So far, 2019 has been a volatile year for local investors. Amid a lacklustre investment environment, investors have also been hampered by external economic and geopolitical uncertainties. The FBM KLCI for instance, plunged to a multi-year low in late May.

This has led to an increased interest beyond traditional investments like equities and bonds, and into alternative assets like gold, as well as base and bulk metals.

Sharp falls in global equity indices in Q42018 and May this year have prompted rallies in gold and its related equities. Gold spot prices hovered between US$1,270.69 and US$1,340.94 for much of the year so far. But in late May, prices began climbing before peaking at end-June at US$1,423.44. Prices then eased off to US$1,384.19 on July 1.

According to Bloomberg, the drop in gold prices came on the back of a temporary trade truce between the US and China, with both countries agreeing to resume negotiations at the G20 Summit in Japan. Even so, gold bullion has significantly outperformed on the back of trade war concerns and top central banks (including the US Federal Reserve) adopting a more dovish tone on interest rates. Precious metals exchange Kitco reported June was gold’s best month in three years, with prices up nearly 8%.

Gold has historically been a very good diversifier for investment portfolios as it is uncorrelated to most markets. Recent moves have served to reinforce its status. RHB Asset Management Sdn Bhd says investor interest in gold exchange traded funds (ETFs) and gold equities has increased as concerns abound about equity markets throughout the world having peaked.

The firm believes gold prices are supported by a number of factors, and the case for higher prices is strengthening as political and economic uncertainties rise. The almost complete reversal of the US Federal Reserve policy since late last year has been a major driver of gold prices near term.

Expectations in November 2018 were still for a number of rate cuts in 2019, but now at least one cut by year end is expected, with possibly more to follow. This has led to a record number of bonds trading with a negative yield as markets search for safe havens.

The main headwind for gold prices in recent years has been the strength of the US dollar, which means gold in many other currencies is already at record levels deterring buyers in those countries. However, this could turn into a very motivation of these banks seems, atleast in part, to diversify away from US dollar assets such as treasuries and this is expect to be a long-term trend. “De-dollarisation” could prove to be a major positive driver of gold prices over the next few decades as governments and individuals look to diversify their reserves and the US dollar loses its status as the pre-eminent safe haven.

Investors looking to gain exposure to the precious metal could take a look at the RHB Gold Fund. Launched in April 2018, it is a feeder fund that invests into the iShares Gold ETF (CH). This particular ETF has been up and running since October 2009. Its May 2019 fact sheet says the ETF tracks the return of the gold spot price. According to Bloomberg data, year-to-date (as at July 11), it has returned 9.89%, while over 12 months, returns have been even better at 11.76%.

Having said that, one obvious key risk about the ETF is its exposure to just the one commodity. There is an added liquidity risk, whereby insufficient buyers or sellers prevent the fund from readily transacting in gold. Other risks include political or environmental events, transportation difficulties, as well as customs and fiscal restrictions, depending on the source of the gold.

RHB GOLD AND GENERAL FUND

Outlook of other precious metals

In addition to gold, there are opportunities emerging in base and bulk metals. Related equity counters could therefore provide investors with upside exposure. Metals prices look more likely to rise from current levels and the equities are poised to benefit as balance sheets are improving.

Eight years on from the peak in commodity prices, depressed commodities are now finding support thanks to renewed demand around the world, in addition to interruptions in supply.

Specifically, iron ore prices have been a major outperformer yearto-date, rising approximately 60%, due to the disruption of iron ore supply out of Brazil. In late January, a tailings dam belonging to Brazilian mining giant Vale suffered a catastrophic failure. This resulted in significant casualties and environmental damage, forcing intermittent production shutdowns to one of the world’s biggest iron ore producers.

More broadly however, base metals have been mixed as demand concerns have offset supply interruptions. For the second half of 2019, the key question is whether demand growth will continue to slow or will stabilise. Any resolution to the trade dispute would see an immediate uplift in prices, particularly for base metals. However, in the medium term, prices could trade sideways until a cyclical recovery takes effect. The risk though remains to the upside for many metals, not least because of an impending election cycle in the US. Meanwhile, both the US and China remain committed to maintaining growth, which should provide some support for base metals going forward.

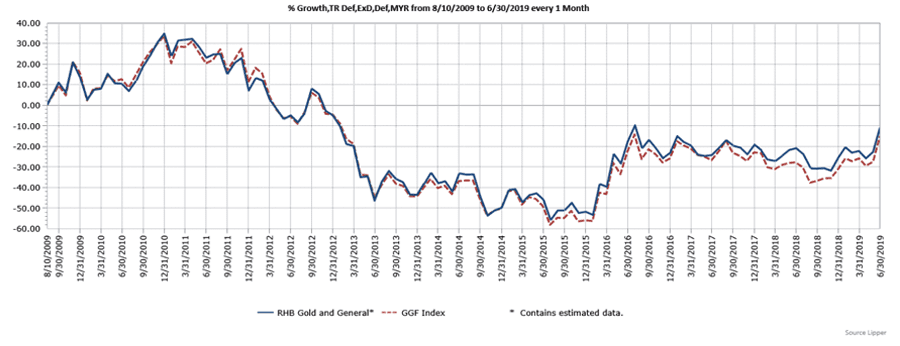

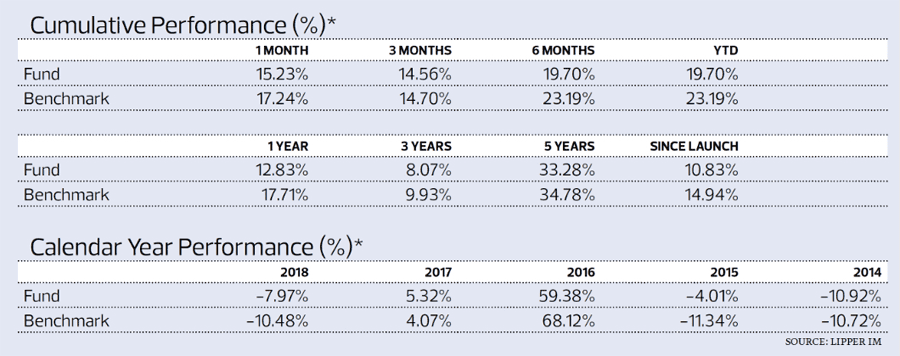

For investors seeking exposure to both gold and other base and bulk metals, there is an option in the form of the RHB Gold and General Fund. Another feeder fund, it invests into the United Gold and General Fund. According to RHB’s June 2019 fact sheet, the fund invests in companies that are primarily involved in the mining or extraction of precious metals, bulk and base metals, other industrial commodities, as well as oil, gas, coal and alternative energy.

The fund is nearly two-thirds invested into gold-based operations, with a further 21.4% committed to diversified metals and mining. In terms of country allocation, Canada tops the list at nearly 42%, comfortably ahead of Australia (22.74%), the United Kingdom (16.07%), and the USA (7.48%). Top stock holdings include Barrick Gold Corporation, Agnico Eagle Mines Limited, Newcrest Mining Limited, and BHP Group Plc.

According to Bloomberg data, the fund has returned nearly 18% year-to-date (as at July 11), while one-year returns are just under 10%.