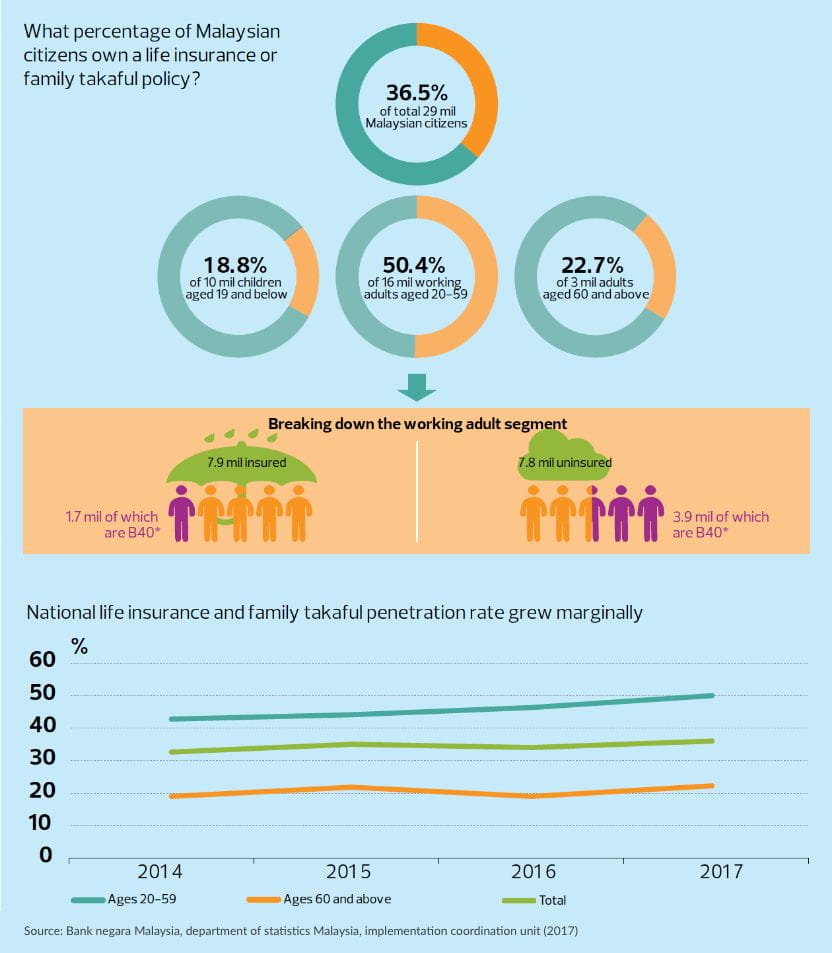

There is a lack of awareness of the importants of buying life insurance in Malaysia. According to Bank Negara Malaysia, only 36.5% of the total population owns at least one individual life insurance or family takaful plan, which is very low compared with the government’s target of 75% by 2020. Despite the penetration of the working age group (20 to 59) showing strong signs of growth to 50.4% as at 2017, national-level growth has been stagnant.

Without life insurance protection, one would most likely have to self-fund medical costs and treatment expenses. There is also the possibility of loss of income in the event of being unable to work due to a permanent disability. But if someone is adequately protected under a life policy, they would receive a permanent disability benefit of a lump-sum payout.

Even with a proper will in place, wealth distribution to the next kin or family can be a lengthy process. Therefore, in the event that an uninsured individual is the sole breadwinner of the family, the financial requirements to sustain day-to-day family life could be severely impacted.

But if one is adequately covered, the family will be financially independent regardless of age and would be able to leverage their policies to minimise disruptions to the current lifestyle and financial commitments.

Even if one is insured, one cannot assume that they are adequately insured. Many Malaysians think they have enough coverage from a policy they bought years ago, or that was bought by their parents when they were younger.

Life insurance needs will continuously change as an individual progresses through their life stages, such as marriage and having children. The needs also increase parallel to their requirements for income replacement or maintenance of lifestyle, especially if any unforeseen events take place. Therefore, it is important to periodically review one’s wealth, assets and financial obligations to ensure they match the value of the life insurance purchased.

While it may seem that the wealthy do not need life insurance as they would have sufficient financial capacity, it is still necessary and can assist them in several ways.

For one, taking up the right life insurance policy would allow affluent individuals to preserve their assets and lifestyle as insurance proceeds are almost instant — it does not attract the usual complications of administering an estate transfer. An estate equalisation can also be made, where the liquidity of life insurance can be used to balance the share of the estate to beneficiaries. RHB tailor-makes for our clients comprehensive life insurance solutions to meet their needs. Tai believes that life insurance products, such as the RHB Prime Vantagelife, offers customers who wish to build their legacy plans flexible premium payment and coverage terms that come with high protection coverage, while being able to boost wealth accumulation through guaranteed cash payments and investment top-up options.

While fundamentally a protection, the current features of life insurance plans have expanded to help an individual attain their financial goals, such as being an alternative asset class that can provide financial security, liquidity and potential returns. It also helps to build and preserve a legacy of choice for the next generation, with the flexibility to refine the estate plans when necessary.

In addition, it can support business continuity or succession, especially in the case of businesses with multiple owners. For example, in the event of the untimely death or critical illness of one of the owners, the life policy payout can be used to fund the buyout of his business interest without causing financial hardship to the business or other partners.

While the options for life insurance in the market come in many different variations, they are generally known as term life, whole life, endowment or investment-linked.

Term life refers to the most basic type of life insurance coverage, providing simple life cover with no elements of savings or profit component. The coverage is fixed for a set period with no cash values accumulated to the policy. Whole life refers to life insurance that provides coverage throughout the lifetime of the assured, as long as the premiums are paid.

Endowment is a life policy that combines protection and saving components, which can build up a lump-sum maturity benefit, usually paid out at the end of the policy period. Lastly, investment-linked is a policy that combines insurance protection with elements of investment through various investment fund types according to the assured’s risk profile. The flexibility of investment-linked policies has generated a stream of innovative product variations to cater for the different financial and protection needs.

While there will not be one best insurance product to cater for all of an individual’s needs, RHB highlights that it is crucial to seek professional advice from qualified personnel who will be able to recommend and tailor the right combination of financial solutions, including life insurance, taking into consideration the customer’s financial plans and needs.