From the 2nd century BCE to the 18th century, China’s Silk Road was a network of trade routes connecting East and West, playing a central role in the economic, political, cultural and religious interactions between the two hemispheres. Today, there is the New Silk Road, revived in the form of the Belt and Road Initiative.

With China firmly on its way to becoming the world’s top economic powerhouse through the New Silk Road, investors will want to get in on the action. China’s economic weight as the world’s largest trading power and manufacturer places it in a significant position, and the country is expected to overtake the US by 20281.

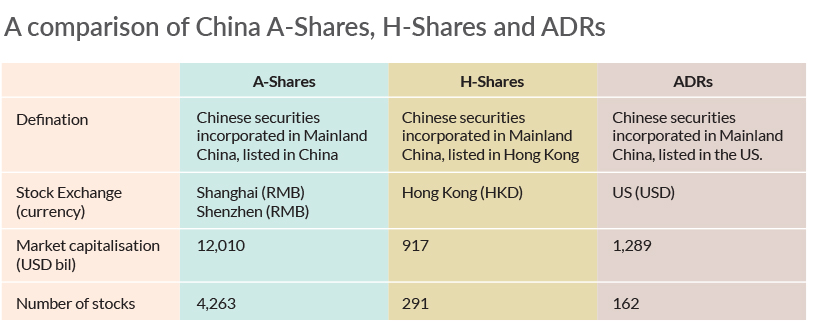

Its Belt and Road Initiative, adopted in 2013, will invest in 70 countries and promote global economic cooperation. As the country grows from an emerging market to an advanced economy, there is a substantial demand for Chinese equities, particularly A-shares, H-shares and American Depository Receipts (ADRs).

China A-shares are the stock shares of mainland China-based companies that trade on the two Chinese stock exchanges, the Shanghai Stock Exchange (SSE) and the Shenzhen Stock Exchange (SZSE). A-shares are also known as domestic shares because they use the Chinese renminbi (RMB) for valuation. Previously, due to China’s restrictions on foreign investment, China A-shares were only available for purchase by mainland citizens. However, since 2003, selected foreign institutions have been able to participate in A-shares trading through the Qualified Foreign Institutional Investor (QFII) system. This exclusivity is what sets it apart from other categories.

Chinese H-shares represent the shares of Chinese companies trading on the Hong Kong Stock Exchange. These are issued in China under Chinese regulation and are subject to the Hong Kong Stock Exchange’s listing requirements.

ADRs are stocks of larger Chinese companies that are listed on US stock exchanges, such as Alibaba, Baidu, and Weibo.

In terms of total market capitalisation and number of stocks, onshore equities (A-shares) outnumber those available offshore (B-share and H-shares). Investing in A-shares would give you direct access to these companies. The Chinese equity market is one of the largest in the world in terms of market capitalisation, and A-shares cover all the sectors that are the new economic drivers for China over the next decade, such as healthcare, consumer products, and tech.

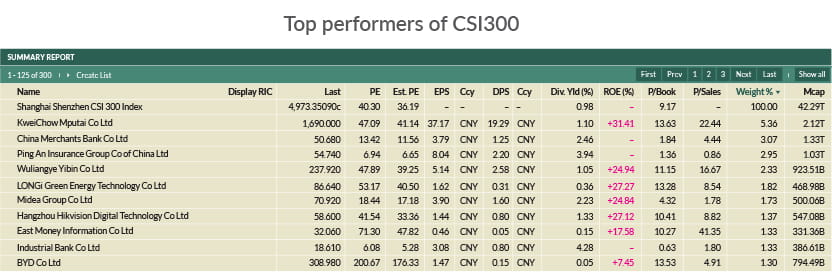

The CSI300 index tracks the performance of the top 300 A-share stocks listed on the Shanghai or Shenzhen stock exchanges.

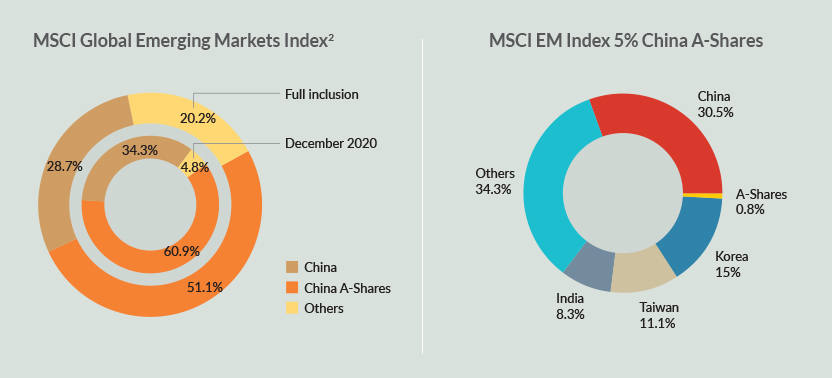

In June 2017, the MSCI Emerging Markets Index announced a two-phase plan in which it would gradually add 222 China A large-cap stocks, in phases. In May 2018, the index began to partially include China large-cap A shares, which make up 5% of the index. Full inclusion of Chinese equities would exceed 40% of the index.

To increase accessibility, the Shenzhen-Hong Kong Stock Connect is a cross-boundary investment channel that connects the Shenzhen and Hong Kong stock exchanges. Investors on each side can trade shares on the other market through their local brokers and clearing houses. Similarly, the Shanghai-Hong Kong Stock Connect links investors on either side.

You might ask, why not just invest in Chinese offshore equities? Offshore Chinese equities, which currently make up more than 50% of the MSCI China All Shares Index, are part of international capital markets. These shares tend to move in tandem with other shares that trade outside China and so are more exposed to currency fluctuations and global economic conditions, compared to A-shares which are largely isolated.

To illustrate this point, here’s a comparison of the five-year performance of the Shanghai Shenzhen CSI300 index vs the Hang Seng China Enterprises Index (HSCEI), the latter of which includes H-shares, red-chips (stocks with a sizable stake owned by the Chinese government) and private enterprises.

One of the constituents of the CSI300, Kweichou Moutai, has seen its share price increase 234.7% over the past five years, and it forecast annual earnings growth is 14.5% over the next three years.

China’s journey to becoming a global superpower is based on a two-pronged growth strategy: strengthening its domestic economy with a focus on the digital economy; and growing and sustaining its influence on regional trade with its regional counterparts.

As part of the growth strategy, China has continued to liberalise and reform its capital markets to attract more foreign asset managers and financial institutions. Despite China being the second largest market globally in terms of capitalisation value, China A-shares have remained a well-kept secret in global portfolios, making up only a small allocation. While China A-shares are underrepresented, there is also a low correlation to other equity markets, providing diversification benefits.

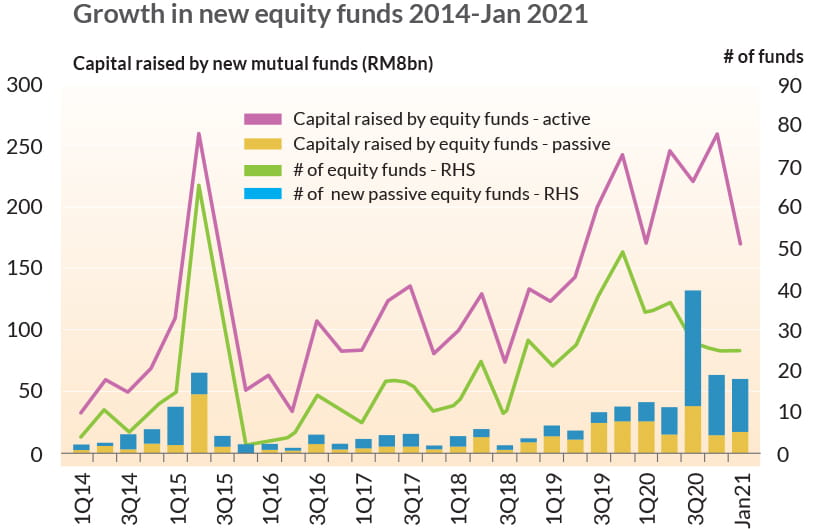

The China A-share space is more retail investor oriented, compared to markets like the US or even Malaysia, where institutional investors are more dominant. This creates more level playing field suited to active strategies. Here is where you can make the most of your opportunities.

Source: Wind, Goldman Sachs Global Investment Research, as at end January 2021

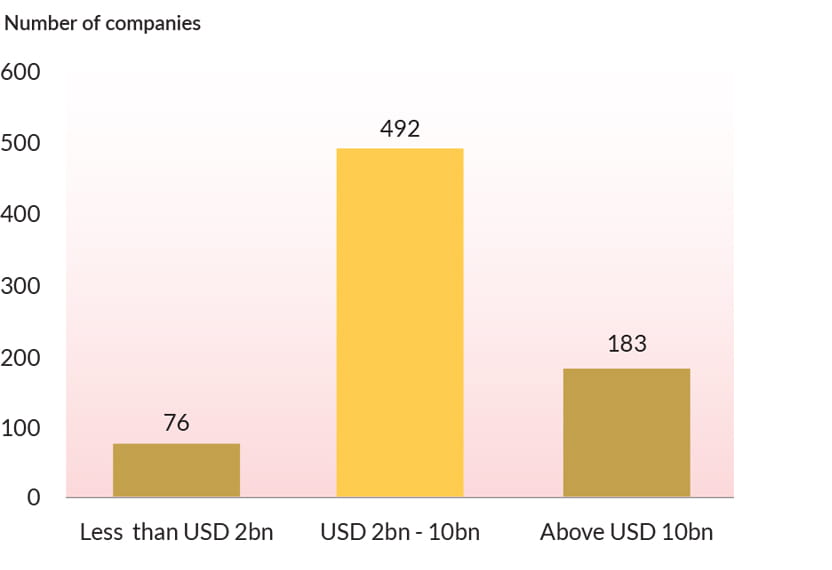

Zooming in on the equities market, we unveil a rising superstar: mid-sized companies. Mid-caps represent a larger part of the onshore investment universe, compared to offshore. A larger pool of mid-caps means more opportunities for investors to spot the outperformers.

An example of a potential outperformer in the mid-cap segment is Desay SV, a company that makes advanced driver assistance systems. This company will likely benefit from the increasing adoption of smart technology for automobiles. It isn’t a small fish, either. Desay currently has a market cap of US$6.7 bil. China is currently the largest market for EVs, with 41% of the global share2. With carmakers set to launch more EV models over the next few years, companies like Desay are set to reap the benefits.

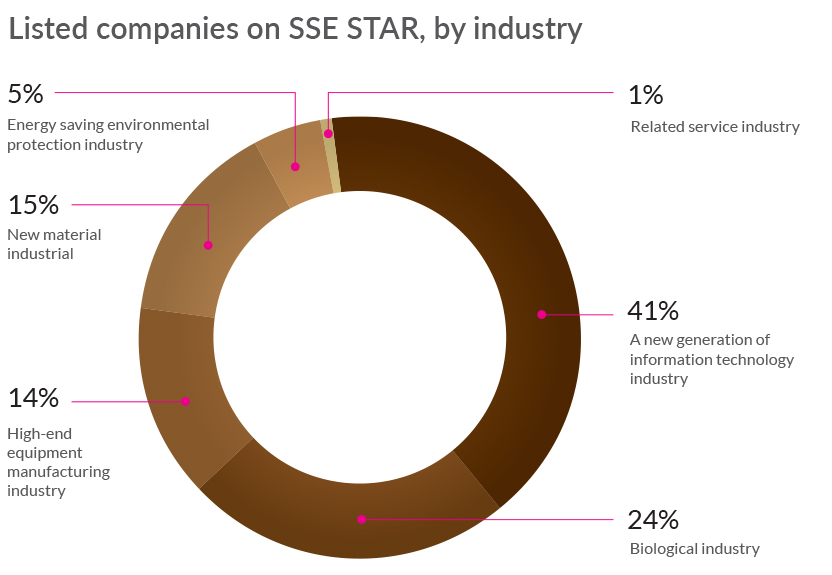

Besides EV and smart vehicle technology, the mid-cap segment is a hotbed for innovation in other tech-related areas. Launched in 2019, the SSE’s STAR Market, also known as the SSE Science and Technology Innovation Board, is the equivalent of New York’s NASDEQ and has allowed more capital to pour into the tech space, making up 47% of capital raised through the exchange.

Source: CICC, July 2020

For the first part of China’s growth strategy, the fast and wide reach of 5G will accelerate development of the digital economy. As all the telcos in China are state-owned, adoption of 5G technology across all networks has been rapid. There are already 792,000 5G base stations across the country, with a target of 1.39 million by the end of 2021. China is forecast to reach 739 million 5G subscribers by 2025, according to a recent study by ABI Research3.

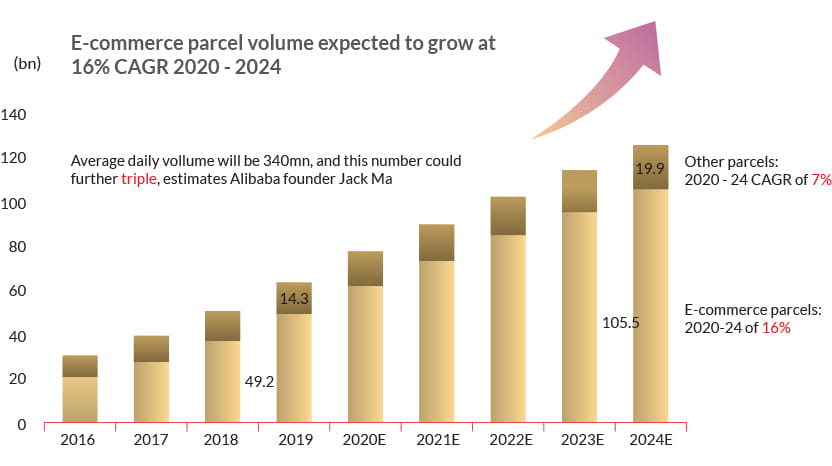

The pandemic has fuelled online activities and boosted delivery demand. Within the logistics sector, premium express delivery players will soon outpace their peers. In the chart below, we can see that e-commerce parcel volume is expected to grow at 16% CAGR from 2020-2024.

Source: CICC Research, Sept 2020

The Covid-19 outbreak has also resulted in travel restrictions, so the Chinese government is encouraging more domestic spending in an effort to repatriate consumption. This leaves plenty of room for growth among domestic manufacturers, retailers and service providers as consumers turn to local alternatives.

In the second part of the growth strategy, the Regional Comprehensive Economic Partnership (RCEP) will open the doors for China to develop closer trade ties with Asean countries in lower value-added manufactured goods, while it enhances cooperation with Japan and South Korea in high-end manufacturing. The RCEP is the world’s largest trade agreement, covering 15 countries that collectively contribute 29% of global GDP. The aim of the agreement is the strengthen regional integration against the backdrop of deglobalisation.

RHB China A Fund (“Fund”) provides the opportunity to participate in the rise of China onshore equities and ride along the Belt and Road initiative, while diversifying your portfolio in an investment that has a low correlation to global indices.

The Fund invests 95% of its net assets value in USD denominated share class of Schroder International Selection Fund China A (“Target Fund”), with the balance in liquid assets including money market instruments, placements of cash in any deposits or investment accounts with any financial institution(s)that are not embedded with or linked to financial derivative instruments (“Deposits”) and collective investment schemes investing in money market instruments and Deposits. This Fund is suited to investors with an aggressive risk profile.

The Target Fund’s investment manager, Schroders Investment Management (Hong Kong) Limited, has a proven long-term track record. The Target Fund aims to achieve sustainable and long-term capital growth, investing not less than 70% of its net assets in Chinese equities.

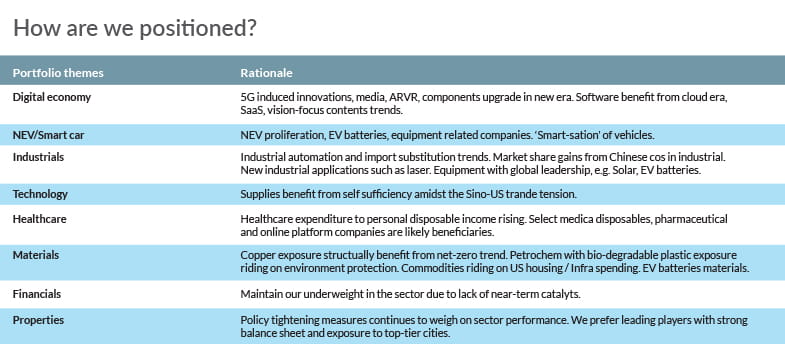

Given the extensive depth and breadth of the China A-share universe (>3,300 stocks), active management is key in sourcing opportunities beyond the top benchmark names. The Target Fund investment team leverages on Schroders’ data scientists to provide a conviction ‘edge’ to investment decisions. The Target Fund manager actively manage the Target Fund to overweight themes which has growth prospect while underweight areas where lacking of growth catalyst.

Source: Schroders, as of May 2021. Sectors shown above are for illustration purposes only. This is not intended to be relied upon as a forecast, research or investment advice and is not a recommendation, offer or solicitation to buy or sell any investments or to adopt any investment strategy. Investment involves risks and investor should conduct their own assessment before investing and seek professional advice, where necessary

1https://www.msci.com/msci-china-a-inclusion

2https://theconversation.com/what-electric-vehicle-manufacturers-can-learn-from-china-their-biggest-market-161536

3https://www.rcrwireless.com/20210423/5g/china-mobile-adds-15-million-5g-subscribers-march