Strategic Shifts in Q2: Income and Value Opportunities in a Broadening Market Rally.

In our quarterly Fund Discovery series, we delve into current market conditions and provide insights and strategies to diversify your portfolio.

Listen and subscribe to the podcast version hosted by RHB Bank’s Head of Investors Advisory Nova Lui here to stay updated on the latest market developments.

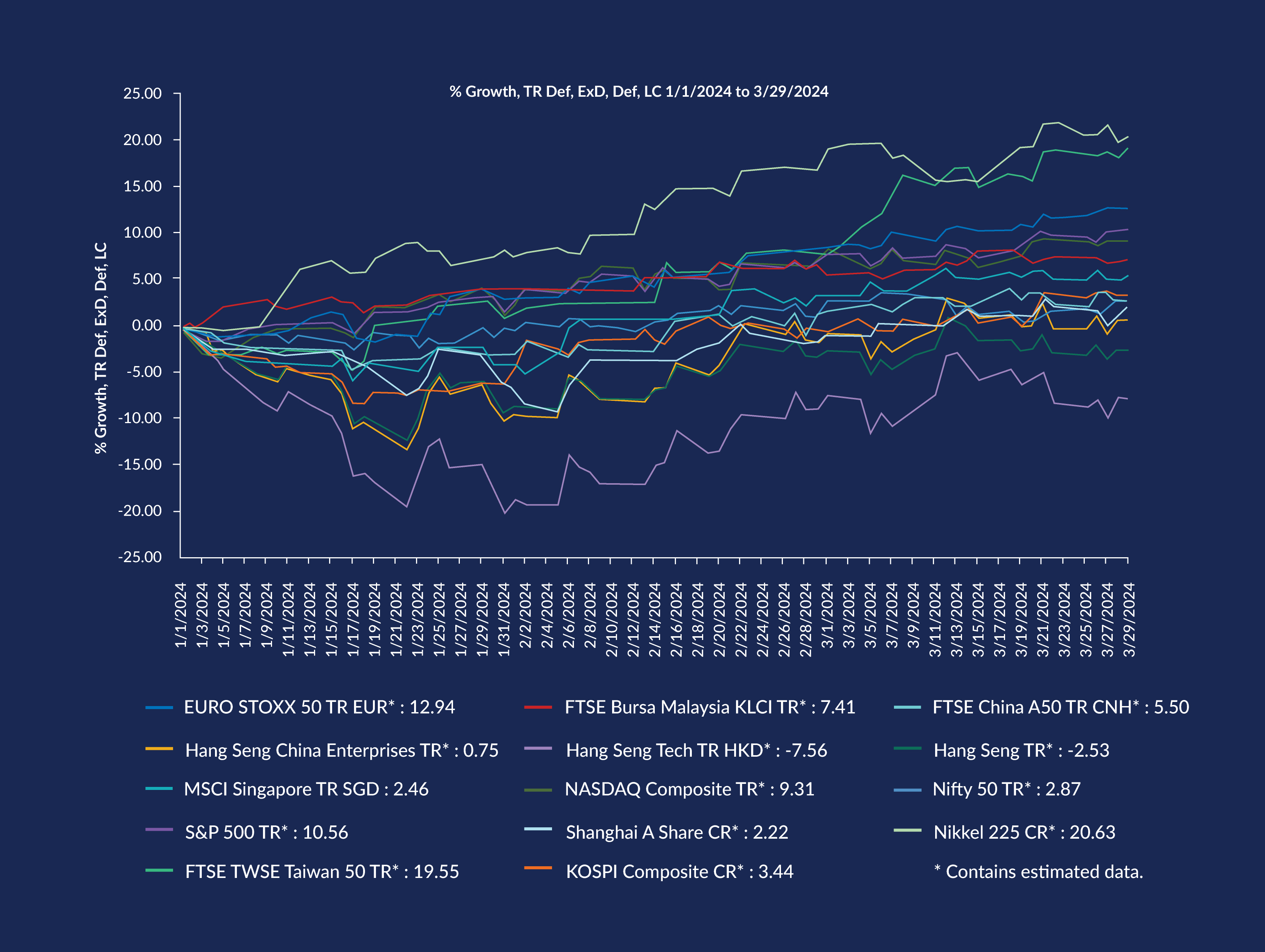

The first quarter of 2024 was a barrel of surprises. The major recession on the tips of our tongues was tactfully avoided, interest/profit rate cuts were pushed back, and the stock markets ended the quarter on a high note. As AI transitioned from buzzword to norm, technology stocks led gains in the equities space, while value stocks also claimed their fair share of attention.

In the equity market rally, developed markets such as Japan and Europe outperformed US equities. Within the US market, the S&P Index outperformed NASDAQ. Meanwhile, Taiwan proved a star player in emerging markets.

Source: Lipper Investment Management as of 31 March 2024.

The picture was not as rosy for Hong Kong, where blue-chip stocks saw a decline. However, both the Hang Seng China Enterprise and Shanghai A Share indices ended the quarter on a slightly more positive note, gathering momentum in the second month, although it wasn’t anything to write home about. The lacklustre performance of the Chinese markets was attributed to the absence of significant stimulus measures from the government and concerns surrounding the financial health of property developers – the latter being a valid concern considering the collapse of the Evergrande Group.

Overall, Chinese equity funds showed support and signs of recovery, buoyed by their better value compared to the rest of the global equity market. Malaysia also proved to be attractive, with the market’s relative stability as its main selling point.

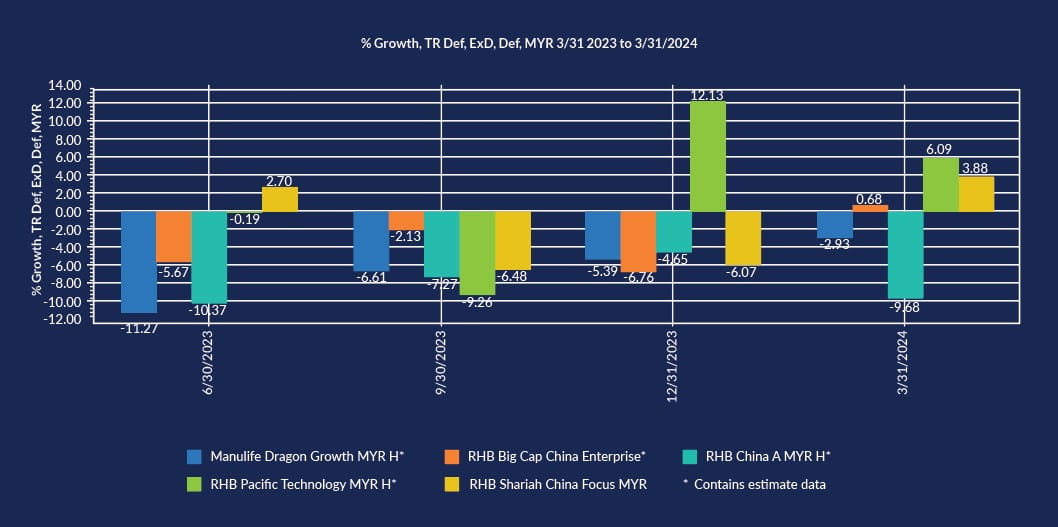

Source: Lipper Investment Management as of 31 March 2024.

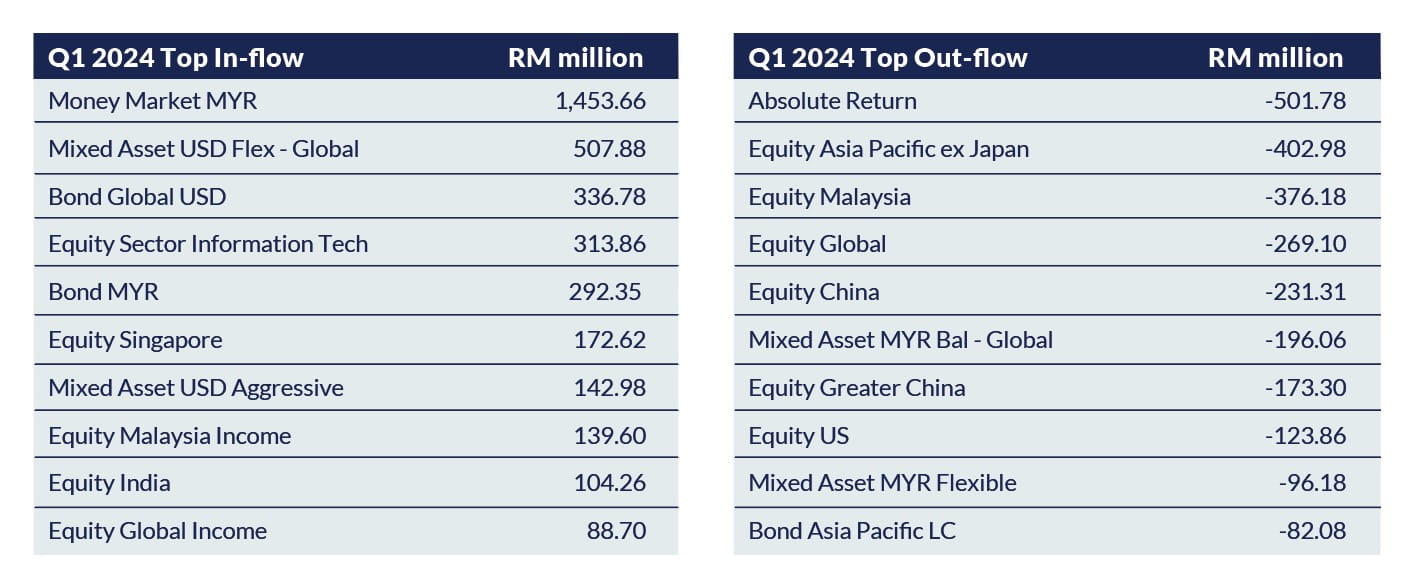

To understand investors’ thought process, let’s look at how the money travelled in Q1.

Source: Lipper Investment Management as of 31 March 2024.

Most investors aimed for exposure, either through mixed assets or pure fixed income funds, to lock in the high fixed income yield in anticipation of aggressive rate cuts. Investors in mixed assets played safe, preferring the global space which would allow them to ride on any potential upside in equities while still keeping a hand on fixed income as a buffer. In terms of markets, the top three single-country funds were Singapore, Malaysia, and India.

Disappointed by its performance over the past year, investors exited the Absolute Return Fund, favouring a more focused exposure in spaces like the global technology market. A similar theme switch can be seen in the movement from global equities to a more singular strategy or sectoral theme, such as income, dividend, or technology.

The first quarter was marked the third consecutive quarter of net outflows from the China equity fund, as investors sought alternatives based on the China+1 story, investing in countries like India.

Key investment themes for Q2

As we enter the second quarter the question on everyone’s minds is: will the bull continue its rampage? To provide some insight, these are the three key investment themes we should pay attention to in Q2 2024.

1. A broader equity rally

Although AI remains a hot topic, fund managers are envisioning a further rally extending beyond the technology sector. While the equities market remains bullish, investors may look into areas which are more fairly valued and offer downside protection. In other words, keep your investor ears tuned out to the hype.

2. Income is IN

We see increasing inflow into “safer” strategies like REITs, dividends and income, which offer attractive yields while allowing the investor to enjoy any potential upside in the equity market. The income is handy as a buffer against any downside, while potential rate cuts could see appreciation in the equities space.

3. Value in emerging markets

Here’s the hidden dragon. Overall, the Asia Pacific equities market has shown resilience, and investors are showing interest in India and the ASEAN region, riding on the China+1 story. Malaysia offers an attractive entry point, with the advantage of being the familiar home turf.

Based on these themes, we’ve handpicked a few funds for you to diversify your portfolio with.

TA Global Absolute Alpha-i Fund

Source: Fund Fact Sheet as of 29 February 2024

Why we like this fund:

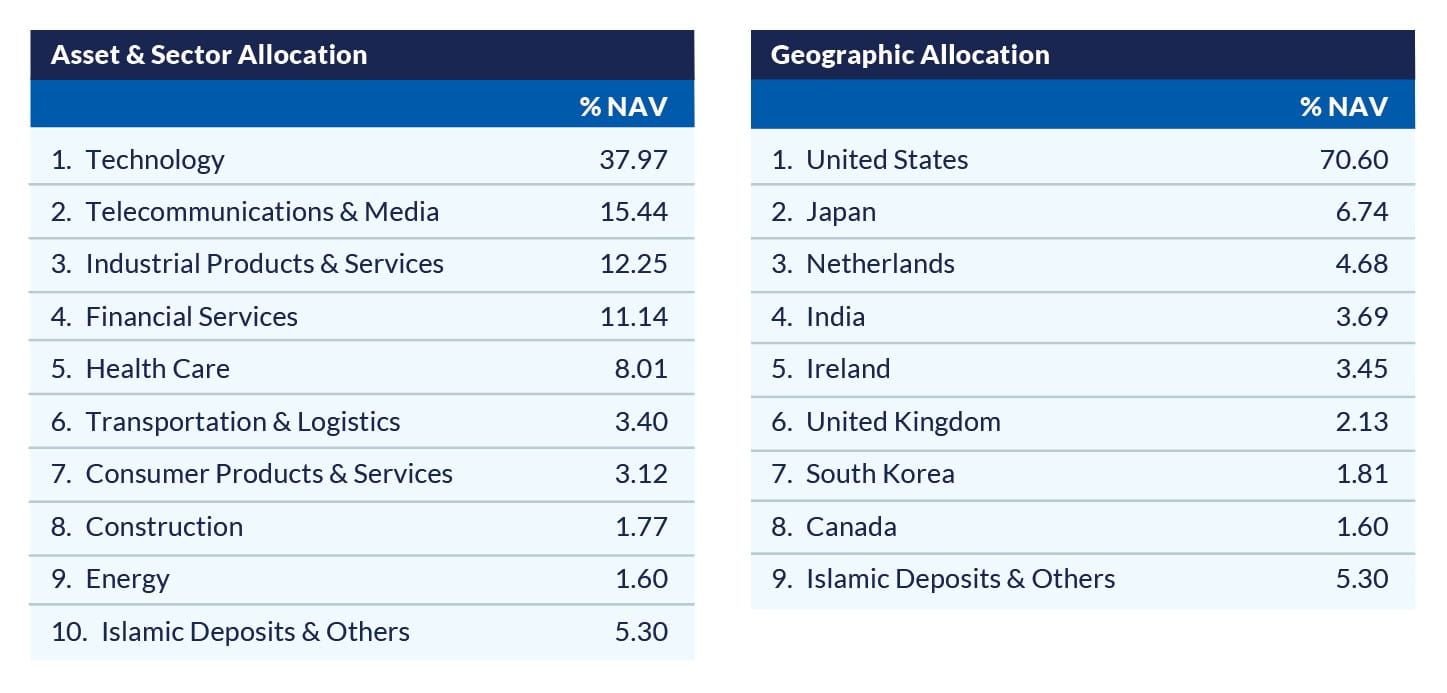

The bull will continue its run in the global equity space, but there will be a broadening out to other markets. Investors will benefit from a strategy that isn’t constrained by a benchmark. The fund mandate allows for bottom-up stock picking that is geographically agnostic. Besides the US, this fund has a relatively high exposure in Japan and Europe, and India and South Korea are in the top rankings, too.

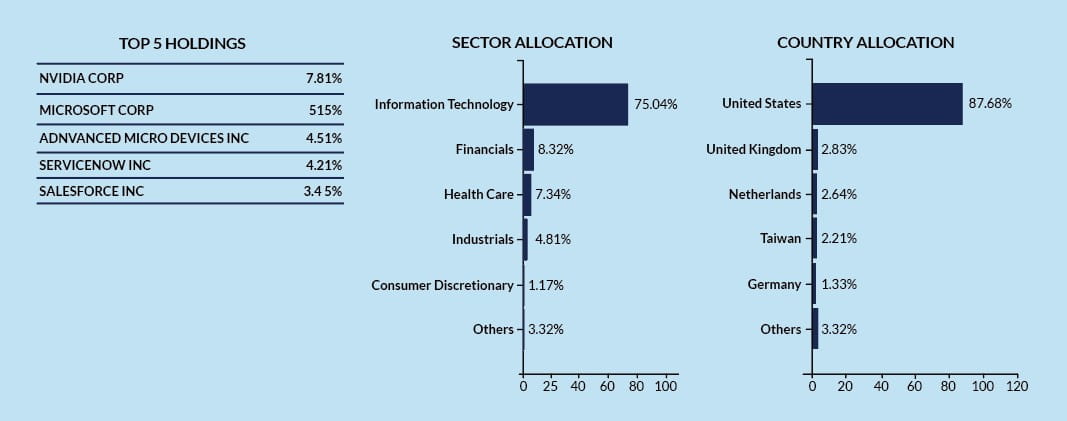

RHB i-Sustainable Future Technology Fund

Source: Fund Fact Sheet as of 29 February 2024

Why we like this fund:

With the technology sector's solid track record so far in delivering consistent returns, it’s hard to ignore it. However, it would be wise to consider a more diversified approach for a better risk-return ratio. As proof, even the Magnificent 7 stocks haven’t all ended up in positive territory. The fund’s external manager is Janus Henderson, known for their extensive experience in managing global technology funds. Their expertise would be put to great use in stock picking.

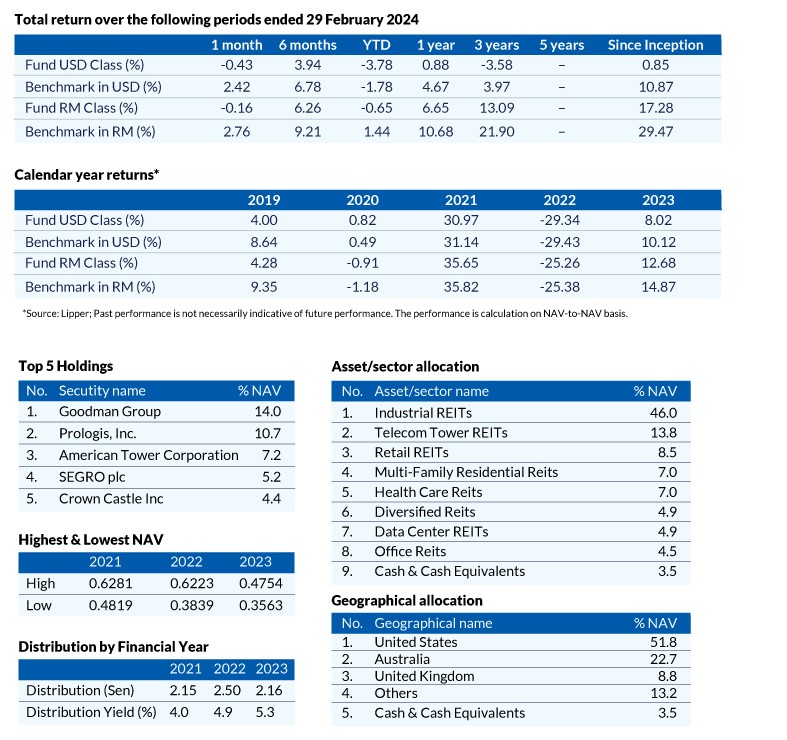

Manulife Shariah Global REIT Fund

Source: Fund Fact Sheet as of 29 February 2024

Why we like this fund:

Moving on to the income theme, this fund remains a great option for diversification. Due to the increasing pressure of rate hikes over the past two years, the fund has placed pressure on many income assets. With a pivot in interest/profit rates looming on the horizon, this fund is well-positioned to still provide the opportunity to accumulate income assets for long-term potential growth. REIT holders typically enjoy both the benefits of capital gain from the equity market and income payouts.

RHB Global Equity Premium Income Fund

Source: J.P. Morgan, RHBAM, March 2024 For illustration purposes only. The manager seeks to achieve the stated objectives. There can be no guarantee the objectives will be met.

1This is not a guaranteed annual payout. The Fund Manager may in the future review the distribution policy depending on prevailing market conditions.

Why we like this fund:

This is a new fund that we will be launching, but that’s not the only reason why we like it. This fund forms the core of our Income Investing strategy, and targets 7-9% per annum (paid out monthly). It aims to achieve a consistent payout from underlying dividends and collecting option premiums. At the same time, the fund also benefits from the upside potential of the underlying equity portfolio, which is actively managed by the J.P. Morgan Global Premium Income Investment Team.

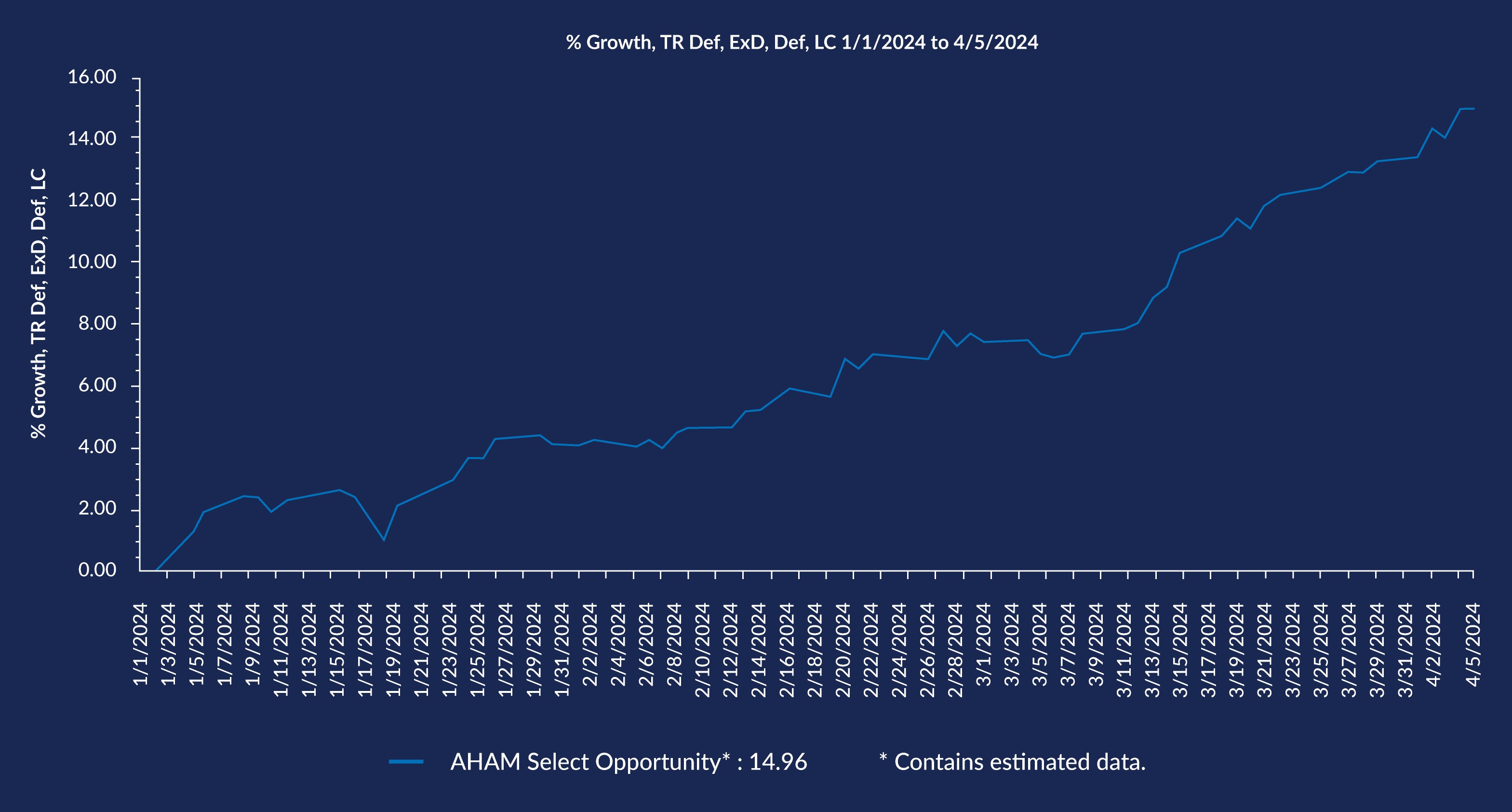

AHAM Select Opportunity Fund

Source: Lipper Investment Management as of 31 March 2024

Why we like this fund:

While it isn’t as attractive compared with a global technology fund, there is still plenty of merit here considering its relatively low volatility and gradual upward momentum, with returns averaging close to 15% annually. Since its launch, annualised returns stand at 11.3% offering a good opportunity for long-term growth in a more fairly valued emerging market space.

Finally, to reiterate our point on the grass being just as green on this side, investors should take the opportunity to relook into Malaysian funds. The entry point is attractive, and the weaker ringgit will be hard for foreign investors to resist. The Rapid Transit System (RTS) and other infrastructure projects are a good prospect to boost sentiment, backed by a relatively accommodative monetary policy.

Investing is dynamic, so keep your eye on market conditions and regularly review your portfolio. Get in touch with your Relationship Manager to see which of the options we mentioned would best suit your risk profile and goals.