Getting to know who you are as an investor can help you make the right investment choices. We break down the more introspective points of investing so you can unleash your full investor potential, no matter where you start.

So, you want to start investing. You begin reading up on the various types of financial tools available and get lost in the jargon. With so many options, how do you know which to pick? Many of us simply say “yes” to anything so we don’t miss out, but this investor FOMO could cost you.

You’re looking in the wrong places. There’s no point in knowing everything about investing when you don’t know yourself. Investing does not require you to know everything about every option available. The most important thing to understand about investing is that it’s all about YOU. Why jump on the latest, most-hyped investment bandwagon if it doesn't serve your purpose?

Studies1 show that psychological factors have a greater impact on investors’ decision-making process than traditional finance assumes. Investing can be compared to dating, especially from a psychological standpoint. Simply swiping right on anyone mildly interesting can lead to numerous misadventures and heartbreaks. That’s why self-help dating guides emphasise the importance of knowing oneself first to improve your odds of finding the right partner. That’s also why matchmakers continue to thrive despite the presence of dating apps like Tinder and Bumble. The key lies in aligning your personality, goals, and values with the right pers…umm, investment.

And do you know why Warren Buffet is an investment idol? It’s because he has a clear understanding of desires and knows his own identity. These topics are essential for getting to know the investor within you and optimising your approach.

Investment goals

Like life and dating, it’s important to have goals. There are many different types of investment goals, and some may be more appropriate for your situation than others. It’s important to determine if you have any specific goal in mind, such as retirement planning, education saving, protection goal or simply just to grow your wealth. You can also categorise them into short-term and long-term goals.

Risk tolerance

Risk tolerance is your ability to bear risk. This can vary over time, depending on your age and financial circumstances. For example, if you are single with no dependents, you might have a greater ability to take on risk compared to someone who is nearing retirement.

Investment style

Investment style is the way you approach investing. It represents your personal preference for how you invest your money, and it can be broken down into three main categories: conservative, moderate, and aggressive.

The risk/reward tradeoff

This concept describes the relationship between investment risk and potential return. Generally, higher risk is associated with the potential for higher returns. But that doesn’t imply the need to “go big or go home” every time. All investments involve some degree of risk; it’s just a matter of evaluating the degree of risk involved. Your expectations should be realistic in gauging your potential returns.

Investment knowledge

While it’s not a requirement to be an expert, having a grasp of the basics is important. For example, it is important to have a general understanding of how the economy works and how companies experience growth. If you own a rental property, knowing how interest rates and inflation affect your rental income and property value is essential.

You should also know the difference between active and passive income. Active income refers to earning returns by putting in effort, like through your job or a side gig selling things online. Trading in the stock market is also considered active income since you need to monitor the share price movements personally. On the other hand, passive income requires little to no legwork. An example is investing in managed funds overseen by professionals or buying a brick of gold and holding on to it for several decades. While passive income may sound wonderful, it often comes with some associated cost, like management fees for funds or insurance and safe deposit fees for holding gold.

Factors affecting risk profile

This next part is just as important. Because your investor profile is so intricately linked to personal identity, it can change over time. Various life events and experiences can shape who you are, and similarly, there are factors that can affect your risk profile, such as:

Time horizon

This refers to the time you give yourself to meet your financial goals and recover from any potential losses. If your time horizon is long, you may be more inclined to take on more risk compared to someone with a nearer-term goal.

Cash requirements

Some people see their investment returns as a means of generating income to meet daily expenses. In such cases, they may not be comfortable taking on more risk.

Emotions

As much as we may aspire to be purely analytical investing machines powered by AI, the reality is that we’re human. How do you react to market fluctuations and volatility?

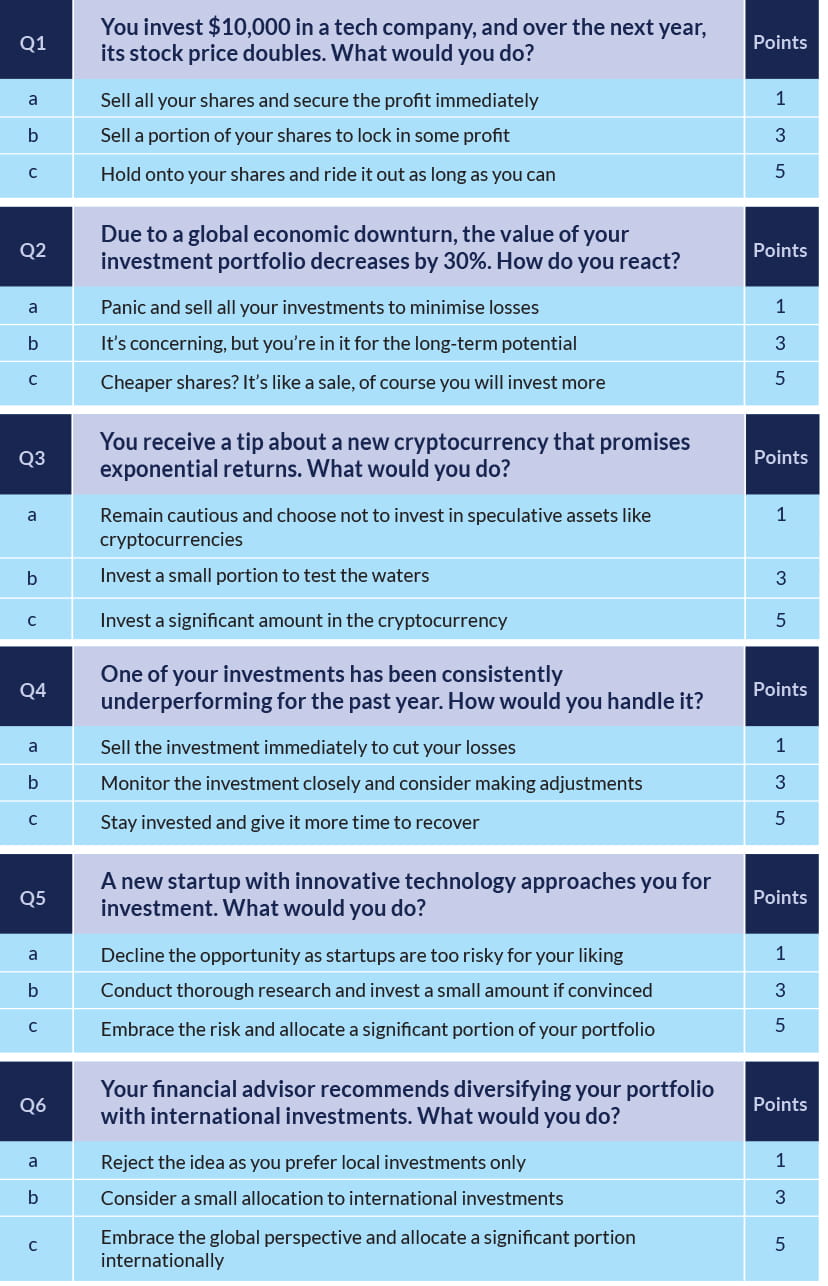

Now, take the quiz below to get a better picture of what kind of investor you are.

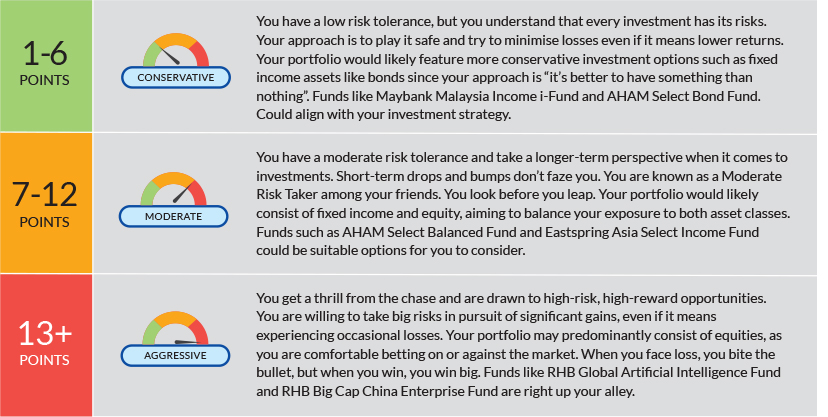

Add up your points and see what type of investor you are!

Conclusion

This short quiz provides a glimpse into your investor profile and serves as a starting point rather than a comprehensive evaluation. It aims to provide you with some insights into your investment preference and help you envision your path as an investor. By understanding your risk tolerance and investment goals, you can make more informed decisions and build a portfolio that aligns with your goals.

For a more in-depth risk profiling assessment and personalised advice on building a tailored portfolio, we recommend reaching out to your RHB Relationship Manager.

1The Impact of Psychological Factors on Investors’ Decision Making in Malaysian Stock Market: A Case of Klang Valley and Pahang, Department of Finance and Economic, College of Business Management and Accounting, University Tenaga Nasional, Suzaida Bakar, Amelia Ng, 2016.

Disclaimer:

This article is strictly for its intended recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party, without obtaining prior permission of RHB Bank Berhad (“RHB”).

This article has been prepared by RHB and is solely for your information only. It may not be copied, published, circulated, reproduced, or distributed in whole or part to any person without the prior written consent of RHB. In preparing this presentation, RHB has relied upon and assumed the accuracy and completeness of all information available from public sources or which was otherwise reviewed by RHB. Accordingly, whilst we have taken all reasonable care to ensure that the information contained in this presentation is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness and make no representation or warranty (whether expressed or implied) and accept no responsibility or liability for its accuracy or completeness. You should not act on the information contained in this podcast without first independently verifying its contents.

Any opinion, management forecast or estimate contained in this article is based on information available as the date of this podcast and are subject to change without notice. It does not constitute an offer or solicitation to deal in units of any RHB fund and does not have regard to the specific investment objectives, financial situation or the particular needs of any specific person who may receive this. Investors may wish to seek advice from a financial adviser/unit trust consultant before purchasing units of any funds. In the event that the investor chooses not to seek advice from a financial adviser/unit trust consultant, he should consider whether the fund in question is suitable for him. Past performance of the fund or the manager, and any economic and market trends or forecast, are not necessarily indicative of the future or likely performance of the fund or the manager. The value of units in the fund, and the income accruing to the units, if any, from the fund, may fall as well as rise.

A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the Maybank Malaysia Income-i fund dated 11 April 2022, AHAM Select Bond Fund dated 22 November 2022, AHAM Select Balanced Fund dated 17 March 2023, Eastspring Investments Asia Select Income Fund dated 30 December 2022, RHB Global Artificial Intelligence Fund, dated 15 December 2022 and RHB Big Cap China Enterprise Fund dated 28 February 2022. (“Fund”) is available and investors have the right to request for a PHS.

Investors are advised to obtain, read, and understand the PHS and the contents of the Information Memorandum and its supplementary (ies) (if) (“the Information Memorandum”) before investing. The Information Memorandum has been registered with the Securities Commission Malaysia (“SC”) who takes no responsibility for its contents. The SC’s approval and authorization of the registration of the Information Memorandum should not be taken to indicate that the SC has recommended or endorsed the Fund. Amongst others, investors should consider the fees and charges involved. Investors should also note that the price of units and distributions payable, if any, may go down as well as up. Where a distribution is declared, investors are advised that following the issue of additional units/distribution, the NAV per unit will be reduced from cum distribution NAV to ex-distribution NAV. Any issue of units to which the Information Memorandum relates will only be made on receipt of a form of application referred to in the Information Memorandum. The printed copy of the prospectus and Product Highlight Sheet is available at RHB branches/Premier Centre and investors have the right to request for a Product Highlight Sheet. Investors are advised that investments are subject to investment risk and that there can be no guarantee that any investment objectives will be achieved. Investors should conduct their own assessment before investing and seek professional advice, where necessary and should not make an investment decision based solely on this update.

The manager wishes to highlight the specific risks of the Maybank Malaysia Income-i Fund are Credit & Default Risk, Profit Rate Risk, Class Currency Risk, Country Risk, Shariah Non-Compliance Risk. The specific risks of AHAM Select Bond Fund are Credit & Default Risk, Interest Rate Risk, Embedded Derivatives Risk, Country Risk, Currency Risk, Regulatory Risk, Distribution Out of Capital Risk. The specific risks of AHAM Select Balanced Fund are Stock Specific Risk, Credit & Default Risk, Interest Rate Risk, Warrants Investment Risk, Country Risk, Currency Risk, Regulatory Risk. The specific risks of Eastspring Investments Asia Select Income are Security Risk, Countries or Foreign Securities Risk, Currency Risk, Credit & Default Risk. The specific risks of RHB Global Artificial Intelligence Fund are Management Risk, Liquidity Risk, Country Risk, Currency Risk, General Market Risk, Emerging Markets Risk, Company-specific Risk, Concentration Risk, Volatility Risk, Derivatives Risk, Sector, and theme fund Risk. The specific risks of the RHB Big Cap China Enterprise Fund are Currency Risk, Country Risk, Market Risk and Particular Security Risk.

This article has not been reviewed by the Securities Commission Malaysia (SC).