BY RHB WEALTH RESEARCH

Investors seeking shelter from global trade and economic uncertainty might find refuge in holding foreign currencies. But even then, foreign currency deposit yields can be low, given the prevailing low interest rate environment.

For an investor with a modest risk appetite, a foreign currency-related structured product such as One Touch Investments is something to consider. Investors need to have a view on the currency to invest in such products. It is so named because investors are paid a coupon rate when a pair of currencies touch a pre-determined mark at any trading day throughout the tenure. These tend to be relatively short-term tenured products, lasting anywhere from three months to a year.

The lock-in tenure is agreed upon by the bank and investor, with the investor enjoying an interest rate comfortably higher than that of the prevailing fixed deposit rate. Suppose an investor has a view that two currencies will hit a particular level relative to one another over a specific time period; if the investor is confident of his outlook, he may request for a structured product to be tied to that event.

Take a hypothetical example where an investor believes Brexit will no longer materialise. This might be a boost for the European Union, thus strengthening the Euro. If, on the other hand, Brexit does take place, the uncertainty that used to plague the region will finally dissipate, possibly also adding strength to the Euro. Further, interest rates in the region have been low, with seemingly very little room for further cuts. Under the circumstances, sustained interest rates would strengthen the Euro.

Assuming an investor is confident of the likelihood of the scenarios above playing out in his favour, he could invest in a structured investment that pays out a one-off coupon over a 12-month period, based on a USD-Euro pair. Suppose the investor locks in a scenario whereby the euro trades at US$1.144 on any trading day within the 12-month tenure. The bank would pay out a better coupon rate, for example 4% per annum, on the capital invested. By comparison, a US Dollar deposit rate would yield less than 2.5% per annum.

SHELTER IN FIXED INCOME

Moving away from currency-related products, investors may still gain additional yield by considering structured investments with other asset classes acting as the underlying, notably, fixed income.

Given the low interest rate environment, RHB Research Institute expects the US Federal Reserve to cut rates by a total of 50 bps in the second half of 2019, of which 25bps has already been slashed.

In late July this year, the Fed cut interest rates by a quarter of a point, down to 2%. This marked the first time it has reduced interest rates since the 2008 financial crisis. But there might be momentum gathering for further rounds of cuts, if recent news is anything to go by.

In mid-August this year, warning signs began flashing in the US bond market when the spread between yields on the 2 and 10 year Treasuries flipped. Long touted as a recession indicator, it preceded the last seven instances of negative US growth, the last of which occurred in December 2005, two years before the global financial crisis. This may well increase pressure on the Fed to embark on more rounds of rate cuts, despite chairman Jerome Powell referring to the July cut as merely a “mid-cycle adjustment”.

Other global central banks are taking the cue, with their rhetoric turning suitably dovish as flagging global growth takes centre stage. This synchronised easing is expected to keep bond yields lower for a longer period of time.

Such as structured investments linked to bond funds which will benefit from the global rate-cut cycle.

Under the circumstances, discerning investors should be on the lookout for alternative investments to diversify their portfolios, committing a small portion to pursue short-term, opportunistic themes.

There are structured investments that give a return calculated from various payoff scenarios on the back of an underlying asset, which in this case, could well be fixed income funds. Investors could look at structured products that build in risk diversification from a basket of bond funds to take a defensive stance against dampening global growth caused by increased China-US trade protectionism.

There are products that could help investors select a diversified basket of top-performing, fixed income unit trust funds, with varying investment strategies. The structured investment returns will be based on the performance of the underlying funds with the multiplier effect known as participation rate. The participation rate ranges from 100% to 200% for example, on the underlying funds selected.

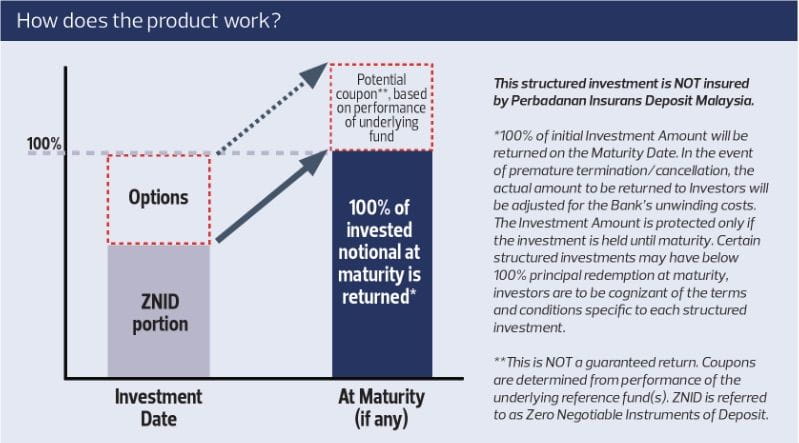

For this type of structured investments, there are two portions of investments. The first will be placed in a ZNID (Zero Negotiable Instruments of Deposit), which is issued by a banking institution to ensure that a certain sum in MYR or foreign currency has been deposited with a certain tenure at a specified coupon, where, upon maturity, the amounts will be added up to a notional amount of the investments. The amount deposited will grow to the notional amount that is required after maturity. For example, RM96,153.84 deposited in ZNID for one year with a fixed coupon of 4% will give a return of RM100,000 at the end of the one-year maturity.

WARNING

THE RETURNS ON YOUR STRUCTURED PRODUCT INVESTMENT WILL BE AFFECTED BY THE PERFORMANCE OF THE UNDERLYING ASSET/REFERENCE, AND THE RECOVERY OF YOUR PRINCIPAL INVESTMENT MAY BE JEOPARDISED IF YOU MAKE AN EARLY REDEMPTION. THIS STRUCTURED PRODUCT INVESTMENT IS NOT INSURED BY PERBADANAN INSURANS DEPOSIT MALAYSIA.

The second portion will be used to buy an option, which provides a leveraged coupon return based on the performance of the underlying fixed fund.

This combination provides capital preservation while enabling the leveraging of fund returns. Options in this case include giving investors an opportunity to mirror the fund performances with the additional multiplier of participation rate based on the notional investments. Hence, if the bond fund returns are 4% upon maturity with a 150% participation rate, investors will get back returns of 6%.

This way, the investor will obtain leveraged returns on the original performance of the fixed income fund. However, in the event that the returns on the underlying fund is negative, customer will risk having no payout at maturity but will only get back the notional amount of the investment. The investment will always return the specified principal redemption amount, which is usually at 100%. Therefore investors will only take on the issuing bank’s credit risk of not being able to return the invested amount.

This fund-linked structured investment is available in the banks via unit trust or treasury products.