The Covid-19 pandemic and movement control order (MCO) has punctured a hole in everyone’s pockets and the financial disruption is expected to continue even after the MCO is lifted. To help ease the burden, Bank Negara Malaysia has mandated a six-month moratorium on loan/financing (April 1 to September 30, 2020) for both businesses and individuals.

Essentially, the moratorium is a break, not a discount. Therefore, if you have the funds to spare and expect to be financially stable for at least a year, it is advisable to service your payments in advance starting now, so you’ll have more flexibility once the moratorium ends. Similarly, if you are up-to-date with your payments and have adequate cashflow, you can opt out of the moratorium to avoid extending your loan/financing term or be burdened with larger monthly payments later on.

While a six-month break from monthly payments can provide temporary relief, should you take it? If you fall under the following categories, the moratorium is an option for you.

You have existing auto financing or personal financing (and/or their Islamic financing equivalents). There are no implications, and your loan/financing shall resume from October 2020.

2 /

Facing serious cash flow issues

You face some serious cash flow issues during this period and have no emergency funds – this deferment is to alleviate this exact concern.

3 /

Foresee a potential cash flow issue

You foresee a potential cash flow issue – with no job security across all industries, you don’t know what to expect. You can opt in for the deferment at any time during the six-month period, so you don’t have to make a decision now.

If you do decide to take up the moratorium for any facility, remember to immediately resume your monthly payments after the moratorium ends to avoid any inconvenience.

Facilities covered by the moratorium

Ringgit Malaysia-denominated mortgages, ASB financing and business financing (and/or their Islamic financing equivalents) with less than 90 days in arrears as at April 1, 2020, automatically qualify for the moratorium. You don’t have to apply to opt in. Your CCRIS (Central Credit Information System) records will not be affected by the moratorium.

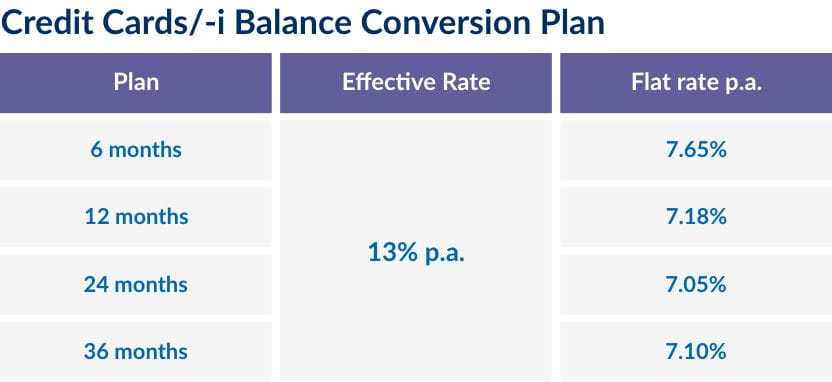

For credit cards/-i, RHB is offering a Credit Card Balance Conversion programme to convert the outstanding balance into an instalment plan of not more than three (3) years, at an effective rate of not more than 13% per annum.

If you have a standing instruction (SI) with another bank to pay your loan/financing but decide to opt in for the moratorium, contact the relevant bank to suspend the SI. If your financing and SI are from the same bank, your SI will automatically be suspended until after the moratorium.

If you have set up future dated/recurring transactions, log in to your online banking facility to cancel them.

If you are currently under AKPK supervision, please contact them for guidance.

If your home financing is more than 10 years old, the impact will not be as large compared to newer loan/financing. If your loan/financing is more than 10 years old and you can afford to opt out of the moratorium, it is advisable to do so. Similarly, if you can afford to continue making monthly payments as usual, it is better not to take up the moratorium.

If you only have a few years left on your mortgage and have the means to clear the balance sooner, you can opt to reschedule and restructure your mortgage to accommodate this.

Banks are not compounding interest/profit during the moratorium, but will do so after the payment holiday. For Islamic financing, profit cannot be made on profit, so you are effectively paying only the accrued profit and nothing more.

When the moratorium ends, monthly payments will be allocated towards the outstanding interest/profit. After these have been paid, your monthly payments then will be allocated towards reducing the principal balance.

Whichever payment method you decide on, it is best to resume monthly payments as soon as the moratorium ends to avoid any inconvenience.

You don’t need to make any monthly payment at all, and resume as usual after the moratorium. Your account status as at April 1 will remain unchanged throughout the moratorium period.

As most home loan/financing facilities charge on a reducing balance basis, interest/profit is charged based on the outstanding balance and daily rest basis. So, while you don’t need to make a payment during the moratorium, interest/profit will still accrue.

For Islamic financing, any fire insurance/Takaful renewal fee during the moratorium period will be added to your monthly payment following the end of the moratorium period. For conventional loan, the fire insurance premium will be added to your principal balance as usual.

For the term of your mortgage, you can simply add on another six months to the maturity date, provided the new tenure is less than 35 years. If you were in arrears before the moratorium, the same will apply to the new tenure.

Here’s a rundown of what will happen based on how you choose to service your loan/ financing should you opt for the moratorium, based on an example of a RM500,000 outstanding loan /financing, with a monthly payment of RM2,387 for the remaining tenure of 30 years:

1 /

Pay the deferred interest/profit as one lump sum in October 2020

Pay the deferred interest/profit which accrued during the moratorium period as one lump sum in October 2020 in addition to your usual monthly payment. Moving forward, the balance will reduce accordingly based on the maturity date plus the additional six months. It is the best – but most difficult - option, and not suitable for those looking to free up some cash during the MCO.

2 /

Pay the same monthly payment amount from October

Pay the same monthly payment amount from October 2020 onwards. In a RM500,000 outstanding home loan/financing example, you’ll need an additional 20 months to pay off the financing (because the interest/profit accrued during the six months will need to be settled before subsequent monthly payment can be made towards your principal balance). The total additional interest/profit charged for this option is RM23,135 compared with method 1. Not a good idea.

3 /

Pay a higher monthly payment from October 2020 onwards

Pay a higher monthly payment from October 2020 onwards to accommodate the deferred interest/profit payment. This is the best option. You are effectively paying both principal + original interest/profit and deferred period interest/profit, and the total interest/profit charged for the remaining tenure will be lower. The new monthly payment amount will be RM2,435 – just RM48 more than your old monthly payment amount. Effectively, you end up paying only RM6,425 additional interest/profit payments compared with method 1.

For interest/profit only loan/financing (property still under construction) we advise you to settle the deferred amount BEFORE the loan/financing is fully disbursed. Otherwise, monthly payments meant for the ensuing monthly payments will go towards settling the deferred amount, resulting in lower monthly payments towards reducing your principal amount. Monthly payment will only be subsequently allocated to reduce the principal balance once all outstanding interest/profit has been paid.

For new loan/financing taken during the moratorium, the moratorium is NOT automatic, and is subject to approval by your bank.

1) Use the balance in your Employees Provident Fund Account 2. For active accounts, withdrawal can be done online, with a processing period of 14 days. This balance can also be directed towards future monthly payments (only for non-redraw financing).

2) Discuss with your bank to reschedule and restructure your monthly payments. To apply for rescheduling and restructuring, you must provide evidence of income (payslip etc).

3) Seek advice from AKPK under its debt management programme.

After the moratorium:

Your original term will be extended by six months. Your monthly payments after the moratorium will be subject to current interest/profit rates.

You can opt to pay the total deferred amount in one lump sum. No interest/profit will be charged on the deferred monthly payments. You can also opt to pay any of the six deferred payments fully or partially at any time during the rest of the term, but interest/profit charges will apply. Either way, your CCRIS record will not be affected.

For new loan/financing taken during the moratorium, the moratorium is NOT automatic, and is subject to approval by your bank.

If your finances are sound, you can contact your bank and continue making monthly payment. Otherwise, if you are tied for cash, opt for the moratorium to free up some cash during the MCO. If you expect your finances to be a little shaky, you can consolidate debt from a different channel by taking up personal loan/financing at a lower rate to create some cash flow. If you are an existing personal loan/financing customer, you may choose to top-up your facility to generate extra cash, subject to your bank’s approval.

You don’t need to make any monthly payment at all, and resume repayments as usual after the moratorium. Your account status as at April 1 will remain unchanged throughout the moratorium period.

For the tenure of your loan/financing, you simply add on another six months to the maturity date. If you were in arrears before the moratorium, the same will apply to the new tenure. Your CCRIS record will not be affected.

If you have the cash, you can opt to pay the deferred payments in full, at no additional interest/profit or late payment charge. Otherwise, you can pay any of the deferred payments, fully or partially, at any time during the rest of the tenure.

For new loan/financing taken during the moratorium, the moratorium is NOT automatic, and is subject to approval by your bank.

If you need help with your monthly payments after the moratorium, contact your bank.

Credit Cards

If you don’t have the means to convert your outstanding balance into an instalment plan now, here are your options:

Hire Purchase Loan/ Hire Purchase Financing-i

(Fixed Rate)

You don’t need to make any monthly payment at all, and resume as usual after the moratorium. Your account status as at April 1 will remain unchanged throughout the moratorium period. There will be no impact on your CCRIS records during the deferment period.

However, if your account is in arrears as at 1 April 2020, the arrears status will remain the same until 30 September 2020, unless you choose to pay off the arrears during the moratorium period.

You will continue to pay same monthly payment from Oct 2020 until Original Maturity Date.

You will need to settle the 6 months deferred monthly payment with an extension of 6 months at end of Original Maturity Date with no additional interest / profit charges. However, you have option to pay off the deferred monthly payment at any earlier time.

1Bank Negara Malaysia, notices and announcements, Reiteration of Our Statements on Moratorium, April 30, 2020.