Opportunity in EM bonds

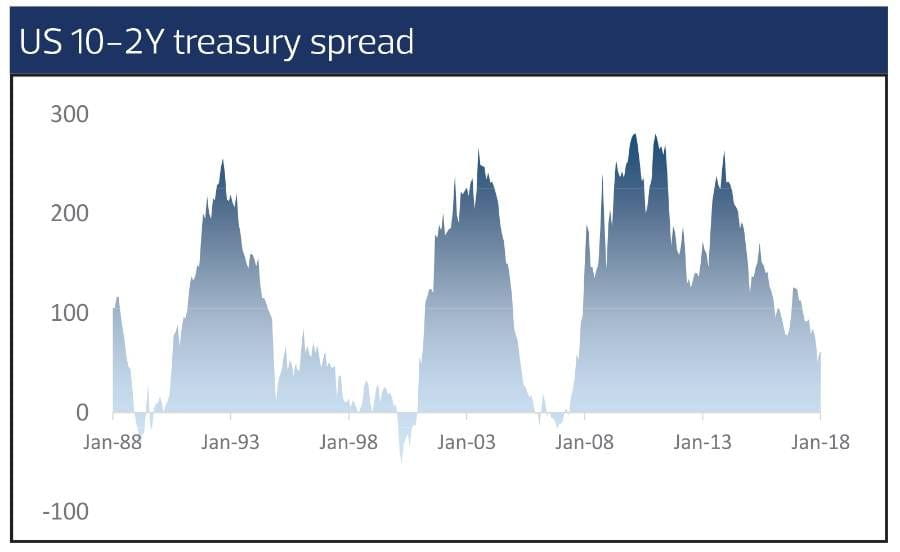

US Treasury yields are expected to spike in 2018, according to the RHB Wealth Research team, followed by European and Japan government bond yields. Bond prices will then be pressured accordingly. The fall in bond prices might take place simultaneously with the correction in share prices as the US market undergoes its long overdue correction in which witnessed in February.

On the other hand, investors should be cautious of the fixed income space and allocate more to shorter duration instruments to limit their exposure to rising rates, warns the RHB Wealth Research team. Credit spreads for Investment Grade (IG) and High-Yield (HY) bonds against the Treasuries are hovering at their lowest levels since the previous peak in early 2016. The credit market is also now pricing in economy stability and the slow and shallow path of normalisation. The spreads within US IG and US HY is now at 230 bps (the historical low is at 160 bps). At this point of time, the team prefers IG bonds against the backdrop of reduced compensation for credit risk.

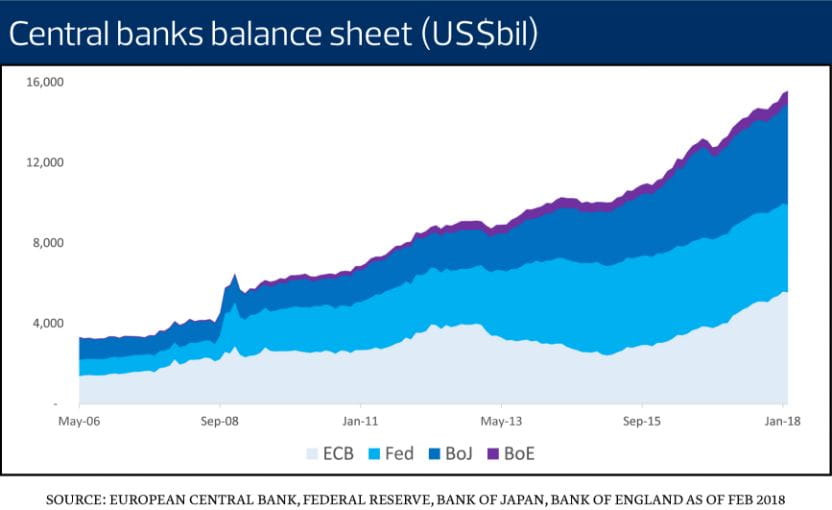

However, the team underweights US, Euro and Japan bonds. Instead, emerging market (EM) bonds are preferred over developed market (DM) bonds as central banks in the EM region have not cut rates as much compared to those in DM. There is lower risk of a rate hike so there are more reasonable risk-adjusted opportunities within the EM. The team also suggest investors to underweight sovereign bonds — especially those with negative yields — because their valuations are distorted.

Better opportunities in non-US stocks

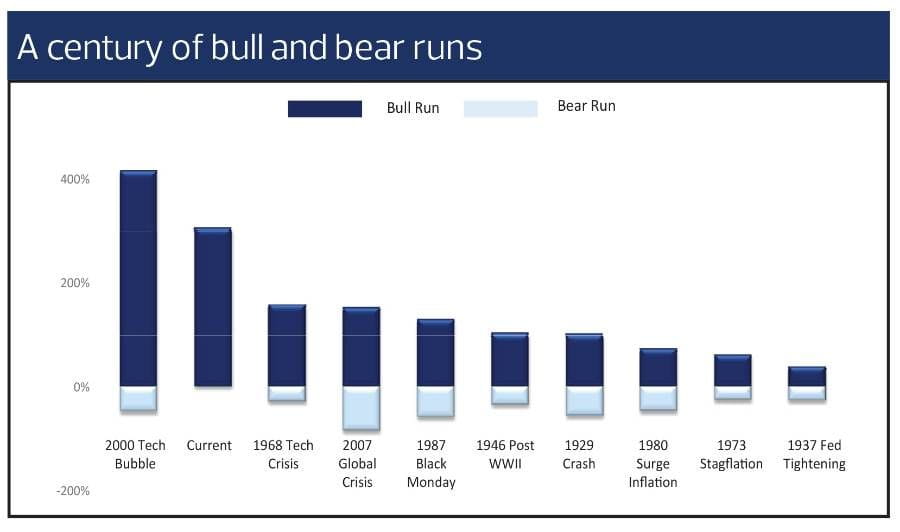

With regards to equities, the RHB Wealth Research team prefers large cap stocks rather than small and mid-cap stocks due to its stability. This is in line with the team’s view that volatility will return in 2018 after a rally in 2017, with the US stock market delivering a Sharpe ratio of close to 4.0.

US stocks are now more expensive than non-US stocks and with the mean reversion likely to happen this for non-US stocks. This is reflected by the rapidly increasing earnings momentum outside the US. The RHB Wealth Research team believes that the transformation in China and India will likely to lead the Asian equity market registering relatively higher returns. The bullishness for EM equities is echoed by Grantham, who has called for investors to own as much emerging market equity risk as they can handle.

In terms of sectors, the RHB Wealth Research team prefers energy stocks with a strong conviction given the broad-based recovery in energy prices. It will benefit profit margins of the companies, who have become leaner after years of transformation. Other sectors such as banking are also poised to benefit from higher interest rates and growth in economic activity. The team is optimistic on evergreen sectors such as healthcare, as there is growing concern regarding rising healthcare costs throughout the past decades. On the other hand, the team suggests investors avoid utilities and telco services that have lesser upside catalysts; and to grab the correction as buying opportunity. Correction shall be deemed as healthy as long as the fundamental remains solid.

Diversify into alternative investments

To achieve the benefits of diversification, investors can set aside some percentage of their portfolio and venture into alternative investments (structured products) and commodities, such as gold and oil. Major banks including JP Morgan and Bank of America Merrill Lynch have raised their Brent crude oil price targets for the year as they expect oil prices to recover after a weak performance in 2017. The asset allocation towards equity, fixed income and alternative assets such as commodities will depend on the individual’s risk appetite. Investors with a higher risk appetite can consider increasing their exposure to equities andcommodities.

For investors who want to gain exposure to these trends and themes, they can check out the wide range For instance, investors who want to gain exposure to the theme of rising commodity prices can do so via the Dual Currency Investment product Investors can also gain exposure to global synchronised growth by investing in global equity, global mixed asset and/or global fixed income via a wide range of product suites in the RHB fund shelf. They can also talk to the RHB Premier Relationship Manager on how to construct their own portfolios based on their risk appetite, time horizon and goals.