So far, 2018 had been a jittery year, despite last year being a stellar year for most asset classes. The financial market this year started with higher volatility, caused by slowing down liquidity growth and investors’ reaction to the dynamics of the policy reversal.

Throughout the year, more volatility was experienced, caused by various geopolitical activities that have caused the market to be on edge. To be able to stomach the volatility and trudge through possible upcoming market turbulences, investors should consider adjusting their investment time horizon longer to embrace further, according to the RHB Wealth Research Team.

Long-term investment is generally defined as investments that can be withheld for more than 10 years. It provides investors with the ability to hold their investment longer if it is justifiable, or when the market is turning against them. By holding on to their investments longer, investors will not be fazed by the market movements during any turbulence, and are more at ease with their portfolio allocations.

Market turbulence

There are many market risks that could spell potential turbulence within the next few years. The most prominent is the trade tensions between the US and China – the tit- for tat tariffs announced by the two countries have caused turbulence in countries like Turkey, which saw massive depreciation of its currency and outflow of foreign investment. Should there be a full-fledged trade war, the impact would be massive – in fact, it could weigh down the global economic growth, which has just recovered not long ago.

Another looming risk that investors have to deal with over the past few years is Brexit negotiations, which did not progress smoothly since the voting ended in 2016. As the negotiations are still ongoing, there is prolonged uncertainty in the market, impacting investor sentiment and confidence.

Slowing down corporate revenue and economic growth could also stir some volatilities moving forward. This is especially as the latest earnings season witnessed some of the stable stocks, such as Facebook, Tencent and Twitter posting less satisfying result or softer guidance on company outlook.

Holding period does matter

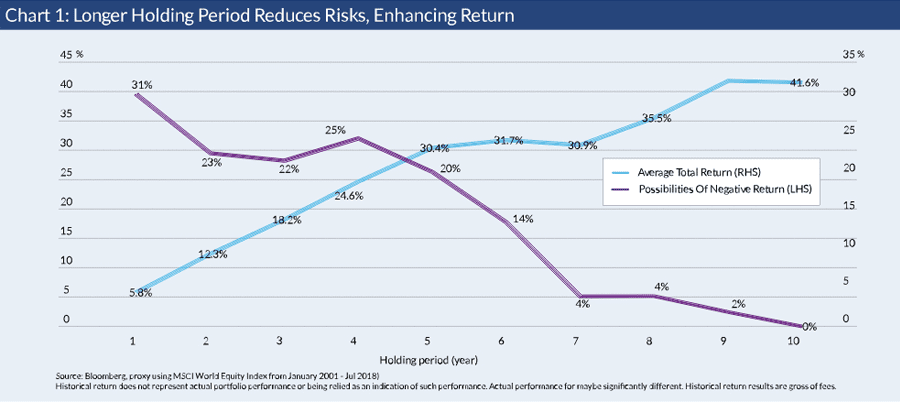

By making long-term investments, investors are not only able to weather through the volatility caused by these risks, they could even potentially achieve higher returns. According to Bloomberg’s historical study (see Chart 1), longer investment horizon reduces the chance of an investment to be in the negative.

There are many other benefits to long-term investments. This includes helping investors to avoid making emotional mistakes driven by greed or fear and enable them to gain the maximum benefit of compounding interest. Longer investment horizon can also allow investors to grab undervalued opportunities and reap steady profit when the market reverts to its mean level.

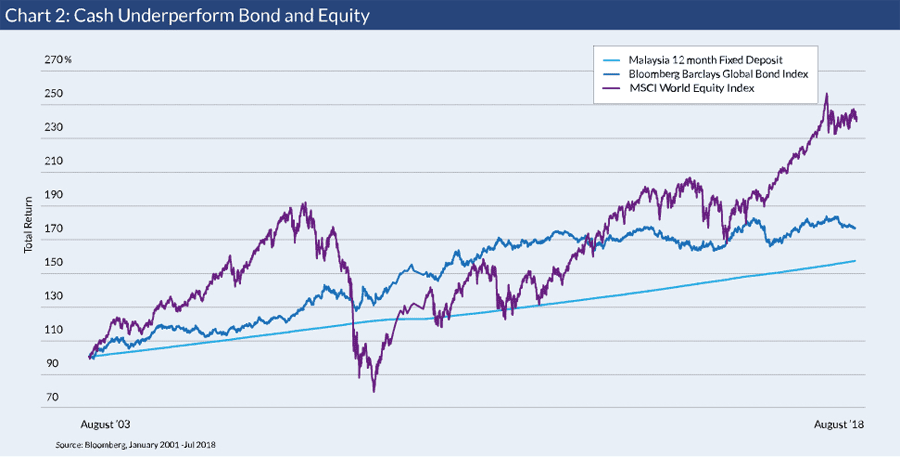

There may be some confusion among investors about the differences between long-term investment and long-term savings – some investors may think that increasing their cash holdings for the long run would be beneficial to their portfolio.

However, this is not necessarily true as cash underperforms stocks and bonds in the long run. As illustrated in Chart 2, cash investors would get lower returns compared to equity and bond investors in a long-term investment horizon, even in the event that they invest prior to a financial crisis year. According to RHB Wealth Research Team, the phrase “cash is king” is only applicable during crisis period, as investors would have the opportunity to invest into assets that are being sold at a great discount.

Options for long term investor

A long-term investment approach can be implemented for most assets, including stocks, bonds, real estate and private equity. Real estate, for example, fits the principle of long-term investment due to its nature of illiquidity in exchange for higher appreciation. Due to its nature of leverage, real estate investment could provide long-term investors with above average return.

There may be some investors who are interested to gain exposure in real estate investment, but are concerned about the asset class’s liquidity risk. According to RHB Wealth Research Team, these investors can consider investing in a Real Estate Investment Trust (REIT) or funds that invest in REITs instead, as the products provide investors with both the exposure and more liquidity.

One of the products meant for long-term holding is private retirement scheme (PRS), which is a voluntary long-term saving and investment scheme designed to help one to achieve their retirement goals, withdrawable upon retirement age. Not only does it help investors to build discipline with their long-term investment or savings, PRS also provides investors with low minimum amount for contribution, no fixed interval for contribution, and multiple established providers to choose from.

Prominent investor Warren Buffet once said that “Nobody buys a farm based on whether they think it is going to rain next year”. Echoing to that, the RHB Wealth Research Team suggests investors to invest with a long duration rather than speculating what will happen in near term. They should also ensure that they are able to sleep well at night by understanding and be confident on the products they investing.