Q2 2025: Resilient Funds for Uncertain Times

In our quarterly Fund Discovery series, we delve into current market conditions and provide insights and strategies to diversify your portfolio.

Listen and subscribe to the podcast hosted by RHB Bank’s Head of Investors Advisory, Nova Lui here to stay updated on the latest market developments.

Volatility may spell bad news for some, but with a keen eye (and some handy tips), fresh opportunities can emerge. Despite persistent market uncertainty, new investment opportunities are emerging across sectors, regions, and asset classes. As we step into Q2 2025, we continue to uncover strategies designed to weather volatility while positioning for long-term growth. Drawing insights from recent fund flows and market performance, we can see three key themes for investors: embracing market swings, adopting dynamic strategies, and accumulating quality assets with patience and precision.

Understanding the shifting landscape

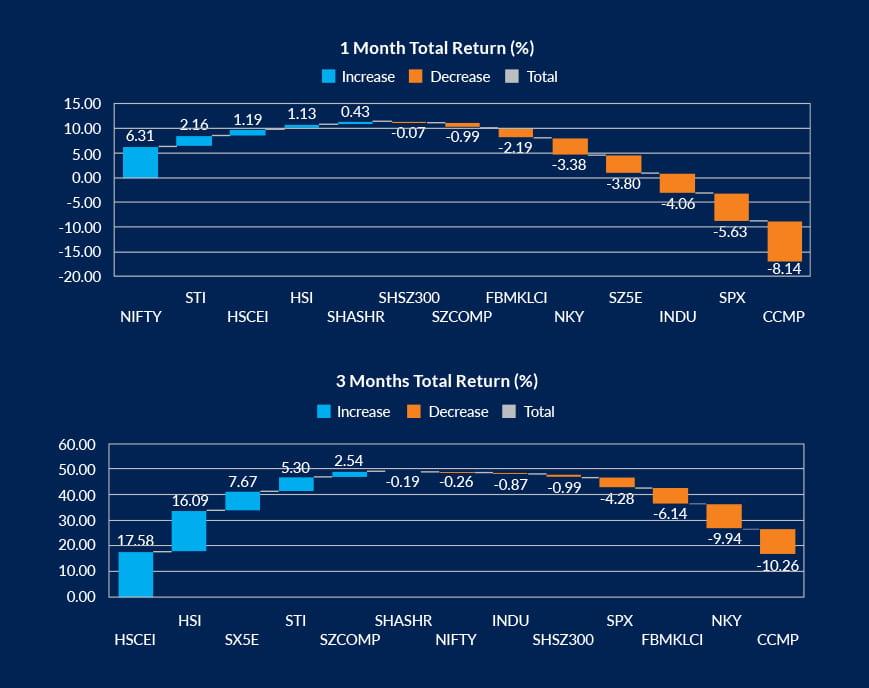

Emerging markets outpaced developed ones over both one-month and three-month periods, with the notable exception of FBM KLCI, which saw a decline. Developed markets, particularly US indices like the NASDAQ and the S&P 500, experienced headwinds, due to political instability and the renewed AI battle with China. As these markets contended with such challenges, investors turned to emerging markets, particularly India and China-related indices, suggesting a shift in focus towards growth opportunities in these regions.

Source: Lipper Investment Management as of 31 March 2025 ( Note CCMP also known as NASDAQ)

NIFTY’s strong showing over one month (+6.31%) reflects India's economic resilience, buoyed by robust corporate earnings in the IT and finance sectors, healthy foreign investment inflows, and supportive government policies that have strengthened investor confidence. On the other hand, NASDAQ’s decline highlights ongoing challenges within the U.S. tech sector, driven by high valuations and intensified competition from China’s DeepSeek AI, leveraging lower-cost, lower-end chips. In contrast, HSCEI surged 17.58% reflecting improved investor sentiment towards Chinese equities listed in Hong Kong. This rally was likely supported by stabilising economic policies, government stimulus measures, and a recovery in the Chinese stock market. Notably, the HSCEI index remains heavily weighted in Chinese technology stocks, benefiting from renewed market optimism.

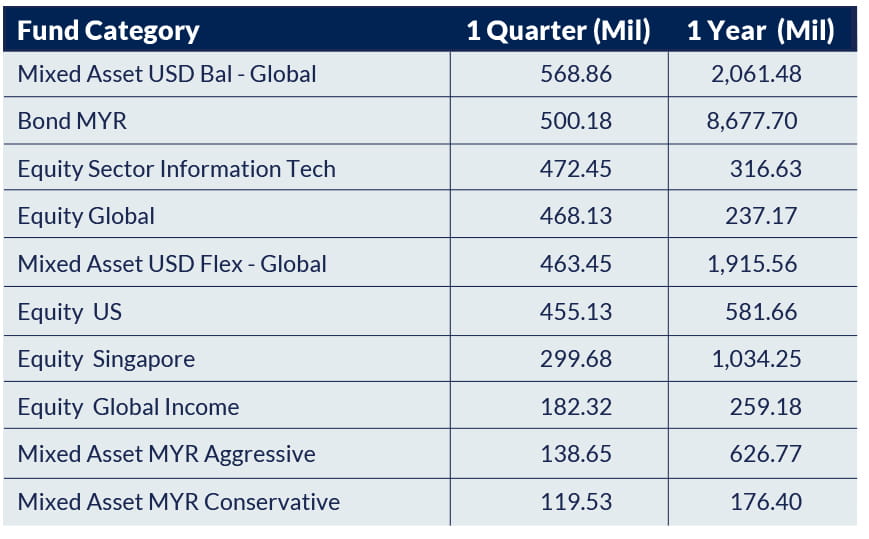

Let’s take a look at the fund flow in the unit trust industry.

Top In-Flows in Malaysia

Source : Lipper Investment Management as of 31 March 2025

Malaysian ringgit (MYR)-denominated bond funds, particularly Bond MYR, have emerged as the top recipients of investor inflows, supported by their stability amid a steady economic climate. Their lower-risk profile, predictable returns, and local currency exposure have made them attractive as a hedge against global interest rate uncertainty.

At the same time, USD-denominated global mixed asset funds dominated inflows, with the Mixed Asset USD Balanced – Global and Mixed Asset USD Flex – Global categories attracting RM568.86 million and RM463.45 million, respectively, over the last quarter. Over the past year, these strategies drew RM2.06 billion and RM1.92 billion, highlighting strong investor preference for diversified, globally exposed portfolios. This trend reflects a broader pursuit of stability, currency diversification, and tactical flexibility in a volatile environment.

Sector-specific funds also gained momentum, with Information Technology (RM472.45 million in Q1) and US equity funds recording notable inflows, signalling targeted confidence in tech growth and US market resilience—although this trend has been concentrated in recent quarters.

Notably, Malaysian investors have adopted a more defensive stance, shifting allocations away from equities and small-cap funds toward domestic mixed asset vehicles. This reallocation reflects a broader pivot towards capital preservation and balanced risk management amid ongoing market uncertainty.

Top Out-Flows in Malaysia

Source : Lipper Investment Management as of 31 March 2025

Over the past year, Asia Pacific and Asia Pacific ex-Japan equity funds led total outflows, recording a combined RM3.3 billion in redemptions. Greater China-focused equity funds also experienced significant net outflows, exceeding RM1.5 billion, highlighting ongoing investor concerns over China’s economic challenges and geopolitical tensions.

Meanwhile, domestic equity funds showed diverging trends: although Malaysia’s equity market recorded net inflows over the past year, Q1 2025 saw a reversal with outflows. This shift may be linked to increased scrutiny over semiconductor exports to China, prompting investors to recalibrate sector-specific exposures.

The broader asset allocation trend indicates a clear shift towards capital preservation. Equity and mixed-asset funds dominated redemptions, while bond funds experienced relatively muted withdrawals. Within fixed income, only Asia Pacific bond funds appeared among the top outflow categories, with RM439 million in redemptions.

Despite a significant rally in gold prices, funds in the Gold & Precious Metals equity category recorded only modest outflows, suggesting that investors engaged in tactical profit-taking rather than abandoning safe-haven assets altogether.

Investment Theme 1

Built for the Storm: Strategies That Benefit from Market Swings

This theme focuses on funds designed to thrive amid volatility and uncertainty.

RHB Global Equity Premium Income Fund: Income with Resilience

Why it stands out:

This innovative fund combines dividend-paying blue-chip stocks with an option overlay strategy to capture equity premiums. It thrives in volatile markets, offering both downside protection and upside participation.

What it offers:

- Targeted annual yield of 7%–9%, paid monthly

- Active sector diversification across companies positioned for earnings growth

- Lower volatility through its structure as a feeder fund into J.P. Morgan Asset Management’s actively managed ETF

Investors seeking stable, diversified income streams without sacrificing growth potential.

MAMG Systematic Asia Pacific Equity Absolute Return Fund: Adaptive Performance

Why it stands out:

A market-neutral, long-short strategy powered by advanced AI and BlackRock’s regional expertise, engineered to deliver positive returns—whether markets rise or fall.

What it offers:

- Dynamic exposure across Asia Pacific small- and large-cap companies

- Alpha generation by exploiting market inefficiencies

- Adaptability to shifting market conditions for consistent performance

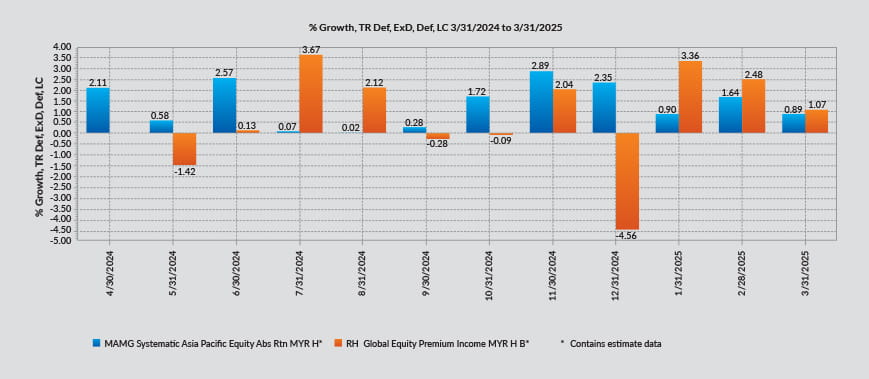

Source: Lipper Investment Management as of 31 March 2025

The Bottom Line: With consistent month-on-month returns over the past year, both funds exemplify robust, future-ready strategies—helping investors stay resilient, generate income, and grow capital even through market storms.

Investment Theme 2

Dynamic by Design: Systematic Approach with Flexible Exposure

In today’s fast-moving markets, flexibility is critical. Our second Q2 2025 investment theme spotlights strategies that adapt in real-time, led by AI.

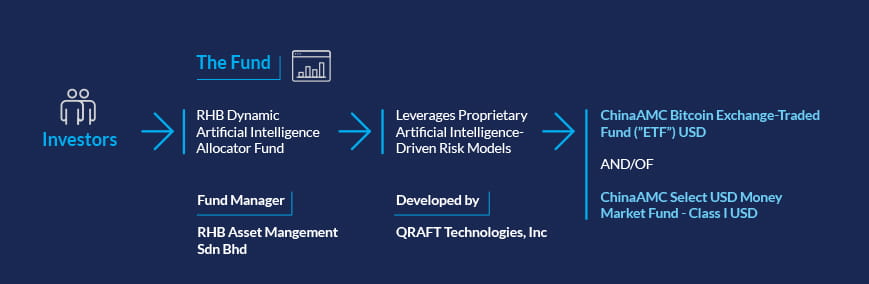

RHB Dynamic Artificial Intelligence Allocator Fund: Smart, Adaptive, Future-Ready

Why it stands out:

Malaysia’s first AI-driven multi-asset fund with digital asset exposure, built to dynamically respond to market shifts without human bias.

What it offers:

- AI-powered allocation across equities, fixed income, and digital asset ETFs

- Dynamic exposure between 0% and 100% based on market conditions

- Diversified, institutional-grade digital asset exposure managed by leading firms

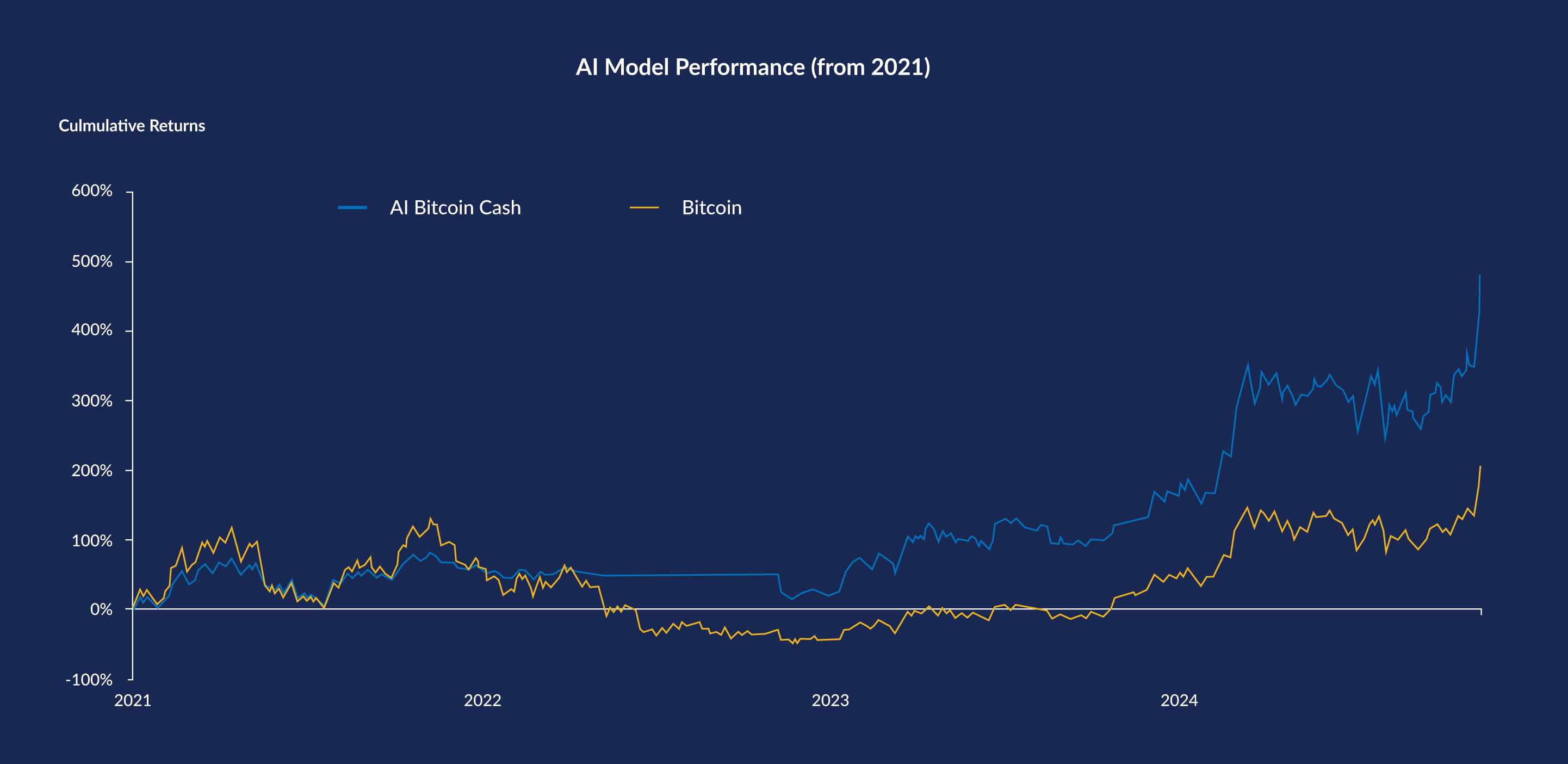

- Risk-managed growth, outperforming direct digital asset investments in back-tests

Who it's for: Investors seeking innovative, adaptive strategies to diversify portfolios, tap into digital assets smartly, and future-proof their investment approach.

The Bottom Line: As digital assets gain broader institutional acceptance, the RHB Dynamic AI Allocator Fund provides a cutting-edge, risk-conscious way to stay ahead in an evolving investment landscape.

Source: RHBAM, February 2025. For illustration and information purpose only. The indicative underlying may subject to change. Investment involve risks. Not all investment ideas referenced are suitable for all investors. Provided for information only, not to be construed as offer, research or investment advice. Opinions and statements of financial market trends are based on current market conditions constitute our judgement and are subject to change without notice.

Source: Refinitiv, QRAFT Technologies, November 2024. Model Portfolio: AI Dynamic Bitcoin-Cash. Past performances are not indicative of the future or likely performance and should not be construed as such. Investments involve risk. Not all investment ideas referenced are suitable for all investors. Provided for information only, not to be construed as offer, research or investment advice. Opinions and statements of financial market trends that are based on current market conditions constitute our judgement and are subject to change without prior notice. The views and strategies described may not be suitable for all investors.

Investment Theme 3

Patience and Precision: Buying Quality Stocks on the Dip

Timing matters—but quality matters more. Our third Q2 2025 theme focuses on disciplined accumulation of high-quality stocks, especially in AI and fast-growing markets.

RHB US Growth Fund: Seizing Tomorrow’s Leaders Today

Why it stands out:

A diversified, multi-sector equity fund targeting high-potential U.S. growth companies at attractive valuations—especially in the booming AI sector.

What it offers:

- Exposure to AI-driven innovation, semiconductors, and top U.S. tech giants

- Strategic entry points created by recent market volatility and tariff-driven pullbacks

- Strong fundamentals and future-ready companies selected through expert active management

Who it's for: Investors with a long-term horizon, looking to gradually accumulate leaders of the AI revolution and position themselves for sustained growth.

The Bottom Line: With a patient, selective approach, the RHB US Growth Fund helps investors build a resilient portfolio—ready to capture the next wave of global innovation and market leadership.

Source : Fund Fact Sheet as of February 2025

Manulife India Equity Fund: Tapping Into India’s Growth Story

Why it stands out:

India is one of the world’s fastest-growing major economies—with strong domestic demand, favourable demographics, and a market increasingly driven by local investors.

What it offers:

- Exposure to high-quality Indian companies across financial services, technology, and consumer sectors

- Strategic advantage as India remains more insulated from U.S.-China trade tensions

- Local market strength, with domestic ownership in equities surpassing foreign holdings for the first time

Who it's for: Investors seeking to diversify into emerging markets with strong fundamentals and a long runway for structural growth.

The Bottom Line: India’s dynamic economy offers fertile ground for disciplined investors. The Manulife India Equity Fund positions portfolios to benefit from this long-term growth momentum.

Source: Manulife Fund Fact Sheet as of February 2025

Seeking Stability: Opportunities in Australian Dollar Bonds

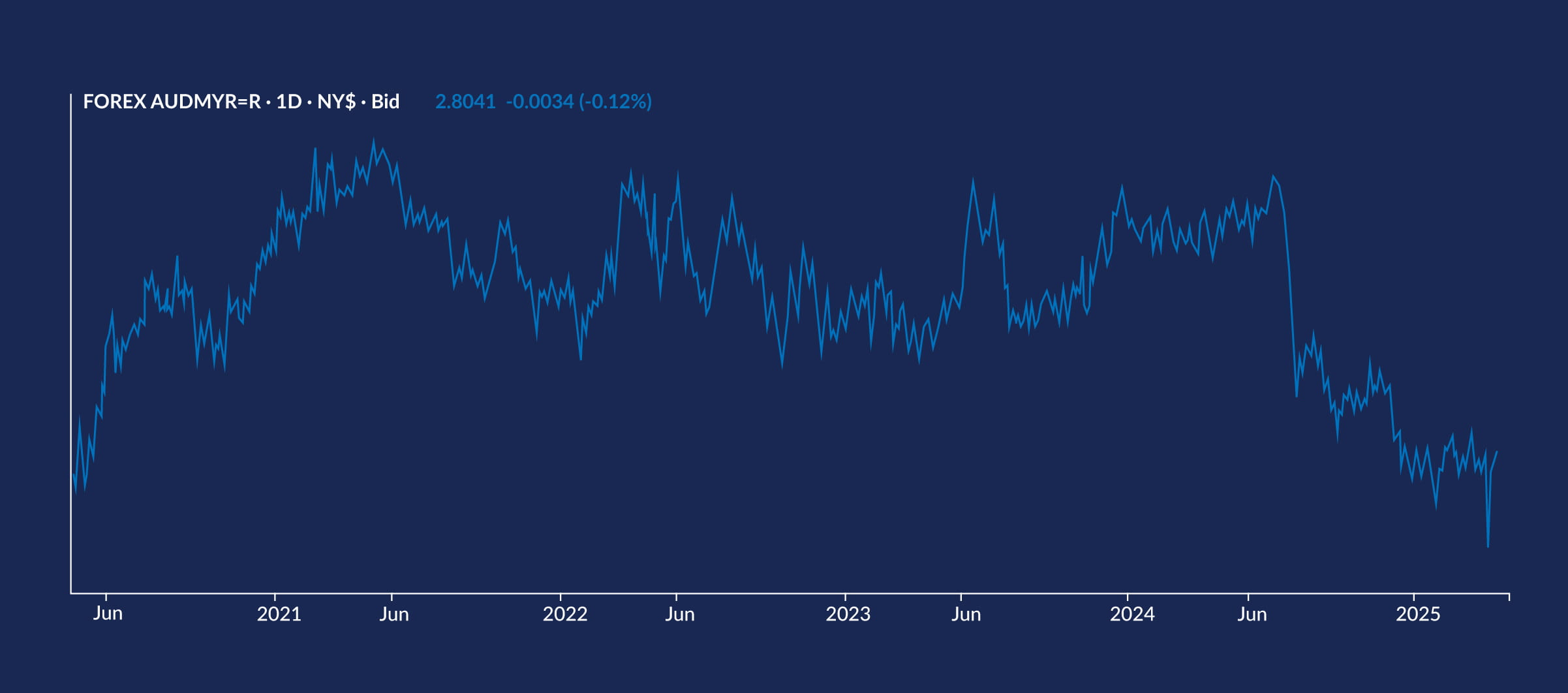

For conservative investors, stability matters—and right now, the Australian Dollar (AUD) presents a compelling opportunity.

Why it’s attractive:

The AUD is currently trading near a five-year low against the Malaysian Ringgit (MYR), creating a rare window for entry. As one of the G7’s stronger currencies, the AUD offers both currency stability and potential upside if it strengthens over time.

What it offers:

- Steady monthly income, with average bond coupon yields between 6.5% and 7%

- Capital gains potential if Australian interest rates are cut

- Diversification benefits through exposure to a developed market currency

Who it's for: Income-focused investors looking to enhance portfolio stability while tapping into favourable currency dynamics.

The Bottom Line: With attractive yields and currency upside potential, AUD bonds offer a timely solution for conservative investors seeking consistent income and capital preservation.

Source: Refinitiv Workspace as of 17 April 2025

Here’s an example of a portfolio made up of diversified AUD-denominated bonds from major financial institutions. It provides investors with steady monthly coupon payments while positioning for potential capital gains. Given the current currency valuation and macroeconomic outlook, this strategy offers a balanced approach to generating income and managing risk.

Source: Bloomberg as of 17 April 2025

Final Thoughts: Staying Resilient, Staying Ready

In a market shaped by volatility and rapid change, the right strategies make all the difference. Whether it’s capturing income amid market swings, embracing dynamic AI-driven allocations, accumulating quality growth stocks, or diversifying into stable currency assets, Q2 2025 offers diverse opportunities for investors at every risk appetite.

At RHB, we’re committed to helping you navigate the journey—building resilience today, and positioning for growth tomorrow. Contact your Relationship Manager today to discuss your strategy!

Disclaimer:

This article is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party, without obtaining prior permission of RHB Bank Sdn Bhd (“RHB”).

This article has been prepared by RHB and is solely for your information only. It may not be copied, published, circulated, reproduced or distributed in whole or part to any person without the prior written consent of RHB. In preparing this presentation, RHB has relied upon and assumed the accuracy and completeness of all information available from public sources or which was otherwise reviewed by RHB. Accordingly, whilst we have taken all reasonable care to ensure that the information contained in this presentation is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness and make no representation or warranty (whether expressed or implied) and accept no responsibility or liability for its accuracy or completeness. You should not act on the information contained in this article without first independently verifying its contents.

Any opinion, management forecast or estimate contained in this article is based on information available as the date of this article and are subject to change without notice. It does not constitute an offer or solicitation to deal in units of any RHB fund and does not have regard to the specific investment objectives, financial situation or the particular needs of any specific person who may receive this. Investors may wish to seek advice from a financial adviser/unit trust consultant before purchasing units of any funds. In the event that the investor chooses not to seek advice from a financial adviser/unit trust consultant, he should consider whether the fund in question is suitable for him. Past performance of the fund or the manager, and any economic and market trends or forecast, are not necessarily indicative of the future or likely performance of the fund or the manager. The value of units in the fund, and the income accruing to the units, if any, from the fund, may fall as well as rise.

Product Highlights Sheets (“PHS”) highlighting the key features and risks of the RHB Global Equity Premium Income Fund dated 22 April 2024, MAMG Systematic Asia Pacific Equity Absolute Return Fund dated 8 January 2024, RHB Dynamic Artificial Intelligence Allocator Fund dated 17 March 2025, RHB US Growth Fund dated 30 September 2024, and Manulife India Equity Fund dated 22 January 2024 (“Fund”) are available and investors have the right to request for a PHS.

The Manager wishes to highlight the specific risks of the RHB Global Equity Premium Income Fund are Fund Management Risk, Liquidity Risk, Currency Risk, Country Risk, Interest Rate Risk, Suspension of Redemption Risk, and Distribution out of Capital Risk. The specific risks of MAMG Systematic Asia Pacific Equity Absolute Return Fund are Concentration Risk, Default Risk, Counterparty Risk, Country Risk, Currency Risk, Derivatives Risk, and Investment Manager Risk. The specific risks of the RHB Dynamic Artificial Intelligence Allocator Fund, which are Liquidity Risk, Currency Risk, Country Risk, Interest Rate Risk, Credit and Default Risk, Financial Derivatives Risk, Equity Risk, Equity-Related Securities Risk, Collective Investment Schemes Risk, Concentration Risk, Distribution Out of Capital Risk, and Risk of Over-Reliance on the Artificial Intelligence Risk Model. The specific risks of RHB US Growth Fund, which are Fund Management Risk, Liquidity Risk, Currency Risk, Country Risk, Financial Derivatives Risk, Credit and Default Risk, Interest Rate Risk, and Suspension of Redemption Risk. The specific risks of Manulife India Equity Fund are Manager’s Risk, Market Risk, Loan or Financing Risk, Suspension/Deferment of Redemption Risk, Country Risk, Currency Risk, Liquidity Risk, Risk Considerations for Investing in Derivatives, Target Fund Manager Risk, Stock Specific Risk, Taxation Risk/ Withholding Tax Risk, and other general risks are elaborated in the Information Memorandum.

Retail Bond is not a principal guaranteed product. The holder of the investment is assuming the credit risk of the issuer of the investment. In the event of winding up, liquidation or rating downgrade of the issuer of the investment or if you sell the investment prior to maturity, you will suffer a potential capital loss. Investor should obtain, read and understand the Product Highlight Sheet of the Retail Bond carefully before you make a decision to acquire the product. All information provided in this document is general and does not take into account of your individual objectives, financial situation or specific needs. The printed copy of Product Disclosure Sheet is available at RHB branches/Premier Centre and investors have the right to request for a Product Disclosure Sheet.

This article has not been reviewed by the Securities Commission Malaysia (SC).

RHB Bank Berhad 196501000373 (6171-M)