Opting for more shariah-compliant investments may be the key to long-term wealth protection and growth. We explain why, and how you can include Shariah-compliant tools in your financial journey.

Your sofa has a giant sinkhole in the middle. It’s been there a while, but you’ve never actually done anything about it. With the Hari Raya holidays coming up, you’re going to be hosting family and friends. You don’t want to lose any small guests in that hole, so you go online to look for a new sofa. Click and purchase.

Then you remember that your washing machine doesn’t really wash anymore; it just swirls your clothes around to look busy. You might as well buy a new one. Click and purchase.

Before you know it, you’ve spent quite a decent amount. It’s too late to cancel your orders, and you need those items anyway. As soon as the holidays are over, you promise yourself that you’re going to be good and restart your wealth management journey.

But what about the inflation rate? What about the crazy economic situation? What about my retirement fund savings? Will I ever have enough? Help! Before you spiral, take a deep breath, and read on. There’s a whole world of wealth management options out there, made just for you.

In today’s market conditions, what’s the one thing we all want as investors, besides returns? Stability! When do we want it? Now!

With rising inflation squeezing the life from our precious savings, this isn’t the right time to pick the riskiest investments just so you can get higher potential gains, unless you can afford to throw caution (and money) into the wind. In the face of uncertainty and volatility of today’s market and economy, Shariah-compliant wealth management may just be the solution for those concerned about their financial future. Safeguard your financial wellbeing in this world and your spiritual wellbeing for the afterlife.

Shariah-compliant tools are for everyone regardless of religious or financial background. The label “Shariah-compliant” may seem like an intimidating term, but it really isn’t. Think of it as an approach that is the opposite of what Jordan Belfort would do. The focus is on long-term ethical and sustainable financial planning.

Shariah-compliant banking and investment tools are available at every stage of your financial journey, whether its Wealth Creation/Accumulation (Investment Products), Wealth Protection (Takaful), Wealth Purification (Social Finance Instruments), or Wealth Distribution (Succession Planning). Put them all together for a complete financial plan, as illustrated further below in this article. You can also refer to this article for more information on the Shariah-compliant wealth journey.

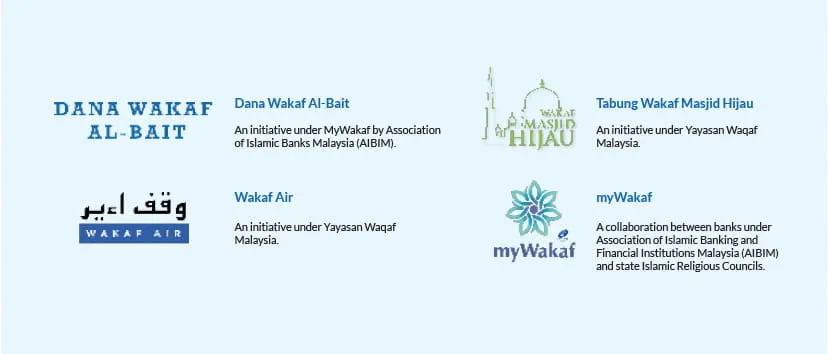

In Shariah-compliant wealth management, the preservation of wealth goes beyond just the literal meaning since it also encourages the generation, accumulation, and distribution of wealth in a fair and just manner. The broader scope includes empowering communities through the provision of financial solutions that create a positive impact by integrating waqf and sadaqah within the Islamic financial ecosystem.

It's important to also note that Shariah law forbids transactions that support industries or activities that bring negative social and environmental impact, such as gambling, alcohol, non-halal foods and goods, usury (interest), and excessive speculation.

Another noteworthy area is the risk-sharing element of Shariah-compliant investing tools. Transactions should promote equality, social justice and inclusion, and economic prosperity. They must demonstrate accountability, transparency, and legal protection for all parties. Sharing the risk – and reward – incentivises minimising risk and increases transparency as all parties are likely to work towards the common goal of protecting each other’s capital. You’re in it together.

Now that we’ve explained the benefits of Shariah-compliant financial tools, here’s how you can apply them to each pillar of your financial journey to get the most benefit.

Wealth Creation/Accumulation

In Islam, wealth can be accumulated through two ways: 1) your own efforts and 2) through inheritance. Your own efforts include jobs and investments in shares or other permissible instruments. It’s allowed - and even encouraged - to work hard to build a comfortable nest egg. These tools can help you save your earnings, and even put it to good use to earn a profit.

Click here to see our Shariah-compliant wealth creation/accumulation products.

Wealth Protection

Protecting the wealth you’ve accumulated is a core component of any sound financial plan. Once you’ve accumulated wealth, it’s logical to want to protect it from any unforeseen circumstances so you can rest assured that you and your loved ones can continue to benefit. At RHB Islamic, our approach to protecting your valuable assets is tailored to your needs and goals. Click here to see our Takaful products.

Wealth Purification

Purification of wealth is a key aspect of Shariah-compliant wealth management that contributes to social wellbeing and is central to creating a positive impact through social justice and equity. During the fasting month, you’ve had a lot of time to reflect on all your blessings and good fortune, and purifying your wealth is a great way to remind yourself that worldly wealth is to be shared.

Zakat, or almsgiving, is the third pillar (rukun) of Islam and is compulsory for all able Muslims. Zakat is aimed at purifying one’s wealth by donating a specified portion to benefit the community. The zakat may be channeled for the benefit of those who are qualified to receive it, known as “asnaf”.

In RHB, you can easily pay your zakat with just a few clicks through RHB Online – no need to queue up at the zakat centre! You’re also less likely to forget.

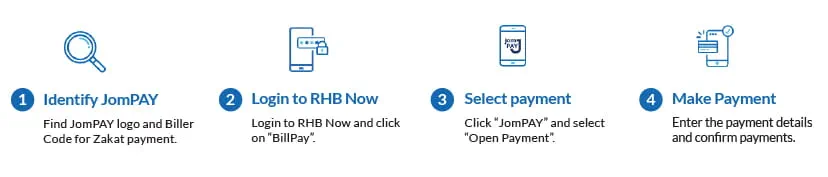

How to pay your Zakat

Follow the steps below to pay your Zakat online using JomPAY.

Wealth Distribution

The reason why we work so hard to accumulate and protect our wealth is so we can pass it on to the next generation. To avoid sticky situations and disputes that you won’t be around to resolve, it’s best to plan ahead using these Islamic wealth distribution tools. Our expert partners can assist and advise you in drawing up a comprehensive wealth plan, ensuring your needs are met and your legacy is successfully distributed in the most effective and efficient way, leaving no room for doubt.

Talk to your Relationship Manager today to create your comprehensive Shariah-compliant Wealth Management plan for your present and future.

From all of us at RHB, we wish you Selamat Hari Raya Maaf Zahir Batin!

For avoidance of doubt, RHB Islamic Bank only promotes and manages promotions in relation to RHB Islamic Bank products and its related proposition only.

Investors are advised to read and understand content of the relevant documents including but not limited to prospectus or information memorandum that has been registered with Securities Commission and Product Hsighlight Sheet before investing. Investors should also consider all fees and charges involved before investing. Prices of units and income distribution, if any, may go down as well as up; where past performance is no guarantee of future performance. Units will be issued upon receipt of the registration form referred to and accompanying the Prospectus. The printed copy of prospectus and Product Highlight Sheet is available at RHB branches/Premier Centre and investors have the right to request for a Product Highlight Sheet.

This material has not been reviewed by the Securities Commission Malaysia (SC).

RHB Islamic Bank Berhad 200501003283 (680329-V)