Here’s how you can diversify into global property – with minimal commitment.

The early 2000s was boom time for property. It’s easy to look back at those times through a nostalgic lens. If you’d bought a house back then, you were lucky. Real estate prices kept rising, and the bubble grew larger and larger as speculators kept puffing up the market. But like Icarus who ignored the warning signs and flew too close to the sun, the subprime mortgage crisis sent the global market crashing down.

Governments reacted by imposing stricter regulations to curb speculation, and since then, property prices have cooled significantly. When COVID came and changed everything, it seemed like the heyday of real estate was gone for good.

However, a closer look at the indicators reveals another story. As we move closer to the peak of interest/profit rate hike cycle, the availability of cheaper loans/financing propped up interest to relook into property investment. In Malaysia, the case is similar, albeit on a higher for longer interest/profit rate environment.

The light at the end of the tunnel is closer than we think. Property is making a comeback in Malaysia, spurred by the revival of several key infrastructure projects, foreign investors’ friendly policies and the potential of cheaper loans/financing.

In relaxing the requirements of the Malaysia My Second Home (M2H) scheme, the government will attract more foreign buyers into the more high-end side of the market, particularly in Penang, Johor, and Kuala Lumpur. The long-term MM2H residents could create a positive impact by spending into the domestic economy. (A side note: Did you know that a study by Nasdaq in 2023 has ranked Malaysia as the safest place to retire in Asia? Nasdaq combined cost of living, economic, and Global Peace Index statistics and we came out tops! The food helps, too.)

All the right indicators

Right now, as you’re reading this, Singaporeans are snapping up real estate in Johor, excited by the upcoming completion of the Rapid Transit System (RTS) link between the island republic and Malaysia. All this movement, even with the increase in additional buyer’s stamp duty for Singaporeans. When the RTS gets rolling, the dreaded congestion at the checkpoint will be a thing of the past.

Things could only get hotter down in the south when the plans for the High-Speed Rail (HSR) materialise. The news has been abuzz with talks of an HSR-based revival of Forest City in Iskandar Puteri. The much-maligned ghost town is said to be the focal point for several planned transportation projects to improve accessibility. The Prime Minister also announced that a special financial zone would be established within the development to boost investment in the state.

Things are looking up for the global real estate market, too. Across the globe, companies are enforcing permanent, or hybrid, return to office policies. Rapid advancements in technology are creating new positions to be filled and propping up demand for digitally driven real estate like data centres and telecommunication towers.

Making property investment accessible to all

Property investment is widely regarded as a sound financial choice, but its considerable initial cost makes it inaccessible to most folks. The high entry point (think deposits, fees, taxes, high commitment to loans/financing, etc) means that once you’re in, you won’t have room to spread your investments across multiple properties. The concentration of investors in just a handful of property types further compounds this issue.

A solution to this would be to make property investment more affordable by breaking it up into bite-sized pieces so everyone can have a slice of the pie. With smaller investments, one would easily be able to diversify across a broader range of properties, locations, and sectors.

The good news is such a thing already exists! Real estate investment trusts (REITs) do exactly this. They can be considered as an investment vehicle for those seeking stable income and long-term capital appreciation. REITs allow you to invest in a whole portfolio of real estate assets, much like mutual funds enable investing in a diversified portfolio of stocks. You don’t hold any physical real estate, so there’s nothing to give you a headache. You don’t have to lift a finger – except to sign the forms.

The income from REITs is from the rent collected from the properties they own or finance, such as commercial buildings, apartments, shopping malls, or warehouses, and the bulk of it is distributed in the form of dividends, or distribution per unit (DPU). That’s how REITs generate a regular income stream.

The portfolios often comprise various types of properties across multiple locations. That’s instant diversification and risk reduction. You get immediate access to different countries without even leaving your couch.

Most REITs are publicly traded, so you can buy and sell shares just like stocks. This makes them highly liquid compared to buying and selling a physical property.

REITs are ripening for the harvest. Falling interest rates can potentially lead to price appreciation of REITs, which can positively impact REITs' net asset value (NAV). REITs can become more attractive to both income and capital growth-seeking investors.

Going global in 2024

While most investors focus on Malaysian REITs, global REITs offer investors exposure to a wider range of real estate assets around the world. Are global REITs worth consideration in 2024? Yes.

In addition to all the benefits we mentioned above, there are more specifically related to the wider diversification of global REITs.

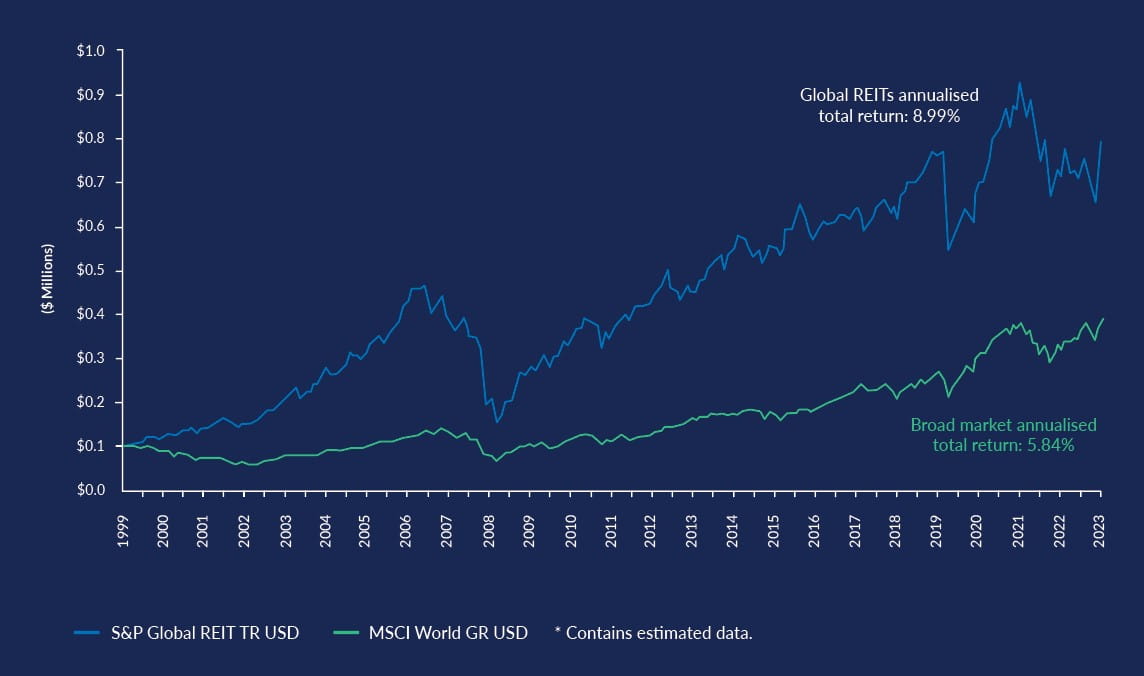

Global REITs have a proven track record, too. They aren’t an unproven new invention.

Source: eVestment, as of 31 December 2023

Take advantage of emerging global trends

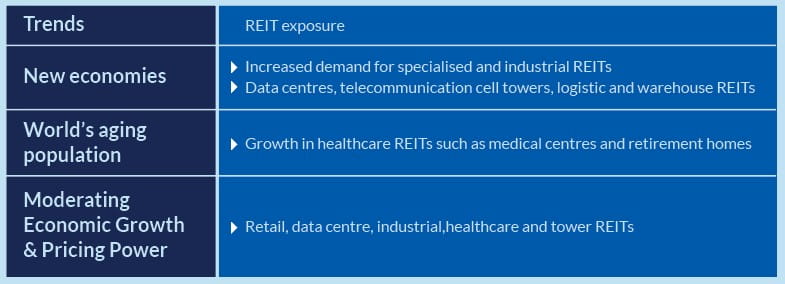

Technology and the needs of the population have pushed change across the global economy, including how we view property as an asset. Investing in global REITs like Manulife Shariah Global REIT can offer you exposure (more than 50% as of December 2023) to emerging trends that support long-term growth.

Source: Manulife Investment Management

Its fund manager Manulife Investment Management (US) Limited assesses both macro and micro economic developments to target companies in stable and growing economies. The fund leverages the talents of more than 650 investment professionals across 19 locations who place emphasis on providing you with capital appreciation and a sustainable income through a diversified real estate portfolio.

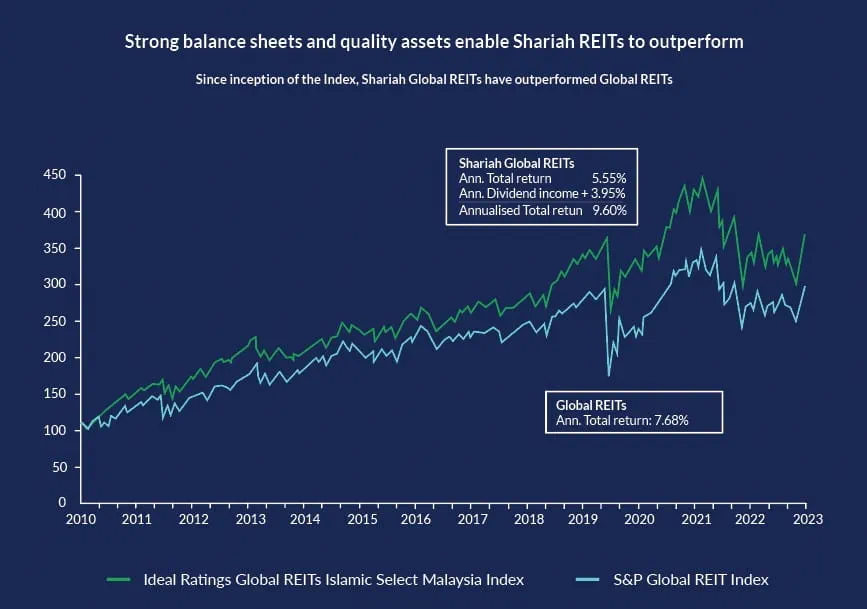

Shariah Global REITs has outperformed Global REITs in long run with more than 40% of the total return derived from income and balance from capital gain.

Source: Morningstar & IdealRatings, as of 31 December 2023

Yes, but you should also know…

Careful analysis of the specific REIT and its management, its sector, and the broader economic context is crucial before making investment decisions based on interest/profit rate expectations. This is something your Relationship Manager will gladly help you with.

Despite their obvious advantages, global REITs aren’t a wonderful risk-free path to instant riches. Some of the key risks (and opportunities) to consider include:

Global REITs offer investors a compelling way to gain exposure to the global real estate market and potentially generate attractive returns. By carefully considering the risks and rewards, they are a valuable addition to a well-diversified portfolio.

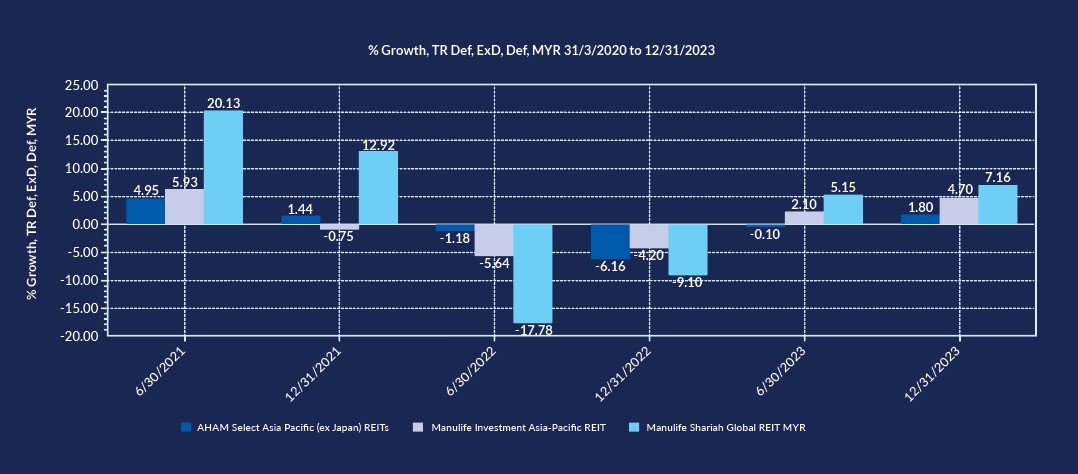

This chart compares some of the other REITs unit trust available through our platform that you may consider:

Source: Lipper Investment Management as of 31 December 2023

We hope this article has been instrumental in helping you fortify your portfolio. An investment decision depends on your risk profile and your current investment portfolio to ensure sufficient diversification. Do engage our relationship manager to know how REITs may potentially fits into your portfolio. Your Relationship Manager is waiting for your call!