Legacy planning is the foundation of one’s retirement plan. Among other benefits, a good plan can help families prepare for the unexpected, avoid unintended beneficiaries, prevent conflicts as well as preserve and grow their wealth.

Despite this, most Malaysians are not proactive in their legacy planning. A survey conducted by Rockwills International Group revealed that only 37% out of 521 respondents had undertaken any form of estate planning such as will writing, setting up a trust fund or both. Most of the respondents were not familiar with the importance of proper legacy planning.

This may create bigger problems later on, such as unclaimed assets. There is a whopping RM5.78 billion worth of total unclaimed money as at June 2017, involving 55 million records since 1977, according to news reports. This comes from various sources such as savings accounts, current accounts and matured fixed deposits with auto-renewal instructions.

As at Oct 31, 2018, unclaimed monies amounting to RM9.97 billion from various entities such as banks had been submitted to the Accountant General’s Department of Malaysia. According to RHB’s Wealth Research team, this could be a result of lack of awareness among the public and the lengthy procedures in estate distribution.

Many Malaysians do not realise that their estates and properties could be frozen according to the Distribution Act 1958 (amended 1997). Once an individual passes on, his assets will be frozen, even with a will. The process to get the estate distributed may be very lengthy and complicated, especially if it involves different types of assets such as real estate, jewellery, cash or shares equivalents as it will require different methods of transfer and distribution.

There are also a lot of misconceptions regarding legacy planning. A very common one is that maintaining a joint-name bank account can be served as a way of wealth transfer. Truthfully, maintaining a joint name account does not necessarily mean that the amount in the account is equally or fully-owned by any of the joint account holders.

A joint-name account is provided by the bank to provide convenience to the account holder in operating the account. When one of the account holders passes on, the amount in the account shall be frozen until the Grant of Probate or Letter of Administration is obtained by the heir(s) of the deceased.

Once a Grant of Probate or Letter of Administration is obtained, the share of the amount owned by the deceased in the joint-name account is to be distributed according to the will or applicable distribution laws.

Another common misconception in the country is that young people should not worry about legacy planning. Many youths feel that they are in the phase of accumulating wealth, not distributing it. Therefore, they do not care to put a plan in action as soon as possible.

Legacy planning can be overwhelming — there are a lot of things that need to be considered, especially as it concerns the future of one’s family members. Thankfully, there are many solutions such as life insurance products that are able to help.

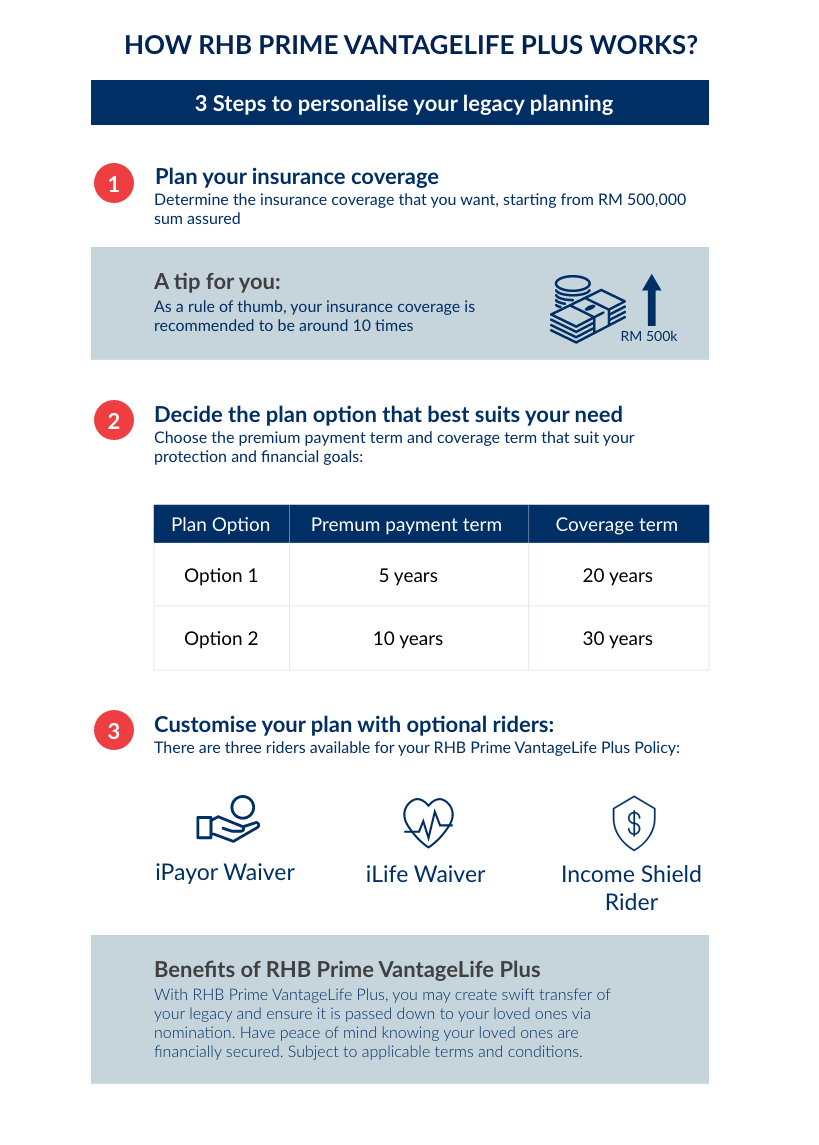

RHB Prime VantageLife Plus is an innovative solution that one can consider to assure their loved ones are protected against unforeseen circumstances. The investment-linked insurance solution offers a lump sum of claims upon death or total permanent disability (TPD) of the life assured.

Eligible to those aged 18 to 70 years old (depending on the plan chosen), the product offers a sum assured from RM500,000 onwards, payable to the loved ones in the event something unexpected happens to the life assured. An individual may sign up for this policy and nominate his/her immediate family members to form a trust beneficiary at the point of the policy issuance or by notifying the insurance company through a written notification.

A single policyowner’s trust nomination should be his/her parents while the nominated person for a married policyowner must be the spouse or child. Under such nominations, the insurance amount will be paid to the nominated person as financial relief if the policyowner passes away. In the event of accidental death or accidental TPD, the nominee will receive an additional 100% of basic sum assured.

Unlike ordinary legacy planning through wills or trusts, which involves lengthy procedures before any assets or estates can be transferred, insurance claim payouts are relatively faster and easier. Upon the fulfilment of the required documents such as submission of proof, a completed claim form by the claimant or nominee and other supporting documents, the sum assured will be paid as the claim benefit to the nominee within sixty days of a claim notification.

With this, the financial needs of the surviving family can be taken care of in the event of an unexpected death of the breadwinner.

The policy offers two coverage options - either 20 years with five years’ limited premium term or 30 years’ coverage with 10 years’ limited premium term. The life assured may top up additional endowment riders, which pays guaranteed cash payment throughout the policy term.

Upon maturity, the life assured may receive a lump sum of the maturity benefit to fund his/her own retirement or serve as a cash gift to loved ones. Premiums are eligible for income tax relief, subject to the approval of the Inland Revenue Board.

As life insurance is a risk transfer tool, an individual may pay a risk premium in exchange for a larger amount of protection. For example, a 40-year-old businessman who is a non-smoker may take up the RHB Prime VantageLife Plus policy with RM1 million coverage for 30 years by paying a limited premium of RM25,000 for only 10 years.

During the 30 years of coverage, the sum assured of RM1 million can serve as part of his legacy planning and emergency cash to support the family’s needs in the event of his death or TPD before his other assets (such as property, stocks or cash equivalent assets) are transferred to the family.

If you are wondering whether your existing protection is fufficient to cover yourself and the future of your loved ones, consult your relationship manager now. He/she will help to reevaluate and come up with a customised plan for you.