Dynamics in the global forex (FX) space have significantly altered the direction of the US Dollar, mainly on the back of the recent statement announced by the Federal Reserve (Fed) as well as the erosion of the currency as a risk aversion tool. Based on the latter (which latter is this referencing?, the Dollar ), we note the Euro and gold have joined the bandwagon of safe haven instruments such as the JPY and Swiss Francs, as internal and external factors previously impacting growth in the US economy have changed course. This gives markets the perfect excuse to unwind long Dollar positions.

Fed’s easing stance longer than expected

The surge in coronavirus cases in the US is beginning to weigh on economic activity, and the Fed is aware this will hae a repercussion on its economic growth prospects. That said, the Fed’s indication that it would “do what we can, and for as long as it takes,” to limit damage and boost growth, is a clear signal that the US monetary policy outlook is on an easing mode for as long as it takes to revive the economy. Without a specific time frame to shift to neutral stance, markets are beginning to price in the fact that relative monetary policy play between the Fed and the rest of the world points towards a reflating of the US economy via an easing stance.

In its latest meeting, the Fed’s policy statement has directly tied the US economic recovery to the resolution of the health crisis, which does not seem to be abating (more than 150,000 Americans have died from Covid-19). Fiscal programs which the government credits with sustaining consumer spending in recent weeks are about to expire, with debate still under way in Congress over what, if anything, will take their place. A key concern is that things are getting murkier with the Presidential elections looming, even if further stimulus is passed. The election risk in November is becoming an outlying factor for markets to price in, as the direction of trade policies may swing around if Joe Biden becomes the next President. And that’s another risk for markets.

Erosion in Dollar as risk aversion tool

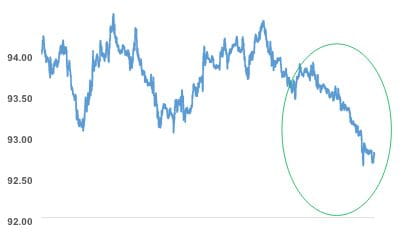

With major internal factors weighing on the Dollar outlook, the external environment has shifted gear. Initial trade disputes between Washington and Beijing has snowballed into a blame game on the Covid-19 outbreak, geopolitical tensions – in particular the South China Sea dispute – and the imposition of the new security law on Hong Kong by Beijing, which Washington is not too happy about. The Dollar, which was viewed as a risk aversion tool during troubled period in markets, has significantly weakened, taking out some very strong technical support lines, in particular the 95.0 level on the index. RHB Wealth Research envisages another 5 ¼ % decline ahead for the Dollar as it heads to the 88.25 level (last seen on February 2018), which indicates that the rest of the G10 and Asian currencies are in full throttle to exploit the Dollar weakness.

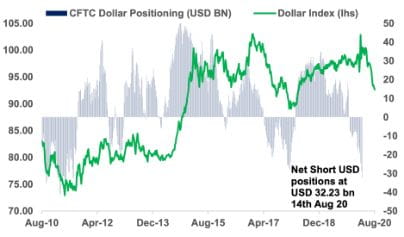

Short Dollar Positions increase

While markets digest the daily drivers of FX moves, net short USD positions seem to be accumulating each week, signaling that the bearish trend for the Dollar is not going away anytime soon. Net bearish bets on the USD grew to their largest since May 2011, and FX spot trading in recent days suggest the position has only grown further since (see Chart 1). Speculators’ net bearish bets on the USD grew in the latest week (can we insert an “as at date” here? as of 14th August ) to the largest bearish position in the last 9 years, according to U.S. Commodity Futures Trading Commission data. Dollar positioning posted a net short of $32.23 billion, up from a net short position of $28.87 billion a week earlier. Extended short dollar positions risk a sharp pull back if the Dollar downside stalls further, but for now the negatives for the Dollar are mostly still in place.

Dual Currency Investments (“DCIs”) are commonly used over one to two week periods to obtain higher interest yields than conventional fixed deposits - nowadays in excess of 10% per annum due to heightened volatility in the market. It is purely a cash product. It is an investment whereby the investment amount, for example in USD, could be returned back to the investor in the alternate currency, for example Euro, at a preferential exchange rate. Investors could then apply ‘roll-over’ strategies to reconvert the Euros back to USD at a new preferential exchange rate, again with returns above 10% per annum. This repeats with the general view that investors will ultimately benefit from Euro over a medium term as it strengthens. Consistently well placed DCIs allows investors to achieve enhanced returns on their monies over and above the returns if directly invested into the currency. The short investment turnaround time also allow investors to mobilise new strategies much more quickly in these uncertain times.

At RHB, we do provide a range of wealth solutions for different clients’ risk profiles. Our relationship managers and Investment Specialists are able to work with you to match your investment profiles with the recommended investment strategies using the latest financial tools and insights available in the market. For more insights, consult our investment specialists by contacting a relationship manager.