PAY OFF THE DEBT

No matter how you see it, debt is something negative since interest makes you keep on paying. Cut that slightly by paying extra off sums that you owe, and you’ll be living interest-free in no time at all.

SAVE FOR RETIREMENT

Not something that many consider, but more should. Retirement savings are long term and money going in to this should be put to work hard, but safely. Consider safe funds to put your money in to, or stable long-term stocks in saving for future retirement.

INVEST THE MONEY

This is something you might seriously consider as it literally is a way to grow your money. Investing can be a strong profit margin item, if you know what you’re doing to improve your growth numbers.

| “The RHB Relationship Manager is key to your future.” |

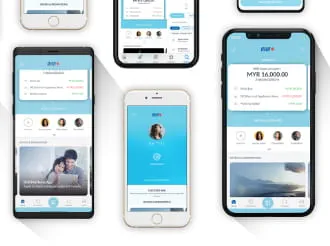

Get in touch with RHB Premier today.

This publication has been prepared by RHB Bank Berhad and is solely for your information only. It may not be copied, published, circulated, reproduced or distributed in whole or part to any person without the prior written consent of RHB Bank Berhad. In preparing this article, RHB Bank Berhad has relied upon and assumed the accuracy and completeness of all information available from public references and articles or which was otherwise reviewed by RHB Bank Berhad. Accordingly, whilst we have taken all reasonable care to ensure that the information contained in this article is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness or fairness of such opinions and make no representation or warranty (whether expressed or implied) and accept no responsibility or liability for its accuracy or completeness. You should not act on the information contained in this article without first independently verifying its contents.

Any opinion, historical account, personal profile, estimate or data contained in this article is based on information available as of the date of this article and are subject to change without notice. It does not constitute any advice, offer or solicitation by RHB Bank Berhad. This document and its contents are not intended to constitute an offer for sale and/or invitation to subscribe for or purchase or otherwise acquire any of the instruments referred to herein.

Disclaimer for Video and Podcast by RHB Asset Management:The podcast provided herein is solely for information purposes only. It does not take into account the specific investment objectives, financial situations or particular needs of any particular person.

This podcast does not constitute an offer, solicitation or recommendation to buy or sell or subscribe for any security or financial instrument or to enter into any transaction or to participate in any particular trading or investment strategy. Information contained in the podcast should not be relied upon when making investment decisions. You should seek independent legal or tax advice before making any investment decisions. Investments are subject to investment risks, including the possible loss of the principal amount invested. Value of the investments and the income, if any, may fall or rise.

No representation or warranty whatsoever (including without limitation any representation or warranty as to accuracy, usefulness, adequacy, timeliness or completeness) in respect of any information (including without limitation any statement, figures, opinion, view or estimate) provided herein and it should not be relied upon as such. The information provided herein may contain projections or other forward-looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures are not necessarily indicative of future or likely performance.

Any reference to any specific company, financial product or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same. RHBAM does not guarantee that all risks associated to the transactions mentioned herein have been identified, nor does it provide advice as to whether you should enter into any such transaction. The contents hereof may not be reproduced or disseminated in whole or in part without RHBAM’s written consent.

This podcast has not been reviewed by the Securities Commission Malaysia. You should not act on the information contained in this podcast without first independently verifying its contents.

Disclaimer for Video and Podcast by Economics and Market Strategy:This report is prepared for information purposes only by the Economics and Market Strategy division within RHB Bank Berhad and/or its subsidiaries related companies and affiliates, as applicable (“RHB”). All research is based on material compiled from data considered to be reliable at the time of writing, but RHB does not make any representation or warranty, express or implied, as to its accuracy, completeness or correctness.

Neither this report, nor any opinion expressed herein, should be construed as an offer to sell or a solicitation of an offer to acquire any securities or financial instruments mentioned herein. RHB (including its officers, directors, associates, connected parties, and/or employees) accepts no liability whatsoever for any direct or consequential loss arising from the use of this report or its contents. This report may not be reproduced, distributed or published by any recipient for any purpose without prior consent of RHB and RHB (including its officers, directors, associates, connected parties, and/or employees) accepts no liability whatsoever for the actions of third parties in this respect. Recipients are reminded that the financial circumstances surrounding any company or any market covered in the reports may change since the time of their publication. The contents of this report are also subject to change without any notification.

This report does not purport to be comprehensive or to contain all the information that a prospective investor may need in order to make an investment decision. The recipient of this report is making its own independent assessment and decisions regarding any securities or financial instruments referenced herein. Any investment discussed or recommended in this report may be unsuitable for an investor depending on the investor’s specific investment objectives and financial position. The material in this report is general information intended for recipients who understand the risks of investing in financial instruments. This report does not take into account whether an investment or course of action and any associated risks are suitable for the recipient. Any recommendations contained in this report must therefore not be relied upon as investment advice based on the recipient's personal circumstances. Investors should make their own independent evaluation of the information contained herein, consider their own investment objective, financial situation and particular needs and seek their own financial, business, legal, tax and other advice regarding the appropriateness of investing in any securities or the investment strategies discussed or recommended in this report.

RHB (including its respective directors, associates, connected parties and/or employees) may own or have positions in securities or financial instruments of the company(ies) covered in this research report or any securities or financial instruments related thereto, and may from time to time add to, or dispose off, or may be materially interested in any such securities or financial instruments. Further, RHB does and seeks to do business with the company(ies) covered in this research report and may from time to time act as market maker or have assumed an underwriting commitment in securities or financial instruments of such company(ies), may sell them or buy them from customers on a principal basis and may also perform or seek to perform significant banking, advisory or underwriting services for or relating to such company(ies), as well as solicit such banking, advisory or other services from any entity mentioned in this research report.

RHB (including its respective directors, associates, connected parties and/or employees) do not accept any liability, be it directly, indirectly or consequential losses, loss of profits or damages that may arise from any reliance based on this report or further communication given in relation to this report, including where such losses, loss of profits or damages are alleged to have arisen due to the contents of such report or communication being perceived as defamatory in nature.

This podcast has not been reviewed by the Securities Commission (SC) and/or Bank Negara Malaysia (BNM).

RHB Bank Berhad 196501000373 (6171-M)

You are about to enter a third party website and RHB Banking Group's privacy policy will cease to apply.

This link is provided for your convenience only, and shall not be considered or construed as an endorsement or verification of such linked website or its contents by RHB Banking Group.

RHB Banking Group also makes no warranties as to the status of this link or information contained in the website you are about to access.

We used cookies to improve your experience on our website. By continuing to use our website and/or accepting this message, you agree to our use of cookies. Please refer to our Privacy Policy for more information.