Beating the inflation of education

"Pursuing a college degree,

regardless if it is a bachelor’s,

master’s or PhD can be a costly

investment for both students

and parents."

Education & Funds

Pursuing a college degree, regardless if it is a bachelor’s, master’s or PhD can be a costly investment for both students and parents. It is also undeniably a key stepping stone to a lifetime of gainful employment. As a parent, you can help your child by planning for their future.

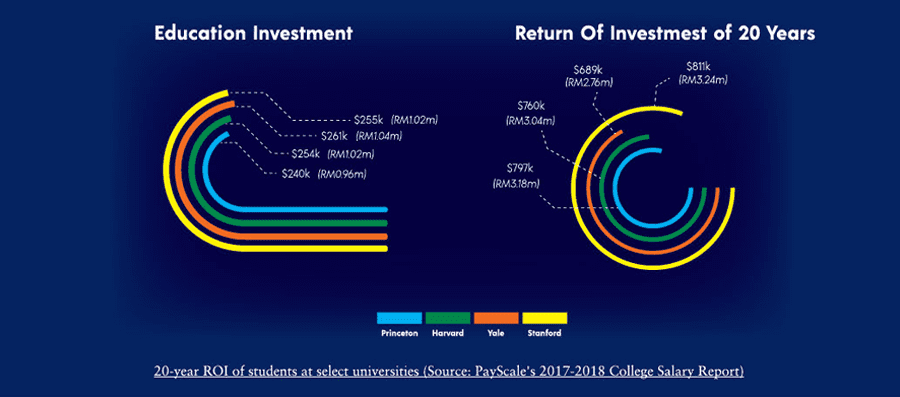

According to current-day estimates in PayScale’s 2018 College ROI Report, a four-year degree from Princeton University will cost around US$240,000 (approx. RM954,960) for a four-year degree. For many preferred private universities abroad, this cost is similar. There is also the option to be closer to home instead. Malaysia offers Twinning programmes with many foreign universities. For example, Sunway University has partnerships with American and Australian universities such as Western Michigan and Victoria.

You can also choose to enrol at the Malaysia campus of some foreign universities such as Monash or University of Nottingham.

Yet to choose these could possibly ignore some of the intangible benefitts that an overseas education might afford. For example, an immersion in native English language speaking societies, exposure to cultures other than their own, and the chance to be more independent as young adults. Although not all Malaysians will want to study abroad, an Anderson Market Analytics survey has indicated that more than 70% of students polled want to study overseas.

Irrespective of the choice of local or overseas education,being aware of the cost of higher education is one step in the right direction towards planning for your child’s future.

Irrespective of the choice of local or overseas education,being aware of the cost of higher education is one step in the right direction towards planning for your child’s future.

The Cost Of Higher Education Is Rising

Data collated by USA Today indicates that the top 50 private universities raised their tuition by an average of 3.6% for the 2017-2018 school year. In the United States, Federal data shows that since 1990, the cost of education has been growing at a rate roughly twice that of overall consumer prices. Yet this rising cost is not limited to just the United States. For example, the United Kingdom has just last year passed new legislation allowing universities to raise fees annually. Australia has seen private education costs rise by as much as 61% over the last decade.

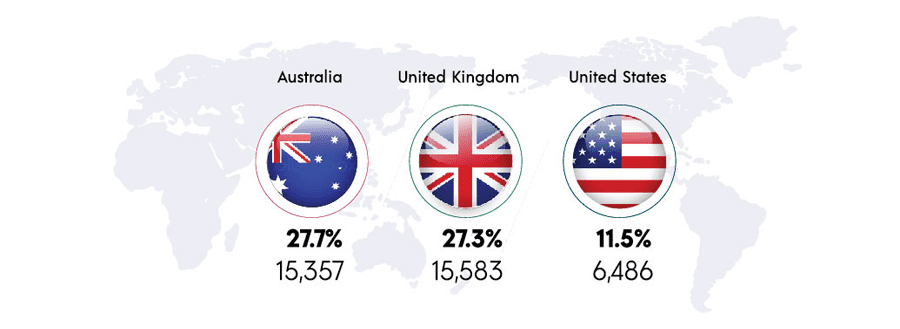

Project Atlas has found that these are the top three destinations favoured by Malaysians studying abroad The

College ROI is determined by comparing the combination of cost of attendance and earning potential in a 20 year

period after graduation. https://www.payscale.com/college-salary-report/methodology

Start Planning Your Child’s Education Fund

The options available to you vary depending on how young your child is. Either way, the key difference would be in your investment choices and strategy. Starting early often means a lesser burden on your finances because you can start with smaller investments. However, if things are getting urgent, all is not lost. If your child is young and time is on your side; Acting now can lead to a much smoother trip down the education highway.

Unit Trust Funds are the perfect way to not only diversify your portfolio, but to steadily build an income stream over time. Unit Trust Funds not only allow you to start off with low initial investments, but also offer a reduction in investment risk through diversification. Also, by investing in Unit Trust Funds, your money is pooled with that of other investors, allowing you to potentially benefit from opportunities that might not be possible for individual investors. For those interested in something slightly more traditional, there are also choices for you. Take for example investment-linked offerings. These plans offer insurance coverage while at the same time letting you grow your wealth through managed funds aimed at maximizing potential medium to long term returns. No matter your choice, you will be able to rest assured that your financial future is in great hands, thanks to professional fund managers with a proven track record in managing high volume of funds.

If you’re starting off late and beginning to worry; Relax, you can still make it!

Dual Currency Investment allows you to link your investment to the performance of a pair of select currencies. This tool of investment is something that you can leverage on to potentially benefit from higher returns compared to traditional deposits.

Irrespective of the choice of local or overseas education, being aware of the cost of higher education is one step in the right direction towards planning for your child’s future. Dual Currency Investments are short-term, high potential yield products. They also present the opportunity to diversify your existing investment portfolio.

Choose the Right Solution for Your Needs

Bridging the gap between the rapidly rising cost of tertiary education abroad and your financial independence is without a doubt challenging for parents. The cost of sending your children abroad may seem disheartening or even downright scary, but it isn’t impossible to achieve.

With the right RHB Wealth Management solution you’ll be able to not only be able to manage this need, but also pave the way for a brighter financial future. RHB offers a wide range of more than 100 professionally managed Unit Trust Funds as well as investment-linked plans such as RHB Essential PrimeLink.

If you’re still unsure about how to proceed or what might best fit your needs, we encourage you to call your RHB Relationship Manager today for advice.

Remember, your child is precious, so why not start planning today?