Back in 2014, a Deloitte report made ten bold predictions about the Healthcare and Life Sciences industry for the year 2020. The paper details an evidence-based picture of how patients, healthcare professionals and life sciences organisations might behave in this new world. So far, half of them have come true: Health consumers in control; Big Data and the Networked Laboratory; Unprecedented medical innovations; The pharmaceutical shift from volume to value; And a wave of new health-related business models; all on a global scale.1

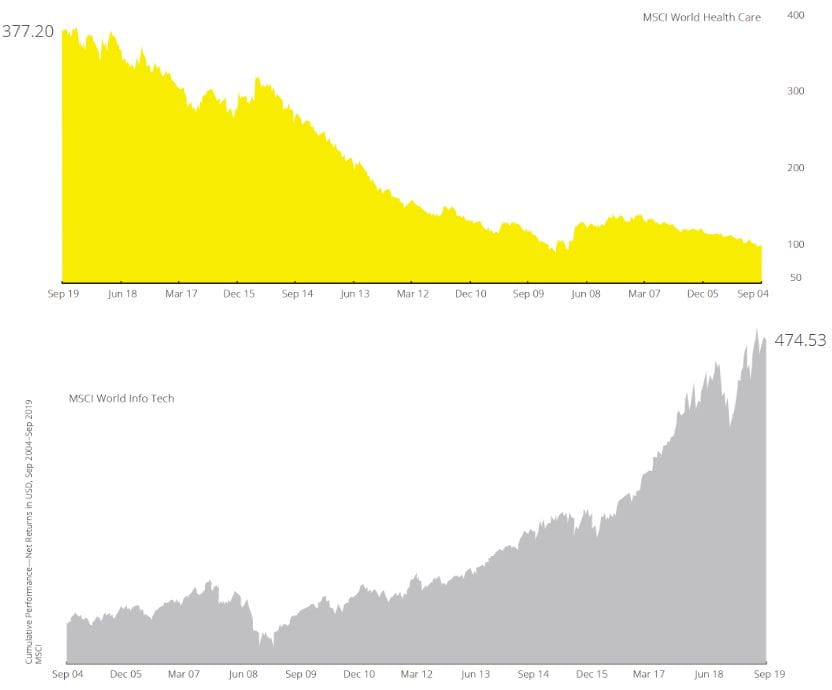

It’s unlikely that the everyday person would be moved by these developments; they have in fact become part of our daily lives. But investors are excited, and it’s plain to see why. What the markets have here is a relatively predictable sector—a priceless one in these volatile times. The Information Technology sector may have been the IPO bad boy of the decade, but Biotech and other Healthcare sub-industries are turning out to be the profitable ones.

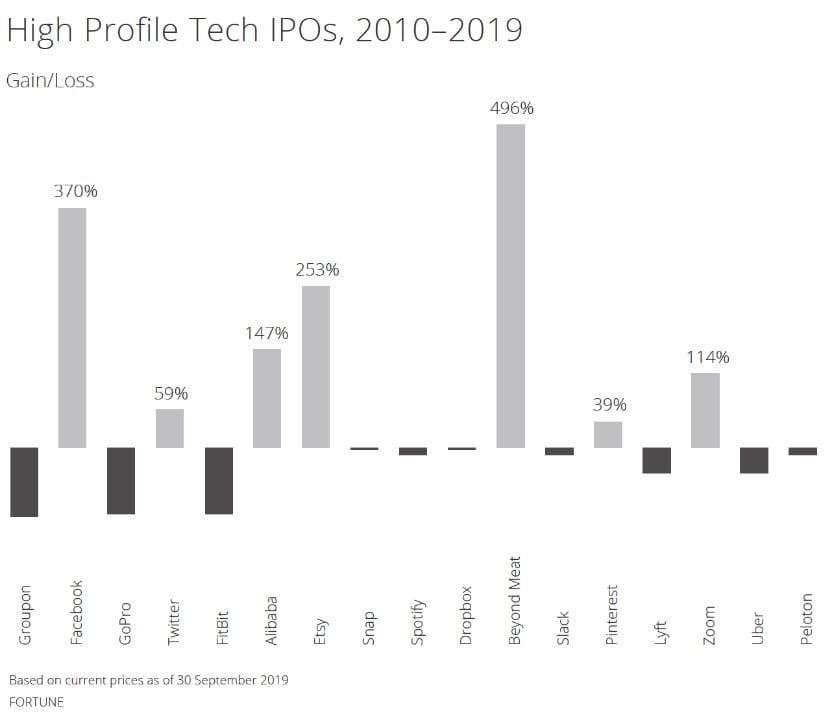

A lot has to do with the difficulty of these tech companies—apart from the Big Techs of Apple, Microsoft, Amazon, Alibaba, Facebook, Netflix, and Google—in finding a clear path to profitability. Twitter, for instance, reported their first profitable year only as recent as February 2018, after thirteen years of operations. 4Even Tech prima donna Uber made clear that it will not see profits until 2021. 5And of course, WeWork’s pipe-dream to profitability was overpowered by Wall Street and Silicon Valley investors just weeks before its 47 billion dollar IPO. It’s not only ‘profitable’ companies like WeWork that hide their excessive liabilities and losses. 6A disruption bubble, where startups seeking to disrupt traditional industries by offering rival products at a discount, is also causing the over-valuation of Tech stocks. 7Meanwhile, trade tensions, the shift of supply chains and data privacy issues have created dead-ends. Others are struggling in the transitioning currents between the East and the West— that is, will the US continue to lead in tech innovations or will big money in China and digital scions of India take over?5

Healthcare, on the other hand, is market-ready. What makes this possible is a mature industry with established pipelines to market products and technologies. Highly-publicised clinical trials as well as government and global regulatory approvals make it stand out in the marketplace as a sector that is attached to hard science, not just dreams.

Biotech vs Tech

Similar surges, but only on the surface

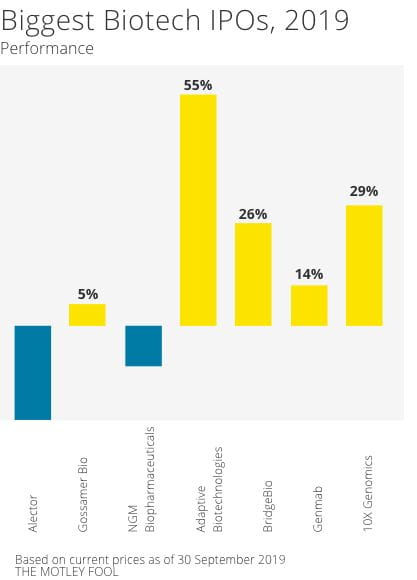

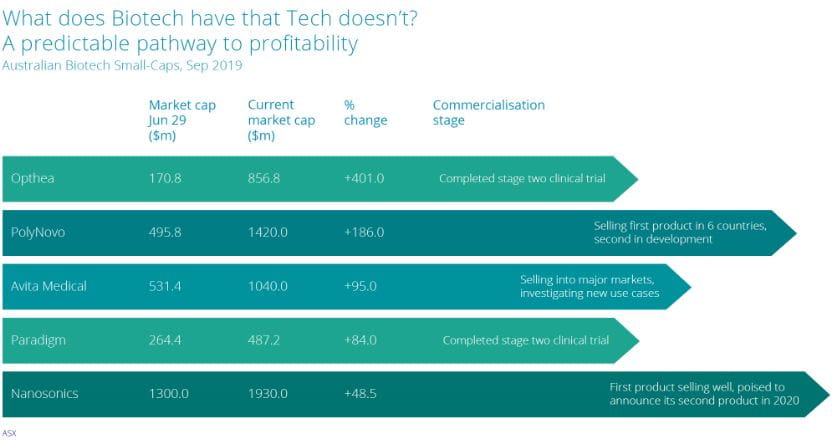

The market was so fixed on the few long-awaited Tech public offerings in 2019 that many missed the biggest story. Around the month of June, Biotech IPOs flooded the NASDAQ and as of 30 September, five out of seven Biotech firms valued above 1 billion dollars made gains of up to 55 percent. 2,9By November, Biogen stocks surged through the roof as they announced the approval of a promising new therapy for Alzheimer’s.8 HLB Inc., a Korean biotechnology stock surged more than 700 percent since August as investors looked beyond an earlier failed clinical study in favour of the prospect of its cancer drug reaching the market. 10At the Australian Stock Exchange, a handful of small- to mid-cap Healthcare stocks added more than 3.25 billion dollars over the six months from April: Opthea surged over 400 percent as it completed its second clinical trial; Avita Medical, the experts in cell- harvesting technology for burn and scar victims, surged 95 percent as it started selling its product into major markets. 11Other Healthcare startups—Alto Pharmacy, Benchling, Miaoshou Doctor, KRY—were floated as the next billion dollar IPOs. 12While Tech remains the marketplace’s most promising stocks, Healthcare seems more palatable. Clinical trials make Healthcare stocks more predictable than Tech. Once drugs and technologies are clinically-approved, there is a set pathway to profitability through established market-ready pipelines.

What’s shaping the Healthcare surge?

Consumers in control. New gen consumers believe in Self-Diagnosis. It‘s all about being in control of their own Personal Well-Being and Personal Data. Inexpensive Genetic Screening prepares adults and children for inherent disorders and encourage prevention. Wearables keep individuals informed and in charge of their daily health decisions.1

Big Data now ubiquitous. Personal digital devices and electronic medical records contribute to medical data explosion. Big Data, along with Networked Laboratories, provide for enhanced patient care and R&D at lower costs.1

Discoveries come bigger and faster with the convergence of technology and science. Data Analytics and Advanced Softwares are speeding up the search for cures, disease simulations, drug design, and new medical technology. Biogen’s Alzheimer drug, the first that could actually halt the neurodegenerative disease, nears FDA approval.8 Just a few years into 3D printing technology, US researchers have arrived at a way to print living skin, complete with blood vessels.13 Soon, printing grafts that the human body is less likely to reject could be reality.

Pharma shift from volume to value.Innovations pay—big time. ASX’s 3.25 billion dollar healthcare stock surge in September 2019 followed a series of successful clinical trials of new products and technologies that treat conditions from burns and to rare genetic disorders.11 Healthcare CEOs and experts have not seen value creation so multiple and diverse in the last two decades. Value creation is replacing volume production as the more profitable commercial model.1

Emerging creative business models driven by patient demand, community engagement, continuous involvement of customers, innovative medical technology, focus on human resources for health, strategic partnerships, economies of scale, and cross-subsidisation. In Indonesia where 260 million people have poor health access due to lack of doctors and loose regulation, the Halodoc telemedicine app connects 2 million users to 10,000 doctors and 1,300 pharmacies. It has to date attracted equity investments from the Bill &Melinda Gates Foundation, UOB, and Go-Jek as well as a Southeast Asian-wide alliance with Grab.14

A Rosy 2020

The in-house RHB Wealth Team would say 2019 and 2020 are made for funds like Blackrock’s World Healthscience Fund. While some Pharma predictions has a lot riding on the upcoming US elections and the resulting drug-pricing decisions, RHB’s analysts believe that it is not a one-size-fits-all scenario.

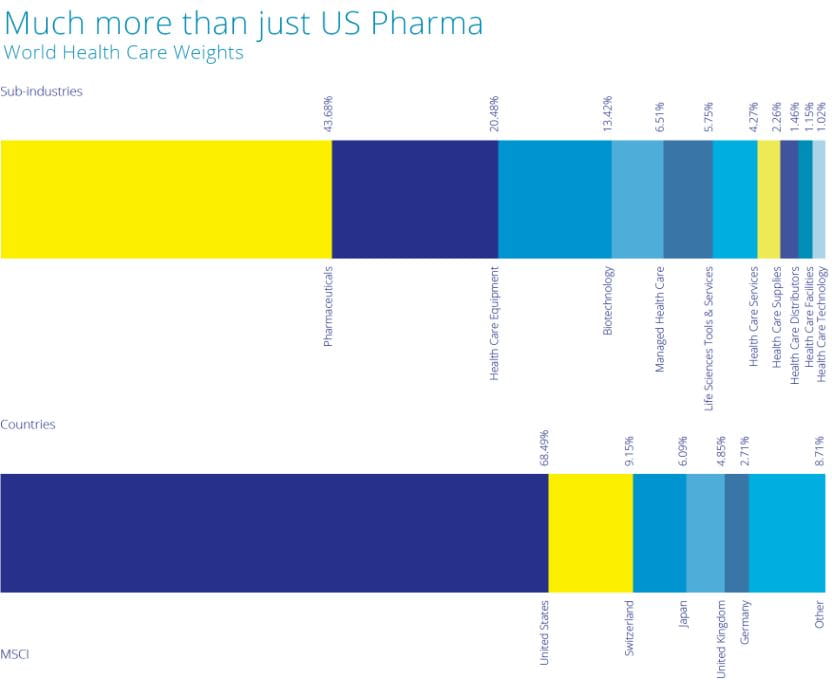

For starters, the Healthcare landscape is much more varied and spread out than Tech. While US Pharma is a huge piece on the Healthcare platter, the big ones aren’t necessarily pharmaceutical-based.

Unlike Tech, which is 85 percent US-centric, considerable portions of the Healthcare sector are either non-Pharma or are Pharma companies outside of the US.15 And that’s what 5-star rated fund managers like Blackrock maximise on beautifully—with top holdings consisting of predominant Pharma stocks not only from the US but also from other advanced countries such as Switzerland, France and Japan, together with huge helpings of non-Pharma equity in Biotechnology, Biopharma, Medical Technology and Equipment, and Healthcare Services.

Bottomline

What makes Healthcare stocks seem less volatile than Tech is a set pathway to profitability through clinical trials, regulatory approvals, and established market-ready pipelines. In contrast, Tech companies suffer trade, data privacy and regulatory headwinds years into business, causing major setbacks. While Tech remains the market’s most promising stocks, you may not be one who’s comfortable embracing volatility to earn potentially high-rewarding gains in the short to medium term; then Healthcare would be more your cup of tea. Of course, not all new science and technologies will succeed, whether they are Biotech or Tech. To be well-positioned as an investor, careful stock selection is critical, based on a good understanding of the industry including its opportunities and threats.

But just to be absolutely certain… apply some science to your investing routine. In today’s market reality, investors can no longer go on observation and intuition alone. Neither can most of the world’s financial theories put together explain movements in the last 12 to 14 months—Biotech, Big Tech or otherwise. Less and less, today’s markets exhibit the sort of fundamentals investors depend on to make good decisions. That’s why at RHB Wealth, it all starts with data. This evidence-based approach—implemented by financial analysts, economic researchers and product heads—is designed to drive your investment decisions through empirical analysis rather than intuition. To get started, talk to your Relationship Manager. Whatever your risk-return appetite and whether it is for long-term capital appreciation or for short-term gains, the RHB Wealth Team can help you build a portfolio aimed to deliver.

Sources : 1 Deloitte UK, Press Releases—Healthcare and Life Sciences Predictions 2020, 2014. 2 Geekwire, Adaptive Biotechnologies stock soars 90% after ringing Nasdaq opening bell following $300M IPO, 27 June 2019. 3 Fortune, If You Think There’s Something Strange About the 2019 IPO Market—You’re Right, 5 October 2019. 4 Bloomberg Live, Bloomberg Markets: Asia, 1 November 2019. 5 France24, News Live, 5 November 2019. 6 Wall Street Journal, How Adam Neumann’s Over-the-Top Style Built WeWork. ‘This Is Not the Way Everybody Behaves.’, 18 September 2019. 7 International Banker, Is A Bubble Forming in Tech Stocks?, 2 October 2019. 8 Bloomberg Live, Bloomberg First Take, 22 October 2019. 9 The Motley Fool, Are There Good Investments Among 2019’s Biotech IPOs?, 2 October 2019. 10 Bloomberg, The Spectacular 770% Surge of a Biotech Stock in Just 12 Weeks, 22 October 2019. 11 The Australian Financial Review, Small cap healthcare stocks surge to billion-dollar plays, 30 September 2019. 12 The New York Times, These 50 Start-Ups May Be the Next ‘Unicorns’, 10 Feb 2019. 13 Rensselaer, Living Skin Can Now be 3D-Printed With Blood Vessels Included, 1 November 2019. 14 Nikkei Asian Review, Indonesia’s Halodoc raises $65m to expand hi-tech healthcare app, 4 March 2019. 15 MSCI, MSCI World Health Care Index, 30 September 2019.