BY RHB WEALTH RESEARCH

Real estate investment trusts (REITs) have been performing well in many parts of the world, especially in recent months. This is mainly due to the sharp fall in interest rates globally, stemming from the slowdown in economic growth and the trade war between the US and China that have sent investor monies flowing into relatively high-yielding and defensive sectors.

The Bloomberg World REIT Index, which is a capitalisation-weighted index of the leading REIT stocks around the world, hit an all-timehigh last month. As at Sept 2, it was at 167.72 points, up 20% from 139.68 points at the start of this year. The MSCI World Equity REIT Index hit 1217.31 points on the same day, a level that is close to its ten-year high reached on Aug 30.

RHB Wealth Research team says REITs are expected to continue their outperformance moving forward as the slowing global economic growth and the US-China trade war persist.

The team points out that the slowing economic growth is already being reflected in decisions of several central banks to lower interest rates in recent months. The US Federal Reserve (Fed) cut its interest rate by 0.25% in July this year, its first rate cut in a decade. Last month, central banks in India, Thailand and New Zealand followed suit, furthering a global trend of monetary easing policy. In Malaysia, Bank Negara Malaysia cut its overnight policy rate (OPR) to 3% and several local banks expect the rate to be lowered by another 25 basis points by the end of this year.

The team adds that these actions resulted in a low interest rate environment that would benefit REITs, which offer investors relatively attractive yields.

Meanwhile, there is no end in sight for the US-China trade war and it might go on for a prolonged period of time. Other political events such as Hong Kong’s ongoing civil unrest and the uncertainties surrounding Brexit will also continue to weigh on markets, says the team.

“The durability and stability of the sector’s cash flow will continue to provide investors with attractive dividend yields that should grow in line with the sector’s earnings. This sector represents a strong opportunity for income-oriented and risk-averse investors.”

While several REIT indexes are close to their multi-year highs, the team says REITs’ valuations are not expensive as many in various countries are still traded at a discount to their net asset values. The supply and demand in the REIT sector also remains relatively balanced, underpinned by a still-growing global economy.

One way investors can capture this opportunity is to invest in the Manulife Shariah Global REIT Fund. Launched in March, it is the first Shariah REIT fund in the world that invests in REITs only and is made available to retail investors with a minimum investment amount of RM1,000.

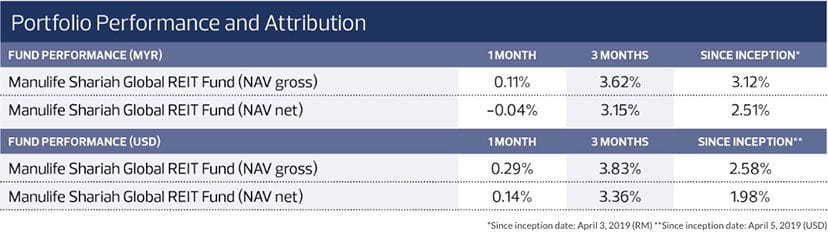

As at July 31, the fund, which aims to provide regular income and capital appreciation returns to investors, has generated a net return of 3.62% (before deducting sales and annual management charges). It has also generated a return of 3.15% since its inception in March.

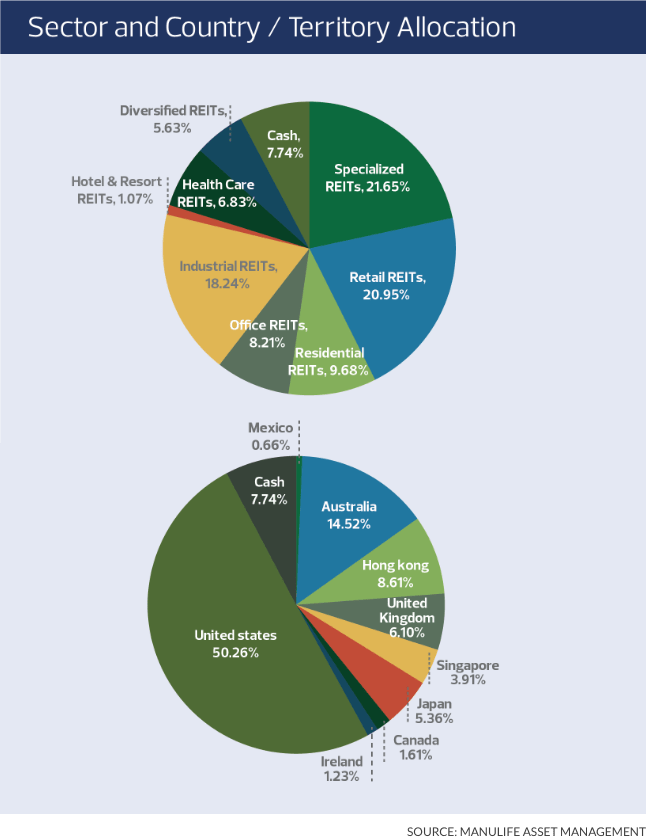

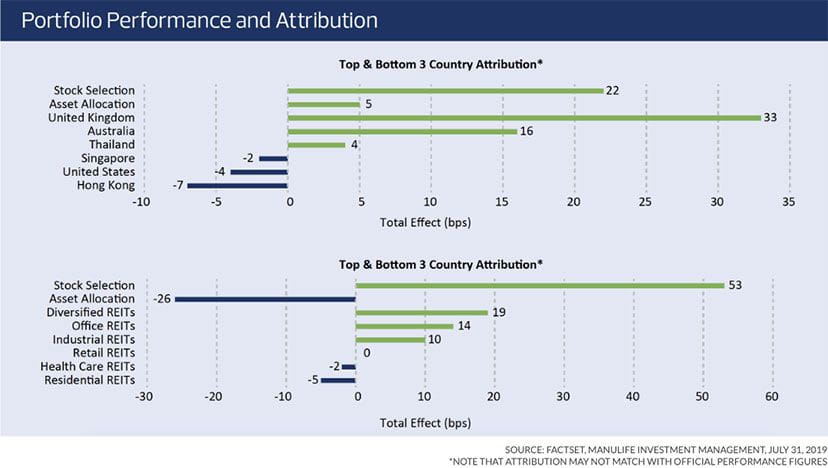

Going forward, the team says the fund favours REITs that invest in data centres and industrial properties that are expected to benefit from the growing big data and e-commerce trend.

The team says more defensive sub-sectors such as healthcare and residential properties within certain regions are also deemed attractive due to an increased uncertainty within the broader market.

Country-wise, the fund favours the US as its economy remains healthy and its technology and telecommunication sector is developing faster than many other countries around the world. As at July, the fund had 50% exposure to the US market.

The team says Singapore is another country that offers attractive REITs investment opportunities, due to the attractive dividend yields and relatively low leverage. “We also believe that the recent slowdown in growth and the lower-than-expected inflation data [in Singapore] would trigger another round of fiscal stimulus to stabilise the country’s economic growth.”

The fund was overweight on Hong Kong earlier this year. However, the ongoing civil unrest there has persisted longer than expected and the fund has shifted its position in Hong Kong to underweight. “We believe that the impact of the ongoing protest may have a material effect on the economy. Additionally, we are not confident that the issues will be resolved in the near term,” says Ng Chze How, head of retail of wealth distribution at Manulife Asset Management Services Bhd.

Nevertheless, it says the fund is not completely shying away from the Hong Kong market. In fact, investment opportunities might emerge in the near future. “Hong Kong REITs are currently traded at an attractive valuations.”

What are the key downside risks for REITs? Ng says one of them is a sudden reversal of headwinds including the US-China trade war, Brexit uncertainties and the civil unrest in Hong Kong. This would result in a shift in investor sentiment and investor monies would flow out of defensive sectors such as REITs.

“Another major risk would be if market volatility increases to the extent that debt markets become strained, causing interest rate spreads to widen. This would impact the REITs’ ability to finance their operations.”

Ng says it is difficult to predict the outcome of these events but it is likely that the US-China trade war would continue while global economic growth slows.

“However, we expect many central banks to remain vigilant and be ready to act [by introducing] more easing measures to support economic growth globally. And we think it will be some time before central banks resume interest rate hikes as the current headwinds facing the market will not be resolved in the near term.”

Ng also dismisses the possibility of a recession happening in the US anytime soon, even though the US Treasury yield curve inverted twice last month. An inverted yield curve is being used as a key indicator by market players to gauge if the US economy is heading towards a recession. Since 1950, all nine major economic recessions in the country were preceded by an inverted yield curve.

He says there are a few factors that give fund managers’ confidence that the US is not slipping into a recession as yet. “For instance, the fixed income spreads have not widened, especially in the high-yield bond markets. Additionally, the recent second-quarter earnings in the US were better than expected.”

On top of that, REITs have performed quite well after the last two major yield curve inversions that occurred in 2000 and 2006, says Ng. “REITs significantly outperformed the broader market in the following 12 months. We believe that the REIT sector will likely outperform once again in this environment as low interest rates and the defensive nature of the sector should continue to be viewed positively by investors.”