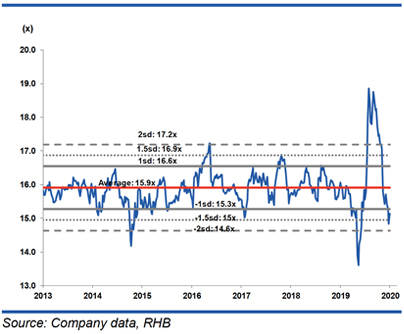

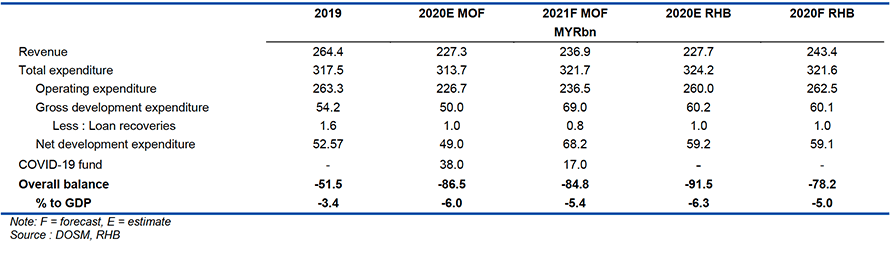

We believe the budget was very balanced in addressing both growth and fiscal constraints. Relative to the MOF, we are more constructive on the fiscal outlook (Figure 1). Broadly, Budget 2021 focuses on substantial support for the economy, given the current challenging macroeconomic and financial markets backdrop, which in turn has been partially due to the COVID-19 pandemic. At the same time, the MOF also had the country’s fiscal constraints in mind when formulating the budget. We expect the budget rollout to be more aggressive in 1H21, given the more pressing need to stabilise the economy.

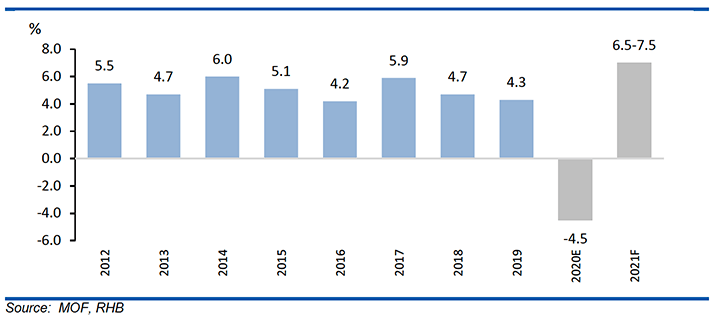

We also deem the MOF’s real GDP growth forecast of 6.5-7.5% for 2021 (from a contraction of -4.5% YoY in 2020F) as realistic (Figure 2). We are in broad agreement with the Government’s optimistic view of the economy in 2021F, with our in-house GDP growth estimated at 7% YoY.

Finance Minister Datuk Seri Tengku Zafrul Tengku Abdul Aziz tabled an expansive budget worth MYR304.7bn for 2021, representing an increase of 10.5% YoY from 2020. Including a special COVID-19 fund amounting to MYR17bn in 2021, this takes the total to MYR321.7bn, implying a 2.6% increase from the previous year.

The operating expenditure (OE) allocation for 2021 will increase by 4.3% YoY to MYR236.5bn, while development expenditure (DE) will rise by a staggering 39.2% (MYR68.2bn) – far higher than the MYR50bn allocated in 2020, and the loftiest on record.

Revenue-wise, there were not many surprises. Higher contributions are expected from all segments, amid expected better economic conditions in 2021. The high dividends that the Government enjoyed in the past are no longer the case this time, with Petronas dividends falling to MYR18bn as oil prices tanked.

Budget 2021 is expected to record a narrower deficit of 5.4% of GDP or MYR84.5bn in 2021, compared to an estimated low of 6% in 2020. At this level, we believe the Government could embark on a fiscal consolidation path while stabilising the economy at the same time.

This should help allay the concerns of credit rating agencies, as the Government remains focused on getting the fiscal deficit back to 4% of GDP in the next four years, as committed to previously.

We were fairly surprised by the significantly large allocation for DE. The focus of DE is primarily towards transportation (MYR15bn; 2020: MYR10.1bn), education (MYR8.9bn; 2020: MYR5.9bn), and healthcare (MYR4.7bn; 2020: MYR2.9bn). Areas for this allocation include:

Transport-related spending. This includes the construction of an electrified doubletrack railway connecting Gemas and Johor Bahru, the Pan Borneo Highway, the Klang Valley Double Track project, the Rapid Transit System, as well as Kuantan Port and Sandakan Airport expansion;

Upgrades of schools, universities and training infrastructure;

Construction of hospitals in small districts, as well as construction of the National Centre for Food Safety.

We think the increase in allocation will likely boost construction activity and be supportive of economic growth in 2021.

On the social front, Budget 2021 has goodies for the B40 group and the public at large. The Cost of Living Allowance has been rebranded to capture a larger scope of beneficiaries (to 8.1m people from 4.3m), while the payment amount per household has been increased by about 20- 40%. On top of that, the Government has allowed the public to make withdrawals from their Employees Provident Fund (EPF) accounts – specifically, from Account 1 by MYR500.00 per month, to up to MYR6,000 a year. These, among other smaller measures, will likely continue providing support to private consumption, which is projected by the Government to rebound by 7.1% YoY next year (2020 estimate: -0.7% YoY).

Much to our expectation, several measures deemed successful this year have been extended. These include the continued reduction in EPF contributions from 11% to 9% (extended to end-2021). The special tax programme for companies relocating to Malaysia will be extended until end-2022. The targeted wage subsidy programme has also gotten a 3-month extension, for tourism-related jobs (until 1Q21). Meanwhile, the stamp duty for property purchases has been extended to Dec 2025.

On housing, measures to address the property overhang appear limited. Except for the extension of the stamp duty exemption, much of the measures for the property sector remain focused on the B40 group. These include an increase in the allocation for public housing, as well as the rent-to-own scheme.

For businesses, the focus is directed towards high technologies. Government has provided some incentives that include MYR1bn in investment incentives for projects in technology and high value-added areas. Another MYR1bn has been allocated for businesses’ digital transformation. We were hoping to see more measures supporting green technology, but there were almost no clear initiatives on this front. Overall, we believe these measures – while positive – will have a limited impact on private investment, unless the economic environment improves.

Amending the Temporary Measure for Government Financing (Coronavirus Disease 2019) Act to raise the ceiling of the COVID-19 Fund by MYR20bn to MYR65bn to fund the Kita Prihatin package and address the needs of frontliners;

Additional MYR1bn (to the existing MYR1.8bn) to be allocated to stem the third wave of COVID-19. This will cover;

To procure equipment to resume dental services, virtual clinical services, and thermometers at health facilities to meet the Standard Operating Procedures;

Provision of MYR500.00 one-off payments to MOH frontliners, which are expected to benefit 100,000 medical staff;

The Government is committed to acquiring COVID-19 vaccine supplies through COVAX, which is expected to cost more than MYR3bn;

Expansion of the tax relief scope for medical treatment expenses to cover vaccination expenses – limited up to MYR1,000;

Increase in tax relief limits on medical expenses for self, spouse, and child for serious diseases up to MYR8,000 from MYR6,000 and tax relief limits for expenses on full medical check-ups up to MYR1,000 from MYR500.00;

Increase in tax relief limits on expenses for medical treatment, special needs, and parental care up to MYR8,000 from MYR5,000;

Allocation of MYR24m to address increased demand for mental health treatment and to strengthen the Mental Health, Violence & Injury Prevention, and Substance Abuse programmes;

Allocations of MYR90m and MYR6m to continue the pneumococcal vaccine programme for children and procurement of biologic medicines for rheumatology illnesses;

Allocation of MYR25m for home-based peritoneal dialysis treatment programmes.

Strategy 2: Safeguarding the welfare of vulnerable groups

Measure 1: Improving financial assistance

The Government has allocated an additional MYR700m (to a total of MYR2.2bn) to increase the monthly rate of financial assistance as follows:

Financial assistance for children to MYR150.00 per child aged 7-18 years, or MYR200.00 per child aged equal to or less than six years with a maximum of MYR1,000 per family;

The Government allocated MYR6.5bn to replace Bantuan Sara Hidup (BSH) with Bantuan Prihatin Rakyat (BPR) vs MYR5bn under BSH, with higher rates of assistance and income categories as follows:

Single individuals aged 21 years and above earning less than or equal to MYR2,500 will receive assistance of MYR350.00;

Allocation of MYR1.5bn to implement the Jaringan Prihatin Programme to alleviate the financial burden of the B40 group in accessing internet services;

Measure 2: Alleviating the rakyat’s cost of living

Income tax reductions for resident individuals by 1% for the chargeable income band of MYR50,001-70,000;

Banks will enhance the Targeted Loan Repayment Assistance to B40 borrowers who are BSH/BPR recipients and to micro enterprises with loans up to MYR150,000. Borrowers in this category can either choose a moratorium on their instalments for a period of three months or to reduce their monthly repayments by 50% for a 6-month period;

Minimum EPF contribution rate is reduced to 9% from 11% beginning Jan 2021 for a period of 12 months;

The Government announced the facility to withdraw EPF savings from Account 1 for an amount of MYR500.00 a month with a total of up to MYR6,000 over 12 months;

Allocation of MYR150m for the enhancement of the Employment Insurance Scheme, whereby the Job Search Allowance for those covered will be extended by three months (nine months in total) with rates being 80% during the first month, 50% for the second till sixth month, and – subsequently – 30% for the last three months;

Income tax exemption limit for compensation of loss of employment to be increased to MYR20,000 from MYR10,000 for each full year of service;

Increase allocation of the Community Drumming Programme to MYR200m from MYR150m.

Measure 3: Assistance to farmers and fishermen

Allocation for the Rubber Production Incentive to be doubled to MYR300m from MYR150m;

Allocation of MYR1.7bn to be provided in the form of subsidies and aid to farmers and fishermen;

Allowance for fishermen to be increased to MYR300.00 per month from MYR250.00;

Allocation of MYR400m to write-off the interest payments on FELDA settlers’ debts.

Strategy 3: Generating and retaining jobs

Measure 1: PenjanaKerja Incentive (hiring Incentive)

Allocation of MYR2bn to continue the hiring incentive programme under Social Security Organisation (SOCSO) or PERKESO – which is now known as PenjanaKerjaya – with new enhancements:

For those employed under PenjanaKerja, the maximum training rate that can be claimed by the employers will be increased to MYR7,000 from MYR4,000;

Measure 2: Reskilling and Upskilling

Allocation of MYR1bn for reskilling and upskilling programmes, which include;

MYR30m to Armed Forces Ex-Servicemen Affairs Corp or PERHEBAT for entrepreneurship training;

Expansion of relief for tuition fees to cover expenditure for attending up-skilling courses provided by certified bolides limited to MYR1,000 for each year of assessment;

Measure 3: MySTEP

More than MYR700m allocated for the Short-term Employment Programme (MySTEP), which will offer 50,000 job opportunities on a contract basis in the public sector and Government Linked Companies (GLCs) starting Jan 2021;

Measure 4: Targeted wage subsidy

Additional MYR1.5bn allocated for the wage subsidy programme, which is extended for another three months with a more targeted approach, specifically for the tourism sector. This is expected to help about 70,000 employers and 900,000 employees;

For the retail sector, workers that earns below MYR4,000 will be given a subsidy of MYR600.00 per month. Additionally, the application limit is lifted to 500 employees per application from 200 employees previously;

Measure 5: Social protection

Members of EPF can now withdraw from EPF Account 2 to purchase insurance and takaful products that are approved by the fund related to life and critical illness coverage for themselves and their family members;

To further encourage old-age savings through Private Retirement Scheme or PRS, individual income tax relief of up to MYR3,000 on PRS contributions will be extended until the Year of Assessment 2025;

MYR24m to be provided for full contributions under the SOCSO Employment Injury Scheme benefitting 100,000 employees from the following groups:

To appreciate the contribution of delivery riders who were in the frontline during the Movement Control Order period, this initiative is also extended to 40,000 delivery riders.

Strategy 4: Prioritising the inclusiveness agenda

Measure 1: Empowering the bumiputera

MYR11.1bn allocated to pursue efforts to support the bumiputera development agenda. MYR6.5bn will be allocated to provide access to quality education to bumiputera institutions, and MYR4.6bn will be provided to boost and empower bumiputera entrepreneurs, which includes:

MYR1.3bn for various capacity building programmes;

MYR750m provided to Pelaburan Hartanah under the 12th Malaysia Plan to increase the value of bumiputera holdings in real estate, especially for commercial developments on Malay reserve land;

Measure 2: Upholding Islamic tenets

MYR1.4bn allocated for Islamic affairs and development under the Prime Minister's Department;

The Government will also enhance the management of endowment or wakaf through collaboration between Yayasan Wakaf Malaysia with federal government agencies, GLCs, and Government-Linked Investment Companies or GLICs. A National Wakaf Masterplan will be created to ensure a more efficient endowment management to maximise the mobilisation of future wakaf assets;

Permodalan Nasional (PNB) – through Amanah Saham Nasional (ASNB) will introduce wakaf services to all ASNB unit trust holders. Under this service, unit holders can endow some of their units into a ASNB wakaf fund and be eligible for an income tax deduction. Returns from the wakaf fund will be channelled to the wakaf projects of national interest identified by PNB;

Allowance rates of guru takmir will be increased to MYR900.00 from MYR800.00 per month in appreciation of the contribution of 4,000 guru takmirs who galvanised the community at the kariah level;

One-off special payments of MYR500.00 to imams, bilals, tok siaks, nojas, merbots, guru takmirs and guru kafas, which is expected to benefit almost 70,000 people;

Measure 3: Enhancing the role of women

MYR95m allocated for special micro credit financing through TEKUN, Majlis Amanah Rakyat or MARA, and Agrobank for women entrepreneurs. In addition, MYR50m will be provided to the Islamic Economic Development Foundation or YaPEIM to support Islamic pawn broking through the Ar-Rahnu BizNita initiative;

Training programmes will be given to more than 2,000 Women Entrepreneurs Micro Entrepreneurs Business Development Programmes, or BizMe;

MYR21m allocated to establish a One-Stop Social Support Centre, which is a collaboration with non-government organisations or NGOs that will provide social protection and moral support to women facing domestic problems like divorce and/or abuse;

MYR30m will be provided for the establishment of childcare centres or TASKA in government buildings, especially in hospitals. For the private sector, a matching grant of up to MYR20m will be provided to encourage private sector employers to provide childcare centres for their employees;

MYR10m will be provided for cervical cancer screening and subsidy incentives for mammograms to women who are of high risk of breast cancer;

Measure 4: Community-based initiatives

MYR177m will be provided for programmes for the Chinese community to improve educational facilities, housing, and the development of new villages, as well as financing facilities through Bank Simpanan Nasional (BSN). For the Indian community, MYR100n is allocated to the Malaysian Indian Transformation Unit or MiTRA to the elevate the socio-economy status of the Indian community;

In addition, TEKUN will provide MYR20m specifically for the Skim Pembangunan Usahawan Masyarakat India or SPUMI and MYR5m for entrepreneurship development for other minority communities;

MYR50m allocated for grants to Rukun Tetangga areas, which will be increased to MYR6,000 from MYR4,000 and benefit more than 8,000 Rukun Tetangga areas;

MYR50m allocated for repairs, maintenance, and small development projects for places of worship in areas under the local authority;

MYR20m allocated to implement human development programmes among others to provide skills training to prisoners. Through this program, inmates have produced various products under the MyPRIDE brand;

Further tax deductions on remunerations given to employers who employ ex-convicts, parolees, supervised persons, and ex-drug dependants are extended until Year of Assessment 2025;

MYR15m allocated to the Cultural Arts Economic Development Agency or CENDANA to implement various arts and culture programmes, which will benefit more than 5,000 artists and production crews;

MYR158m allocated for the implementation of social assistance and integrated development programmes for Orang Asli Villages. The Government will also upgrade and construct 14 new kindergartens at Pos Slim Sungai Kinta, Perak, and Pos Sungai Kelai Jempol, Negeri Sembilan;

MYR5m is provided to carry out land survey work for demarcation of borders in 21 Orang Asli villages. In addition, MYR41m is allocated for Native Customary Rights programmes in Sabah and Sarawak;

Honorarium value for volunteers under the Home Help Services Programme will be increased to a maximum of MYR400.00 from MYR150.00. Meanwhile, the assistance value to the vulnerable group of the programme will also be increased to MYR80.00 from MYR30.00. The increase is expected to benefit more than 2,000 volunteers and 8,000 senior citizens, as well as the disabled;

Additional tax relief limits for disabled spouses will be increased to MYR5,000 from MYR3,500;

MYR100m allocated for supervisors and officers under the Community Rehabilitation Organisation (PDK). Staff rates will be increased to MYR1,200 per month, while the rate of supervisors will be increased to MYR1,500 from MYR1,200 per month. This increase will benefit 3,500 PDK staff and supervisors nationwide;

Annual financial aid to operate the Senior Citizens Activity Centres (PAWEs) managed by NGOs is increased to MYR50,000 from MYR33,000. This increase is expected to benefit 285 PAWEs nationwide;

Further tax deductions on remunerations given to employers who employ senior citizens is extended until Year of Assessment 2025;

MYR170m allocated for early childhood education programmes by the Community Development Department or KEMAS. This allocation among others is to fund Supplementary Food Assistance, Per Capita Assistance, and maintenance and repairs for both TABIKA and TASKA facilities;

MYR20m is allocated to establish community centres as transit centres for children to attend after school. These community centres – in collaboration with NGOs – will be equipped with self-care facilities, tuition classes, libraries, and mentor guidance programmes;

Measure 5: Enhancing rural infrastructure

MYR2.7bn allocated to implement various rural infrastructure improvement programmes and projects as follows:

MYR121m to install 27,000 units of lamps as well as to cover operational and maintenance costs of 500,000 units of street lights in villages;

In addition, the Government will broaden mobile banking services in Sabah and Sarawak, modelled on the Sarawak State Government’s initiative;

Eligibility limit for the use of funds under the Malaysian Road Records Information System or MARRIS has been increased to 20% or MYR50m – whichever is lower – to finance road maintenance works that are beyond the usual scope of MARRIS;

Measure 6: Youth and sports development

MYR250m allocated to provide an incentive of MYR1,000 per month for up to three months to private employers for each new graduate who participates in the apprenticeship programme. In addition, employers can also claim a grant of up to MYR4,000 for training programs for the apprentices. This programme is expected to benefit up to 50,000 new graduates;

MYR75m allocated for a one-off MYR50.00 credit into e-wallet accounts for those aged 18 to 20 years via the eBelia programme. This initiative is expected to benefit more than 1.5m youths;

MYR19m allocated to implement the Malaysia National Healthy Agenda aimed at strengthening a healthy lifestyle to reduce the risk of diabetes, hypertension, and obesity. MYR28m is also provided to implement the MyFit, National Sports Day, and Insire programmes for the disabled community;

Allocate MYR103m to build upgrade and maintain sports facilities nationwide;

MYR20m is provided as soft loans through the TEKUN Sports scheme to ensure continuity of sports facilities operators;

Increased tax relief limit for lifestyle to MYR3,000 from MYR2,500, where the additional MYR500 is specifically provided for expenditure related to sports. The relief is also expanded to include the subscription of electronic newspapers.

Allocate MYR500m to implement National Digital Network initiative or JENDELA to ensure the connectivity of 430 schools throughout Malaysia;

Malaysian Communications & Multimedia Commission is to allocate MYR7.4bn for 2021 and 2022 to build and upgrade broadband services;

GLCs and GLICs to contribute MYR150m into the Tabung CERDIK to provide laptops to 150,000 students in 500 schools;

Measure 2: Access to quality education

The Ministry of Education to receive the largest allocation of MYR50.4bn (15.6% of the total allocation);

MYR420m is allocated to improve the Supplementary Meal Plan by providing milk supply on a daily basis vs twice a week currently. Part of the procurement will be reserved for local milk producers;

MYR800m is allocated for the maintenance and repair works on government and government-aided schools;

MYR725m is allocated to upgrade buildings and infrastructure in 50 dilapidated schools. For schools in rural Sabah and Sarawak, the Government will implement 184 construction projects and install tube well water supplies with a total project cost of MYR120m;

MYR45m is allocated to provide for the special needs stream;

MYR14.4bn is allocated to the Ministry of Higher Education. MYR50m will be for infrastructure and equipment replacement in public universities;

MYR50m is allocated to upgrade the Malaysian Research & Education Network or MYREN access line from 500Mbps to 10Gbps;

The Government – together with BSN – will provide MYR100m to finance the BSN MyRinggit-i COMSIS Scheme. This is a laptop loan scheme. This is to ensure National Higher Education Fund Corp or PTPTN loan holders can continue to learn online;

Extension of tax relief of up to MYR8,000 on net annual savings in the Skim Simpanan Pendidikan Nasional until the Year of Assessment 2022;

Allocate MYR6bn to strengthen Technical and Vocational Education & Training (TVET);

Provide MYR300m through the Skills Development Fund Corp that will provide loans to 24,000 trainees to pursue TVET programmes in public and private skills training institutions;

Allocate MYR60m to increase the National Dual Training System Plus allowance from MYR625.00 to MYR1,000. This will encourage more industry involvement in implementing TVET-based programmes;

Allocate MYR29m to implement TVET programmes under the Ministry of Higher Education – including Islamic education and lifelong learning initiatives;

Measure 3: Increasing home ownership

Extension of full stamp duty exemption on instruments of transfer and loan agreements for first-time home buyers until 31 Dec 2025. The duty stamp limit for first residential home is also increased to MYR500,000;

Extension of stamp duty exemption on loan agreements and instruments of transfer given to rescuing contractors and original house purchasers for another five years. This exemption is effective for loan agreements and instruments of transfer executed from 1 Jan 2021 to 31 Dec 2025 for abandoned housing projects certified by the Ministry of Housing & Local Government;

Allocate MYR500m to build 14,000 low-cost housing units under the People’s Housing Project or PPR;

Allocate MYR315m for the construction of 3,000 units of Rumah Mesra Rakyat by Syarikat Perumahan Nasional;

Allocate MYR125m for the maintenance of low cost and medium-low stratified housing as well as assistance to repair dilapidated houses;

Allocate MYR310m for the Malaysia Civil Servants Housing Programme or PPAM;

The Government will collaborate with selected financial institutions to provide a rent-to-own scheme. This programme will be implemented until 2022 and involve 5,000 PR1MA houses with a total value of more than MYR1bn and reserved for first-time home buyers;

Measure 4: Public transport

Allocate MYR300m to continue the My30 unlimited travel pass initiative and expand it to Kuantan and Penang;

Introduction of an unlimited monthly travel pass for as low as MYR5.00. This is for children in Year 1 to Form 6 to commute to school, and for the disabled;

Allocate MYR150m to expand the Stage Bus Service Transformation Programme or SBST to Johor Bahru, Kuching, Kota Kinabalu, and Kuantan;

Extension of sales tax exemption for the purchase of locally assembled buses including air conditioners for a 2-year period effective 1 Jan 2021 until 31 Dec 2022. This is to reduce the burden on bus operators;

Measure 5: Defending the nation’s sovereignty and security

Allocate MYR16bn and MYR17bn to the Ministries of Defence and Home Affairs;

Increase the allocation to MYR2.3bn from MYR2bn for the maintenance work needed by the Malaysian Armed Forces;

Allocate MYR27m to CyberSecurity Malaysia to increase the country’s cyber security;

Approved MYR500m for the construction of 1,000 new units of Rumah Keluarga Angkatan Tentera or RKAT;

Allocate MYR153m to upgrade the facilities at the training centre and to strengthen the role of People’s Volunteer Corp or RELA.

Second Integral Goal: Business Continuity

Strategy 1: Driving investments

Measure 1: Investment in key sectors:

Allocate MYR1bn as a special incentive package for high value-added technology. This fund aims to support research & development (R&D) investment in the aerospace and electronic clusters, such as in Batu Kawan, Penang, and Kulim, Kedah, industrial parks;

High Technology Fund of MYR500m by Bank Negara Malaysia (BNM) will be provided to support high technology and innovative companies;

Relaxation of tax incentive conditions for principal hubs, and the incentive will be extended until 31 Dec 2022;

New tax incentive for the establishment of Global Trading Centre at a concessionary rate of 10% for five years, and renewable for another five years;

Increase the limit on the sales value for value-added and additional activities carried out in the free industrial zone and licensed manufacturing warehouse from 10% to 40% from the total annual sales value;

Special income tax treatment at a flat rate of 15% for a period of 5 years to non-resident individuals holding key positions, for strategic new investments by companies relocating their operations to Malaysia under the Pelan Jana Semula Ekonomi Negara;

Extension for special tax rate applications by selected manufacturing companies relocating their businesses to Malaysia, and bringing in new investments. The incentive will be extended for another year until 31 Dec 2022;

Special tax rate of 0-10% for 10 years, for companies in selected services that have a significant multiplier effect;

Existing tax incentive (for maintenance, repair and overhaul (MRO) activities for aerospace, building and repair of ships, Bionexus status and economic corridor developments) that are due this year-end will be extended until 2022;

Bank Pembangunan Malaysia to introduce a National Development Scheme (NDS) valued at MYR1.4bn that will support the development of the domestic supply chain, and increase production of local items;

Extension of the Maritime Development & Logistics Scheme, Sustainable Development Financing Scheme, Tourism Infrastructure Scheme, and Public Transport Fund until 31 Dec 2023. Total fund size is MYR3.7bn, of which MYR500m will be designated for bumiputera entrepreneurs;

Introduction of a targeted assistance and rehabilitation facility worth MYR2bn under BNM to further assist affected SMEs;

Measure 2: Improving the business environment

MYR100m to maintain industrial parks’ infrastructure;

MYR42m to improve internet connectivity in 25 industrial parks under JENDELA;

Development of a water treatment plant in Kubang Pasu, in support of the Kota Perdana Special Boundary Economic Zone project in Bukit Kayu Hitam, Kedah;

MYR45m for water supply needs for the Gebeng Industrial Zone petrochemical sector;

Authorised economic operator (AEO) facilities implemented at the national level to facilitate the AEO accreditation process, and the expansion of AEO to logistics players and warehouse operators;

Royal Malaysian Customs Department will bring together 43 permits and trade licences agencies on the AEO platform for improved efficiency and productivity;

Measure 3: Science, technology and innovation

MYR400m for R&D purposes;

Tax incentives for non-resource-based R&D product commercialisation activities will be reintroduced, and tax incentives for the commercialisation of R&D products by public research institutions will be extended to private higher education institutions;

MYR20m provided for the Malaysia Techlympics and Science Space programmes;

MYR100m from the proceeds of the Sukuk Prihatin allocated for research related to infectious diseases covering vaccine development;

MYR400m contributed by Top Glove, Hartalega, Supermax, and Kossan for the fight against COVID-19;

Measure 4: Locally Manufactured Products

MYR25m for the Micro Franchise Development and Affordable Franchise programmes, as well as Buy Made In Malaysia programme;

MYR150m for training programmes, sales assistance and digital equipment for 100,000 local entrepreneurs under e-Commerce SME and micro SME campaigns;

MYR150m to implement the Shop Malaysia Online initiative and encourage online spending;

MYR35m to promote Malaysian-made products and services under the trade and investment mission;

Strengthening of the MOH’s off-take agreement programme to attract investment to this country and encourage potential vaccine production in the future;

Preferential tax rates of 0-10% for 10 years to encourage manufacturers of pharmaceutical products (including vaccines) to invest in Malaysia.

Measure 1: Empowering the agriculture sector

MYR30m for the extension of the Community Farming Programme to the semi-urban and rural communities – MYR500.00 per individual, MYR50,000 per community;

MYR50m for the implementation of the Organic Agriculture Project;

MYR10m for the implementation of the e-Satellite Farm Programme, in the form of matching grants up to MYR30,000 to Pertubuhan Peladang Kawasan;

MYR150m provided by Agrobank for the financing of up to MYR5m at a rate of 3.5% for 10 years under the Vessel Modernisation and Capture Mechanisation Programme;

MYR60m provided by Agrobank for the funding of up to MYR1m at a rate of 3.5% for 10 years, under the Agrofood Value Chain Modernisation Programme;

MYR10m allocated through matching grants of up to MYR20,000 for the implementation of Aquaculture Development Programme;

MYR100m for the implementation of impactful and high-value farming projects;

Measure 2: Development of the commodity sector

MYR20m to continue Malaysian Sustainable Palm Oil Certification (MSPO), with matching grants of MYR30m introduced to encourage the industry’s investment in automation;

MYR16m incentive for latex production;

To open a furniture industrial park in Pagoh to boost the timber industry;

MYR500m revolving fund provided for the Forest Plantation Development Loan (PPLH) programme under the 12th Malaysia Plan;

Measure 3: Sustainability of the tourism industry

MYR50m for the training and placement of 8,000 employees of airline companies;

To provide employment opportunities for 500 people in the local and Orang Asli communities as tour guides at national parks;

MYR50m for the maintenance of tourism facilities across the country – MYR20m to improve the infrastructure and promotion of Cultural Villages;

MYR10m allocated to ensure the preservation of national heritage buildings;

MYR35m allocated to the Malaysia Healthcare Travel Council, and extension of income tax exemption for the export of private healthcare services until 2022;

Grant Khas Prihatin of MYR1,000 to be given to 20,000 traders and hawkers in Sabah, as well as drivers of taxis, rental cars, etc;

An exemption from the Human Resources Development Fund levies will be given for six months effective 1 Jan 2021, covering the tourism sector and sectors affected by COVID-19.

To focus on long-term productivity through the use of new technology;

Industrial Digitalisation Transformation Scheme valued at MYR1bn, extended until 31 Dec 2023;

MYR150m provided under the SME Digitalisation Grant Scheme and the Automation Grant, with relaxed conditions.

Strategy 4: Enhancing access to financing

Measure 1: Micro credit financing

MYR300m provided by SME Bank to the Lestari Bumi financing facility scheme;

MYR300m for the National Supply Chain Finance Platform to be introduced, called “Jana Niaga”;

MYR50m to be allocated to support P2P platforms;

MYR1.2bn worth of micro credit financing provided through TEKUN, PUNB, Agrobank, Bank Simpanan Nasional, etc – including MYR110m to Micro Enterprises Facility under BNM;

iTEKAD programme to be expanded with participation of more financial institutions and state religious authorities and delivery partners in 2021;

MYR230m allocated through PUNB as financing to SMEs for working capital, automation, and expenditure on COVID-19 compliance;

Measure 2: Loan guarantees

To increase Syarikat Jaminan Pembiayaan Perniagaan by up to another MYR10bn (from MYR25bn) – MYR2bn reserved for bumiputera entrepreneurs;

MYR3bn allocated under the Danajamin Prihatin Guarantee Scheme, extended until 2021;

The Consumer Credit Act will be formulated to provide a regulatory framework for the issuance of consumer credit, among others;

Measure 3: Alternative financing

Income tax exemption of 50% of the investment amount or limited to MYR50,000 to be given to encourage equity crowd funding (ECF) – MYR30m also allocated through matching grants.

Government revenue revised to MYR227.3bn;

An increase of MYR17.7bn in total expenditure for 2020, intended to finance the stimulus package and economic recovery – the fiscal deficit is estimated to increase to 6% of GDP (vs the original target of 3.2%);

Revenue collection for 2021 is expected to increase to MYR236.5bn;

Total expenditure for 2021is the largest in history, at MYR322.5bn – allocating MYR236.5bn for operating expenses, MYR69bn for development, MYR17bn under the COVID-19 fund, MYR2bn for contingency reserve advance warrants. The 2021 fiscal deficit is projected at 5.4% of GDP;

Measure 1: Expenditure with a higher multiplier effect

MYR2.5bn allocated for contractors in Classes G1 to G4, MYR200m for maintenance projects for federal roads, and MYR50m for People’s Housing Programme houses – in addition to extended flexibilities on procurement procedures until Dec 2021;

MYR50m provided through MARA as financing access to construction contractors under the Skim Pembiayaan Kontrak Ekspres or SPiKE;

Measure 2: Sustainability of government revenue

Government revenue is currently around 15% of GDP, including petroleum-related revenue of around 3% The Government is to ensure the revenue source is sustainable and able to finance expenses;

Strengthening of the Multi-Agency Task Force with the participation of the Malaysian Anti-Corruption Commission and the National Anti-Financial Crime Centre;

Freezing the issuance of new cigarette import licenses;

Tightening renewals of import licences for cigarettes through the review of license conditions

Limiting transhipments of cigarette to dedicated ports only;

Imposition of tax on the import of cigarettes, with drawback facilities for re-export;

Disallowing transhipments of cigarettes and re-exporting cigarettes by small boats;

Making cigarettes and tobacco products as taxable goods in all duty-free islands, and any free zones that permit retail sale of duty-free cigarettes;

Imposition of excise duty of 10% on devices for all electronic and non-electronic cigarettes, effect Jan 2021 – while liquid used in electronic cigarettes will be imposed an excise duty at a rate of 40 sen per ml.

Strategy 2: Development agenda under the 12th Malaysia Plan

Measure 1: Transport infrastructure development

MYR15bn allocated to fund the Pan Borneo Highway, Gemas-Johor Bahru Double-Tracking Electrified Project and Klang Valley Double Tracking Project Phase One, in addition to other key projects;

To continue the HSR;

MYR3.8bn worth of large new projects to be implemented:

Construction of the Cameron Highlands bypass road, with emphasis on preserving the environment;

Measure 2: Balanced regional development

MYR780m for 2021 to include:

MYR150m allocated for the Raw Water Transfer Project;

EPF to continue the development of Kwasa Damansara, with an estimated value of MYR50bn;

MYR5.1bn and MYR4.5bn for Sabah and Sarawak in 2021 for building and upgrading infrastructure.

Strategy 3: Enhancing the role of GLCs and civil society

Measure 1: Alternative service delivery

Government to work with NGOs and social enterprises in the national development agenda;

MYR50m for income generation and employment promotion initiatives for the vulnerable;

MYR30m for the initiative to address social issues;

MYR20m for environmental conservation initiatives;

The MYR100m grant will be matched with contributions from GLC-owned foundations;

MYR20m for the Malaysian Global Innovation and Creativity Centre (MaGIC).

Strategy 4: Ensuring resource sustainability

Measure 1: Sustainable development agenda

MYR20m for the establishment of the Malaysia- Sustainable Development Goal (SDG) Trust Fund, in cooperation with the United Nations;

MYR5m will be allocated in support of SDG programmes implemented by the Malaysian Parliamentary Cross Group;

Measure 2: Sustainable finance

To issue the first sustainability bond in Malaysia in 2021;

Income tax exemption for the Sustainable & Responsible Investment (SRI) green sukuk grant to be extended to all types of sukuk and bonds, extended until 2025;

MYR2bn for the Green Technology Financing Scheme 3.0 for two years up to 2022;

Measure 3: Environmental conservation

MYR50m to address waste trapped in rivers;

MYR40m over five years to strengthen monitoring enforcement activities;

MYR10m for the Integrated Island Waste Management project;

MYR400m (from MYR350m) allocated under the TAHAP to all state governments – of which, MYR70m is for ecological fiscal transfer activities;

Implementation of mangrove tree planting programmes;

MYR30m for the introduction of SAVE 2.0 – an e-rebate of MYR200.00 – to households that buy energy-efficient locally-manufactured air conditioners/refrigerators;

The Government is in support of the initiatives in Sarawak in using public buses that operate on hydrogen fuel cells;

MYR20m for the Biodiversity and Patrol Programme to control poaching.

Measure 1: Strengthening public service delivery

Digitalisation should be maximised in any day-to-day affairs;

To build an Urban Transformation Centre (UTC) in Lembah Pantai, in collaboration with the private sector;

To expand the use of kiosks as an alternative channel for the public delivery system by way of the Road Transport Department;

MYR14m to upgrade the infrastructure and facilities in the Ministry of Foreign Affairs, as well as digitalisation of Malaysian consular services abroad;

Measure 2: Strengthening governance and integrity in Malaysia

To ensure initiatives contained in the National Anti-Corruption Plan are implemented, and recruitment of 100 SPRM officers will be continued;

Special provisions are provided as a reward to anyone who provides information on any violations of the law;

Measure 3: Welfare of civil servants

Increase the allowance rate from MYR6.00 to MYR8.00 per hour to more than 1,900 auxiliary bomba officers from 2021;

Introduce a free personal accident protection scheme of MYR100,000 to new borrowers of the Public Sector Home Financing Board or LPPSA for 2021 and 2022;

One-off grant of MYR500.00 to 40,000 National Hero Service Medal recipients;

MYR600.00 as special financial assistances to be paid to all civil servants Grade 56 and below, while MYR300.00 in special financial assistance will be paid to retirees and non-pensionable veterans in 2021.