SME Landscape

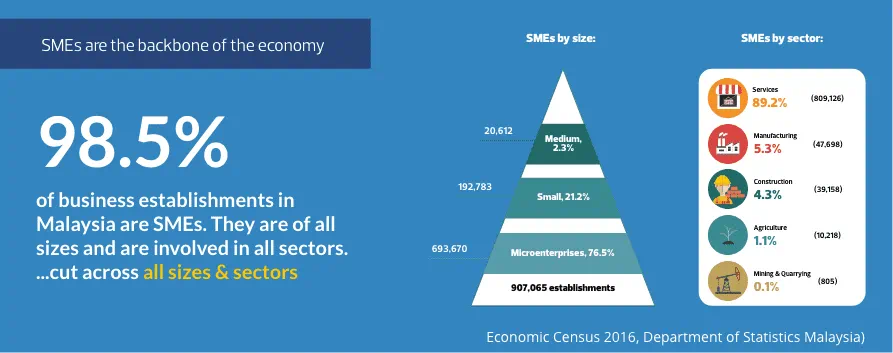

As of 2016, the country had more than 900,000 SMEs, according to the Department of Statistics Malaysia. Twenty percent of the businesses have some form of relationship with RHB Banking Group. The department also revealed that in the same year, SMEs contributed 36.6% (equivalent to RM405.5 billion) of the country’s gross domestic product (GDP), a strong and steady growth from the 32% recorded in 2010.

RHB’s Wealth Research team says factors such as disruptive technologies that are reshaping industries as a whole, digitalisation efforts that call for dependency on the internet as well as lower barriers to entry like selling things online with higher financing costs are stalling some of the growth in SMEs.

Common Challenges

One of the common challenges that could put SMEs at a disadvantage, according to the research team, is the lack of networks that can assist SME owners in terms of business knowledge, market information and experience. Additionally, they also have limited knowledge of tax and accounting practices, as well as economies of scale. The team says these practices, which should be ingrained in the SMEs’ business model, are important components as robust, consistent and transparent operating procedures are essential to determine whether the business is on track for long-term growth.

Capital management is also key in taking the business to the next level, hence it must be a top priority in the SMEs’ daily operations, the research team points out. Due to the numerous transactions they have to make — paying suppliers and depositing sales collections and salaries — a bank is an ideal partner for SMEs’ cash flow management.

According to a survey published by global information services group Wolters Kluwer, most SME businesses fail because of similar reasons, including an inexperienced management, poor business model, shortage of capital, lack of marketing and insufficient time.

A study titled “Failure Experiences of Entrepreneurs: Causes and Learning Outcomes” by Nuray Atsan of Akdeniz University in Turkey categorised business failures into individual or organisation (internal) and environmental (external). While internal factors are described as decisions or actions under the management’s control, external ones are outside of management’s control.

In most cases, a combination of both factors contributes to the failure of the business. Topping the list of internal factors are managerial incompetence or poor management, which encompasses failure to identify problems and to apply appropriate solutions as well as spending money on the wrong things.

External factors include inadequate economic circumstances, government policies and lack of financial resources.

Digitisation

On top of that, the research team suggests that SMEs raise external capital, partner with investors and set up joint ventures. Having adequate funds is also important to ensure that the business runs smoothly.

RHB Group has recently launched an online SME financing platform that aims to approve loans of RM100 million in one year. RHB SME Financing offers term loans of between RM50,000 and RM300,000 with tenures of six to 24 months.

Businesses with an annual turnover of no more than RM35 million may apply online and submit two documents. Turnaround time is five days and the application can be tracked on the online platform. During the platform’s launch, head of group business and transaction banking Jeffrey Ng Eow Oo said the bank aims to increase its financing for SMEs from 16% of the bank’s domestic financing to 20% by 2022.

This move is also in line with Bank Negara Malaysia’s mandate to promote an inclusive financial system in the creation of a comprehensive ecosystem for SME financing. The mandate includes establishing effective institutional arrangements, including specific schemes for financing and development, and providing avenues for SMEs to seek information and advice, as well as assistance through debt resolution and management programmes.

In an article entitled “Developing the SME financing ecosystem”, the central bank said that financial institutions — comprising commercial banks and development financial institutions (DFIs) – are the largest providers of financing for SMEs. They extended RM266 billion or 96% of total outstanding financing in all economic sectors.

It also remarked that financial institutions (FIs) and non-FI lenders have their respective roles in addressing certain financing issues while the government continues to assist businesses to build capacity and capability in other areas. The central bank also said SMEs need to have a proper business model and clear strategies on how they can expand sustainably and profitably.

Incorporating Personal and Business Finance

RHB Banking Group, the fourth largest bank in terms of SME financing, has identified significant synergies to be unlocked within the SME and affluent segments. The research team says there is a sizeable number of SME owners who are eligible to be Premier Wealth customers. They will have access to exclusive privileges and opportunities that will help them achieve their financial goals.

The research team says the bank will provide the SME owners with a one-stop solution that will improve their time management and provide them with a seamless experience when carrying out their personal and business errands. As RHB Premier clients, SME owners can benefit from advisory services in business, insurance, tax as well as corporate risks from a list of Premier partners.

The first few years is a make-or-break period for SMEs, which makes it all the more important for business owners to approach the experts. The advisory services offered by Premier partners will be useful for entrepreneurs who want to avoid common mistakes while achieving long-term growth.

It is also imperative for SMEs to learn from their issues and generate learning outcomes. This is very important to strengthen their ability to cope with obstacles and uncertainties when looking for financial start-up capital, building legitimacy, adapting to change and getting access to social and business networks. It also provides entrepreneurs the opportunity to gain knowledge that can be readily used in other businesses, thereby allowing them to enter new markets, products and technologies successfully.

RHB Premier Wealth is also adopting a portfolio advisory approach, in which the bank will help clients achieve their investment goals through a combination of investment products that can be matched to their risk appetite, returns target and time horizon. RHB Premier’s product suits consist of investment products denominated in local and foreign currencies as well as alternative products that are customisable to clients’ needs.

The research team says clients will also be supplied with regular portfolio reviews to keep them updated on global current affairs that might impact on their portfolios, and be advised on how to strategise their investments accordingly.

On the other hand, SME owners who join RHB Premier will also be able to enjoy privileges such as business advisory and insurance risk advisory services, preferential pricing on selected banking products such as hire purchase and unit trust and take advantage of networking and lifestyle events, which are excellent opportunities for SME owners to market and expand their businesses.

At RHB Premier, connectivity is key to business growth. Therefore, we gather different key industry players and SME owners at our networking events to bring business people together. This will be an excellent platform for SMEs to expand and promote their presence.