your RHB relationship manager to design a plan to tap on this investment opportunity.