Different perspectives present different investment paths.

The World Economic Forum calls it the ‘perfect storm’, a confluence of rising trade tensions between major powers, slowing global growth, record global debt burden, social inequality, protectionism and the resulting reversal of globalisation.1,2 The first surge hit financial markets in 2018. Global stock gains in the first nine months were wiped out by a fall of more than 12 percent in the third quarter.3 It left investors shell-shocked. Coming out of the first quarter this year, the world’s second largest economy reported a better-than-expected growth and trade talks began to solidify among other geo-economic positives. Analysts were quick to proclaim that the global outlook is not as bad as feared.4 But is it really? How much of a relief or how risky the outlook remains and the investment path you take from here depends greatly on your perspective. The question is: which investor are you?

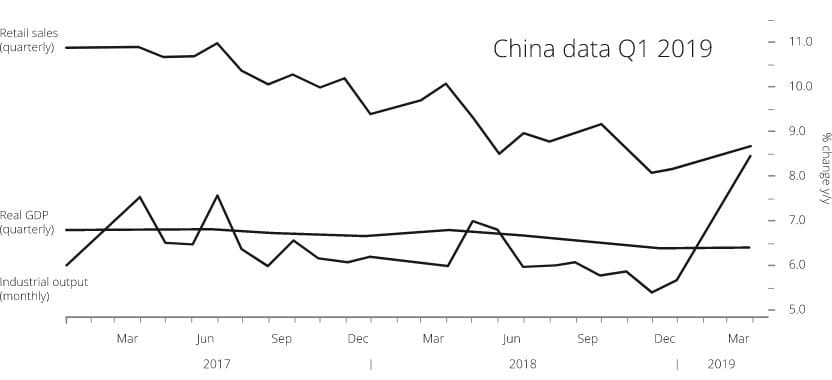

Sign of stabilisation?

BLOOMBERG/National Bureau of Statistics of China

The pessimist

These would be the things that you hear running through your mind.

The US-China trade dispute is nearing resolve, but unpredictable White House policies continue to instigate new ones. The Brexit can has been kicked further down the road, together with the increasing prospect of a disorderly exit from the EU. Jokowi’s second term victory was seen as extending a stock-rally worth 53 billion dollars in market value, but Southeast Asia’s largest economy first needs reform.5 Asian share markets swung higher over China‘s quarter-one data, the same week the FTSE Bursa Malaysia index fell.6 The ringgit continues to be volatile. The Fed has been staying put, but the US dollar story is still a bit of an uncertainty and not a green light for emerging market investors to keep going.5

There have been bright spots, but they do not fully convince. Instincts tell you that both existing and new uncertainties will continue to cloud the year through.

Sunshine, but no rainbows

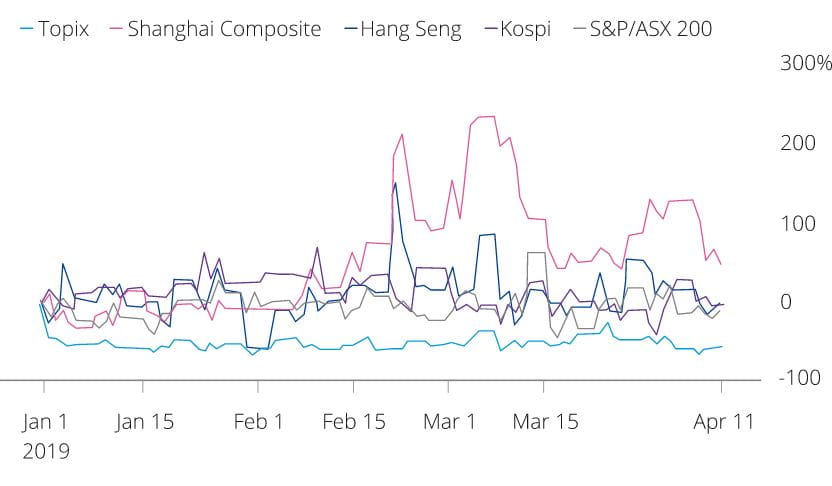

Despite the best first-quarter rally since 2012 for the regional benchmark index, it soon tapered off.

Risk-aversion trading and safe-haven allocation may be your preferred path forward. They point to stable stores of value in precious metals and hard currencies.

Traditional risk aversion strategies include liquidating your positions in risky assets to take up positions in currencies that serve as stable stores of value. These ‘hard currencies’ are often the currencies of developed countries that have earned long-term stability in terms of purchasing power as well as central bank reserves and policies.

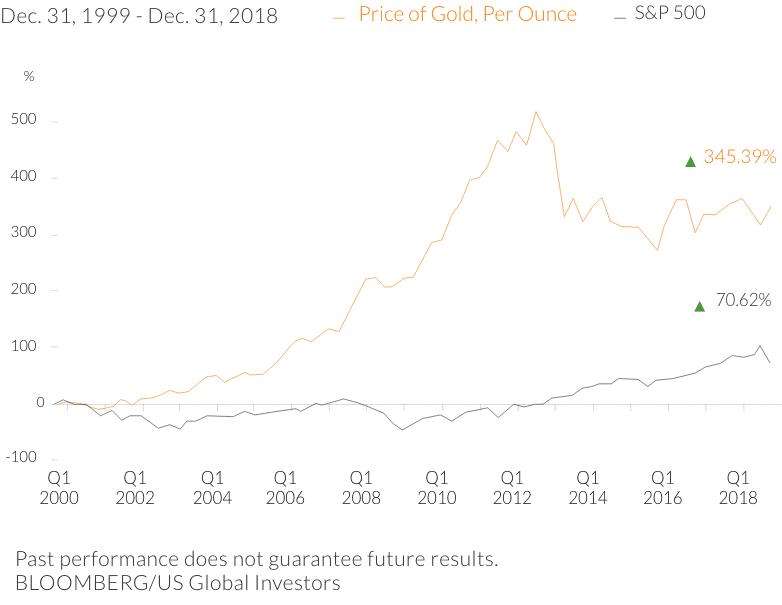

During last year’s heightened volatility, panicked investors also ditched stocks and fled to gold, the other traditional safe-haven.

Historically, gold has always had an inverse correlation with the markets. Because of this, investors—even countries—regard gold as a valuable asset in times of financial instability. When Bloomberg reported the biggest one-day increase in purchases in the last 12 months ending in December of 2018,7 the biggest investors were the central banks of Eastern European and Asian countries with large dollar-holdings, seeking to stabilise their reserves in a bleak end to the year. They included the world’s second largest economy, China, which added to its gold reserves for the first time since 2016.8

One cost-effective way to start hedging against the current uncertainties is RHB Asset Managementʼs ringgit-hedged Gold Fund, an affordable access to physical gold and exposure to the daily price of gold bullions in the iShares Gold ETF (CH) target fund managed by BlackRock Switzerland. Or ask your Relationship Manager about other precious metal investment options that match your risk-appetite.

Still new to the game and don’t have much to play with? Consider bond trusts and regular unit trust investment plans.

Bond funds are the safest, most conservative of unit trust investments. These low-risk unit trust funds consist of fixed income securities such as corporate or government bonds, offering a fixed current income and the stability of principal. They are resilient throughout a crisis and in extreme cases, the priority in compensation is to the bond investor rather than the fund distributor.

Dollar-cost averaging is another low-risk strategy that is low in cost. In practice, you invest in shares with a consistent small deposit on a regular basis into a regular savings fund or unit trust investment plan instead of putting in your money all at once, regardless of current share prices. This way you are not exposed to wild market swings. In fact if share prices do go down, you’ll be buying more shares with the same amount. And when prices go up, you effectively turn market fluctuations into potential gains.

Looking for a reputable fund house to help you diversify into unit trusts? RHB offers a variety of over 100 unit trust funds distributed by established fund management companies with proven track records managing high volumes of funds. They include ASNB, a part of PNB with nearly 10% of market capitalisation in Bursa Malaysia across major companies in oil and gas, utilities, construction and financial institutions. RHB Group Asset Management is Malaysiaʼs top three fund house based on total Assets Under Management (AUM) across conventional and Islamic products. With 30 yearsʼ of investment expertise and experience in the region, it offers significant insights into the Asean and Greater China markets.

The opportunist

Contrary to popular sentiments, you may find the current atmosphere exciting. The markets are just positive enough to venture into and while investors are still cautious and prices low, you see good-value buying opportunities. Although billionaire investor Warren Buffett is not regarded as an opportunist, you may be inspired by his ‘be greedy when others are fearful’ saying. In times of uncertainty you can, in theory, act greedy when others are fearful and reap enhanced returns, under the right set of circumstances.

Equity is the asset class that Mr. Buffett was referring to. Therefore we imagine that he’d also advise some degree of predictability and not let short-term downgrades in prices be moat-eroding. For instance, if you hear of a local company that has been given the go-ahead on a key infrastructure project, you might want to pick up its stocks while the current price is relatively weak.

Further up the risk-scale, it is the market fluctuations that present opportunities—

particularly in the foreign exchange and gold markets.

The foreign exchange market or FX holds the world’s largest high-liquidity asset class. In fact, it’s such a liquid market that you can get in or cash out as much as you want to, whenever you want to. Watch out for world events and geopolitical policies that could translate to potential gains in swapping currencies. For instance, when China’s quarter-one data came out pointing to recovery, investors immediately when into buying the Australian dollar, often a liquid proxy for China plays, pushing it up to a two-month high.9

Time zones and borders are irrelevant when it comes to the FX. What’s unique about the FX is that, unlike other markets, it is traded continuously for 24 hours a day and is not regulated by a centralised exchange. This means your money doesn’t stop working even when you do. With the FX, your money works round the clock—literally.

Did you know that RHB has a Multi Currency Account (MCA) that lets you manage a personal portfolio of 17 foreign currency deposits alongside paper forms of precious metals such as gold and silver, all in one account? Buy and sell currencies directly via the RHB Now app and internet banking, make strategic gains from the foreign exchange market at the swipe of the screen, or hedge against currency fluctuations. It is also linked to the first multi-currency Visa debit card in Malaysia. With a choice of 13 foreign currencies on one card, you can go cashless and avoid the usual currency conversion fees when travelling or shopping abroad.

Shining example

The optimist

It’s barely visible, but you do see the light at the end of this tunnel. So you’re thinking, why not free yourself from the volatility and focus solely on long-term gains. At the same time, you also greatly reduce the emotional component.

You accept that global economic slowdown is a certainty. But you’re also aware of the geoeconomic-and-political dynamics at work. Events are developing for the better in specific areas. On the homefront at least, regional reforms and local infrastructure policies are restarting. You’ve watched Singapore Finance Minister say how ‘Southeast Asian economies are benefitting as companies adjust supply chains to take advantage of rising US and China tariffs’.11 You’ve also heard how one Invesco investment director believe that ‘if everything falls into place, Malaysia could be a shining light of an emerging market’.12 As an optimist, you’d want your money sitting on these goldmines when the time comes.

For starters, there are low-volatility funds. They are all about diversifying your portfolio away from volatile stocks while staying invested. Funds with a minimum-volatility strategy focus specifically on the current or historically least-volatile of risky asset classes like stocks and emerging markets (EM). Low-volatility stocks often include utilities and healthcare stocks that have traditionally offered better downside protection than the market as well as better risk-adjusted performance over long periods of time. This way, you’re prepared for the downside while maintaining upside participation. Similarly, you can count on EM to always yield a higher positive return premium over time compared with developed markets.13

Or if you’re sensing a global recovery, keep an eye out for multi-asset funds that capitalise on exactly that. These fund-of-funds are dynamic portfolios of exchange-traded funds (ETF) that manage allocations according to the current market climate. When volatility is high, less risky assets such as bonds and money market securities are selected. When volatility is low, the fund selects up to 100 percent of returns-biased ETF like equities and commodities.

Looking ahead

In spite of positive events, there’s still an overwhelming mix of optimistic voices, discouraging signals, notes of caution, hopeful sentiments and inconsistent statistics which adds to the complexity of making investment decisions.

During these times, itʼs best to turn off the noise and go back to the basics: How well-prepared are you? How liquid are your assets currently? Which category of investor are you? What is your risk-appetite?

The answers will help you decide on an investment path that suits you best. What is also ideal going into the rest of the year is having an investment partner who has a keen eye on both developing local and global affairs, especially in the Asean region. These regional economies are closely-tied to ours. They’re also increasingly linked to China, the world’s second largest economy, and together we make up most of the world’s emerging economies. As uncertainties recede, new waves of growth and gains to be made will potentially be right here where we are. The next question is ‘when?’.

To make the most out of your wealth during these times, first talk to your RHB Relationship Manager about managing risks. Through your Relationship Manager, you will have privileged access to in-depth market and economic outlooks, specifically in the Asean region, for a holistic view of all conditions that could affect your investments through this cycle. Your Relationship Manager will help you review your current portfolio, set realistic objectives and find the most comfortable investment fit for you.

Sources : 1 World Economic Forum, Populism, trade tensions and social inequality, 16 January 2019. 2 World Economic Forum, The Global Risks Report 2019, 15 January 2019. 3 Schroders, Financial markets 2018: the year in review, 24 December 2018. 4 Bloomberg, China’s Strengthening Economy Bolsters Its Hand in Trump Trade Talks, 17 April 2019. 5 Bloomberg, Bloomberg Daybreak: Asia, 15–30 April 2019. 6 The Edge Markets, KLCI falls 0.8% on possible downgrade of market accessibility level, 17 April 2019. 7 Forbes, Gold Has Beaten the Market Over Multiple Time Periods, 3 January 2019. 8 Bloomberg, China Adds to Gold Reserves for First Time Since October 2016, 7 January 2019. 9 Reuters, Asia relieved as China data point to recovery, 17 April 2019. 10 Bloomberg, Gold Will Be Most Contentious Trade, IG Group’s Rodda Says, 16 April 2019. 11 Bloomberg, Singapore’s Finance Minister Sees Solid Southeast Asia Growth Despite Risks, 7 April 2019. 12 Bloomberg, Malaysia’s Stock Market Is Asia’s Only Loser of 2019 - Bloomberg, 12 March 2019. 13 BlackRock Blog, Take control of emerging markets with minimum volatility, 6 February 2019.