It has been a whirlwind few weeks for the US technology sector. Uncertain geopolitics and increasing regulatory pressure do not appear to have dampened investors’ appetites for technology-centric initial public offerings (IPOs). Technology listings have come in thick and fast recently, with a number of multi-billion-dollar US unicorns going public over the last few weeks.

In mid-April, software as-a-service company PagerDuty Inc went public. Given its relatively niche market — it provides a comprehensive package of IT monitoring tools to enterprises — it would have perhaps been understandable if the company had got buried under the large number of unicorn IPOs over the last few months. In fact, this was exactly what CEO Jennifer Tejada worried about when she was interviewed by The New York Times.

Barely a month later, PagerDuty is tracking a strong upward trajectory. It started out at US$24 per share on April 14 but as at May 10, is trading at US$51.82. According to Forbes, the company made US$118 million in revenue last year, up some 48% from the year before, while posting a loss of US$41 million. More than 11,000 businesses use PagerDuty, the Forbes article noted.

Beware the hype jobs

But not all technology IPOs this year have been quite so positive. In early May, ride-sharing behemoth and socalled “super app” Uber was accorded a US$110 billion valuation estimate (US$58 per share) by Morningstar senior equity analyst Ali Mogharabi.

Uber’s rise has been meteoric and controversial in equal measure, with the company drastically disrupting the transport industry over a relatively short span of time. Uber is expected to have an addressable market of US$740 billion by 2023, according to Morningstar. This includes the aggregate of global taxi, ride, bike and scooter sharing, in addition to its burgeoning food delivery business (Uber Eats).

Unfortunately, its May 10 IPO fell well short of Morningstar’s early estimates. Uber’s IPO took a turn for the worse after its market debut on a Friday. After opening for trade on the New York Stock Exchange, the shares fell nearly 8%, hovering at US$41.57 over the following weekend. This makes it one of the worst first-day performers of all time, according to a recent Fortune article quoting financial analytics firm DealLogic. Investor reticence is perhaps unsurprising, considering that despite sky-high valuations and a much-anticipated IPO, Uber has never posted a single profitable quarter since it began operations.

Uber courted ire among the world’s taxi services and unions, while also colliding with a number of powerful local and federal governments along the way. A number of high-profile crimes that occurred during Uber rides further damaged the brand.

As the PagerDuty and Uber IPOs demonstrate, technology listings are by no means a straightforward investment proposition. It can be all too easy to get so caught up in the hype that investors end up missing out on lesser known gems elsewhere. According to RHB Investment Advisory, it is not realistic to value technology stocks using a onesize- fits-all method.

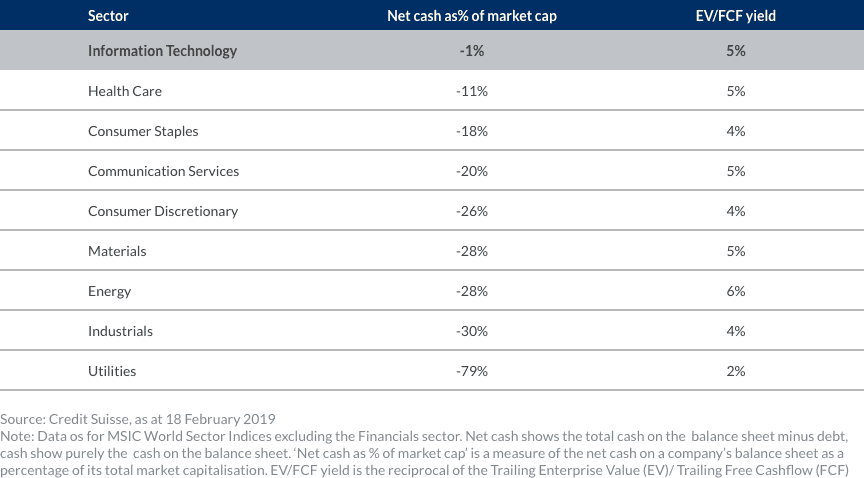

Source: Credit Suisse, as at 18 February 2019

Note: Data os for MSIC World Sector Indices excluding the Financials sector. Net cash shows the total cash on the balance sheet minus debt, cash show purely the cash on the balance sheet. ‘Net cash as % of market cap’ is a measure of the net cash on a company’s balance sheet as a percentage of its total market capitalisation. EV/FCF yield is the reciprocal of the Trailing Enterprise Value (EV)/ Trailing Free Cashflow (FCF)

Go to the experts

The technology companies of today are vastly different from traditional businesses in legacy sectors like property development, manufacturing or mining. Today, a technology company with a groundbreaking idea can easily command billions in private valuations, seemingly without clear business models. Investor hype and charismatic founders can further drive valuations up and over what the market might have actually deemed reasonable.

In order to ride the gains and avoid the pitfalls of the sector, it is therefore advisable to look at gaining exposure through funds, rather than in individual stocks. To this end, RHB Wealth Research advises going with an experienced and disciplined management team that avoids the hype around new technologies and, instead, focuses on identifying unexpected earnings growth.

To this end, the most recent economic news out of the US should be cause for some cautious optimism on the part of technology investors. The economy remains strong so far this year despite geopolitical risks. Inflation remains under control while the country recorded 3.2% growth in the first quarter, higher than consensus. In short, the US economy remains resilient, even in the face of intensifying US-China trade war rhetoric.

“With the US Federal Reserve adopting a dovish stance, preferring to stay on the sidelines and watch the economy evolve, the headwinds seem to have eased for now. This, coupled with global investor appetite for growth, means the tech sector is uniquely placed to once again become an interesting proposition for investors,” RHB Wealth Research says.

In order to maximise opportunities in the current environment, investors must remain both objective and liquid. There is merit in being cautious about IPOs with a lot of hype baked into the numbers. However, it also pays to remain invested in the market, while being sure to add on to one’s portfolio of funds by taking advantage of any dips that may occur. “As always, there is a continuing need to navigate the ‘hype cycles’ of technology, which comes back to the need for active management in investing,” says RHB Wealth Research.

Investors should, therefore, continue to keep their ears to the ground and be prepared to pick up both new and existing investment opportunities that may occasionally trade lower on external risk factors. The fourth quarter of last year, for instance, provided an opportunity for savvy investors to pick up tech gems at lower prices.

RHB Wealth Research says the volatility late last year was brought about by negative news and data points throughout key facets of the public markets. These included worrying economic data out of China and extended through to automotive, industrial and, of course, the tech sectors.

Volatility does not appear to have hit quite as hard this year. Two major indices — the S&P 500 IT (2,884.05 points at the time of writing) and the S&P 500 Communications Services indices (164.28 points) — stood out in terms of returns, outperforming the broader S&P 500 Index (2,879.42 points).

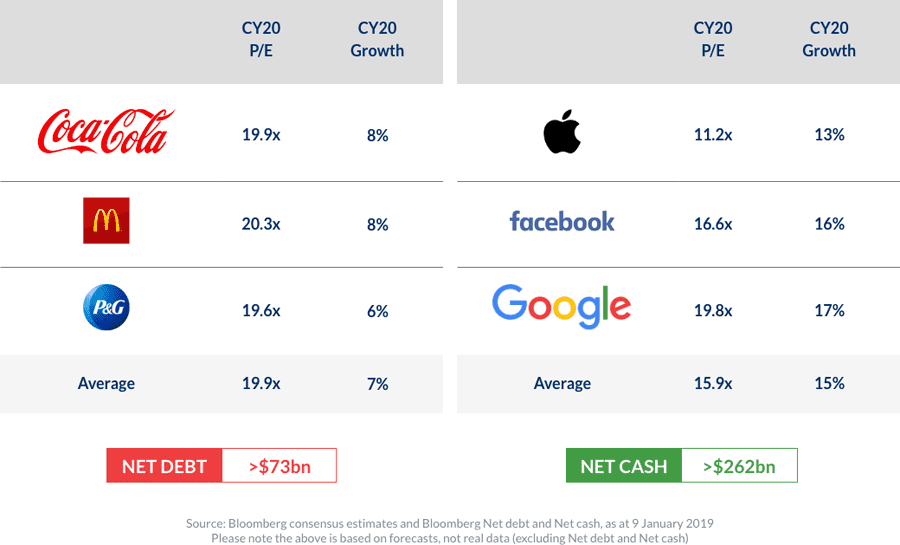

Large cap tech stocks attractive

Getting tech exposure

Against this backdrop, RHB Wealth Research notes the fundamental drivers of technology remain unchanged, and expects disruption to accelerate through the old economy. Unit Trust Funds such as TA Global Technology Fund has been a notable performer, remaining largely positive and comfortably beating the market, even during some of the pockets of intense volatility last year.

TA Global Technology Fund

It adds, “We watch developments to trade discussions very carefully, given their strategic importance to the technology sector. The fund managers of the TA Global Technology fund are very careful to factor trade war developments into all of their investment theses. But having said that, we note much of the demand for tech is being driven by corporates, and in developed markets. This is why large cap tech names continue to see healthy demand from developed markets.”

The fund provides investors with an effective route into some of the world’s top tech names, without the risk of getting caught up in the so-called hype cycle, as RHB Wealth Research puts it. “The fund’s top 10 holdings consist of players that are deeply entrenched in the up-and-coming 5G play. Names like Cisco Systems align very well with a key theme that we have for the fund — that of ‘Next Generation Infrastructure’.The fund managers believe Cisco is poised to successfully transition to a much more software-driven business,in addition to being among the leading companies involved in the rollout of 5G communications networks over the next few years.”

In addition, the TA Global Technology fund comprises some of the more popular internet and semiconductor names, so investors will be assured of exposure to a suitably diverse subset of the technology and communications space. According to its March 2019 fund fact sheet, it has significant holdings in Microsoft, Apple Inc, Facebook Inc, MasterCard, and Samsung Electronics, just to name a few.

RHB Wealth Research adds, “Generally, in terms of forecast horizon, the fund managers of TA Global Technology are more comfortable modelling out five years or more for internet names, and between one and two years for a semiconductor company.

“The fund managers tend to look at the earnings power of the internet companies, considering price-earnings ratio (PER) and overall valuations. As for semiconductor players, they look atprice-to-book (P/B) ratios, PER, and free cash flow yields, depending on the cycle we are at. They would also cross-check earnings with cash flow to adjust for capitalised research and development, leases, and any non-generally accepted accounting principle (non-GAAP) adjustments.”

Another very exciting investment theme is artificial intelligence, says RHB Wealth Research. It has exploded in popularity over the last few years, with AI technology increasingly driving analytics and distilling unique insights into financial services, healthcare, highend manufacturing, and logistics, just to name a few.

Drilling down into the various subsets of AI, investors will find a broad range of readily investible themes. Cutting-edge subsets like deep learning, machine learning, big data and three-dimensional vision technology are advancing at near breakneck speeds, and gradually converging to create even more exciting AI applications. Naturally, companies that embrace these innovations are likely to capture much of their industries’ profits, RHB Wealth Research advises.

To this end, the RHB Artificial Intelligence Fund offers unique investment opportunities across a broad spectrum of AI-centric technologies, as well as the sectors that are embracing these disciplines. According to RHB Wealth Research, companies like Tesla Inc, Amazon.com, LendingTree Inc, Salesforce.com, Facebook Inc, Broadcom and NVIDIA are just some of the names that investors stand to gain exposure to via the fund.

Despite largely strong and positive fundamentals, the last couple of years have proven that tech companies are increasingly susceptible to government oversight and regulatory pressure. Global scrutiny of social media giants like Facebook has brought the issue of user privacy, security, and the US-based giant’s highly dominant position into sharp focus. RHB acknowledges that this is an ongoing risk, but notes how tech companies have been proactively improving their own risk management and governance standards in recent years, in a bid to placate regulators and users alike.

RHB Research Wealth adds, “Facebook is an interesting one. Despite concerns around data privacy, shares surged recently as the company’s earnings beat market expectations. In fact, over the last few years, the fund managers of the TA Global Technology fund spent a lot of time engaging directly with Facebook on the issue of privacy in social media. We are pleased to note that Facebook is making good progress on these fronts.

“But ultimately, tech companies are disruptive entities with business models and balance sheets that are strong enough to ride out these regulatory pressures.”