Once upon a time, people worked until the age of 55 years and then retired to enjoy their old age. The retirement age has since increased. In Malaysia, the minimum retirement age was increased to 60 years in 2013. Recently, there was a debate on whether the minimum retirement age should be raised to 65 years.

The current economic and demographic trends do not bode well for an early and comfortable retirement for millennials who are currently aged between 24 and 39 years. The reality for them is that it is no longer enough to save 10% of their income, and expect to retire comfortably.

Life expectancy is increasing around the world and Malaysia is no exception. Malaysian life expectancy increased from 52.80 years in 1950 to 76.36 years in 2021.1 While rising life expectancy may sound like a good thing, it’s not so great if you want to retire early. For example, if you retire aged 55 years and live until the age of 77 years, you will be retired for 22 years. That’s a long time to be relying on your savings! Higher life expectancy also means higher medical expenses and specialised care later in life. These factors mean that millennials will need more money to retire compared to previous generations. Unfortunately, projected demographic and economic trends over the next 30 years will not make it easy for millennials to acquire such a nest egg.

The job market has changed. Baby boomers worked at one company their entire lives. This job came with benefits such as pension and insurance. Millennials, on the other hand, are less likely to be employed in such jobs. Many prefer to strike out on their own, and employment with such benefits are now scarce. To a greater extent than prior generations, millennials will be employed in the gig economy that provides little or no automatic enrolment in, or contribution to, any retirement programmes.

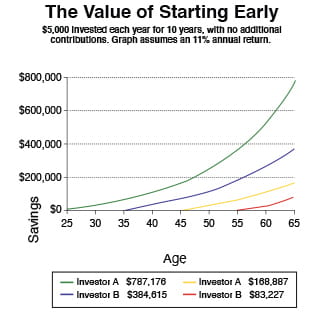

Millennials also start saving for retirement later as many graduate with student debt. They are also getting married and having children later. This affects retirement savings as many people feel that they have to save for a house and family before saving for retirement. As a result, young people lose their biggest retirement savings advantage, which is time. Time is your best friend, as shown below.

The real income of young wage-earners grew a paltry 2.4%, from 2009 to 20192. At the same time, housing remained seriously unaffordable in Malaysia as a whole in 20193. The B40 group is the most impacted, but even the M40 group finds housing seriously unaffordable in the states of Selangor, Kuala Lumpur and Sabah. The wealth gap between the T20 and B40 group also widened between 2016 and 20194. These economic factors make it harder for millennials in the B40 and M40 income groups to get ahead on savings and investments.

Millennials will not enjoy the same returns on investments as previous generations. Economic growth is expected to slow down as the population ages, and so will investment returns. In the US, Charles Schwab projects an annual expected return of 6.6% for US large-capitalization stocks over the next nine years, compared with an average return of 10.8% per year since 19705. Don’t scoff at this 4.2% difference in returns. It makes a huge difference to your retirement savings when compounded into the future as shown below.

| Value of investment on RM10,000 compounded at | ||

| Year | 7% p.a. (RM) | 10% p.a. (RM) |

| 5 | 14,025.52 | 16,105.10 |

| 10 | 19,671.51 | 25,937.42 |

| 15 | 27,590.32 | 41,772.48 |

| 20 | 38,696.84 | 67,275.00 |

| 25 | 54,274.33 | 108,347.06 |

| 30 | 76,122.55 | 174,494.02 |

| 35 | 106,765.81 | 281,024.37 |

| 40 | 149,744.58 | 452,592.56 |

Despite the obstacles in the way, it is not impossible to start work on making your retirement as comfortable as possible. Here’s what you can do.

If you don’t know where you are going, how will you get there? The first step is knowing how much you need. A good starting point is the recommendation by the Private Pension Administration (PPA), which is to have two-thirds of your last drawn salary before retirement to maintain your standard of living after retirement. To obtain this, we recommend that you save one-third of your monthly income.

This isn’t as difficult as it seems. If you are an employee, you already contribute 11% of your income to EPF and your employer contributes another 12%. This means that you only need to save another 10% of your income. You can also check out the PPA retirement calculator at https://www.ppa.my/retirement-calculator/ to estimate the total amount you need for retirement.

You may expect that the next step is to start saving. But, if you have a lot of credit card debt with high-interest rate charges, you may want to focus on paying these off first. The magic of compounding interest also applies to your borrowings, causing your outstanding balance to balloon out of control. As credit card interest rates are much higher than your average investment returns, it is worthwhile to focus all your financial resources to clear off these debts first.

To accelerate debt payment you can consider debt consolidation. By streamlining your debts from different credit cards and loans into one consolidated payment, you can jump-start your debt payment success. This is because consolidated loans often offer a lower interest rate, lower monthly instalments or both. For example, if you transferred your credit card balance to RHB Bank, you will enjoy an interest rate of 0% per annum for 12 months. Or you can simplify and accelerate your debt pay-off by consolidating your debts via Personal Financing-i at a lower interest rate. Apply before 31 December 2021 to enjoy financing up to RM200,000 with a tenure of up to 10 years. Your RHB Relationship Manager will be able to help you decide on a plan that best suits your credit score and your financial goals.

| Year | Value of RM10,000 earning a return of 10% per annum compounded over 40 years (RM) |

Value of annual investment of RM10,000 earning a return of 10% per annum compounded over 40 years (RM) |

| 5 | 16,105.10 | 51,051.00 |

| 10 | 25,937.42 | 149,374.25 |

| 15 | 41,772.48 | 307,724.82 |

| 20 | 67,275.00 | 562,749.99 |

| 25 | 108,347.06 | 973,470.59 |

| 30 | 174,494.02 | 1,634,940.23 |

| 35 | 281,024.37 | 2,700,243.68 |

| 40 | 452,592.56 | 4,415,925.56 |

At the end of 40 years, the one-off investment of RM10,000 would be worth RM452,593. If you had invested RM10,000 every year, you would have RM4,878,518, of which you contributed RM400,000. If you start investing early, the magic of compounding interest will do most of the work of growing your retirement fund for you.

Because of the magic of compounding interest, you don’t want your money lying idle in non-interest bearing current accounts. With the RHB Smart Account, a current account that can earn up to 2.85% per annum, you can be assured that your money will never be idle again.

Once you start saving, you can start investing. It is much easier to get started on investment than you think. You don’t have to buy an investment property or learn how to invest in the stock market. Investment is as easy as making a contribution to EPF. Make the maximum contribution as an employee. Look for an employer that offers more than a 12% contribution to EPF. If you are self-employed you can voluntarily contribute up to RM60,000 to EPF every year.

Once you have maxed out your EPF contributions, the next easiest way to invest for retirement is by contributing to the Private Retirement Schemes (PRS). PRS are voluntary investment schemes initiated by the Government to provide employees and the self-employed with an additional avenue to save for their retirement.

PRS works a little bit like the EPF. All contributions will be allocated into two accounts, Sub-Account A and Sub-Account B. 70% of your funds will be allocated to Sub-Account A and money in this account can only be withdrawn upon retirement. The rest of your funds go into Sub-Account B. These funds can be withdrawn once a year after you have completed the first year of contribution.

PRS makes it easy to make additional savings for retirement on top of your EPF. You can start small from as low as RM100 per month. As a PRS contributor, you will also enjoy a tax relief of up to RM3000 until 2025, and tax exemption on income received from PRS funds.

RHB Asset Management is proud to be one of the eight PRS Providers approved by the Securities Commission Malaysia. We offer 5 different funds to meet your different retirement needs, goals and risk appetite. Contact your Relationship Manager to learn more about how the PRS can help you to boost your retirement savings for a comfortable retirement.

You may also want more financial flexibility and options than what is offered by the PRS. For this, RHB offers a smorgasbord of options for all your investment needs. Further fine-tune your portfolio with our regional and sector-specific unit trust funds and retail bond offerings. Hedge financial market and currency risks with our Precious Metals Investments and the RHB Multi-Currency Account. Look into our Structured Product Investments for risk-return profiles that are not possible with conventional bonds or equities. Feeling giddy with all the possibilities? Make an appointment with your RHB Relationship Manager to discuss which of these options will best help you to meet your financial goals.

Despite all your efforts, if your retirement number still feels unachievable, you can consider a semi-working retirement, or retire at an older age. This isn’t the end of the world, as retirement may not be the bed of roses you think it is. So, if you enjoy your work, there’s no reason to stop. You can also turn your hobby into a business. This will keep you socially active and intellectually stimulated into your old age, which may not be a bad way to spend your golden years.

If you want to start working on turning your hobby into a business now, RHB is here to help you elevate your passion to the best of your abilities. Start building a foundation for your business with RHB Reflex with an initial deposit from as low as RM1,000. RHB Reflex helps you to keep track of finances for your growing business to maintain a healthy cash flow so you can thrive in the long run. Speak to our SME Relationship Manager to find out the best solutions to help you grow your business to its full potential.

1 Macrotrends, Malaysia Life Expectancy 1950-2021.

2 The Edge Markets, Sluggish Wage Growth Drag on Low-Income Earners, 10 December 2019.

3Ministry of Finance, Malaysia, Economic Outlook 2021, 6 November 2020.

4 Ministry of Finance, Malaysia, Economic Outlook 2021, 6 November 2020.

5Charles Schwab, Why Market Returns may be Lower and Globa Diversification More Important in the Future, 3 May 2020.

Disclaimer

This article is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party, without obtaining prior permission of RHB Bank.

This article has been prepared by RHB Bank and is solely for information only. It may not be copied, published, circulated, reproduced or distributed in whole or part to any person without the prior written consent of RHB Bank. In preparing this article, RHB Bank has relied upon and assumed the accuracy and completeness of all information available from public sources or which was otherwise reviewed by RHB Bank. Accordingly, whilst RHB Bank have taken all reasonable care to ensure that the information contained in this article is not untrue or misleading at the time of publication, RHB Bank cannot guarantee its accuracy or completeness and make no representation or warranty (whether expressed or implied) and accept no responsibility or liability for its accuracy or completeness. You should not act on the information contained in this presentation without first independently verifying its contents.

Any opinion, management forecast or estimate contained in this article is based on information available as the date of this article and reflects prevailing conditions and underlying fund manager’s views as of the date of this presentation, all of which are subject to change at any time without notice. Such opinions, forecasts and estimates as well as the information contained herein relating to the historical performance of various indices is for information only and is not indicative of the future or likely performance of the Fund and should not be construed as such.

A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the RHB Retirement Series (“Fund”) is available and investors have the right to request for a PHS. Investors are advised to obtain, read and understand the PHS and the contents of the Disclosure Document dated 2 December 2015 and its supplementary(ies) (if any) (“the Disclosure Document”) before investing. The Disclosure Document has been registered with the Securities Commission Malaysia (“SC”) who takes no responsibility for its contents. The SC’s approval and authorization of the registration of the Disclosure Document should not be taken to indicate that the SC has recommended or endorsed the Fund. Amongst others, investors should consider the fees and charges involved. Investors should also note that the price of units and distributions payable, if any, may go down as well as up. Where a distribution is declared, investors are advised that following the issue of additional units/distribution, the NAV per unit will be reduced from cum-distribution NAV to ex-distribution NAV. Any issue of units to which the Disclosure Document relates will only be made on receipt of a form of application referred to in the Disclosure Document. The printed copy of prospectus and Product Highlight Sheet is available at RHB branches/Premier Centres and investors have the right to request for a Product Highlight Sheet. Investors are advised that investments are subject to investment risk and that there can be no guarantee that any investment objectives will be achieved. Investors should conduct their own assessment before investing and seek professional advice, where necessary and should not make an investment decision based on this presentation solely.

The Manager wishes to highlight the specific risks of the RHB Retirement Series – Conservative Fund are equity risk, credit risk, interest rate risk, liquidity risk, income distribution risk, currency risk and country risk. The specific risks of the RHB Retirement Series – Growth Fund and RHB Retirement Series – Moderate Fund are equity risk, credit risk, interest rate risk, liquidity risk, income distribution risk, derivatives risk, collective investment scheme risk, currency risk and country risk. The specific risks of the RHB Retirement Series – Islamic Equity Fund and RHB Retirement Series – Islamic Balanced Fund is management risk. These risks and other general risks are elaborated in the Disclosure Document.

This article has not been reviewed by the SC.

Disclaimer for Structured Investment as at 8 September 2021:

This article has not been reviewed by the Securities Commission Malaysia (“SC”).This article is produced for information purposes by RHB Bank Berhad (“RHB Bank”). The information provided in the article does not contain a complete analysis of every material fact and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. Investors are advised to read and understand the disclosure documents including the General Terms & Conditions, Risk Disclosure Statement, Product Highlight Sheet, Term Sheet and complete the Suitability Assessment where required before investing. Without prejudice to the generality of the foregoing, Investors are encouraged to seek advice from an independent expert such as a financial adviser regarding the suitability of any Structured Investment Product taking into account specific investment objectives, financial situation or particular needs before investing. Structured Investment Products are only available to persons specified as High Net-Worth Individual / High Net-Worth Entity / Accredited Investor as specified in the Capital Markets and Services Act 2007 (“CMSA”) as may be amended from time to time (“relevant persons in Malaysia”). Please refer towww.rhbgroup.com/e/sip for the updated list of relevant persons in Malaysia. Do take note that Structured Investment Products shall not be made available to any other person other than the relevant persons in Malaysia. Any persons intending to invest in Structured Investment Products represents and warrants that (i) they are lawfully able to do so under the laws of Malaysia and (ii) they are relevant persons in Malaysia. Investors are not covered by the compensation fund under section 152 of the CMSA. This compensation fund does not extend to Investors if they suffer monetary loss as a result of a defalcation, or fraudulent misuse of moneys or other property, by a director, officer, employee or representative of RHB Bank.

WARNING: THE RETURNS ON YOUR STRUCTURED PRODUCT INVESTMENT WILL BE AFFECTED BY THE PERFORMANCE OF THE UNDERLYING ASSET/REFERENCE, AND THE RECOVERY OF YOUR PRINCIPAL INVESTMENT MAY BE JEOPARDISED IF YOU MAKE AN EARLY REDEMPTION. THIS STRUCTURED INVESTMENT IS NOT PROTECTED BY PERBADANAN INSURANS DEPOSIT MALAYSIA.